Buy Compound

Compound

COMP

Overview

What is Compound?

Why do investors buy Compound (COMP)? Because it is decentralised lending made simple. Cryptocurrencies have revolutionised the financial landscape, and decentralised finance (DeFi) platforms play a pivotal role in this transformation.

One such platform is Compound. But what is the platform Compound? And what about its token, COMP?

What is Compound?

Compound (COMP) is a DeFi platform that uses blockchain.

It is designed to give cryptocurrency users access to borrowed funds in an efficient, automated way.

Think of it as a decentralised lending marketplace where users can interact with smart contracts to access funds or earn interest on their holdings.

How does Compound work?

Liquidity pools

Compound operates on the Ethereum blockchain. It creates liquidity pools for various cryptocurrencies (like ETH, DAI, USDC, etc.).

A liquidity pool in crypto is like a digital central swimming pool where people throw in their coins. These coins help make trading faster and smoother on platforms like decentralised exchanges (DEXs).

When users want to trade one coin for another (say, swap Bitcoin for Ethereum), the liquidity pool helps make it happen instantly.

If someone wants to trade Bitcoin for Ethereum, but there is no Ethereum in the pool, then the trade will have to wait until there is Ethereum in the pool, and this slows everything down.

The more coins in the pool, the faster the trades can occur.

Supply and borrowing

Users can supply their crypto assets to these pools, becoming lenders. In return, they earn interest on their deposits.

And on the other side of the coin, users can borrow from these pools by putting assets down as collateral. The interest rates are dynamic and adjust based on supply and demand.

Interest rates

Compound uses an algorithm to set interest rates. When more users borrow a specific asset, its interest rate increases. But if supply is more than demand, the interest rate decreases. This ensures efficient allocation of capital.

Collateralisation

Borrowers must maintain a collateral ratio (usually 150%) to secure their loans. If the value of their collateral falls below this threshold, their assets are liquidated to repay the loan.

COMP token

Here’s where COMP comes into play. It’s the native token of the Compound ecosystem. Holders of COMP have governance rights, allowing them to propose and vote on protocol changes. Additionally, they receive a share of the platform’s fees.

Why would anyone want to borrow against their crypto holdings?

Imagine you bought some Ethereum (ETH) a while ago, and now its value has increased by 20 times. Instead of selling your ETH and paying taxes on the gains, you have another option.

You can borrow money against your ETH holdings without triggering any taxes. This borrowed money is tax-free in most places (but it’s always a good idea to get advice from your accountant).

While this loan is ongoing, if your ETH rises in value, you can still benefit from this. If you had sold your ETH instead of borrowing, you would have reduced your exposure to the underlying asset. So, borrowing against your ETH allows you to access funds while maintaining your investment position.

House deposit scenario

Alex owns 20 ETH (worth $60,000) and dreams of buying a house. However, he doesn’t want to sell his ETH because he believes its value will increase over time. Instead, Alex decides to use their ETH as collateral to borrow funds for the house deposit.

Using Compound, Alex follows these steps:

Deposit Collateral: Alex interacts with the Compound protocol. He deposits his 20 ETH into a liquidity pool on Compound. This ETH serves as collateral for the loan.

Borrowing Funds: Alex borrows $50,000 worth of stablecoin (e.g., DAI) from Compound. The borrowed funds are used as the house deposit. The loan is secured by Alex’s ETH collateral.

Loan Terms: Compound sets an interest rate (let’s say 6%) for the borrowed DAI. Alex agrees to repay the loan over time, making regular payments. If Alex fails to repay, their ETH collateral could be sold to pay for the balance of the loan.

Advantages: Alex avoids selling his ETH, allowing them to benefit from potential future price increases. By using Compound, Alex can access funds without going through traditional banks or revealing personal information. If the price of ETH rises, Alex’s investment pays off even more.

Risks: If the value of their ETH falls significantly, Compound may liquidate part of it to repay the loan.

In summary, Alex leverages his crypto holdings as collateral through Compound, securing a house deposit while keeping their long-term investment intact.

What are the advantages of the Compound DeFi platform?

Decentralisation

Compound operates without intermediaries. Users interact directly with smart contracts, reducing reliance on traditional banks.

Efficiency

The algorithmic interest rate model ensures efficient capital allocation, benefiting both lenders and borrowers.

Incentives

COMP incentivises participation. Users earn COMP tokens for supplying assets or borrowing. This aligns interests and encourages network growth.

Transparency

All transactions are publicly recorded on the Ethereum blockchain, ensuring transparency and auditability.

Conclusion: What investors buy Compound (COMP)

Compound simplifies lending and borrowing, making DeFi accessible to everyone.

Understanding Compound opens doors to a new financial horizon, creating new options for those that want to try an alternative to traditional banking.

Cash, credit or crypto?

Buy Compound instantly using Visa or Mastercard. Get cash in your account fast with bank transfer, PayID or Osko. Convert crypto-to-crypto with a single click.How to buy Compound with CoinJar

Start your portfolio with Australia's longest running crypto exchange with these simple steps.Featured In

CoinJar Card

CRYPTO SPENDING POWERED BY MASTERCARD®

CoinJar Card

CRYPTO SPENDING POWERED BY MASTERCARD®

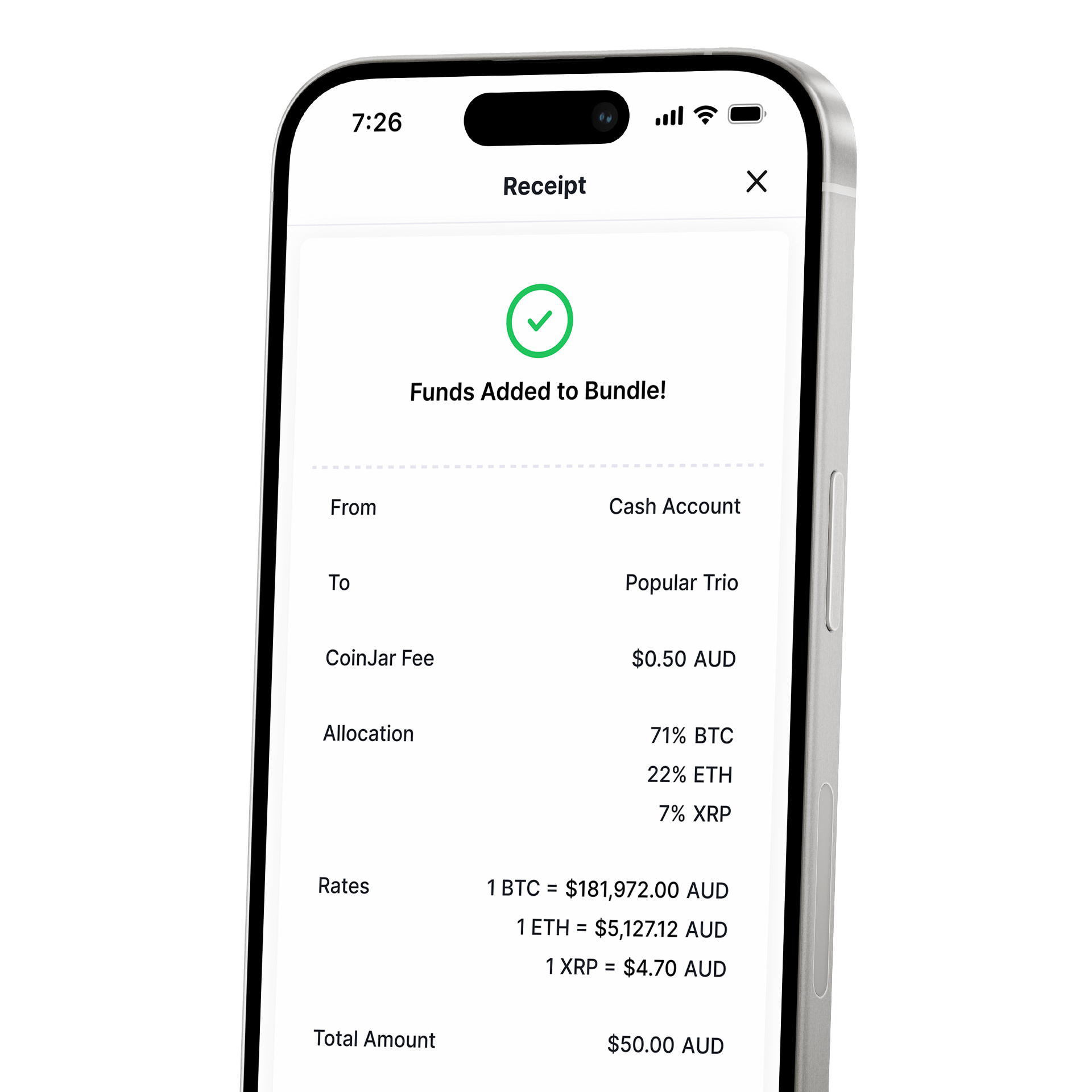

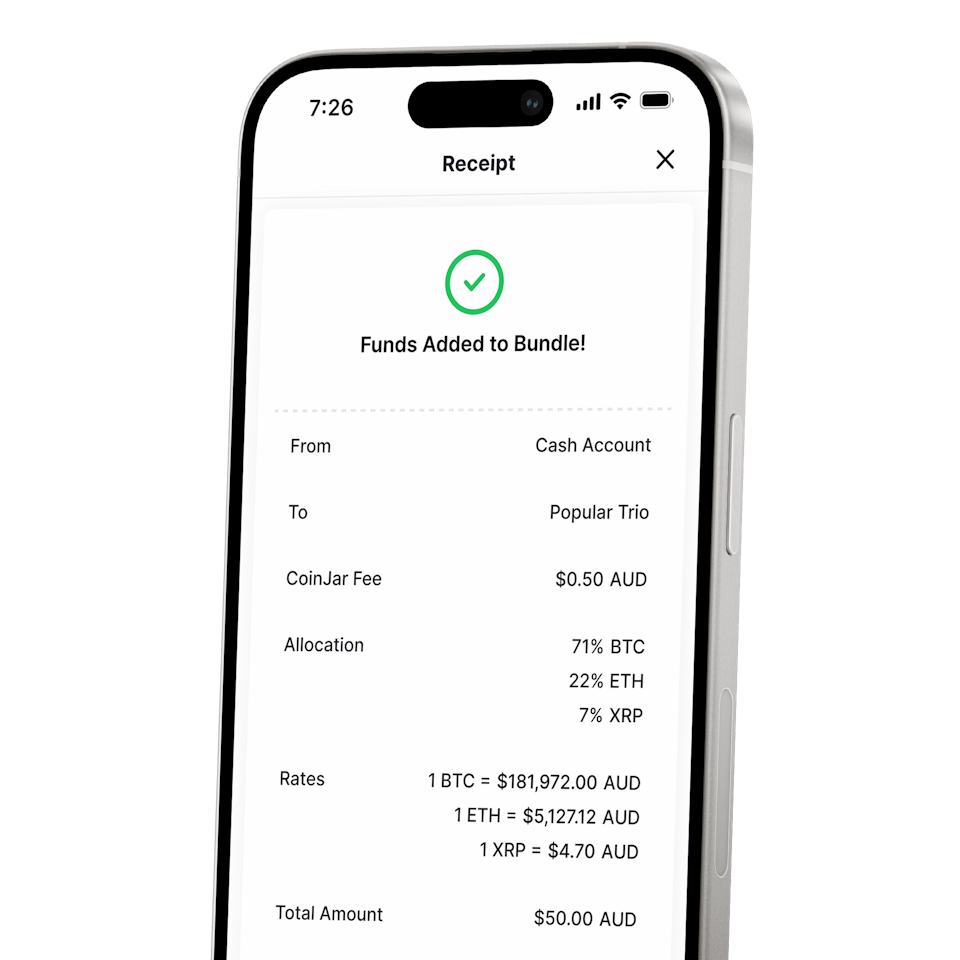

CoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIOCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

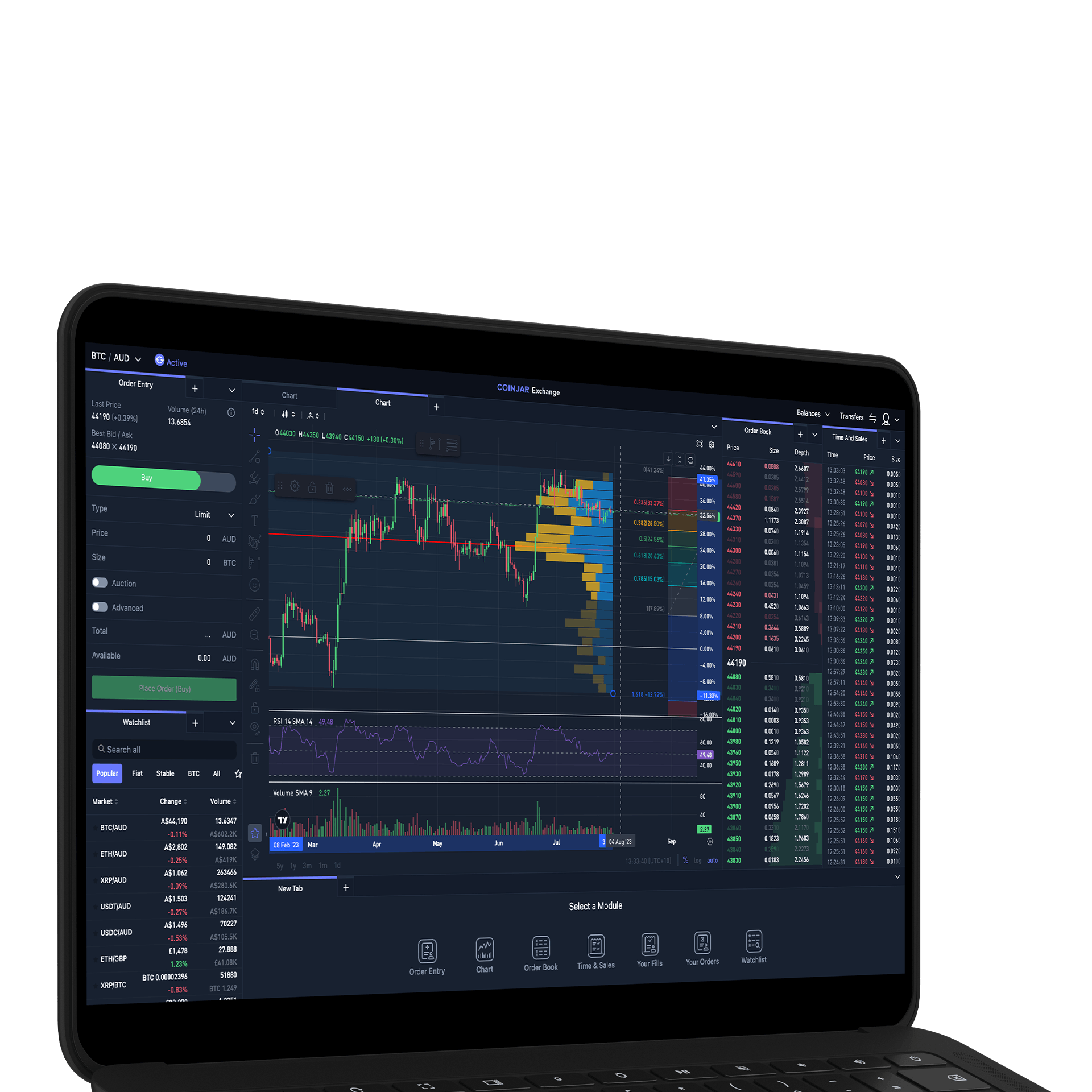

CoinJar Exchange

TRADE FOR AS LOW AS 0%

CoinJar Exchange

TRADE FOR AS LOW AS 0%

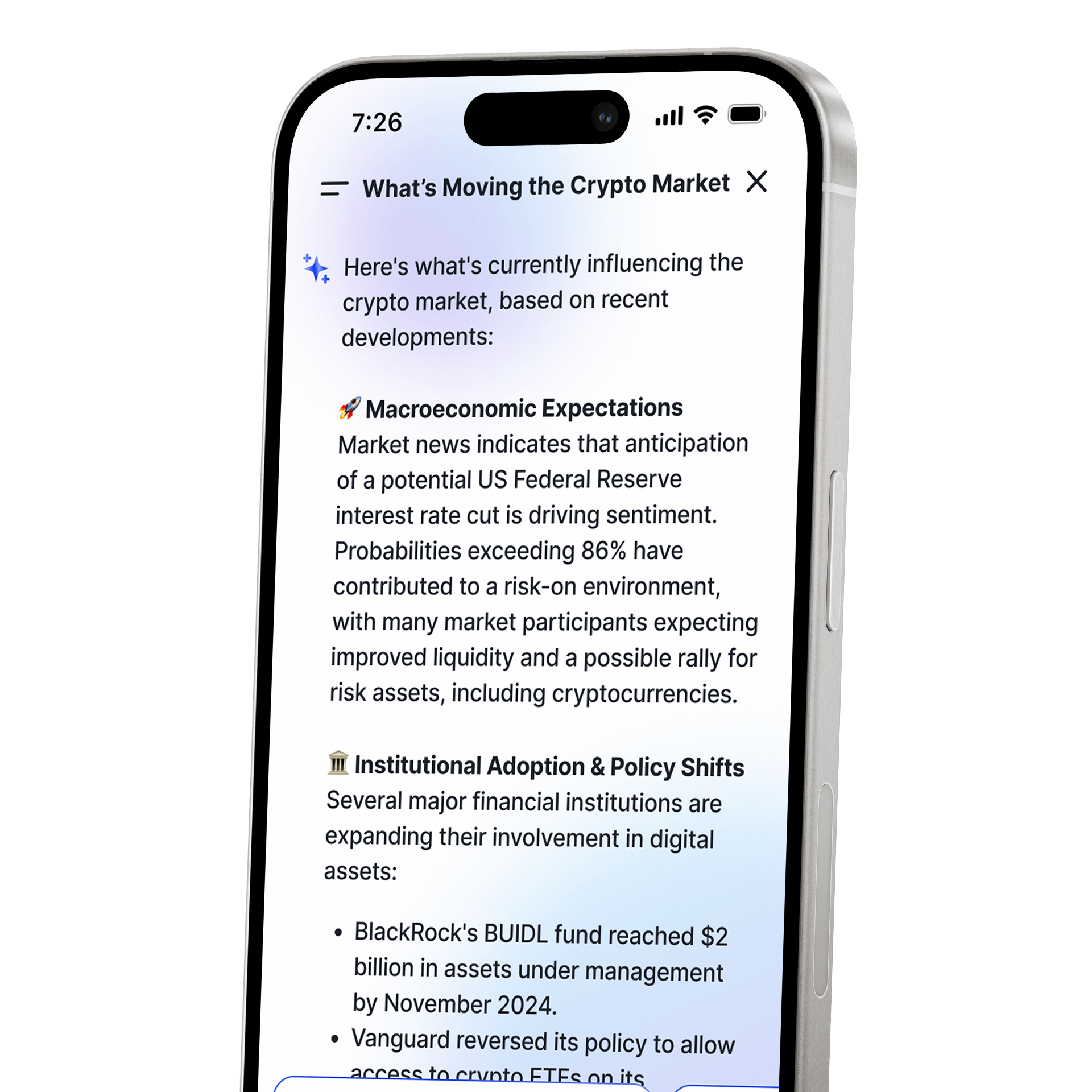

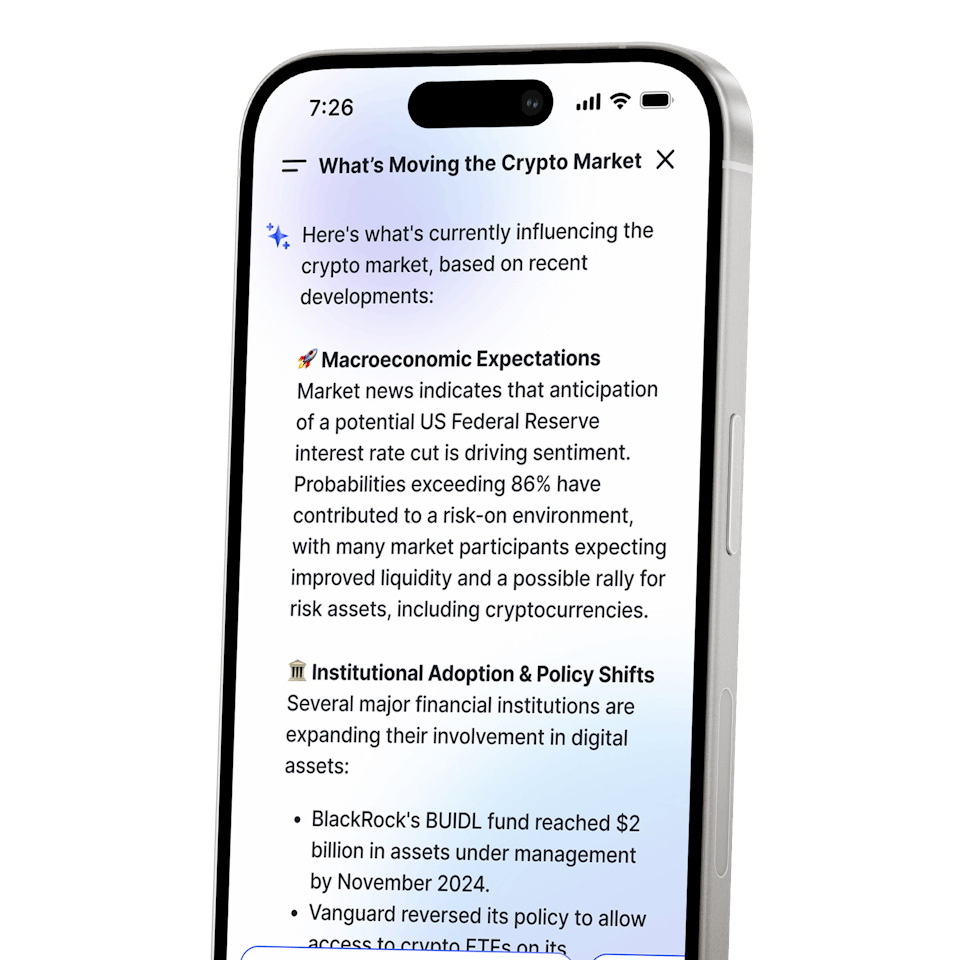

CoinJar AI

A portfolio and market assistant built into CoinJarCoinJar AI

A portfolio and market assistant built into CoinJar

Your information is handled in accordance with CoinJar’s Collection Statement.

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.