Buy XRP

XRP

XRP

Overview

What is XRP?

Want to buy XRP? But what is XRP? And how is it connected to Ripple? How do I buy it? XRP is a cryptocurrency that you can use to send and receive payments across the world.

XRP and the XRP Ledger was designed to connect banks, payment providers, and other financial institutions to each other. By using XRP, these institutions may save time and money, and offer better services to their customers.

XRP is different from regular money because it is not controlled by any government or bank. Instead, it runs on a network called the XRP Ledger (XRPL). XRP is the native token of that the XRP Ledger.

While Ripple created XRP, and holds a large amount of XRP, they don't control the XRP Ledger. The XRP Ledger is decentralised, meaning it's not controlled by any single entity.

XRP consistently lists among the top 10 cryptocurrencies by market capitalisation. At the time of writing (03 Octover 2024), XRP was the 7th most-popular cryptocurrency. It can be bought at pretty much every crypto exchange.

Why XRP?

XRP is designed to be efficient, cost effective. It can handle thousands of transactions per second, and it only takes a few seconds to confirm a payment. It also has very competitively priced fees. While Bitcoin is also handy for international payments with competitively priced fees, XRP is less energy intensive.

XRP can also be exchanged for other types of fiat currency or crypto, such as dollars or Bitcoin. This aims to remove complexities when moving money across different countries and currencies.

Many people invest in XRP because they believe in its potential to change the future of finance. Purchasing XRP with Pounds Sterling on CoinJar is straightforward. The XRP tokens remain in your CoinJar account if you don't want to create a separate wallet.

Why the XRP Ledger is better than existing systems like SWIFT

- Transaction speed: XRP can be used to settle payments in 3 to 5 seconds, while SWIFT can take up to 5 business days.

-Competitively priced: XRP has a competitive transaction fee of 0.0001 XRP, while SWIFT charges banks to use their service. Banks also charge their customers fees for international wire transfers, which frequently use the SWIFT network. These bank fees can be based on a percentage of the transaction amount and can become quite expensive for large transfers.

-Transparency differences: XRP utilises a distributed ledger technology that allows for public verification of transactions, potentially offering greater transparency. SWIFT operates through a network of financial institutions, which may have less public visibility.

-Higher scalability: XRP can handle thousands of transactions per second, while SWIFT has slower settlement times.

Ripple legal dramas

Ripple has had some famous stoushes with regulators in the USA.

The drama began in late 2020 when the U.S. Securities and Exchange Commission (SEC) charged Ripple with selling unregistered securities.

After years of litigation, on July 13, 2023, a federal judge handed the company a partial victory by ruling that XRP sales on public crypto exchanges were not offers of securities under the law.

On the 8th August 2024, a federal judge ordered Ripple Labs to pay a $125 million civil penalty in the long-running case brought by the Securities and Exchange Commission (SEC). The judge denied the SEC's request for a penalty of $2 billion.

Following the ruling, the value of the XRP token rose significantly.

Cash, credit or crypto?

Buy XRP using Visa or Mastercard. Get cash in your account with Faster Payments Service (FPS). Convert crypto-to-crypto with a single click.How to buy XRP with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.

Finder Awards Winner 2024

CRYPTO TRADING - VALUEFinder Awards Winner 2024

CRYPTO TRADING - VALUE

Featured In

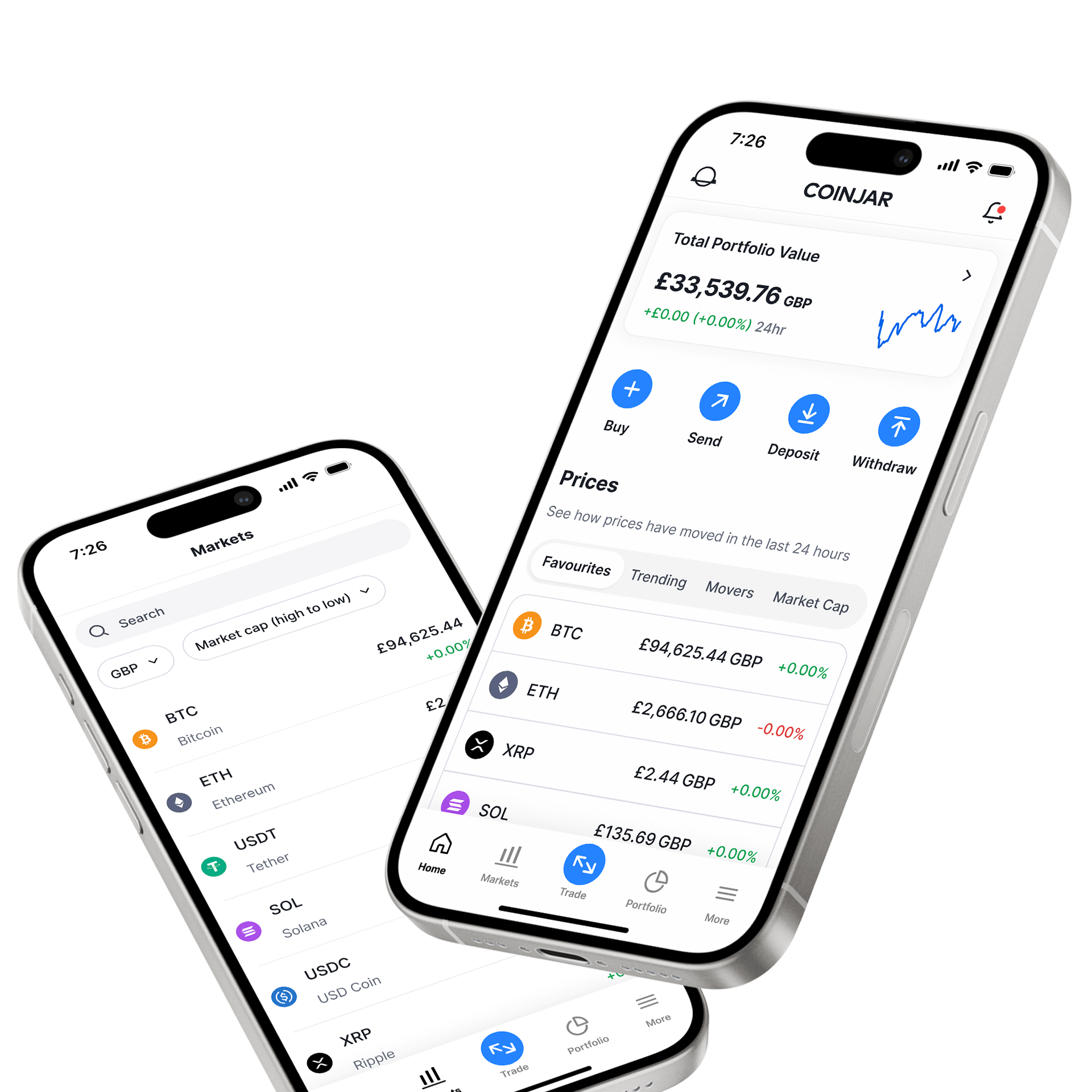

CoinJar App

All-in-one crypto walletCoinJar App

All-in-one crypto wallet

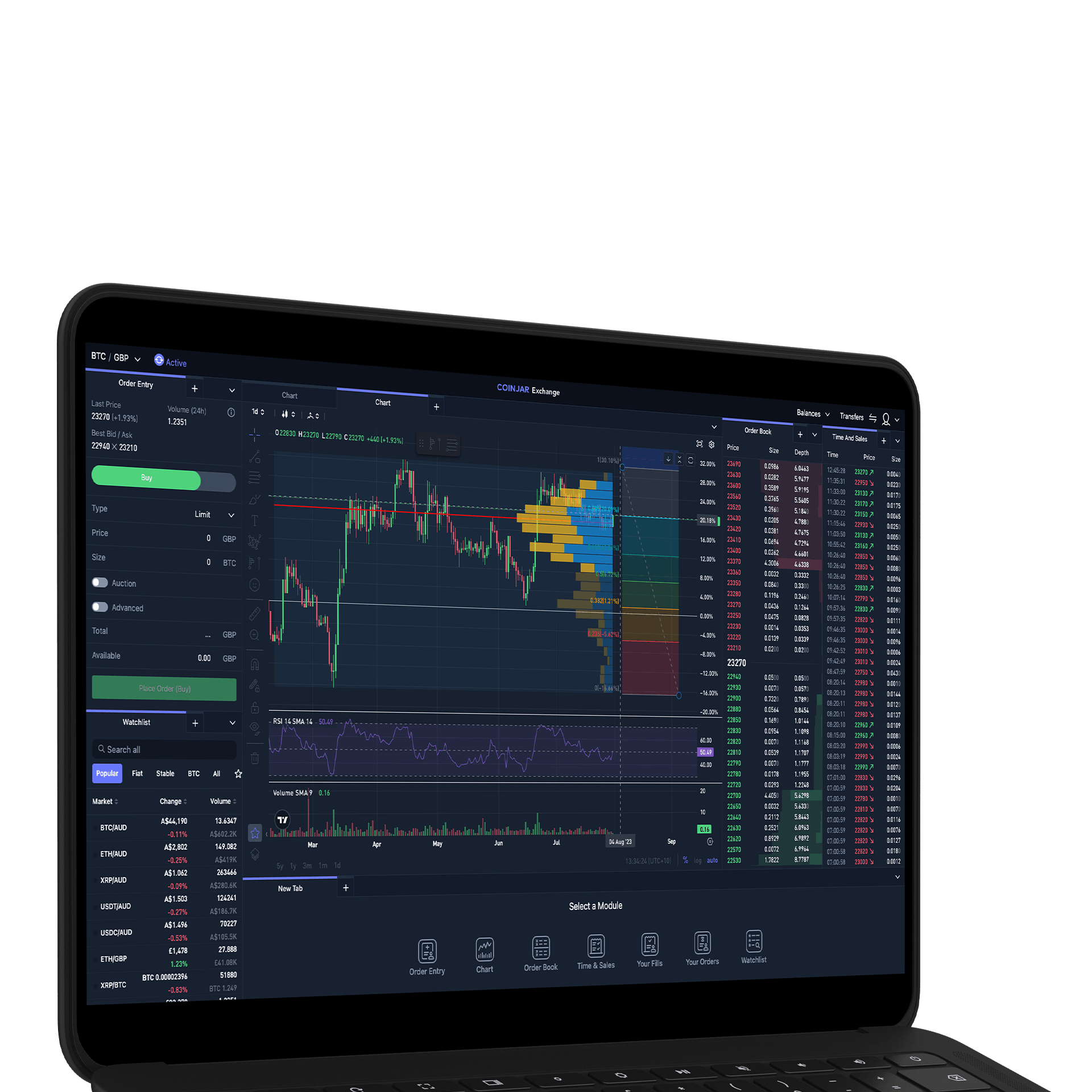

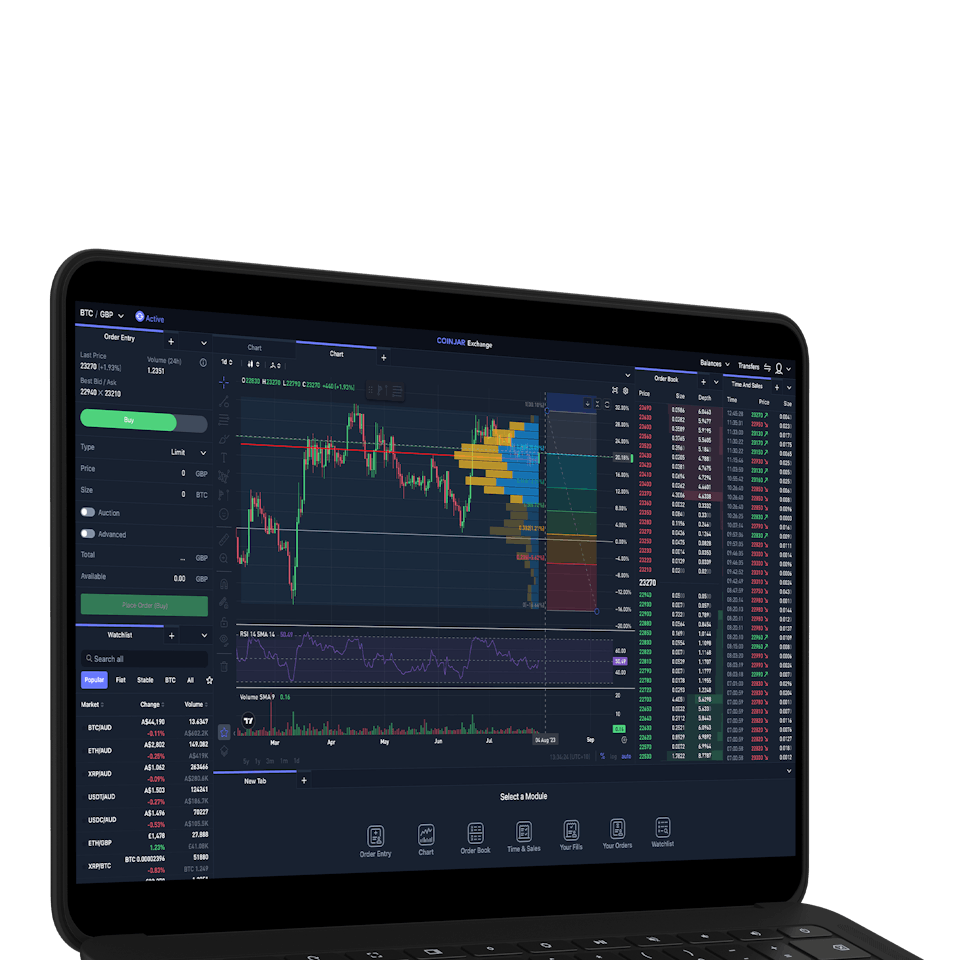

CoinJar Exchange

FOR PROFESSIONAL CRYPTO TRADERS

CoinJar Exchange

FOR PROFESSIONAL CRYPTO TRADERS

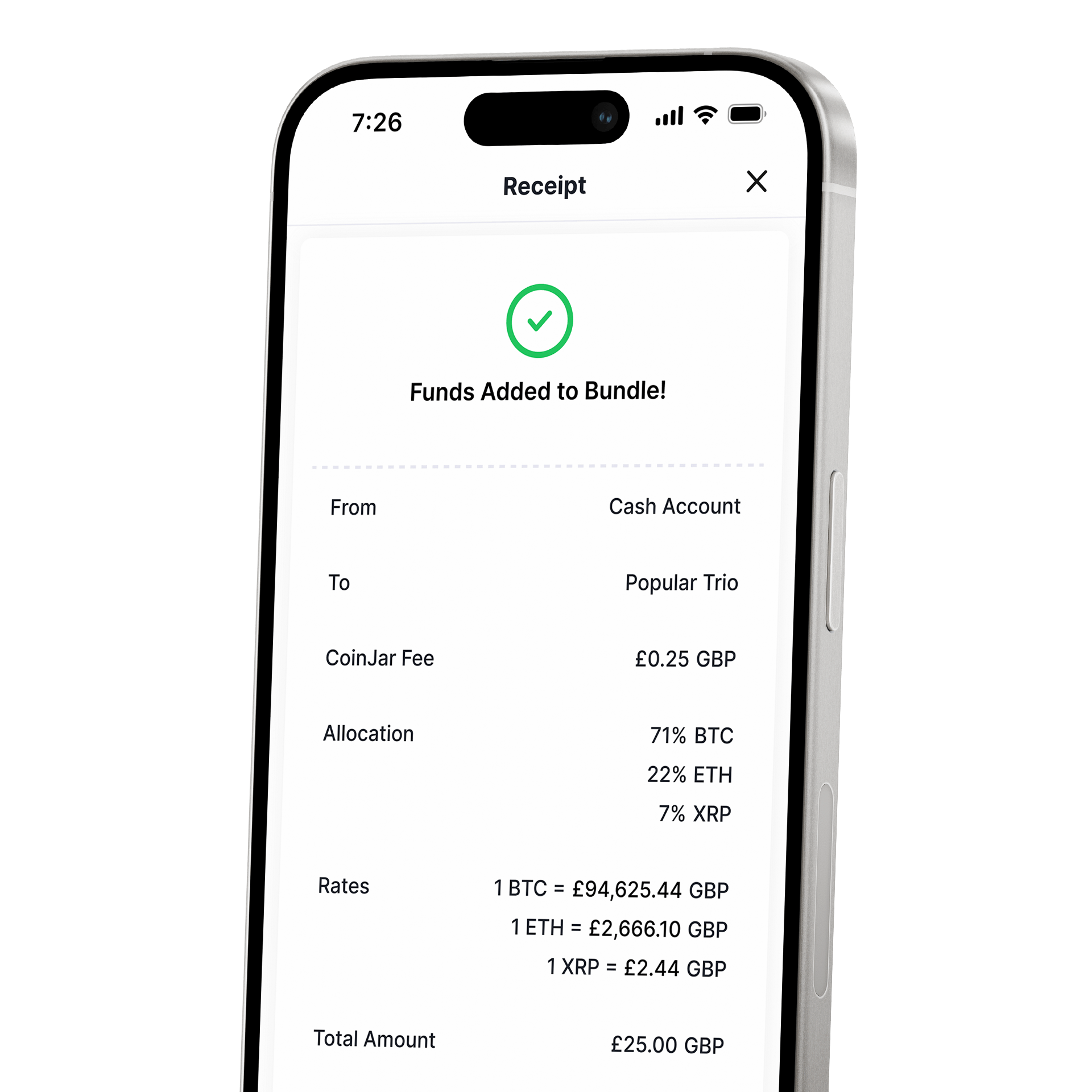

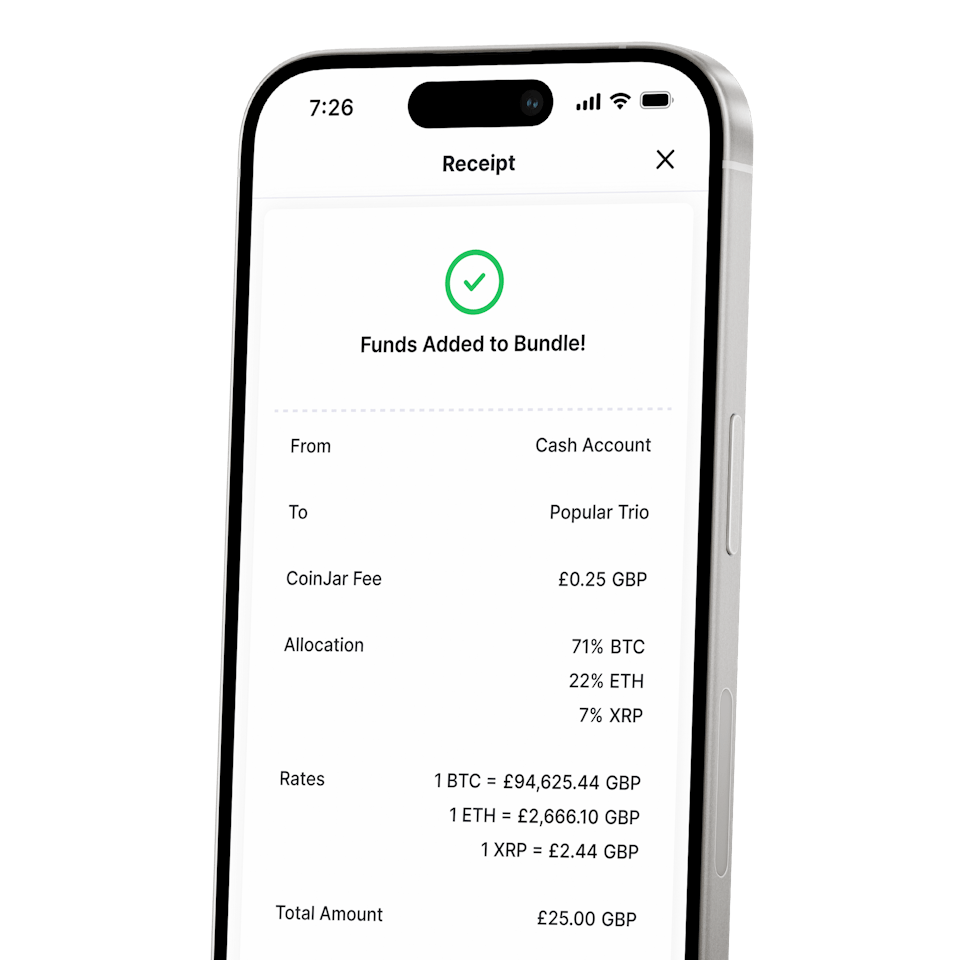

CoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIOCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Standard Risk Warning: The above article is not to be read as investment, legal or tax advice and it takes no account of particular personal or market circumstances; all readers should seek independent investment advice before investing in cryptocurrencies.

The article is provided for general information and educational purposes only, no responsibility or liability is accepted for any errors of fact or omission expressed therein. Past performance is not a reliable indicator of future results.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar's digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767). In the UK, it's legal to buy, hold, and trade crypto, however cryptocurrency is not regulated in the UK.

It's vital to understand that once your money is in the crypto ecosystem, there are no rules to protect it, unlike with regular investments. You should not expect to be protected if something goes wrong. So, if you make any crypto-related investments, you're unlikely to have recourse to the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service (FOS) if something goes wrong.

The performance of most cryptocurrency can be highly volatile, with their value dropping as quickly as it can rise. Past performance is not an indication of future results. Remember: Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://www.coinjar.com/uk/risk-summary.

UK residents are required to complete an assessment to show they understand the risks associated with what crypto/investment they are about to buy, in accordance with local legislation. Additionally, they must wait for a 24-hour "cooling off" period, before their account is active, due to local regulations. If you use a credit card to buy cryptocurrency, you would be putting borrowed money at a risk of loss.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets.

Specific risks associated with DeFi tokens Decentralised Finance (or 'DeFi') tokens (e.g. UNI, AAVE) are crypto-assets linked to financial applications and protocols built on decentralised blockchain technology. DeFi tokens carry the following risks:

Smart contract risk: DeFi relies heavily on smart contracts. Even a minor coding error or oversight can lead to a contract being exploited, potentially resulting in significant losses for DeFi tokens.

Regulatory risk: DeFi operates in a decentralised manner, often without intermediaries or financial crime controls. Regulatory bodies across jurisdictions might introduce new regulations impacting the use, value, or legality of certain DeFi protocols or assets.

Rug-pulls / Exit scams: Some DeFi projects might be launched by anonymous or pseudonymous teams, increasing the risk of "rug pulls" where developers abandon the project and withdraw funds, leaving investors with worthless tokens.

Data/oracle risk: DeFi protocols often rely on external data sources or 'oracles. Manipulation or inaccuracies in these data sources can lead to unintended financial outcomes within the protocols. Protocol complexity: The complexity of some DeFi protocols can make it difficult for average users to fully understand the mechanisms and associated risks.

Specific risks associated with meme coins:

'Meme coins' (e.g. DOGE, SHIB, PEPE) are crypto-assets whose value is driven primarily by community interest and online trends.

Meme coins carry the following risks:

Volatility risk: Meme coins can have extreme price volatility, often experiencing rapid and unpredictable price fluctuations within short periods. The value of meme coins can be influenced by social media trends, celebrity endorsements, and other factors unrelated to traditional investment fundamentals. Lack of utility: Meme coins often lack intrinsic value or utility, being primarily driven by community interest, online trends, and speculative trading.

Market manipulation: Meme coins may be susceptible to increased risk of market manipulation including 'pump-and-dump' schemes, where the price is artificially inflated followed by a sudden crash.

Lack of transparency: Meme coins may have limited available information about their development teams, goals, and financials. This lack of transparency can make it challenging to assess the credibility and potential of a meme coin accurately.

Emotional investing: Meme coins often garner strong emotional reactions from investors, leading to impulsive decisions. Emotional trading activity can amplify losses.

Specific risks associated with stablecoins:

There is a risk that any particular stablecoin may not hold their value as against any fiat currency; or may not hold their value as against any other asset. Stablecoins carry the following risks:

Depegging events: Depegging events may occur with stablecoins that fail to maintain adequate controls and risk mitigants. A depegging event is when the value of the stablecoin no longer matches the value of the underlying asset. This could result in a loss of some or all of your investment.

Counterparty risk: Counterparty risk arises when an asset is backed by collateral, involving a third party maintaining the collateral, which introduces risk if the party becomes insolvent or fails to maintain it.

Redemption risk: Redemption risk refers to the possibility that an asset's ability to be redeemed for underlying collateral may not be as anticipated during market fluctuations or operational issues.

Collateral risk: Collateral risk refers to the possibility of the collateral's value declining or becoming volatile, potentially impacting the asset's stability, particularly when it is another crypto-asset.

Exchange rate fluctuations: Stablecoins, often denominated in US Dollars, expose investors to fluctuations in the USD:GBP exchange rate. Algorithmic risk: Algorithm risk refers to the possibility of an asset's stability being compromised due to unexpected failure or behaviour of the underlying algorithm, potentially leading to loss of value.

CoinJar does not endorse the content of, and cannot guarantee or verify the safety of any third-party websites. Visit these websites at your own risk.

Your information is handled in accordance with CoinJar’s Privacy Policy.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.