Onchain: Arbitrum Governance on fire, the Euler hacker returns nearly $200 million, and NFTs ready for take-off

April 13, 2023

Share this:

Story One

Arbitrum Governance on fire 🔥

But when we say fire, it's not the good kind. Arbitrum, an Ethereum Layer-2, recently airdropped over 1 billion of its native token to nearly 300,000 wallets to kickstart the Arbitrum DAO. In addition to the DAO, they set up the Arbitrum Foundation responsible for promoting and allocating grants in the ecosystem. Within its short lifespan, the foundation has already sparked massive outrage for selling ARB tokens.

The first proposal for ARB holders to vote on included allocating 750 million ARB tokens to the foundation and granting it special powers to move fast in without having to hold a vote on everything. It turned out the community vote was more like elections in North Korea - not very meaningful. Even though the majority voted against the proposal, the foundation went ahead and loaned 40 million ARB tokens to a Market Maker and sold 10 million to cover operational costs.

Doesn't seem very democratic. However, the Arbitrum team quickly realized that they should have communicated better, putting out a statement saying that it was all down to the chicken-and-egg problem of creating DAOs. And anyway, this wasn't a vote but a ratification.

This doesn't make it a whole lot better, as some crypto personalities pointed out, because had they bothered to look up the word ratification in the dictionary, they would have figured that it means "giving formal consent to a decision."

Key takeaway: DAOs are hard to run. Every DAO requires smart contracts to facilitate votes - which need to be developed before the DAO can even operate, usually something done by a centralized team.

Story Two

A hacker returns nearly $200 million.

In March, a hacker managed to exploit the DeFi protocol Euler Finance for $197 million. Normally, when a protocol loses money, it's gone forever - unlike when losing cash in Tokyo. Fortunately for the Euler team, after returning an initial $30 million, the hacker has now returned all recoverable funds. This comes as a surprise since the hacker had already moved funds to Tornado Cash - a mixing service used to obfuscate traces.

While it's unclear why the hacker decided to return the funds, one big reason might have been the $1 million bounty Euler had set out for anyone delivering information getting them closer to the identity of the hacker.

With the funds back, the bounty has been taken down, and Euler doesn't seem to want to go after the hacker.

Key Takeaway: Fully obfuscating your traces as a DeFi exploiter when interacting on public ledgers is nearly impossible. Even the US treasury department acknowledges as much stating that a majority of criminals rely on fiat for their illicit activities.

A takeaway for anyone using DeFi protocols is that smart contract security is hard, and even protocols with 10 audits over 2 years can get exploited. Your best bet is to spread risk.

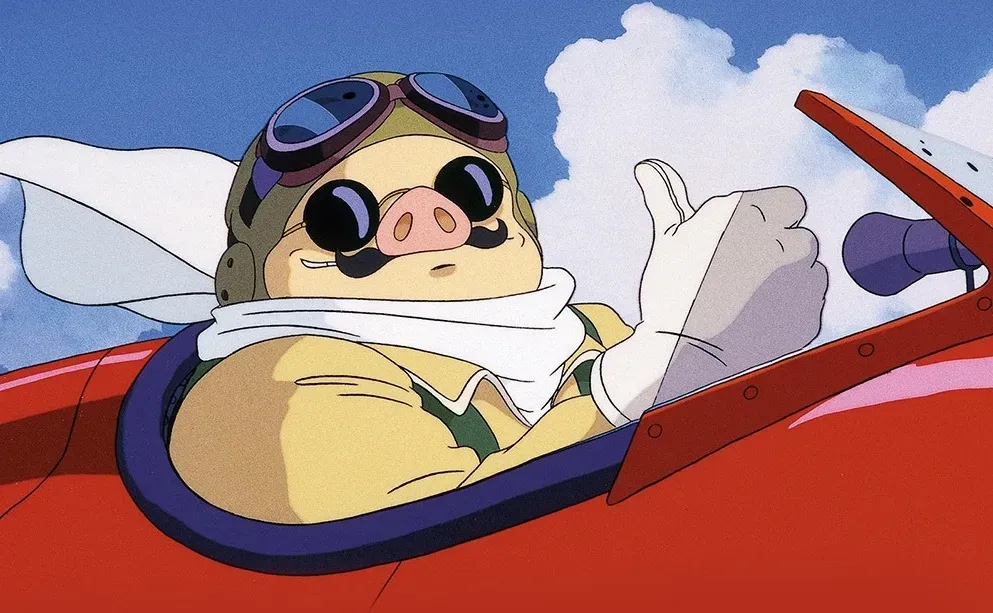

Story Three

NFTs ready for take-off

The Argentinian airline Flybondi has become the first to offer all their e-tickets as NFTs using an integration called Ticket 3.0. That means whenever you buy a ticket with the airline, your ticket will be issued as an NFT on the Algorand blockchain.

NFT tickets provide more flexibility as you can transfer them freely and apparently don't even have to specify where you are going. Unfortunately, though, so far the airline doesn't offer destinations beyond South America. Nevertheless, a good first step to use NFTs for real-life things outside of giving you the right to buy merch (what a scam is that anyway).

Key Takeaway: NFTs are a great solution for ticketing and a logical next step as things become more digital. And not just for flights, it's not a coincidence that Ticketmaster is continuing to experiment with NFTs. 👀

- Naomi from CoinJar

The above article is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. This article is provided for general information and educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar, Inc. makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. Past performance is not a reliable indicator of future results.

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: The selling continues

February 11, 2026Until morale improves, or so I hope. Story One L2s are pointless Tweets the guy who advocated for them as part of the Ethereum scaling roadmap. Perhaps to deflect from his...Read more

Onchain: Lots of things on sale

January 28, 2026Story One Crypto Social for Sale Been an interesting time to observe what happens to the still-standing crypto social networks. Aave, a leading DeFi protocol and creator of...Read more

CoinJar Unlocks European Expansion with MiCA Authorization

January 21, 2026CoinJar has just become a crypto asset gateway for Europe, having received full authorization from the Central Bank of Ireland as a Crypto-Asset Service Provider under...Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.