Onchain July: Still no Bitcoin ETF, Azuki enraging its holders, and Poly Network hacked again

July 6, 2023

Share this:

Story One

Still no Bitcoin ETF

Even though major banks now offer digital asset solutions, what's missing so far in the US is a Bitcoin Spot ETF. Exchange Traded Funds are a vehicle that allows institutional investors, such as pension funds, to gain exposure to an asset's appreciation.

When Blackrock, the world's largest asset manager, applied for a Bitcoin ETF, hopes ran high, pushing the price of Bitcoin to a new high this year - and a few crypto bros celebrated this by purchasing an unofficial black rock NFT.

Other asset managers like Fidelity followed suit and re-filed their previous applications. Unfortunately, the SEC ruined the party over the weekend, declaring that the paperwork wasn't sufficiently clear and lacked details on surveillance-sharing agreements.

Takeaway: Crypto companies and investors in the US are between a rock and a hard place (no pun intended). If the SEC really wanted to protect investors, an ETF would be a "safer" option compared to forcing them to gain exposure through MetaMask and Uniswap. 🤷♀️

Story Two

Azuki enraging its holders

It's the anime trailer season. And not just from the usual suspects such as Studio Mappa, but also NFT projects are dropping videos left and right, creating the illusion of meaningful accomplishments. But, making Anime is expensive.

Maybe that's why Azuki, the anime-inspired NFT pfp project, dropped a new 20k collection called Elementals. They raised $38 million in just 15 minutes by selling half of the collection. The other half was airdropped to current Azuki holders.

Latter quickly learned that nothing in life is free. When the art was revealed, it turned out to be eerily similar to their current pfp. Needless to say, the floor price of the original Azuki collection dropped by over 40% - that's just basic supply-demand math.

In reaction to the backlash, the team commented that the art wasn't final yet, but the damage had been done. As if a different background could save them.

Takeaway: Just issuing a JPEG isn't enough anymore. NFT projects must prove they have a legitimate reason to exist, especially when they hold so much f*cking money. Creating more JPEGs probably isn't the answer. It also doesn't help with outsiders taking us seriously.

Story Three

Poly Network hacked again

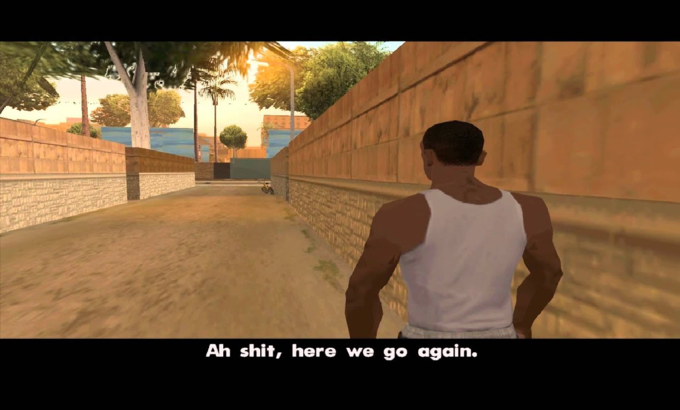

If you had funds in Poly Network, last week must have felt like:

The cross-chain bridging protocol has once again been exploited affecting 57 assets across ten blockchains, including Ethereum, Metis, OKX, and BNB Chain.

The attackers found a bug that enabled them to mint billions of tokens out of thin air. So much so that at some point, the attackers' wallet held $43 billion in value. Fortunately, low liquidity prevented them from cashing out most of that.

So far, the attackers have managed to swap over $4 million into mainstream assets, according to BlockMist. A lot less than the North Korean Hacker group who enriched themselves by $600 million when exploiting Poly in 2021.

Takeaway: Moving assets across chains remains risky. Often bridges rely on a multi-sig (a wallet where multiple parties have to sign to make transfers) controlled by very few people. It's no coincidence that the five largest DeFi hacks all were bridges. So bridge with caution.

Fact of the week: How much anime can you produce with a floor price Azuki? Not a single episode. Current anime like Jujutsu Kaisen or Attack on Titan cost an average of $150,000 per episode to produce - but at least those have an actual business model attached. 💸

- Naomi from CoinJar

The above article is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. This article is provided for general information and educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar, Inc. makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. Past performance is not a reliable indicator of future results.

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: In bad taste

February 25, 2026ICYMI, the tech bros have once again discovered taste, so get ready to be lectured by dudes who think it's acceptable to live with one ceiling light on what to wear and consume....Read more

Onchain: The selling continues

February 11, 2026Until morale improves, or so I hope. Story One L2s are pointless Tweets the guy who advocated for them as part of the Ethereum scaling roadmap. Perhaps to deflect from his...Read more

Onchain: Lots of things on sale

January 28, 2026Story One Crypto Social for Sale Been an interesting time to observe what happens to the still-standing crypto social networks. Aave, a leading DeFi protocol and creator of...Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.