Onchain: Stranger

December 4, 2024

Share this:

That's the path crypto seems to be going down. It's also the name of a novel by Camus, published in 1942. In it, he wrote, “After a while, you could get used to anything.”

I am approaching that point, but that won't stop me from reporting in from the frontlines of the absurd. Or the trenches, as we've coined gambling in crypto now.

Story One

Smart contracts are not property

Not that any of us would ever have considered smart contracts to be property, to begin with. Nevertheless, it took the Fifth Circuit Court of the US to rule that in reaction to the Treasury sanctioning Tornado Cash two years ago.

Tornado Cash is a mixer; it takes coins and obfuscates their origin, which allows users to maintain their privacy when sending transactions. Unfortunately, it has also been discovered as a useful tool by North Korea's GDP Growth Working Group (others call them Lazarus), who used it to launder $7 billion in proceeds from crypto exploits.

As a reaction, the US Treasury sanctioned Tornado Cash, making it somewhat illegal. Two Tornado Cash developers were arrested for money laundering and put in jail.

It was the first case of a smart contract being sanctioned, and it might be the last, as the court ruled that the treasury was overstepping its boundaries. According to their ruling, the smart contract as automation software isn't owned or controlled by humans.

A win for privacy and anyone building truly decentralized protocols.

Takeaway: Even the court will acknowledge a smart contract without anyone able to control it as sufficiently decentralized not to be sanctioned as they did.

Story Two

Fair launch is the new fair launch

If you've been around long enough, you might remember when Pepe and Shiba launched. It was a time when memecoins would write Fair Launch on their website and then allocate large portions of their supply to their team under the guise of special community allocation.

Fair launch is back. And this time, it's different. Take Clanker, an AI agent on Farcaster that launches memecoins based on casts. Here's the kicker: everyone has to buy in, including the person who told it to launch the coin.

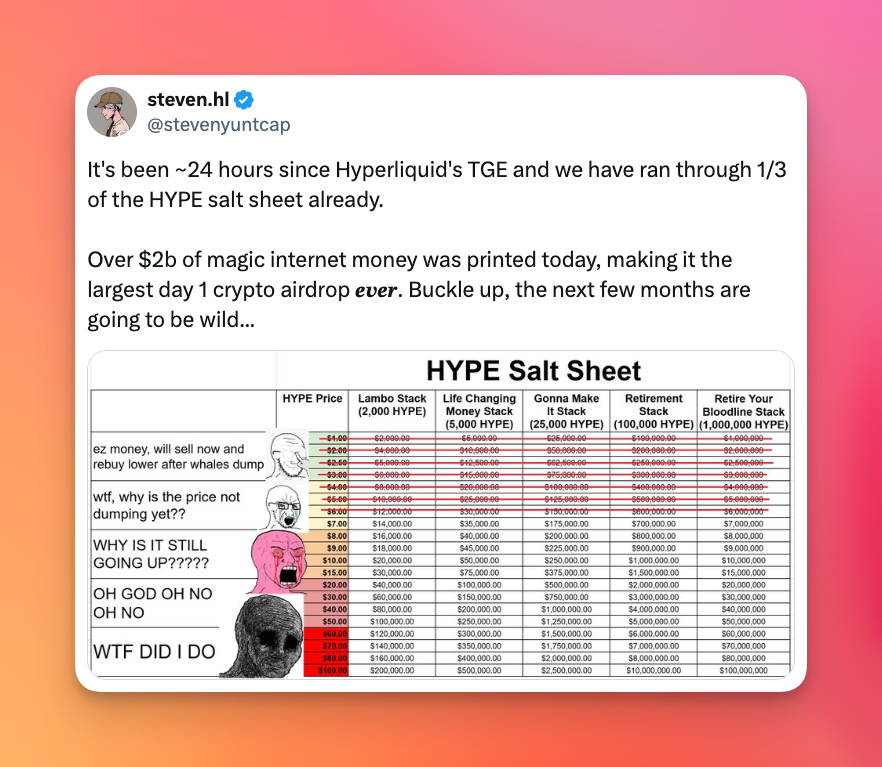

But FC isn't the only place for a fair launch. On November 29th, Hyperliquid, a perpetual trading platform and L1, executed the biggest airdrop worth 1.2 billion.

While most launches this year have been cynically viewed as yet another opportunity for VCs to dump on retail, Hyperliquid gave 30% of its supply to users of its product - without any lockup. No money was given to private investors, exchanges, or market makers.

And it paid off. Within one hour since its launch, trading volume had reached $157 million. At the time of writing, the token price hovers around $9, a solid 3x.

Takeaway: The new meta is the old meta. With all the excitement about fairness, though, don't forget to ask yourself whether any project you invest in has a point.

Story Three

Bananas

Never has a banana had more spotlight than the one featured in the artwork by Maurizio Cattelan. He decided that taping a Banana against the wall with duct tape was High Art. And the art world agreed - just as they did when Marcel Duchamp put a pissoir on display in Paris in the early 20th century.

If you don't get it, it's avant-garde. If you don't understand why this Banana is in a crypto newsletter, it's because an obnoxious, attention-seeking crypto-rich entrepreneur bought it for $6.2 million.

He wouldn't be Justin Sun if he had left it at that. No, the founder of Tron also organized a whole press conference to eat the banana illuminated by the lightning of dozens of journalists' cameras.

He wasn't the first to eat the Banana, yet the first to spend $6.2 million plus the money it took to purchase bananas and duct tape for all the event attendees - so they could recreate the experience at home.

Takeaway: This, too, must be avant-garde because I don't get it.

Fact of the week: On the topic of Bananas, it's always a good idea to eat them for the potassium. But you probably know that. What you didn't know is that technically, they are classified as berries while growing on plants that are considered herbs.

Naomi for CoinJar

The above article is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. This article is provided for general information and educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar, Inc. makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. Past performance is not a reliable indicator of future results.

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: In bad taste

February 25, 2026ICYMI, the tech bros have once again discovered taste, so get ready to be lectured by dudes who think it's acceptable to live with one ceiling light on what to wear and consume....Read more

Onchain: The selling continues

February 11, 2026Until morale improves, or so I hope. Story One L2s are pointless Tweets the guy who advocated for them as part of the Ethereum scaling roadmap. Perhaps to deflect from his...Read more

Onchain: Lots of things on sale

January 28, 2026Story One Crypto Social for Sale Been an interesting time to observe what happens to the still-standing crypto social networks. Aave, a leading DeFi protocol and creator of...Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.