Buy Balancer

Balancer

BAL

Overview

What is Balancer?

Buy Balancer (BAL): Balancer is a decentralized finance (DeFi) protocol running on the Ethereum blockchain. Its primary goal is to incentivise a distributed network of computers to operate a decentralized exchange where users can buy and sell any cryptocurrency. Think of Balancer as a unique type of index fund within the crypto world.

How Does Balancer Work?

Balancer pools

Balancer pools are at the heart of the Balancer protocol. These pools are created by users who bundle together various cryptocurrencies from their portfolios.

Each Balancer pool can contain up to eight different tokens. The value of a pool is determined by the percentages of each token within it.

For example, a Balancer pool might start with 25% Ethereum (ETH), 25% DAI, and 50% Aave (LEND).

Self-balancing mechanism

Balancer uses smart contracts to ensure that each pool maintains the correct proportion of assets, even as individual token prices fluctuate.

If the price of a specific token increases significantly (e.g., LEND doubles in value), the pool automatically reduces its holding of that token to maintain the original weight distribution.

Liquidity providers (those who deposit assets into the pool) continue to earn fees during this rebalancing process.

Incentives for liquidity providers

There’s good news for users that provide liquidity to a Balancer pool. They earn part of the trading fees that are paid by traders who use their funds.

These liquidity providers are rewarded with a custom cryptocurrency called BAL.

By depositing assets into Balancer pools, they contribute essential liquidity to the network, enabling smooth trading for other users.

Why do investors buy BAL?

Liquidity mining

Investors buy BAL tokens to participate in liquidity mining. By staking their assets in Balancer pools, they earn BAL tokens as rewards.

Liquidity mining incentivises users to provide liquidity, which is crucial for the efficient functioning of decentralised exchanges.

Governance rights

BAL holders have governance rights within the Balancer ecosystem.

They can vote on proposals related to protocol upgrades, fee structures, and other important decisions.

This democratic governance model allows the community to shape the future of Balancer.

Speculation

Like any other cryptocurrency, some investors buy BAL tokens speculatively, hoping that their value will appreciate over time.

As Balancer gains popularity and adoption, demand for BAL may increase.

Conclusion: Buy Balancer (BAL)

Balancer’s innovative approach to liquidity provision and self-balancing pools sets it apart from other decentralised exchanges like Uniswap and Curve. As the DeFi space continues to evolve, Balancer remains an essential player, attracting both liquidity providers and investors seeking exposure to this dynamic ecosystem.

Cash, credit or crypto?

Buy Balancer instantly using Visa or Mastercard. Get cash in your account fast with bank transfer, Faster Payments, PayID or Osko. Convert crypto-to-crypto with a single click.How to buy Balancer with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.Featured In

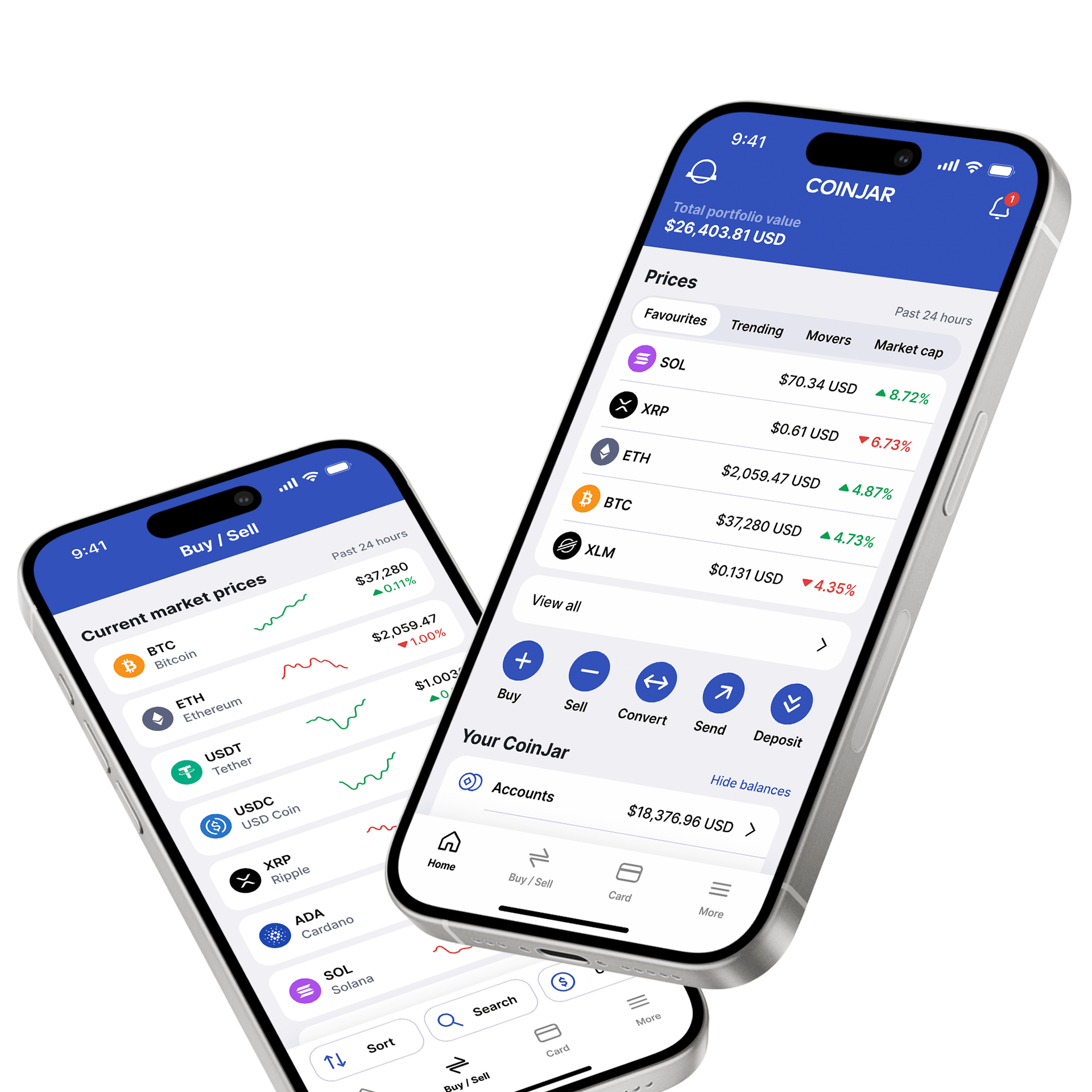

CoinJar App

All-in-one crypto walletCoinJar App

All-in-one crypto wallet

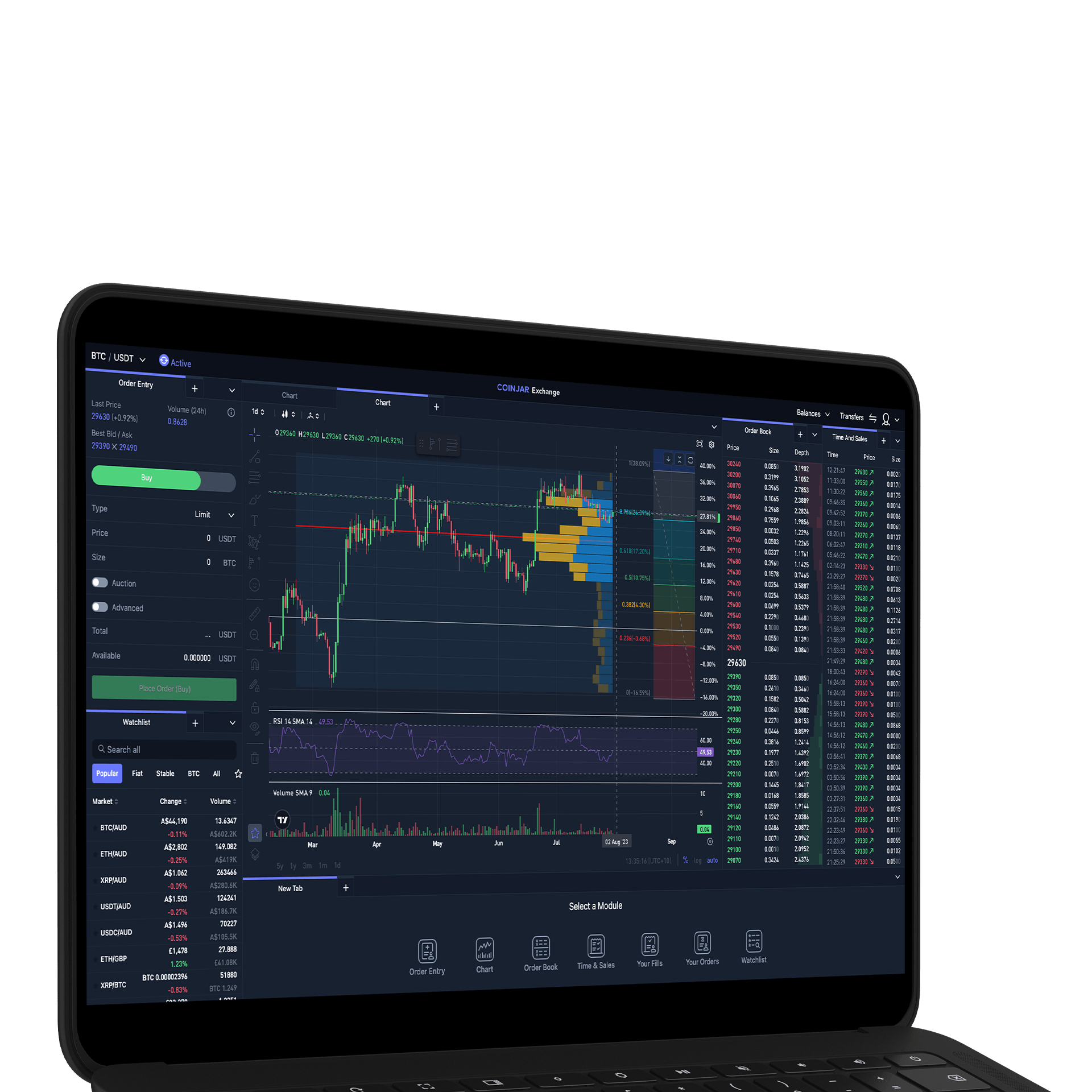

CoinJar Exchange

TRADE FOR AS LOW AS 0%

CoinJar Exchange

TRADE FOR AS LOW AS 0%CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.