Buy Bitcoin in Australia on CoinJar

Bitcoin

BTC

Overview

What is Bitcoin?

Bitcoin is the most famous , and probably always will be. It has the highest market capitalisation, which is another way of saying that more people own Bitcoin than any other cryptocurrency. It was also the to be created, and this happened in 2009.

So who created this “digital gold” that now is becoming a mainstream store of value? Strangely, the creators of Bitcoin, even to this day, remain anonymous.

Buy Bitcoin: Why do investors purchase Bitcoin?

The cryptocurrency was created by one person or perhaps a group of people who called themselves “Satoshi Nakamoto”. They have not been heard of and it may be a mystery that is never solved.

Bitcoin (also known as BTC) was the first digital asset to be built on a blockchain, which means that every transaction that takes place using BTC is recorded on that blockchain. These transactions can be viewed by the public at any time. While we can’t know who is using the BTC to make these transactions, it is still a public ledger that is viewable by anyone.

Bitcoin Culture

Bitcoin started its life just 13 years ago, but already there is an established culture and lore that keeps media outlets buzzing. Even in the early days, the idea of Bitcoin captivated people.

For example, the first Bitcoin purchase was for pizza. However, this has blown up into “” and is a really fun theme on the internet.

On May 22, 2010, a programmer named Laszlo Hanyecz paid 10,000 Bitcoin for two pizzas, which was worth about US$41 at the time. Today, that Bitcoin would be worth over US$500 million. Keep in mind that the performance of bitcoin can be highly volatile, with the value dropping as quickly as it can rise. Past performance is not a guide to the future.

These days, you can buy a lot of stuff with Bitcoin. Besides pizza, you can use Bitcoin to buy things like travel, gift cards, games, art, and even .

There are also many charities that accept Bitcoin donations.

Buy Bitcoin: Other interesting Bitcoin facts

Bitcoin is legal tender in El Salvador. On September 7, 2021, El Salvador became the first country to accept Bitcoin as legal tender, meaning that people can use it to pay taxes, debts, and goods and services. The government also gave every citizen US$30 worth of Bitcoin to encourage adoption.

In other interesting Bitcoin news, Bitcoin has a finite supply of 21 million coins, but not all of them are in circulation. Some of them are totally lost. Sometimes this is due to forgotten passwords, lost wallets, or the death of the owners. According to crypto data firm Chainalysis, around 20% of Bitcoin has been lost or is stuck in wallets that can’t be accessed.

Bitcoin is not only a currency, but also a network of computers that run the Bitcoin software and validate transactions. These computers are called nodes, and anyone can run one. There are tens of thousands of nodes distributed across the world, with the highest concentration in the United States, Germany, and France.

You can actually buy part of a Bitcoin. You can invest in a whole Bitcoin if you want, but you can also just buy a part of a Bitcoin too!

Buy Bitcoin: How many Bitcoin exist?

Any investor who trades Bitcoin knows there will only ever be 21 million Bitcoin in circulation, but they have not all been “released” yet. At the time of writing, have been mined so far.

When 21 million Bitcoin have been mined, that’s the end of the road for new Bitcoin. It’s still a long way off yet and is predicted to happen in 2140.

Cash, credit or crypto?

Buy Bitcoin instantly using Visa or Mastercard. Get cash in your account fast with bank transfer, PayID or Osko. Convert crypto-to-crypto with a single click.How to buy Bitcoin with CoinJar

Start your portfolio with Australia's longest running crypto exchange with these simple steps.Featured In

CoinJar Card

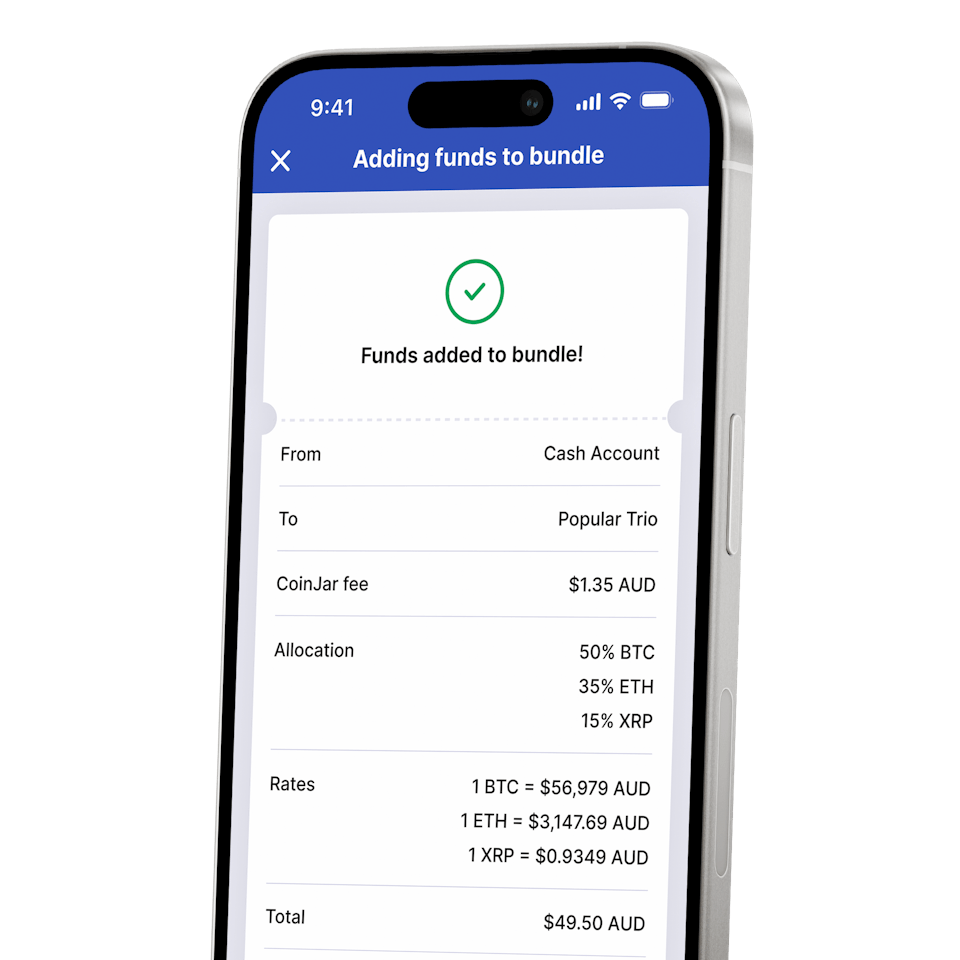

CRYPTO SPENDING POWERED BY MASTERCARD®CoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

CoinJar Exchange

TRADE FOR AS LOW AS 0%Frequently asked questions

Where can I use Bitcoin?

While it’s still rare to find retailers that accept Bitcoin as payment, with you can use the Bitcoin in your CoinJar account (or any of the other 50+ cryptos we offer) to make purchases anywhere that Mastercard is accepted.

How can I buy Bitcoin?

Buying Bitcoin is convenient with CoinJar! Simply create a free account, verify your identity, link your Australian bank account or credit/debit card, and you're ready to buy.

How much is $100 Bitcoin worth right now?

The price of Bitcoin constantly fluctuates. To see the current value of $100 AUD worth of Bitcoin, check our live price chart at the top of this page.

How to buy BTC in Australia?

CoinJar makes buying Bitcoin in Australia straightforward. Sign up for an account, complete the quick verification process, deposit AUD via bank transfer, card, or other supported methods, and then buy Bitcoin.

Can I buy $10 of Bitcoin?

Yes, absolutely! CoinJar allows you to buy fractions of Bitcoin, so you can start with amounts that are small. This makes Bitcoin accessible to everyone, regardless of budget.

How do I buy Bitcoin on CoinJar?

To buy Bitcoin on CoinJar, first create an account by signing up with your email and verifying your identity. Once your account is set up, you can deposit funds using options like bank transfer with BSB and account number, PayID/OSKO, Faster Payments, SEPA or make an instant Bitcoin purchase using a debit card, credit card, or Apple Pay / Google Pay.

See fees . Select Bitcoin (BTC), enter the amount, and confirm your purchase. You can buy Bitcoin instantly with supported payment methods, and your BTC will be added to your CoinJar wallet.

What is the easiest way to start buying Bitcoin?

To start buying Bitcoin, sign up for a CoinJar account and complete the verification process. Deposit funds via bank transfer (you can also buy with other payment methods). Then, hit the trade button and choose Bitcoin. CoinJar makes it convenient to buy crypto with a user-friendly interface, allowing you to purchase Bitcoin instantly and store it securely in your wallet.

Is my Bitcoin secure after I buy it on CoinJar?

CoinJar prioritises security for your Bitcoin and other crypto assets. After you buy Bitcoin, it’s stored in a secure CoinJar wallet. The platform uses advanced encryption and cold storage to protect your BTC from unauthorised access. Always enable two-factor authentication (2FA) on your account for added security.

How does CoinJar compare to Coinbase or CoinSpot for buying Bitcoin?

While Coinbase and CoinSpot are popular platforms, CoinJar offers a seamless way to buy Bitcoin with competitive fees and multiple payment options, including credit card. CoinJar’s intuitive interface and secure wallet make it a great choice for both beginners and experienced users looking to buy crypto or swap assets in the market.

Can I transfer my Bitcoin after buying it?

Yes, after you buy Bitcoin on CoinJar, you can transfer your BTC to another wallet or exchange. Simply navigate to the "Send" option in your CoinJar account, enter the recipient’s wallet address, and confirm the transaction. Ensure the address is correct to avoid losing your crypto.

Are there other ways to buy Bitcoin, like a Bitcoin ATM?

While Bitcoin ATMs are an option for purchasing BTC, CoinJar offers a more convenient way to buy cryptocurrency. You can buy Bitcoin directly from your account using a credit card, or bank transfer, without needing to locate a Bitcoin ATM. This makes CoinJar ideal for quick and secure transactions.

What can I do with my Bitcoin after buying it on CoinJar?

Once you buy Bitcoin on CoinJar, you can hold it in your wallet as a long-term asset, trade it for other cryptocurrencies, or swap it for fiat currency. You can also transfer your BTC to external wallets or use it for transactions where Bitcoin is accepted.

How fast are Bitcoin transactions on CoinJar?

When you buy Bitcoin on CoinJar, the transaction is typically instant, especially with credit card payments. The BTC appears in your wallet almost immediately, ready for trading, holding, or transferring. Blockchain confirmation times may affect external transfers.

Why choose CoinJar to buy cryptocurrency?

CoinJar is a trusted platform to buy cryptocurrency like Bitcoin, and it is the longest-running crypto exchange in Australia. With options to buy BTC using credit card, or bank transfer, a secure wallet, and a user-friendly interface, CoinJar makes buying Bitcoin accessible for all. Whether you’re new to crypto or an experienced trader, CoinJar supports your journey.

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the and before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the and apply.