Buy Ethereum

Ethereum

ETH

Overview

What is Ethereum?

Ethereum is the second-biggest cryptocurrency by market capitalization and the crypto that pioneered the broader use of blockchain as a technology.

Created in 2015 by 19-year-old prodigy Vitalik Buterin, Ethereum inverted the Bitcoin model, emphasising the blockchain over the currency itself. If blockchains could verify monetary transactions, then why not shipping manifests, airline bookings, website code or home ownership?

Buy Ethereum: Ethereum in popular culture

Buy ETH because it's cool? How pop culture is absorbing Ethereum

Ethereum and its related concepts have started to seep into pop culture. If you were considering a crypto that the cool kids like, buying Ethereum might interest you.

Futurama and Ether

Futurama, the animated sci-fi comedy series, has mentioned Ethereum more than once.

And of course, you can buy an NFT of Viterlik Buterin’s head in a Futurama-style vase.

Celebs and Ether

Celebs are also deep into Ethereum. For example, Paris Hilton got into Ethereum in 2016, and claims to have made a tidy profit from her early investment.

Vitalik Buterin, founder of Ethereum, has become a celebrity in his own right. And, he is becoming known as quite the fashion leader.

These kinds of pop culture appearances helped to raise awareness and interest in Ethereum and other cryptocurrencies among the general public, especially the younger generation. And this just makes buying ETH seem like a fun thing to do!

Buy ETH: Because of the developers behind it

Ethereum’s biggest innovation in this respect was what Buterin termed ‘smart contracts’ – programmable and unalterable contracts that would auto-execute when certain conditions were met.

This simple idea meant Ethereum could become the first true blockchain platform: A blockchain upon which decentralized apps and blockchains could be built.

Participants pay so-called “gas” fees to use the network, which are denominated in Ethereum’s native cryptocurrency, Ether (ETH). The more demand there is, the higher the gas fees.

While there’s no hardcoded upper limit on the amount of ETH to be created like there is with Bitcoin, Ethereum has introduced a mechanism that means a certain amount of ETH is burnt in every transaction, helping to reduce inflationary pressures. It’s predicted that over time this will lead to more ETH being destroyed than created.

The network is powered by a Proof-of-Stake consensus model that requires 99.95% less energy than Proof-of-Work models like Bitcoin. This means that people who hold a certain amount of ETH can stake it to help verify transactions, receiving newly issued ETH in the process.

Many of the biggest and most exciting projects in the crypto space are built on Ethereum. The platform’s ERC-20 standard is the architecture that powers more than 20 of the coins on CoinJar – including all the major DeFi projects – while NFTs (non-fungible tokens) came into being thanks to ERC-721.

Cash, credit or crypto?

Buy Ethereum instantly using Visa or Mastercard. Get cash in your account fast with bank transfer, PayID or Osko. Convert crypto-to-crypto with a single click.How to buy Ethereum with CoinJar

Start your portfolio with Australia's longest running crypto exchange with these simple steps.Featured In

CoinJar Card

CRYPTO SPENDING POWERED BY MASTERCARD®

CoinJar Card

CRYPTO SPENDING POWERED BY MASTERCARD®

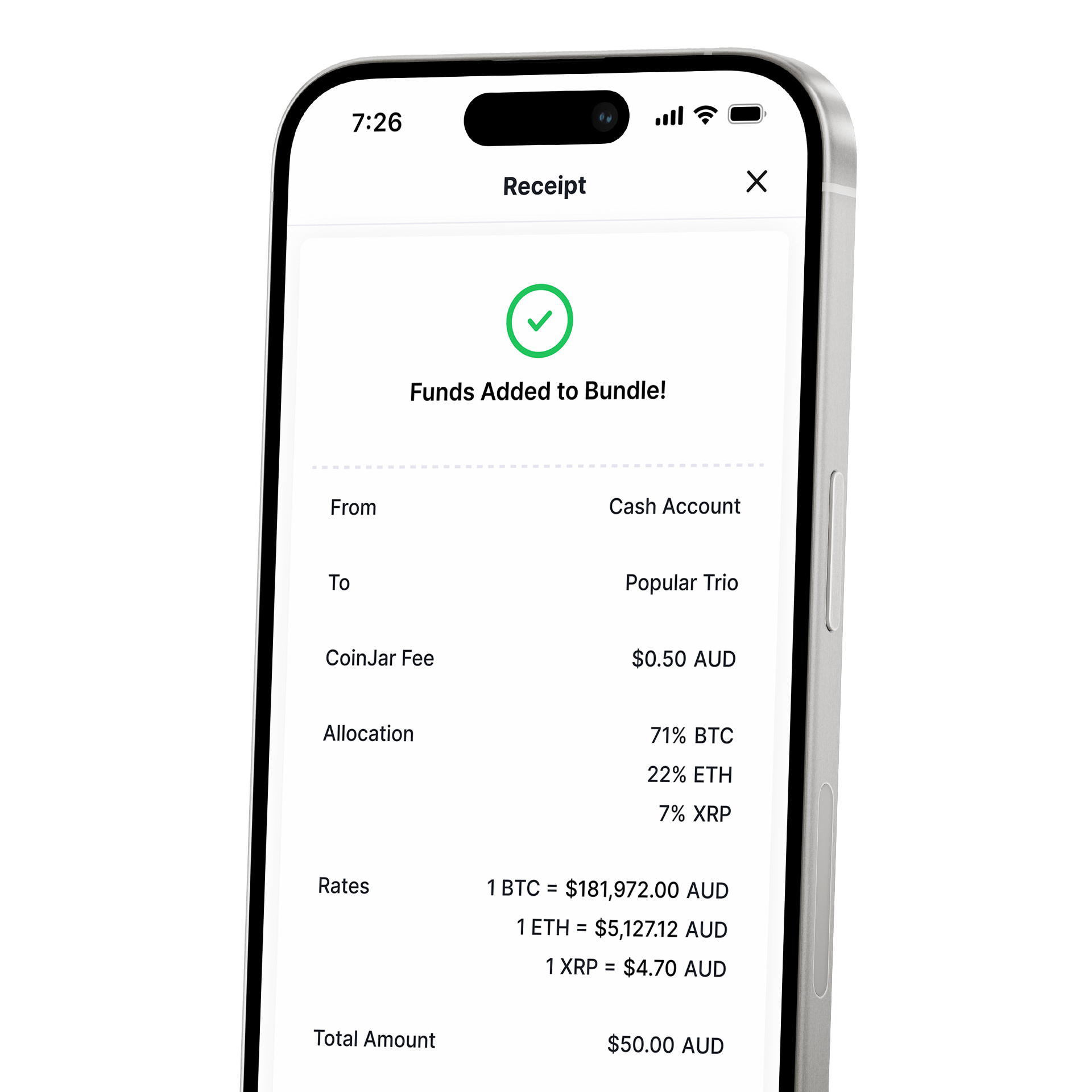

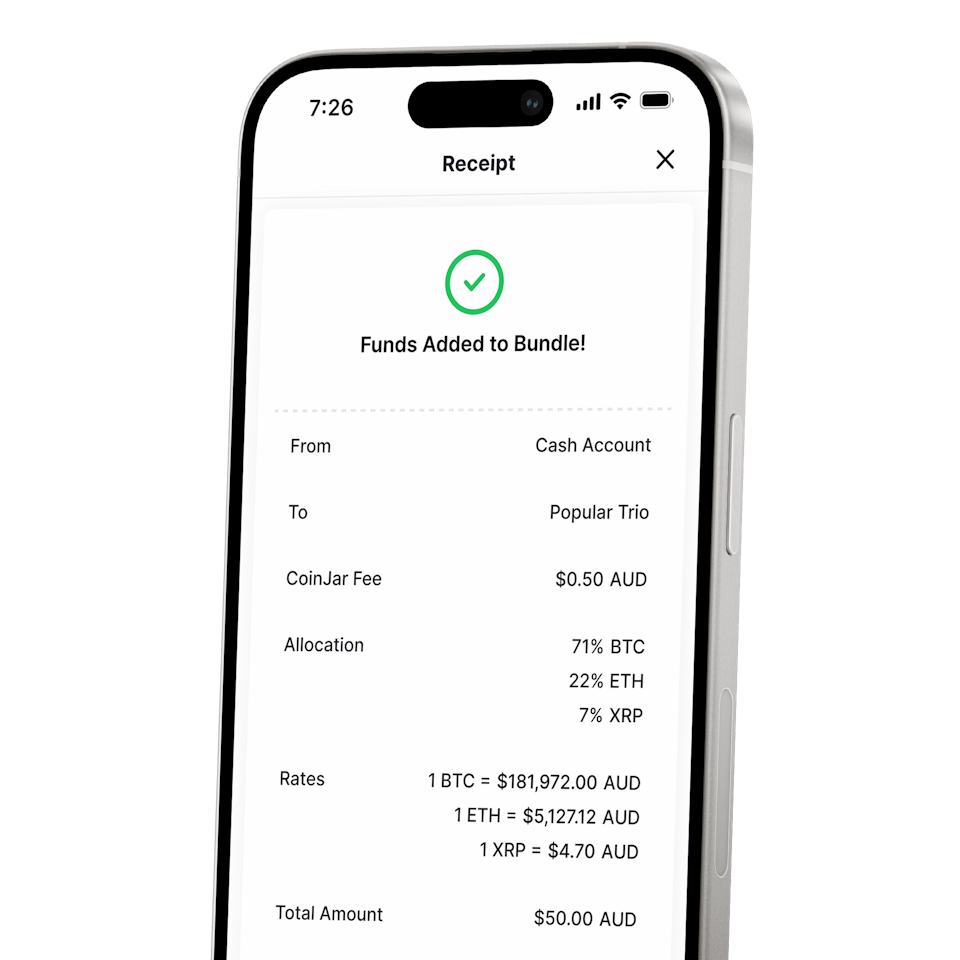

CoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIOCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

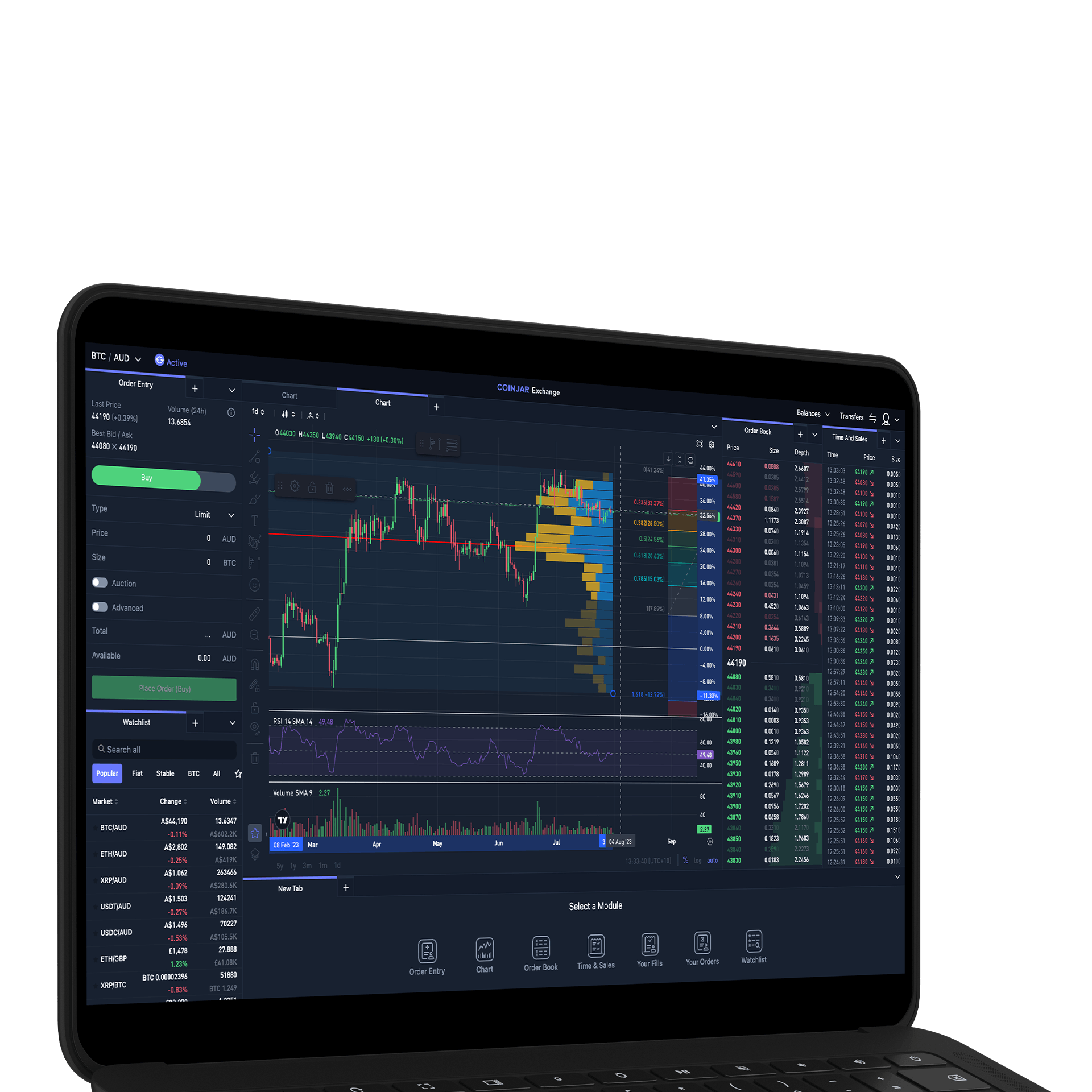

CoinJar Exchange

TRADE FOR AS LOW AS 0%

CoinJar Exchange

TRADE FOR AS LOW AS 0%

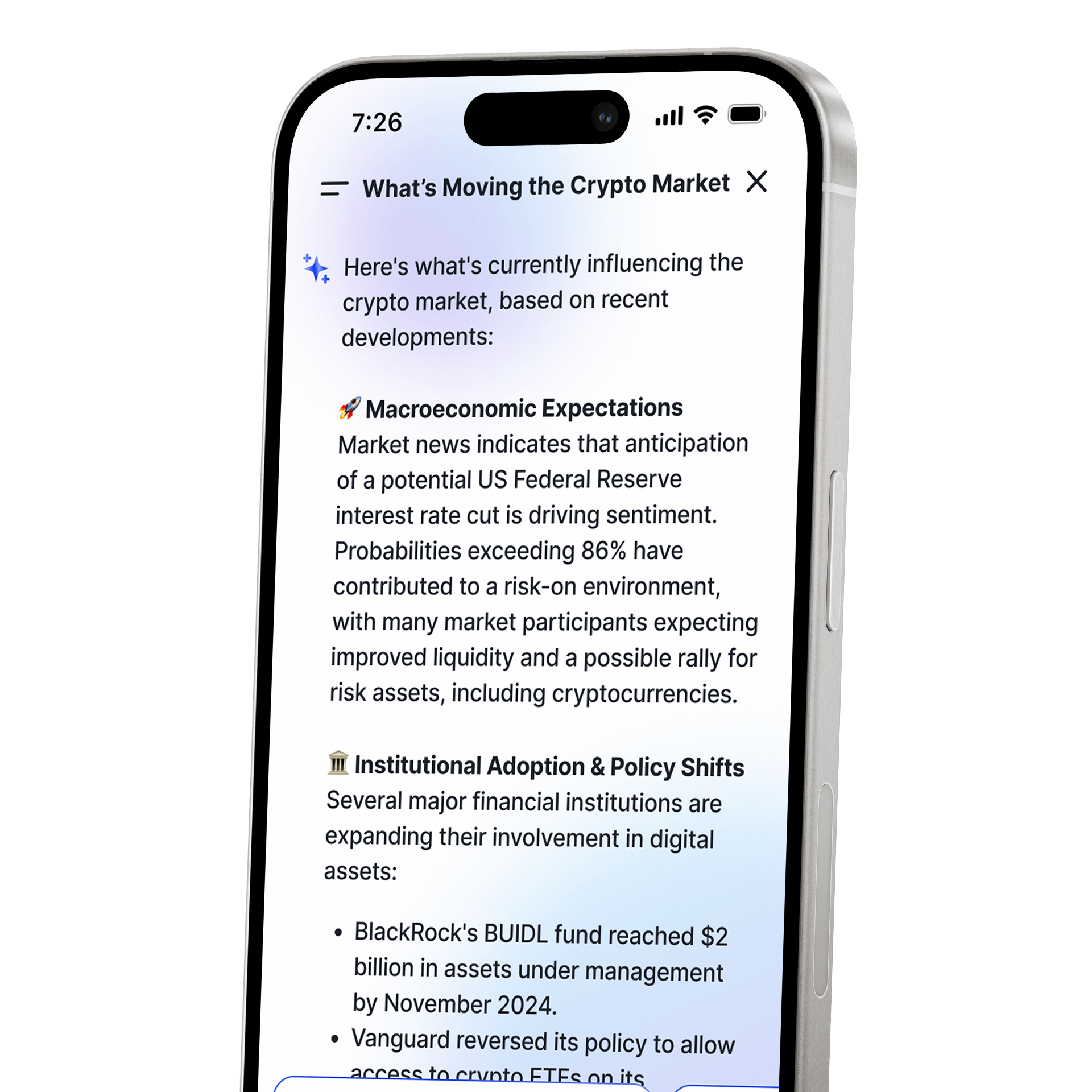

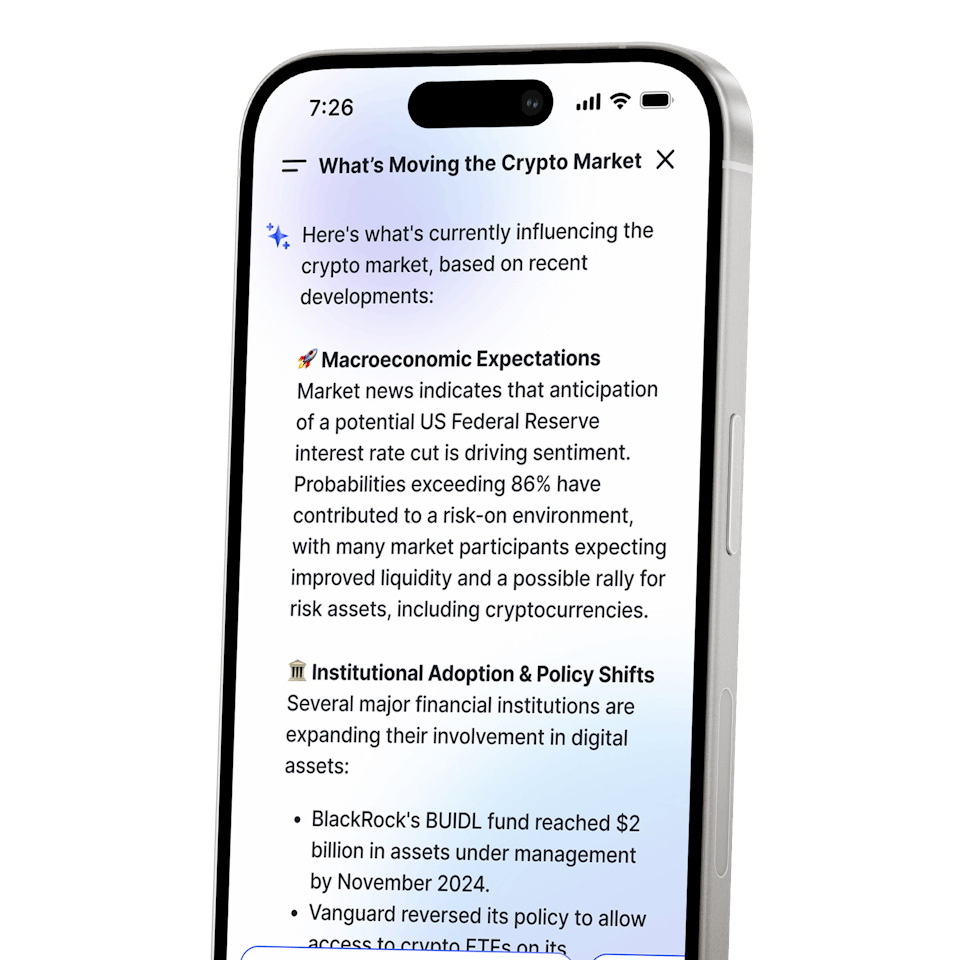

CoinJar AI

A portfolio and market assistant built into CoinJarCoinJar AI

A portfolio and market assistant built into CoinJar

Your information is handled in accordance with CoinJar’s Collection Statement.

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.