Onchain: Crypto Realism

October 9, 2024

Share this:

In his essay Capitalist Realism, Mark Fisher establishes that we've canceled the future and are just recycling the old instead. And what's old in crypto? Discussing who Satoshi is, viewing memecoins as community coins and incompetent projects with million-dollar backing... Crypto is having its recycling moment this week.

Story One

The Big Reveal?

The go-to driving force of modern men is the urge to dissect anything into tiny pieces, digging for an acceptable truth. Not even the seemingly untouchable creator of Bitcoin is safe from such desires. And so HBO decided to use a reveal of Satoshi Nakamoto's identity to drive viewership for their upcoming documentary.

Of course, ever since the disappearance of Satoshi, people have been wondering who he was, with theories ranging from cypherpunks to the CIA. Then appeared Craig Wright, claiming to be Satoshi, but ultimately, even the normie judge had to rule that out since the claimant had no evidence to back himself up—an expensive hobby for the wannabe.

Will the HBO documentary reveal anything new? By the time you're reading this, it'll have aired and we'll know for sure (scheduled for October 8th at 2 am CET..). In the meantime, betters on Polymarket estimate that Len Sassman, a cypherpunk who committed suicide at the age of 31, will be the one revealed with a 48% chance.

Takeaway: The myth around Satoshi is strong. Why ruin that? Clearly, he's had a strong desire for privacy, and with the increase in assaults on crypto holders, do we need to give them more targets? I don't think so. Get over it and go back to birdwatching...

Story Two

Memecoin Supercycle

Remember the supercycle? It was an idea by 3AC founder Shu Zu that stated the crypto markets would go up without a sustained bear market. Things didn't play out like that, and even Su had to admit he got it "wrong".

Enter the new super cycle, the one that's taken over crypto Twitter by storm, gobbled up by unimaginative reply guys.

Introduced by Murad, a crypto thought leader, the memecoin super cycle is a thesis based on a recent resurgence of people pouring their funds into memes - disregarding tech and valuations. Who needs market cap math, when you can decide based on whether a ticker looks good or not?

And it's not all financial nihilism, either. The memecoins utility isn't the tech. It's the frens we make along the way, the feeling of belonging, that - even if just for a short time - glosses over the existential dread we have since Nietzsche declared God dead. It's also a recognition that the life-changing gains aren't attainable in a world of heavily inflated valuations.

Takeaway: God might be dead, but at least we got our memecoin cults. Still, if you want to join a subcult, I'd urge you to get into running or biking, the cult for guys over 30, instead. It'll be better for both your mental and physical health. Trust me.

Story Three

Nothing to see here ...

Live view of the Eigenlayer team over the weekend.

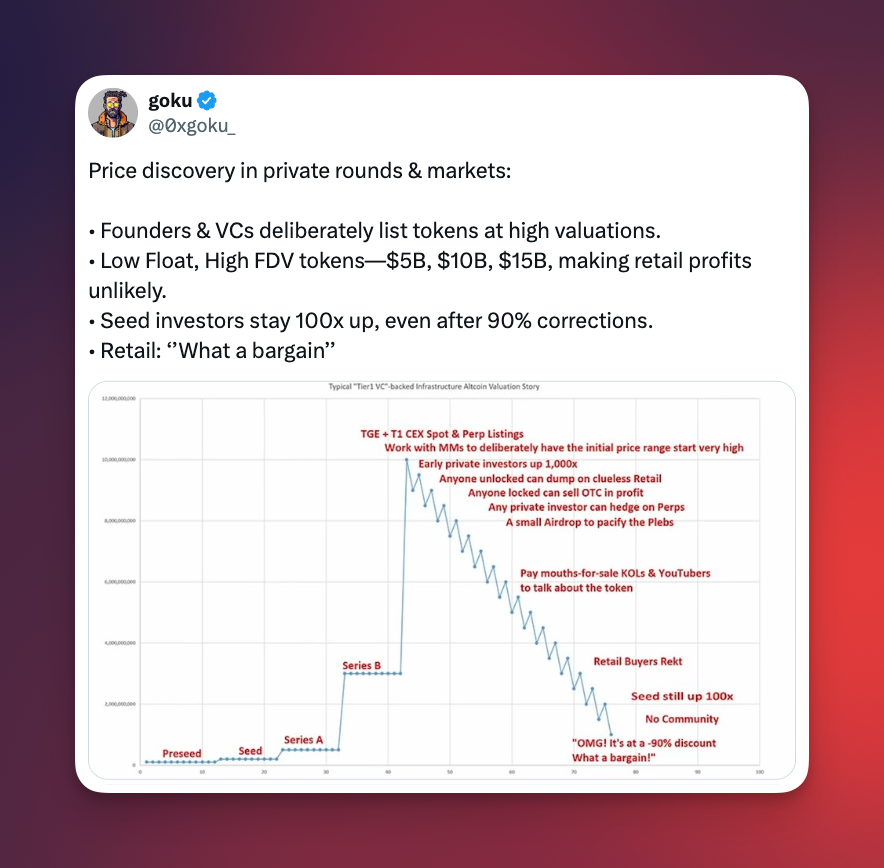

Eigenlayer is one of those technically so sophisticated projects that you can't explain it like I'm five. It combines re-staking and data availability, with a pinch of Ethereum alignment. In short, a project beloved by VCs who poured $171 million in. Last week, the Eigen token went live, and after a short price increase, it started falling.

It didn't help that the supposed community airdrop favored whales, including Tron founder Justin Sun, who received $8.75 million. More like Eliterianlayer.

Things got even messier when the team shared they were investigating "unapproved selling activity". It turned out that an exploiter managed to send an email pretending to be an investor and receive 1.6 million tokens, which they immediately dumped.

As if that wasn't bad enough, it also proved that investors could sell if they wanted to - despite supposed lock-ups.

No one in their right mind uses MetaMask Swap.

Takeaway: Smart contracts exist. Instead of using them to enforce vesting, the team decides to just ask investors to sell respectfully. Pathetic.

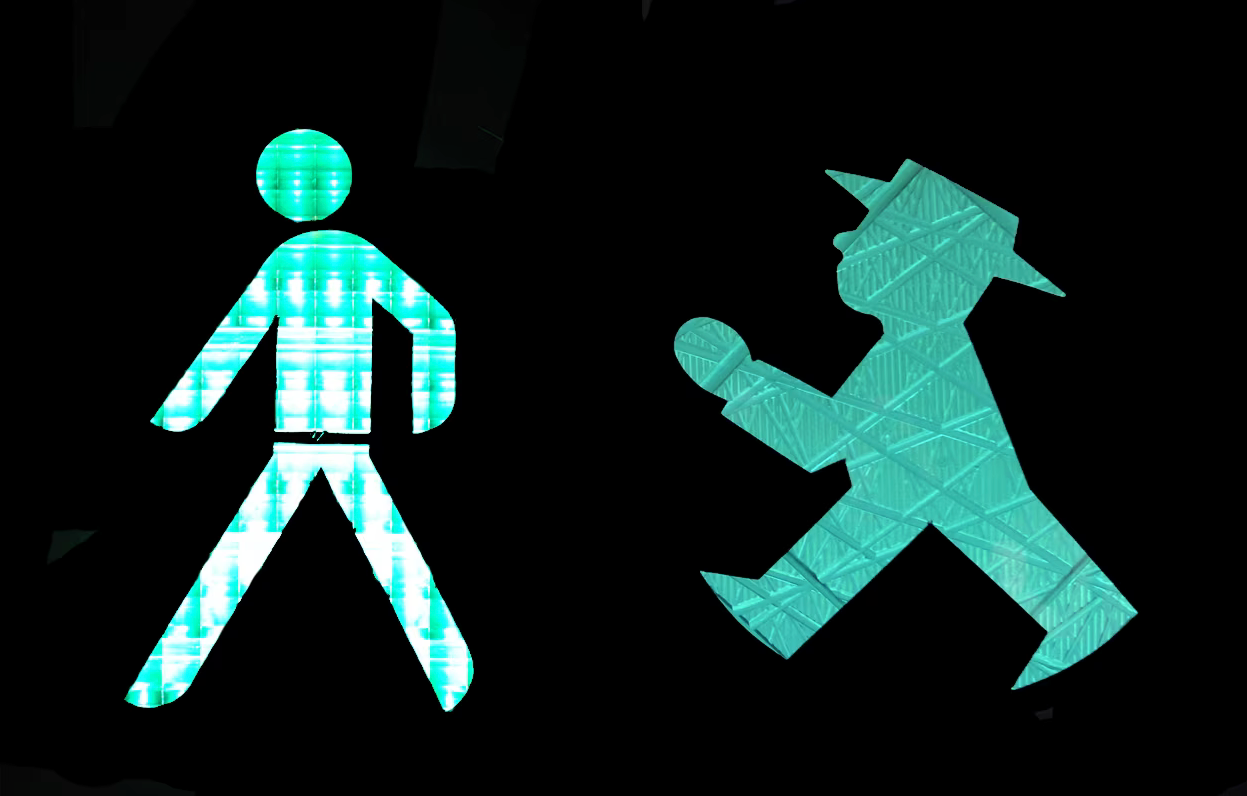

Fact of the week: The third of October is the day of German unity. One reminder from the previous separation is the Ampelmannchen, a different version of the pedestrian traffic light. While unification nearly killed it, protests led to its continued use, and it's become a tourist photo op since.

West vs. East.

Naomi for CoinJar

The above article is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. This article is provided for general information and educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar, Inc. makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. Past performance is not a reliable indicator of future results.

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: In bad taste

February 25, 2026ICYMI, the tech bros have once again discovered taste, so get ready to be lectured by dudes who think it's acceptable to live with one ceiling light on what to wear and consume....Read more

Onchain: The selling continues

February 11, 2026Until morale improves, or so I hope. Story One L2s are pointless Tweets the guy who advocated for them as part of the Ethereum scaling roadmap. Perhaps to deflect from his...Read more