Onchain: New Year, Same old industry

January 15, 2026

Share this:

2026 has been off to a strong start, with constant drama from the White House. But it’s not on Trump alone to keep our cholesterol levels high. Crypto is contributing its part.

Story One

Zcash devs said: f*ck this shit

At least in regards to the corporate structure they had to labor under, which was called Electric Coin Company and had been operating as the de facto entity for Zcash development for years. Since late 2025, Zcash has been having a moment as crypto people jumped on the privacy train - aided by an increase in governments seeking to turn their states into a panopticon.

On January 7th, the developers sent a shockwave through the community when they collectively resigned over differences with the board. In essence, the developers felt their working environment had changed in a way that made it impossible to continue delivering a protocol that’s resistant to censorship and surveillance.

In the aftermath of the announcement, the price dropped by 20%, halted by shills on CT, who pointed out that this was a rejection of bureaucracy and that the devs would continue working on the protocol.

Takeaway: Probably not the last time corporate compliance runs up against cypherpunk ethos-maintaining developers. It did, however, expose that the tech is not the only thing chains have to worry about.

Story Two

If you know, you know

In 2026, the best way to make money is the same way it’s been for Nancy Pelosi for years. All you need is insider information and an account on one of the many prediction markets sprouting faster than the mold on the abandoned cheese sandwich at the bottom of your kids' bag during the holidays.

From the get-go, one concern around prediction markets has been that they’d become a haven for insiders. The capture of Maduro has once again lit a fire under the debate over whether that’s how people use these markets, with one new account making nearly half a million dollars betting that Maduro will be out of office by the end of January.

Crypto Twitter has taken note, and some have made a sport of finding Polymarket accounts with an immaculate track record of 100% correct predictions. The second-biggest market in the game, Kalshi, was quick to point fingers, accusing that all this insider trading could never happen on their platform. It’s the unregulated ones we have to worry about.

Let’s be real, if part of the selling point of these markets is that they accurately predict what will happen, who better to rely on than insiders?

Takeaway: Trump’s son is an advisor to both the biggest prediction markets. Do we really think they’ll face regulatory restrictions? I doubt it.

Story Three

We did it

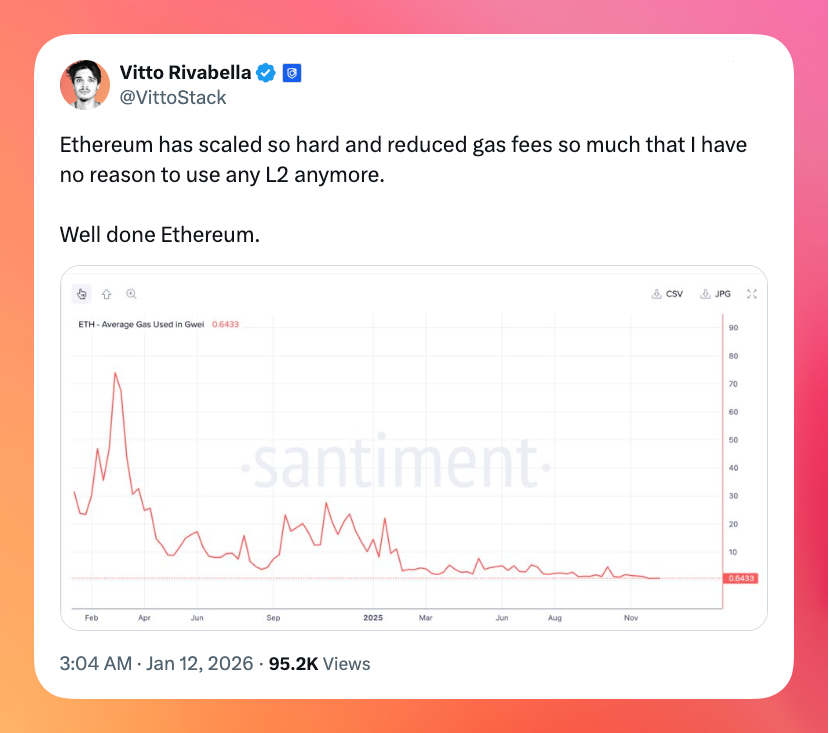

The blockchain trilemma has been solved. This is a phrase usually uttered by new L-1 blockchains trying to collect venture funding. This time, it’s different. It was Vitalik, the creator of Ethereum, who posted a long tweet explaining how we did it; it’s real now.

The trilemma assumes that blockchains could never have all three: decentralization, safety, and scalability. Vitalik essentially explains that the trilemma isn’t real anymore; it can’t hurt us. With the code Ethereum has, it’s on the best path to move beyond such limitations.

So how did Ethereum get to this point? It’s through the addition of Data Availability Sampling, a fancy word to say that instead of checking the whole chain, nodes can sample probabilistically, and the progressing development of zkEVMs.

Some view this as an admission that the entire L2 thing didn’t work out as planned. It doesn’t help their cause that mainnet Ethereum fees have been very cheap recently.

Takeaway: Admittedly, the trilemma isn’t entirely solved, but it makes for a good feeling when the guy at the top says that we're actually fixing things. Rip to the L2s.

Fact of the Week: Speaking of high cholesterol levels, did you know that chronic stress will shrink your hippocampus, worsening memory, focus, and your ability to learn? Consider this before getting rage-baited.

Naomi for CoinJar

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

More from CoinJar Blog

Onchain: In bad taste

February 25, 2026ICYMI, the tech bros have once again discovered taste, so get ready to be lectured by dudes who think it's acceptable to live with one ceiling light on what to wear and consume....Read more

CoinJar Wins Gold and Silver at 2026 Asia-Pacific Stevie Awards for AI Innovation

February 12, 2026Australia's longest-running cryptocurrency exchange recognised for excellence in artificial intelligence and fintech innovation. We're thrilled to announce that CoinJar has...Read more

Onchain: The selling continues

February 11, 2026Until morale improves, or so I hope. Story One L2s are pointless Tweets the guy who advocated for them as part of the Ethereum scaling roadmap. Perhaps to deflect from his...Read moreCoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.