Onchain: A new hack, new money, and a new threat

June 5, 2025

Share this:

Story One

A hack with a twist

On May 22nd, the leading DEX on the SUI blockchain tweeted that it had detected an incident leading to the loss of $223 million in user funds. So far, just another successful exploit by a hacker. Shortly after draining the liquidity pools, the hacker began bridging their funds to Ethereum in an attempt to launder them. As a result of this massive exploit, memecoins dumped — including the supposedly stable coin USDC, which suddenly was stable at 0.

After $60 million had been moved off SUI, the validators collectively decided to simply freeze the funds, leaving the hackers unable to access the money they had stolen. Can they do that? Yes, they could. As it turns out, SUI is structured to give validators the right to exempt transactions from specific wallets in extreme circumstances as long as a broad consensus is reached.

CT is split in the reaction to this. Some point to the positive effect of saving $160 million worth of user funds from being drained, while others worry that the power to freeze might not always be used for such noble causes.

Cetus has suspended operations and initiated a governance vote to decide the fate of the frozen funds. So far, 90% are in favor of distributing them back to the victims.

Takeaway: The lesson here is that the social layer can trump the technical. If people decide to act against the decentralization maxime, not much you can do.

Story Two

Money as a social construct

Remember when you first learned about fractional reserve banking? I was about 24 and just got started in crypto. What blew my mind back then was that banks just create money out of nothing. Well, it’s not nothing, in the end it’s trust.

Ironically, in crypto the main propaganda is to get away from trust, to create trust-less money, rejecting the idea that money is just a social construct. Bitcoin started as an attempt, but it accumulated mainly in the hands of Michael Saylor and corporations seeking PR coverage (see Metaplanet).

Most memecoins follow a similar pattern of accumulation. But what if there was money that didn’t follow this path? That’s what Circles promises: a project by Gnosis that just launched its V2. In essence, everyone on there mints one token per hour. Through agreements with others to use these tokens, they gain value. This enables the creation of circles of trust, allowing trust to scale beyond the bonds of people you know.

Takeaway: Finally, an interesting social monetary experiment. Will it work? Who knows, but at least it’s an attempt to do something different than all these PVP coins.

Story Three

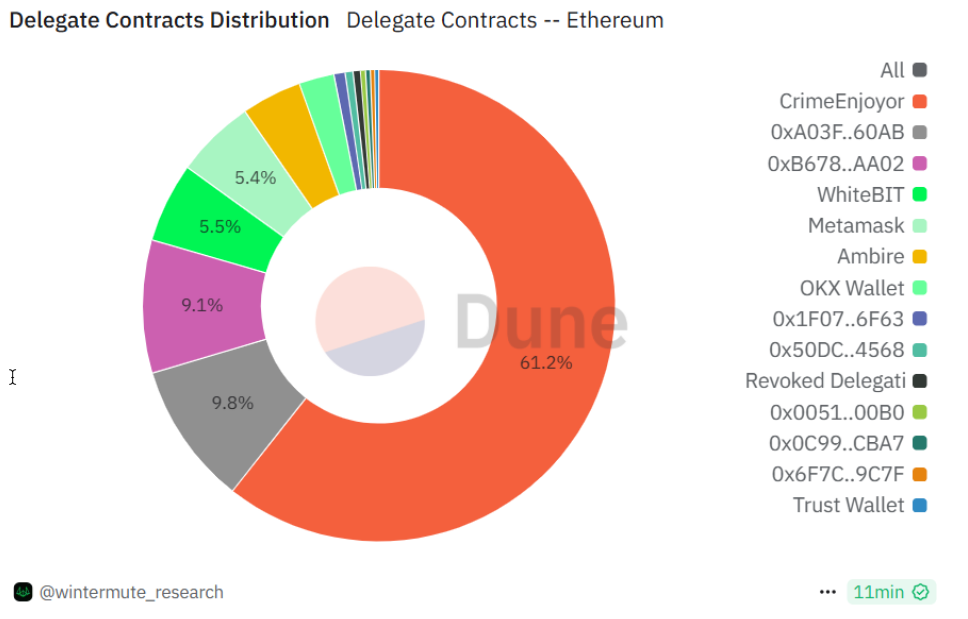

EIP 7702 adoption is going great

It’s especially going great if your hobby is draining people’s wallets. While Ethereum’s recent Pectra upgrade focused on improving UX, it also made it easier for criminals to drain people with even less clicks.

The proposal in question is EIP7702, which introduced account abstraction, a buzzword of last year. Once implemented, this allows wallets to behave like smart contracts, giving them the ability to, for example, batch transactions (avoiding getting stuck in approve & confirm loops), sponsor gas fees, and use passkeys.

Unfortunately, over 60% of delegations authorize contracts to act on behalf of wallet users that aren’t in the interest of the user, as Wintermute, a crypto trading firm, has found. They dubbed these contracts Crime Enjoyer as they’re all versions of the same copy-pasta code that sweeps wallets if keys are leaked and sends the funds to the deployer.

One user lost $150,000 this way to a supposed batch transaction. Wintermute commented they found this trend "funny, bleak and fascinating".

Takeaway: Wallets should step up to make it clearer what users are signing when they hand over control. What’s more, we should all think about the fact that all technological improvements will also end up in the hands of our adversaries.

Fact of the week: Speaking of constructs, did you know that the lifetime of reinforced concrete is about 50 - 100 years? That's because after a while, the steel inside starts rusting, breaking up the concrete from the inside. Fun prospect if you're living in a city built from concrete 50 years ago. To learn more go here. You might never look at concrete bridges the same again.

Naomi for CoinJar

The above article is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. This article is provided for general information and educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar, Inc. makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. Past performance is not a reliable indicator of future results.

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: In bad taste

February 25, 2026ICYMI, the tech bros have once again discovered taste, so get ready to be lectured by dudes who think it's acceptable to live with one ceiling light on what to wear and consume....Read more

Onchain: The selling continues

February 11, 2026Until morale improves, or so I hope. Story One L2s are pointless Tweets the guy who advocated for them as part of the Ethereum scaling roadmap. Perhaps to deflect from his...Read more