Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

How to buy cryptocurrency with CoinJar crypto exchange

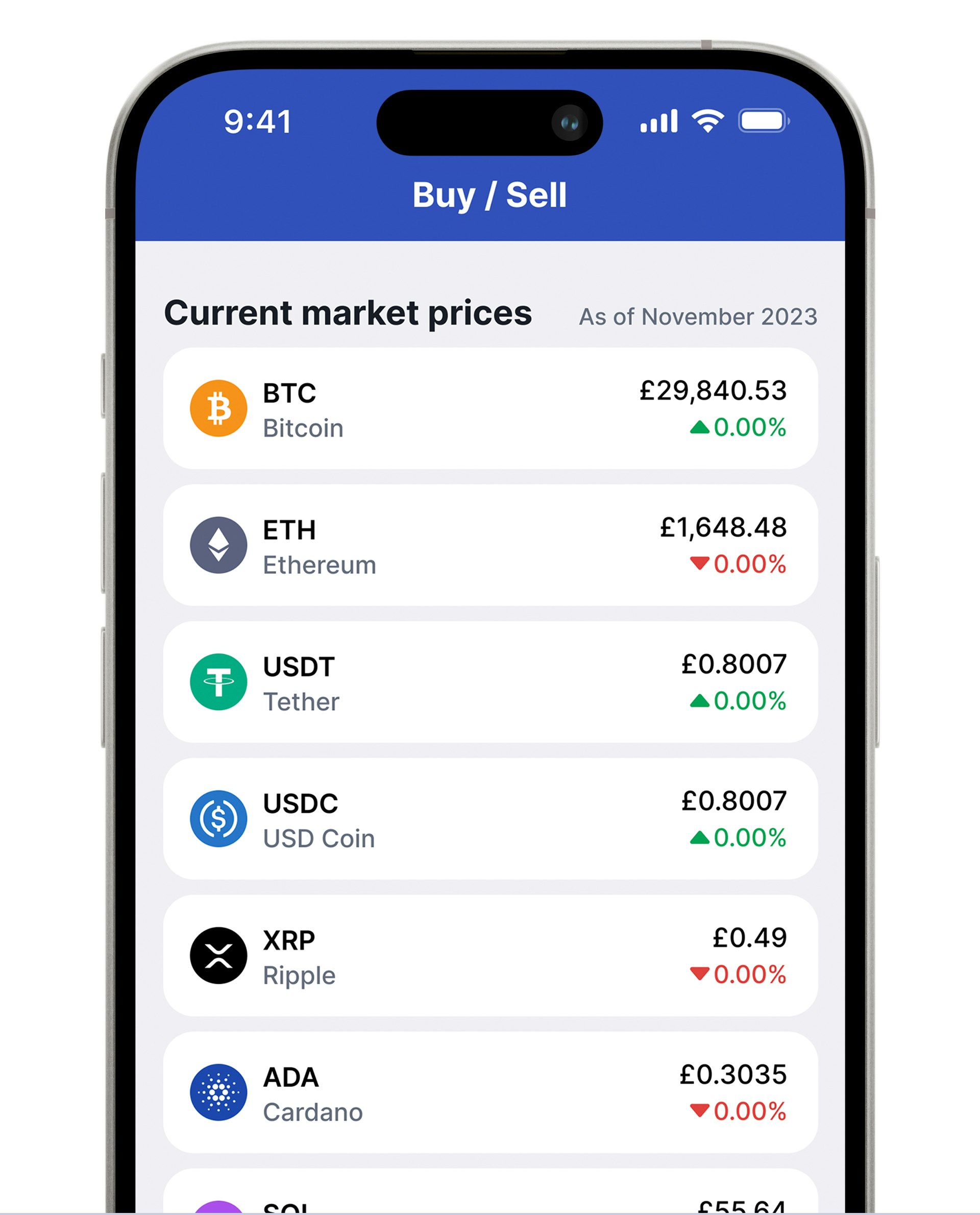

Pick your crypto

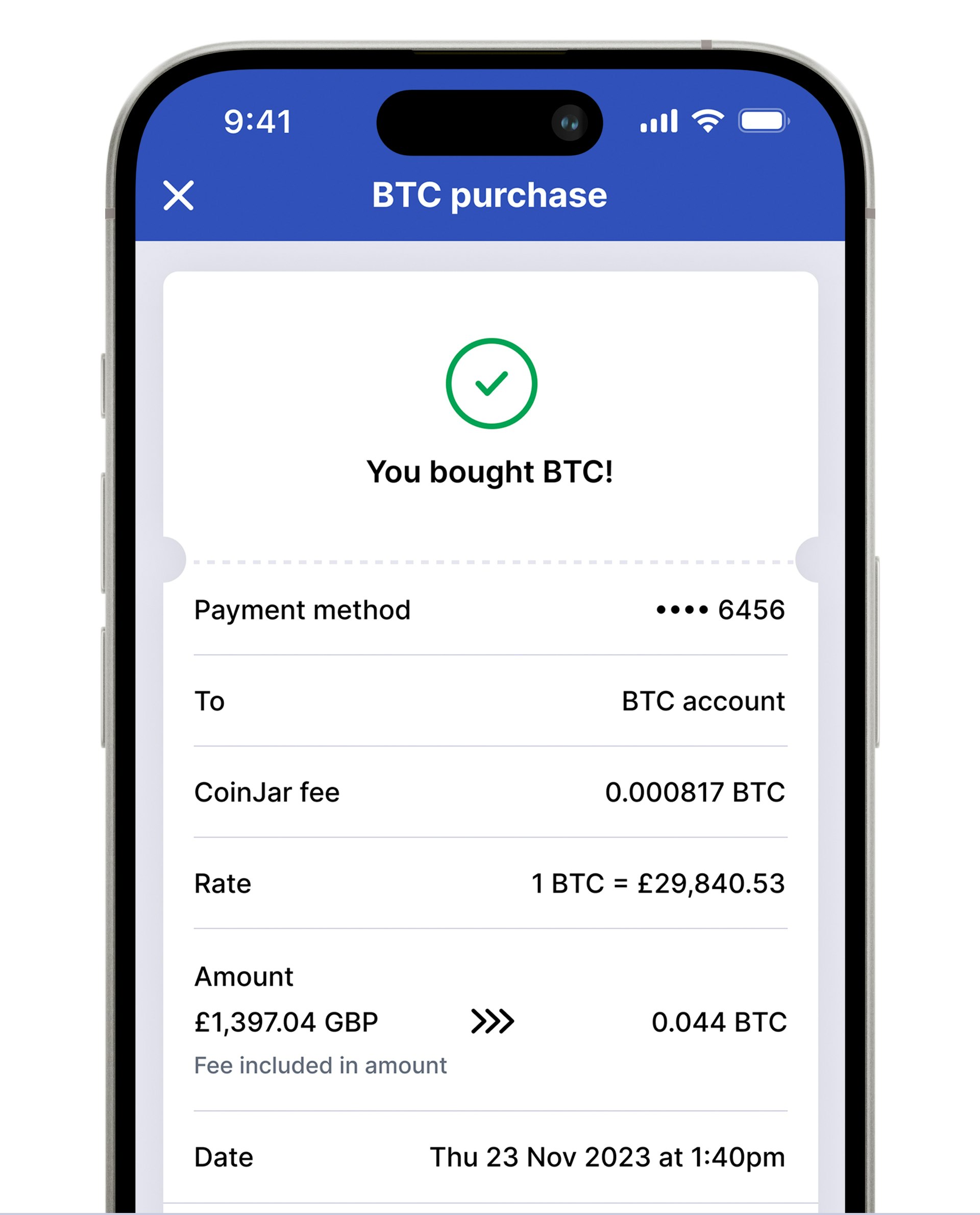

Choose between 60+ leading cryptocurrencies on the crypto exchange.Pay your way

Faster Payments GBP bank deposits or instant card payments. EUR and AUD deposits are also available.Grow your portfolio

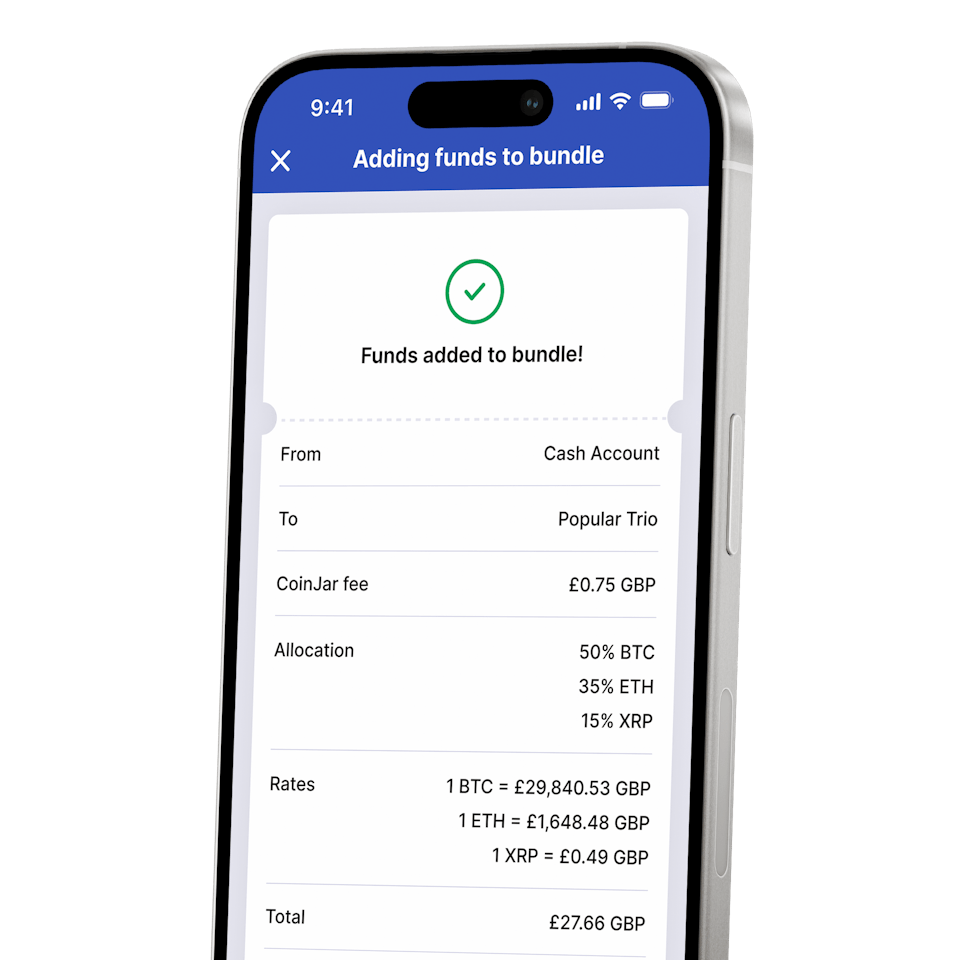

Store your crypto in our wallet. Diversify with CoinJar Bundles.

CoinJar DCA & Bundles

Automate and diversify your portfolio

Trade your local currency

MULTI-CURRENCY SUPPORTFinder Awards Winner 2023

CRYPTO TRADING - VALUE

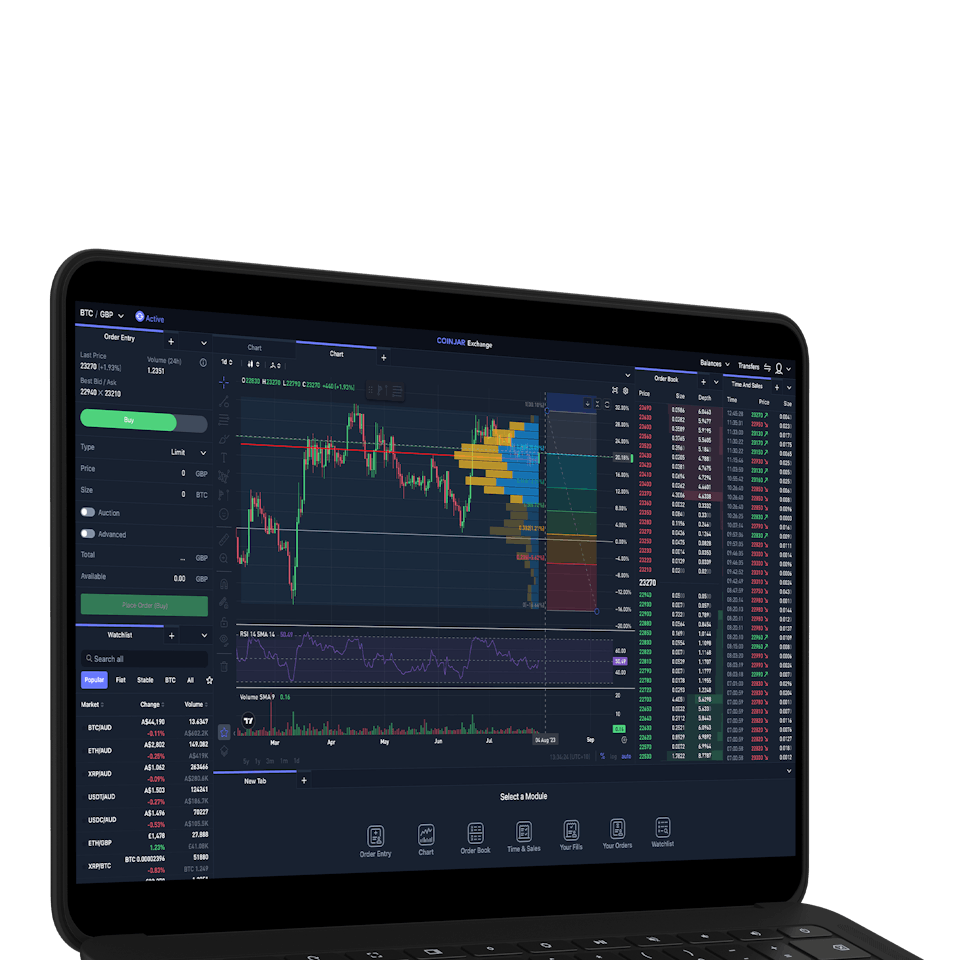

Institutional-grade crypto solutions

Products and services designed for institutions, market makers and finance professionals.

CoinJar Crypto Exchange

FOR PROFESSIONAL CRYPTO TRADERSPrivate and encrypted crypto storage

Fraud protection

We employ multi-level data encryption, audits and follow best practice guidelines to protect customer accounts. Our Support team uses advanced machine learning to recognise suspicious logins, account takeovers and financial fraud.

Crypto storage

Our assets are stored in BitGo and Fireblocks cryptocurrency custody providers.

Established in 2013

CoinJar was established as a cryptocurrency exchange in 2013. We’re backed by investors, which include Blackbird and DCG Group.Featured In

Frequently asked questions

Why should you use CoinJar for trading cryptocurrencies?

CoinJar is a platform that offers a user-friendly experience for cryptocurrency enthusiasts in the UK. Its trading volumes solidify its position as a prominent exchange by trade volume, facilitating efficient buy and sell cryptocurrencies transactions.

The exchange allows users to access a diverse range of digital assets, which users can buy with credit or debit cards. Furthermore, platforms offer varying features, but exchange offers like CoinJar's competitive fees and intuitive interface make it a top choice, whether you're looking to trade Bitcoin or explore other cryptocurrencies.

How does CoinJar compare as a crypto exchange in the UK?

CoinJar stands out due to its convenience, efficiency, and excellent customer support, making it a top choice among UK crypto exchanges.

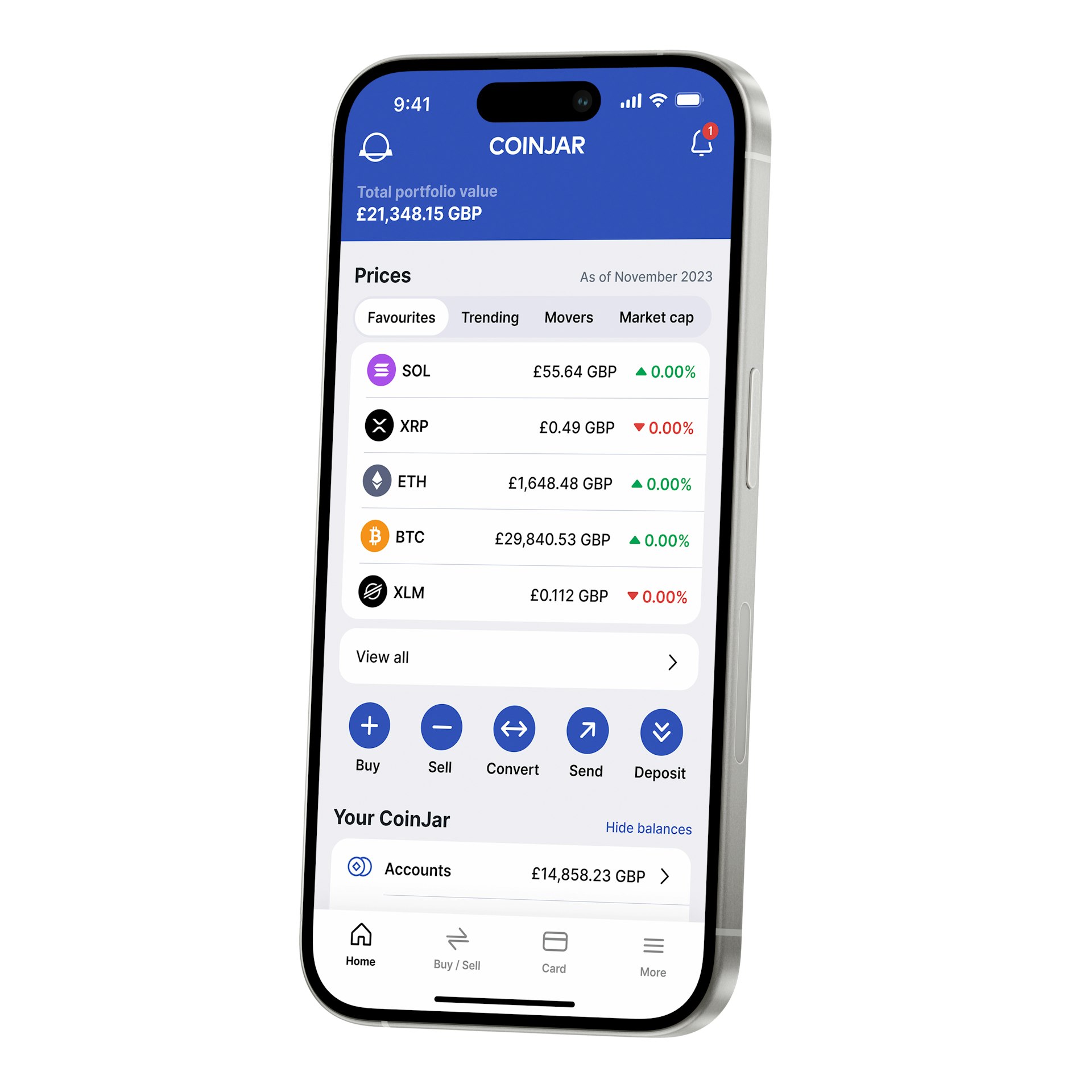

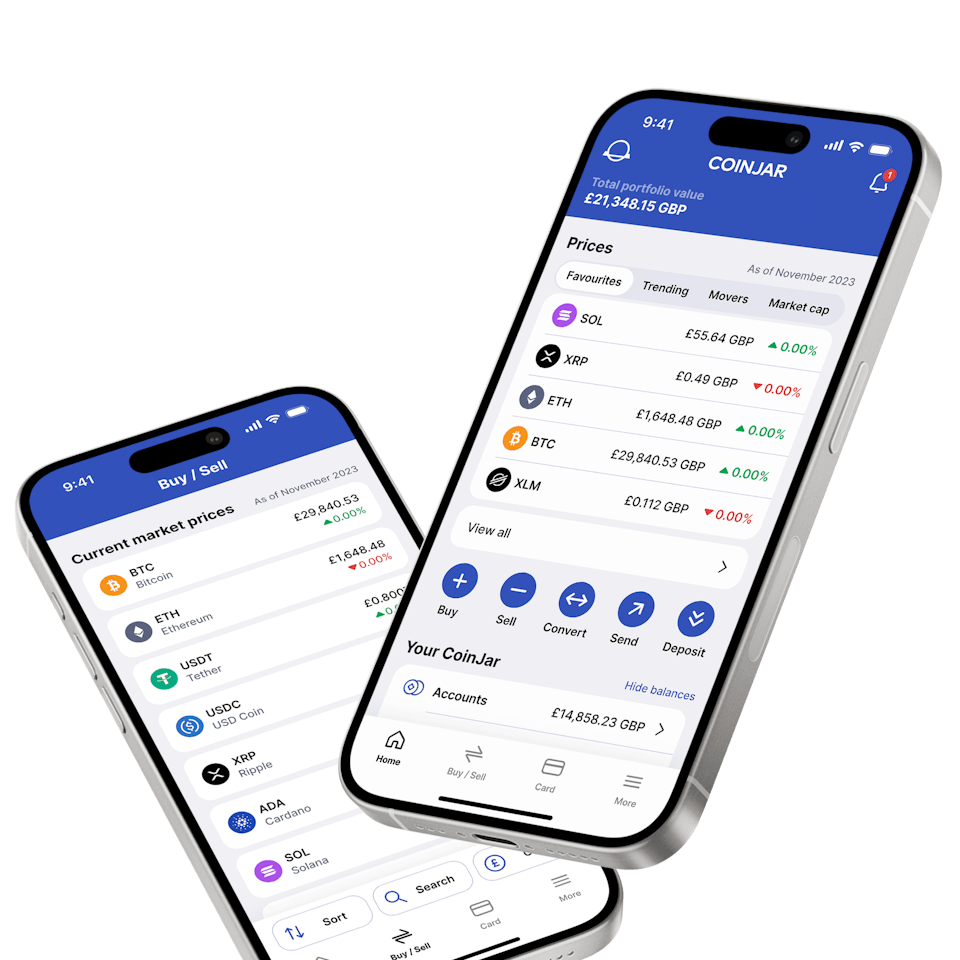

Can I use CoinJar as a crypto exchange from my mobile device?

Yes, the CoinJar app is available for both iOS and Android, allowing you to trade anytime, and from anywhere in the UK. This makes it one of the most convenient crypto exchanges for mobile users.

Does CoinJar offer a crypto exchange wallet?

Yes, CoinJar provides an integrated wallet within the exchange, giving you convenient access to your funds.

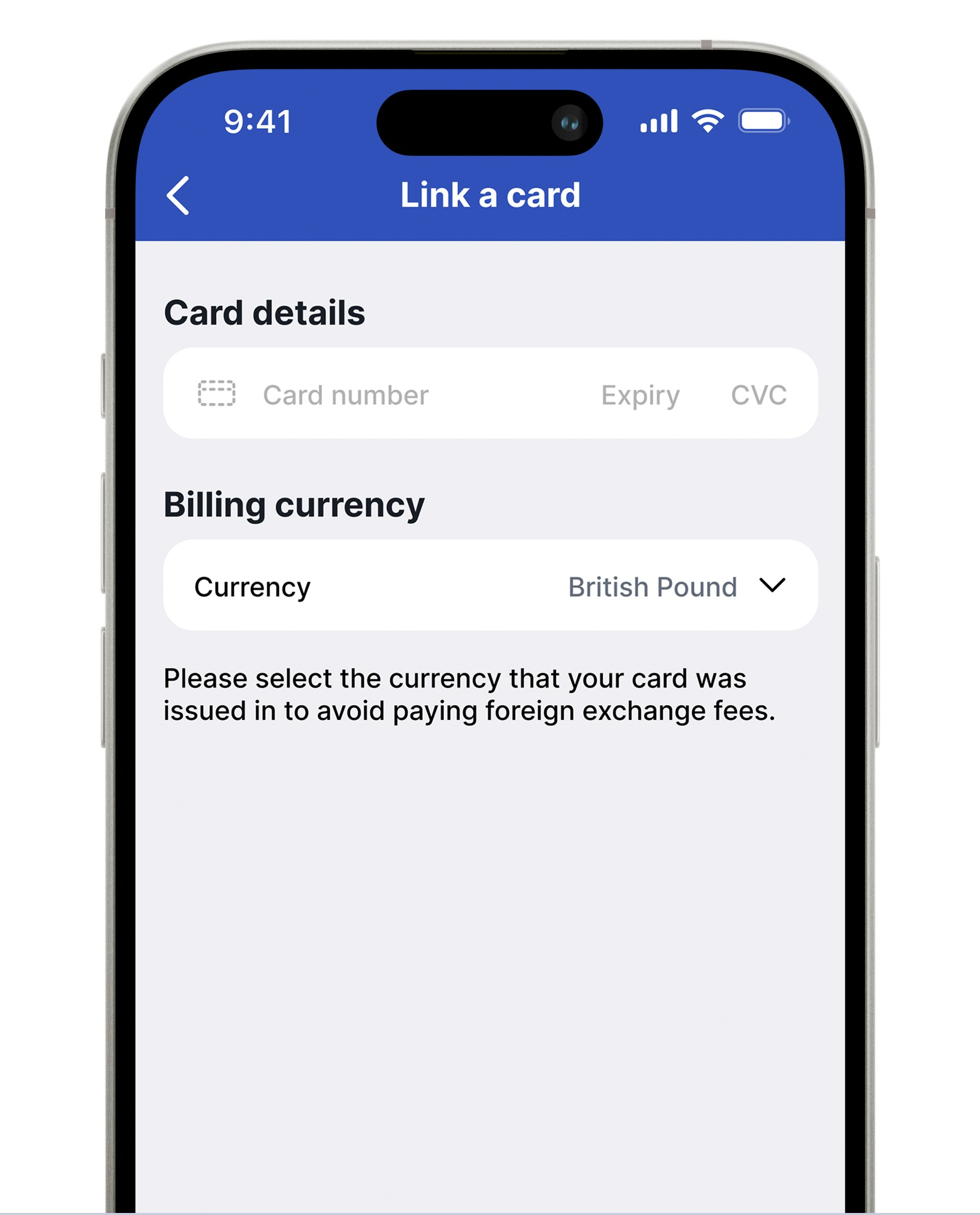

What are the deposit and withdrawal options on CoinJar as a crypto exchange?

CoinJar supports GBP deposits via bank transfer, and you can buy crypto via card.

Is the CoinJar Exchange a good crypto exchange for making multiple trades per day?

While the CoinJar app is beginner-friendly, there is also the for more active traders with real-time price tracking, limit orders, TradingView charts, and access to multiple trading pairs, ideal for those needing more flexibility from their crypto exchange.

How long do trades take on CoinJar as a crypto exchange?

Most trades on CoinJar are executed instantly, making it a convenient crypto exchange in the UK for buying and selling digital assets.

Does CoinJar offer customer support as a crypto exchange?

Yes, CoinJar provides responsive customer support via email, ensuring you get help quickly if issues arise on the platform.

How does CoinJar handle tax reporting for crypto exchange users?

CoinJar makes it easy to track your crypto activity with downloadable transaction history and integrations with popular crypto tax platforms used in the UK.

Why should I choose CoinJar as my preferred crypto exchange?

With over a decade of experience, local support, and a wide range of coins, CoinJar is a crypto exchange trusted by thousands of UK residents.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.