Buy Curve DAO

Curve DAO

CRV

Overview

What is Curve DAO?

Want to buy Curve DAO (CRV)? CRV is the governance token for Curve Finance, a decentralized exchange (DEX) protocol. Unlike traditional exchanges, Curve focuses on allowing users to swap between assets that have very similar underlying values with minimal slippage.

(An example of slippage in crypto is when you check the price of a crypto, then go to buy, but in the time between deciding and buying, the price has jumped. Slippage is the difference between the price you expected and the actual price you paid.)

Curve DAO is designed for stablecoin swaps and low volatility trading to avoid slippage.

Why does Curve DAO exist?

Curve DAO was created to give users a say in how the protocol operates. Here are some key points.

Governance

CRV holders can vote on proposals that impact the Curve platform. These proposals can include changes to the protocol’s parameters, fee structures, and new features.

Liquidity mining

Curve incentivizes liquidity providers by rewarding them with CRV tokens. Liquidity providers play a crucial role in maintaining stablecoin pools, which are essential for efficient trading.

Staking and veCRV

CRV can be staked to earn veCRV (voting escrow CRV). veCRV holders have additional voting power and can participate in important decisions. The longer you stake CRV, the more veCRV you receive.

Why would someone want to buy CRV?

Governance influence

If you’re interested in shaping the future of Curve Finance, owning CRV gives you voting power. You can participate in governance proposals and help decide the direction of the protocol.

Liquidity mining rewards

By providing liquidity to Curve pools, you can earn CRV tokens. These rewards incentivize users to contribute to the platform’s liquidity, which benefits all traders.

Potential price appreciation

Like any other cryptocurrency, CRV’s price can fluctuate. Some investors buy CRV in the hope that its value will increase over time.

Interest in DeFi

If you’re curious about decentralized finance (DeFi), CRV provides exposure to a popular DEX protocol. Learning about Curve Finance and CRV can deepen your understanding of the DeFi ecosystem.

Conclusion: Why Buy Curve DAO (CRV)

Curve DAO plays a vital role in the DeFi landscape, offering stablecoin swaps and governance opportunities. Whether you’re a trader, liquidity provider, or simply interested in crypto, understanding CRV can enhance your knowledge of this exciting space.

Cash, credit or crypto?

Buy Curve DAO instantly using Visa or Mastercard. Get cash in your account fast with bank transfer, Faster Payments, PayID or Osko. Convert crypto-to-crypto with a single click.How to buy Curve DAO with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.Featured In

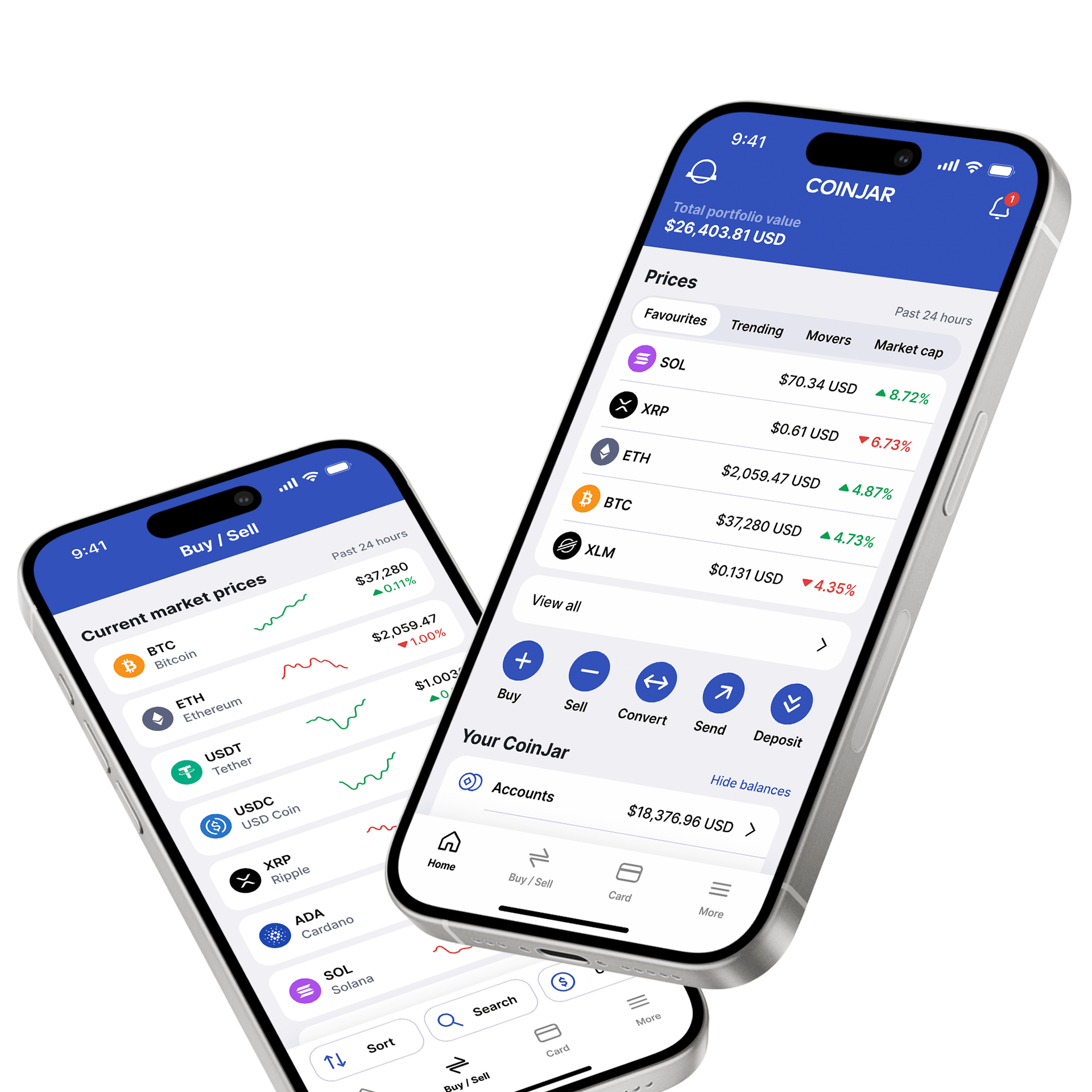

CoinJar App

All-in-one crypto walletCoinJar App

All-in-one crypto wallet

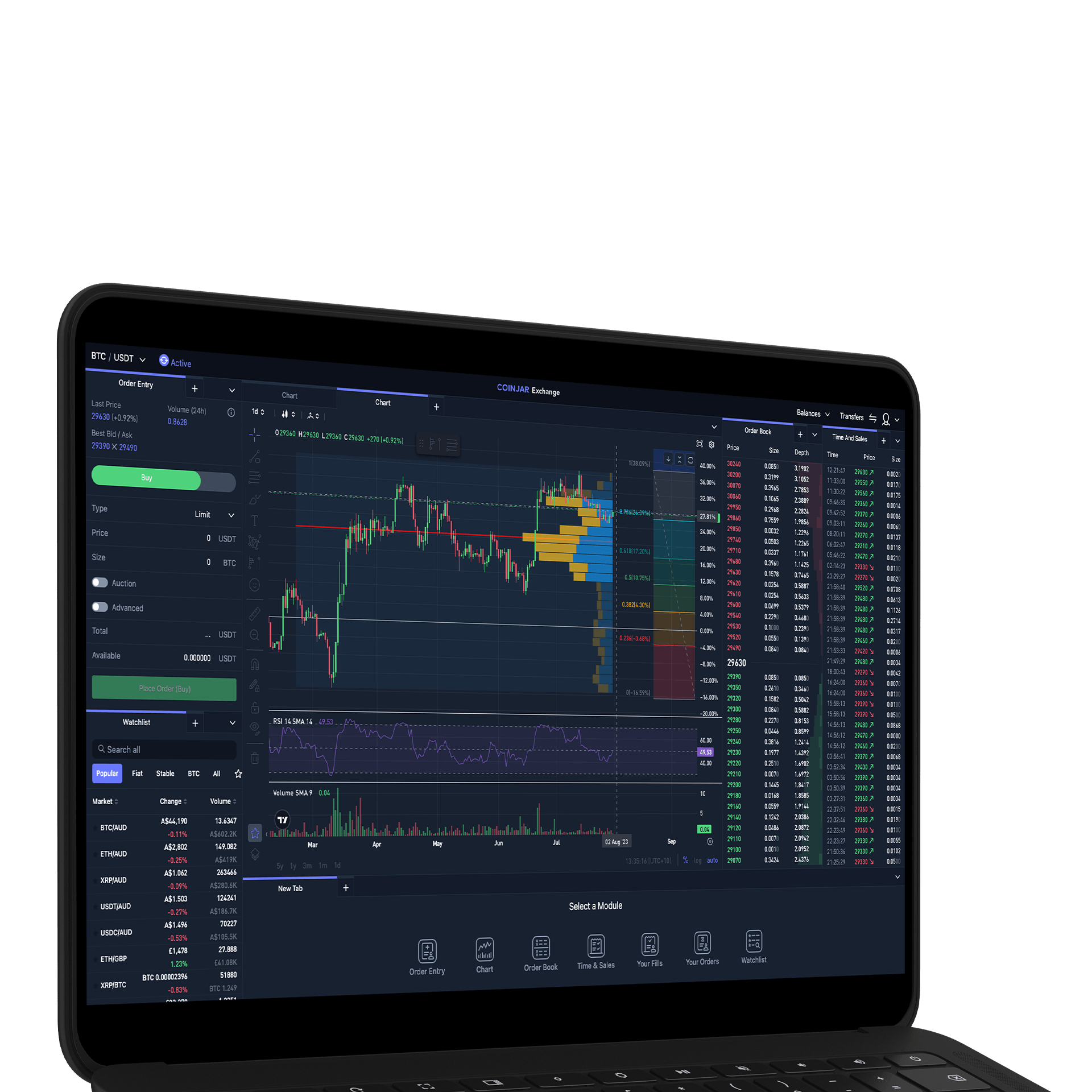

CoinJar Exchange

TRADE FOR AS LOW AS 0%

CoinJar Exchange

TRADE FOR AS LOW AS 0%CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.