Buy USDC

USDC

USDC

What is USDC?

USD Coin, now rebranded to USDC (USDC) is a type of cryptocurrency that is backed by the U.S. dollar. Unlike other cryptocurrencies that have volatile prices, USDC is designed to maintain a stable value of one USDC equal to one U.S. dollar.

This makes USDC a stablecoin, a digital currency that aims to provide a reliable and convenient way to store and transfer value using blockchain technology.

How does USDC work?

USDC is issued by a private company called Circle.

Circle claims that every USDC in circulation is backed by a corresponding U.S. dollar or other approved assets held in segregated accounts with regulated U.S. financial institutions. These accounts are regularly audited by an independent accounting firm to ensure that the USDC supply matches the reserve assets.

You can buy USDC with fiat currency (like USD) or other cryptocurrencies (such as Bitcoin or Ethereum) on various platforms, including CoinJar. You can also sell USDC for fiat currency or other cryptocurrencies on CoinJar.

What are the benefits and risks of USDC?

One of the main benefits of USDC is that it seemingly offers low price volatility, meaning that its value does not fluctuate significantly over time. This makes USDC suitable for storing and transferring value without worrying about losing purchasing power due to market fluctuations.

USDC can also be used as a hedge against inflation, as it is pegged to the U.S. dollar, which is considered a relatively stable currency.

This however means that the value won’t rise, it aims to stay stable. However, stablecoins have “unpegged” before.

USD audits

USDC provides regular and verifiable reports on its reserves and operations. However, after successful audits in 2019, 2020 and 2021, there was a failed audit in 2022.

Circle hired Deloitte for the 2023 audit, and the results are here.

Why own USDC?

A benefit of USDC is that it can be used as a medium of exchange for various purposes, such as buying and selling other cryptocurrencies, paying for goods and services, sending remittances, and accessing decentralized applications (DApps).

USDC can be transferred 24/7 and is faster and cheaper than traditional payment methods, such as bank transfers or credit cards.

USDC can also be integrated with various platforms and protocols that support blockchain technology, such as Visa, which announced that it would allow USDC to settle transactions on its network.

Who started USDC and why?

USDC was launched in September 2018 by Centre. The main goal of Centre was to create a global and open standard for fiat-backed stablecoins that could enable interoperability and innovation across the cryptocurrency ecosystem.

Centre aimed to change the global financial landscape by connecting every person, merchant, financial service, and currency worldwide.

Is USD Coin popular and what is it used for?

USDC is currently the second-largest stablecoin in the world, after Tether (USDT) in terms of market capitalisation.

Uses of USDC

While USDC isn’t ideal as a speculative investment, as its value is stable, it has some uses that make it worth having.

-USDC can be used as a bridge currency to trade other cryptocurrencies on various platforms, including CoinJar.

-USDC can be used as a payment method for goods and services that accept cryptocurrencies, such as online shopping, gaming, travel, and entertainment. USD Coin can also be used to pay for fees and subscriptions on various platforms and services that support cryptocurrencies.

-USDC can be used as a remittance tool to send money across borders and regions, especially to countries with limited access to banking and financial services. All users need is a phone. USDC can be faster, cheaper, and more convenient than traditional methods, such as wire transfers, or using banks.

-USDC can be used as a gateway to access various DApps that run on blockchain technology, such as gaming platforms.

USDC in popular culture

In September 2021, Twitter announced that it would enable users to tip each other with cryptocurrencies, including USDC, through a partnership with Stripe, a payment platform.

This made Twitter the first major social media platform to support cryptocurrency tipping, allowing users to reward each other for their content and engagement.

Buy USDC: Conclusion

USDC is a stablecoin. It is backed by the U.S. dollar and runs on blockchain technology. USD Coin offers low price volatility, high transparency, and wide usability, making it a popular and convenient choice for cryptocurrency users and enthusiasts.

Whether you're looking to buy crypto with Apple Pay or Google Pay, trade USDC, or withdraw AUD, the solid market cap makes USDC a sturdy choice.

Cash, credit or crypto?

Buy USDC instantly using Visa or Mastercard. Get cash in your account fast with bank transfer, Faster Payments, PayID or Osko. Convert crypto-to-crypto with a single click.How to buy USDC with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.Featured In

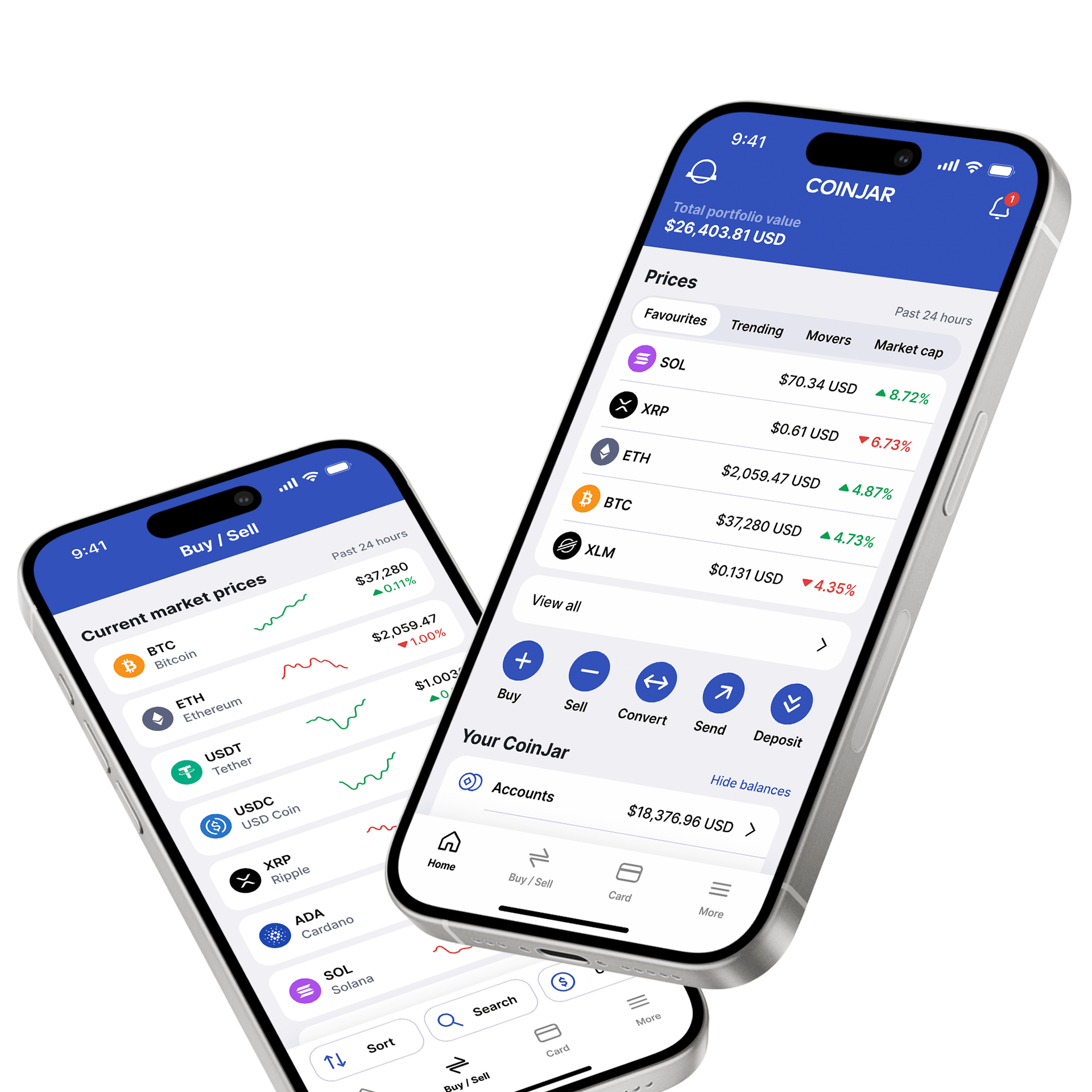

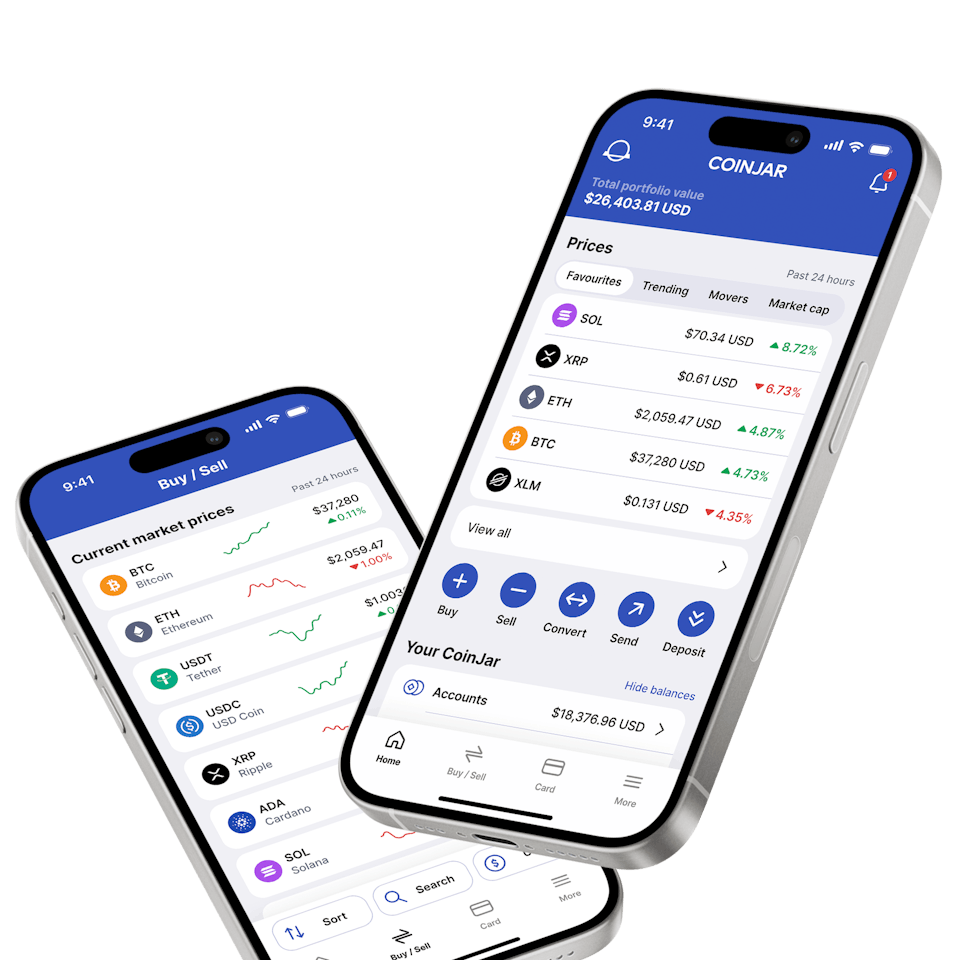

CoinJar App

All-in-one crypto walletCoinJar App

All-in-one crypto wallet

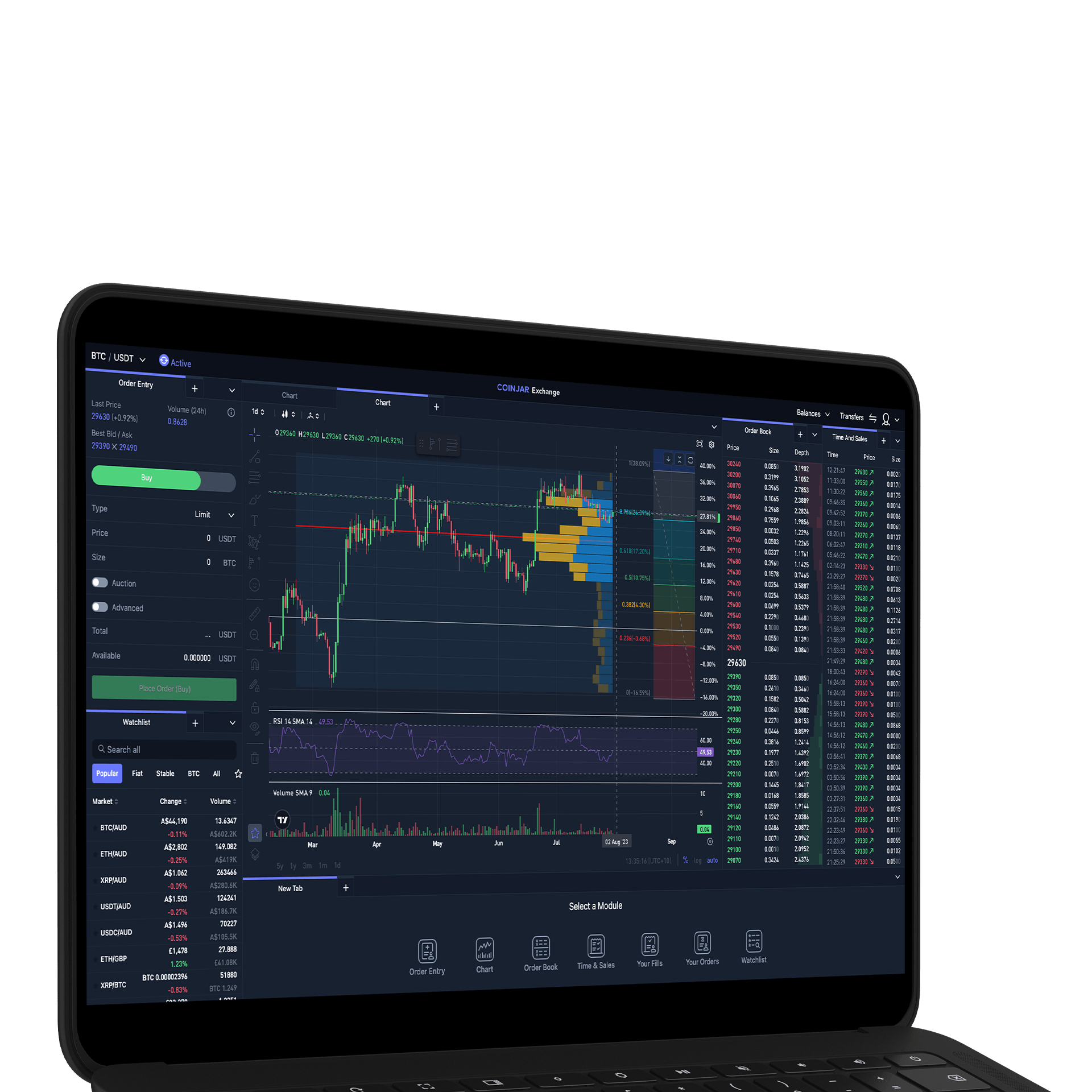

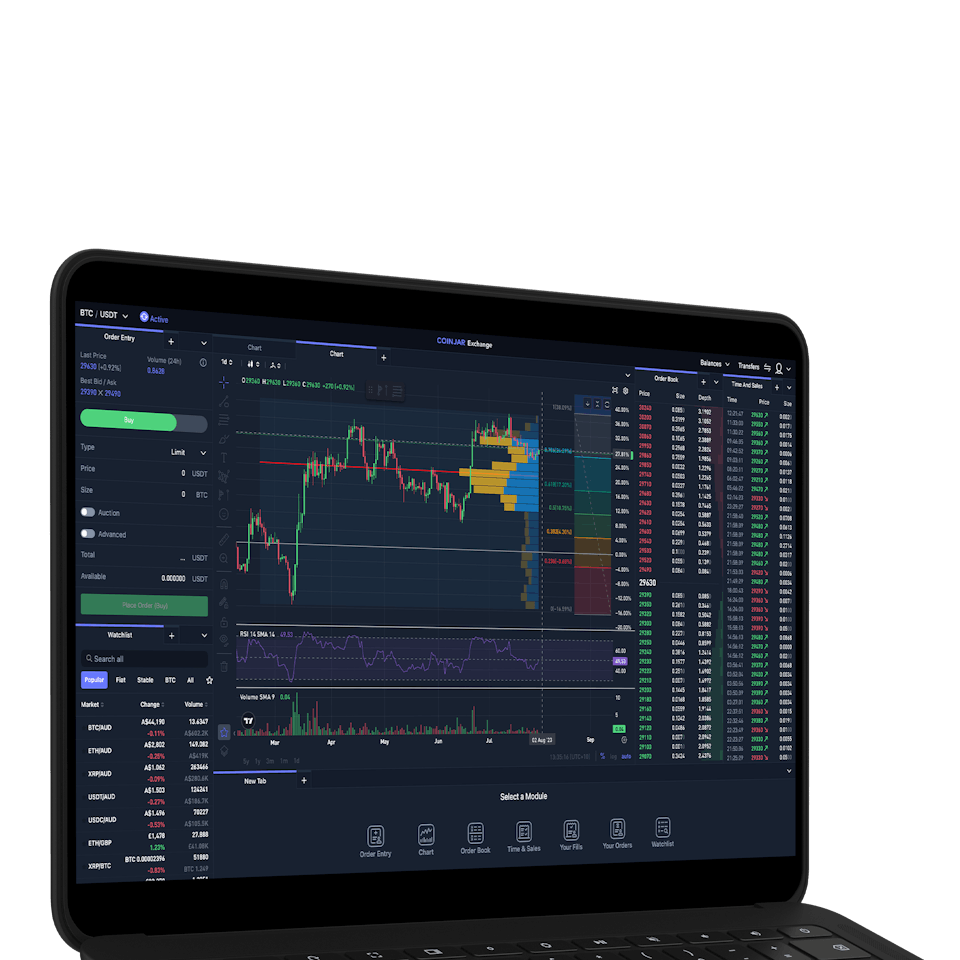

CoinJar Exchange

TRADE FOR AS LOW AS 0%

CoinJar Exchange

TRADE FOR AS LOW AS 0%CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.