Onchain: Bullishness indicators

August 13, 2025

Share this:

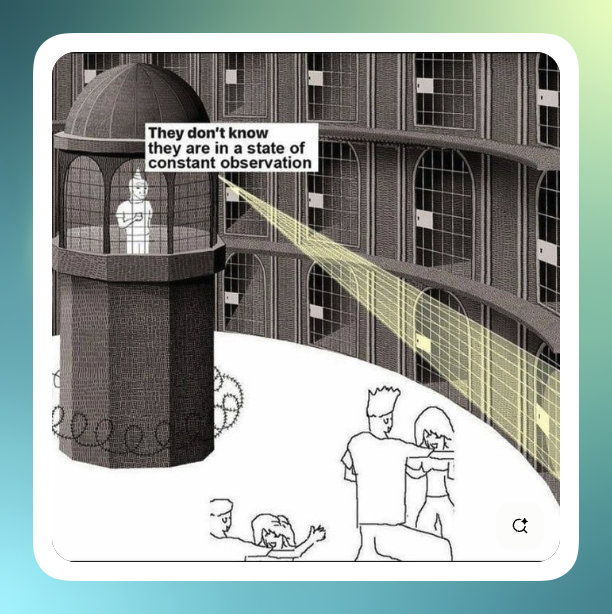

Wherever you look, as long as you avoid checking what's happening to privacy in the UK, and maybe soon in the US...

Story One

CT unites

For once, people on Crypto Twitter have come together to fight against a common enemy: the overreach of regulators. Last week, news broke that a jury in Manhattan had found Roman Storm, the creator of Tornado Cash, guilty of operating an unlicensed money transmitter.

As a reminder, Tornado Cash is a non-custodial mixing service, allowing anyone to obfuscate the trail of their transactions. While North Korean hackers have used it, it has also provided thousands of normal citizens access to much-needed privacy in a world of increasing surveillance.

The bigger threat is the dangerous precedent this judgment could set, with implications for user privacy and open-source developers. Roman had no control whatsoever over the smart contract and could not, even if he had wanted to, stop it. Making him responsible for criminal use of the technology is a bit like asking knife sellers to be responsible when a customer chops up their neighbours instead of onions.

Takeaway: Nothing like a shared enemy to unite and stop the infighting for a bit.

Story Two

ETH is going up

Which, in itself, is quite big news for everyone who, like me, has been holding ETH for the past few years, defending the choice with your lofty integrity and aspiration to see the world computer flourish. Apparently, our time has come, and the ETH price has made our choices seem less off to the outside spectators.

Even Arthur Hayes, the (in)famous co-founder of BitMex - now full-time leisure enjoyer and writer - has been forced to rethink his outlook on the future of ETH. After selling roughly $8.32 million worth of ETH when the price was at $3.5k, g, he changed his mind once ETH crossed $4k.

While his macroeconomic worries, such as tariff fears, lukewarm job report, and a US economy propped up by AI hype, all remain valid, he probably forgot that this market isn't rational. So why expect traders to act that part? Or maybe it was just good old FOMO that got him back in.

Takeaway: No one is safe from feeling FOMO.

Story Three

Bullish Outage

We've entered a new era of crypto where outages are not events to decry, but, according to some CT leads, bullish events. The logic is simple: if it was a chain used by no one, no one would care whether it's offline.

The chain in question is Base, the Layer 2 built by Coinbase, which stopped producing blocks for 33 minutes after a switch to a badly configured backup sequencer. All L2s have a sequencer that organizes transactions, batches them, and communicates with the L1.

If the sequencer stops, so does much of the onchain activity because what's a blockchain if no one can transact?

Base has often been criticized for its sequencer setup where Coinbase as the sole sequencer operator acts as a benevolent ruler over transaction ordering. So far, this has stopped no one from using Base, probably aided by the launch of the Base App, and their ability to make you use it to buy coffee while avoiding hipster prices.

Takeaway: These days, just as anything can be a recession indicator, it can be bullish.

Fact of the week: Speaking of overpriced coffee, did you know that instant coffee was invented as early as 1901 by a Japanese chemist named Satori Kato? Only 30 years later, when Nestlé adopted it, it became popular. It remains to this day, with some even using it for self-defense purposes.

Naomi for CoinJar

Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: In bad taste

February 25, 2026ICYMI, the tech bros have once again discovered taste, so get ready to be lectured by dudes who think it's acceptable to live with one ceiling light on what to wear and consume....Read more

Your Voice Can Shape the Future of Crypto in the UK

February 17, 2026The UK is now shaping the future of cryptocurrency and digital assets. Right now, there's a narrow window for stakeholders to help define the rules.Read more