Buy SushiSwap

SushiSwap

SUSHI

What is SushiSwap?

Why investors buy SUSHI: SushiSwap, a decentralized exchange (DEX), has been making itself known in the crypto world. But what exactly is it, and why are investors interested in it? Let’s take a look at SushiSwap’s popularity and why its token, SUSHI, is an interesting investment choice.

One-Stop shop for passive income

SushiSwap offers a diverse range of passive income opportunities, setting it apart from other DEXs.

Here’s how it works.

Liquidity pools

SushiSwap allows investors to provide liquidity by participating in liquidity pools. These pools enable users to earn fees on the exchange for tokens listed on the platform. What’s unique is that SUSHI operates on 20 different blockchains.

Yield farming

Liquidity providers receive LP tokens, which they can use for yield farming. Yield farming involves staking LP tokens to earn additional SUSHI tokens. Unlike Uniswap, SushiSwap supports this functionality, making it a go-to platform for yield-seeking investors.

Utility token

SUSHI is not just a governance token; it’s a utility token. Investors benefit from its practical use within the ecosystem.

Gas-efficient borrowing

The BentoBox smart contract acts as a token vault. By depositing tokens into BentoBox, users earn more tokens over time. The key advantage? Gas-efficient interactions with decentralised applications (dApps).

Gas fees are transaction fees on the Ethereum blockchain. BentoBox minimises gas costs, making it an attractive feature for investors.

Flexibility

The decentralised exchange operates without intermediaries. Users trade directly with liquidity pools via non-custodial wallets. This design reduces the risk of hacks and provides flexibility in coin selection.

Conclusion

SushiSwap’s unique features and utility token, SUSHI, make it an appealing choice for investors. As the crypto industry continues to grow, SUSHI is expected to grow in importance.

Cash, credit or crypto?

Buy SushiSwap instantly using Visa or Mastercard. Get cash in your account fast with bank transfer, Faster Payments, PayID or Osko. Convert crypto-to-crypto with a single click.How to buy SushiSwap with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.Featured In

CoinJar App

All-in-one crypto walletCoinJar App

All-in-one crypto wallet

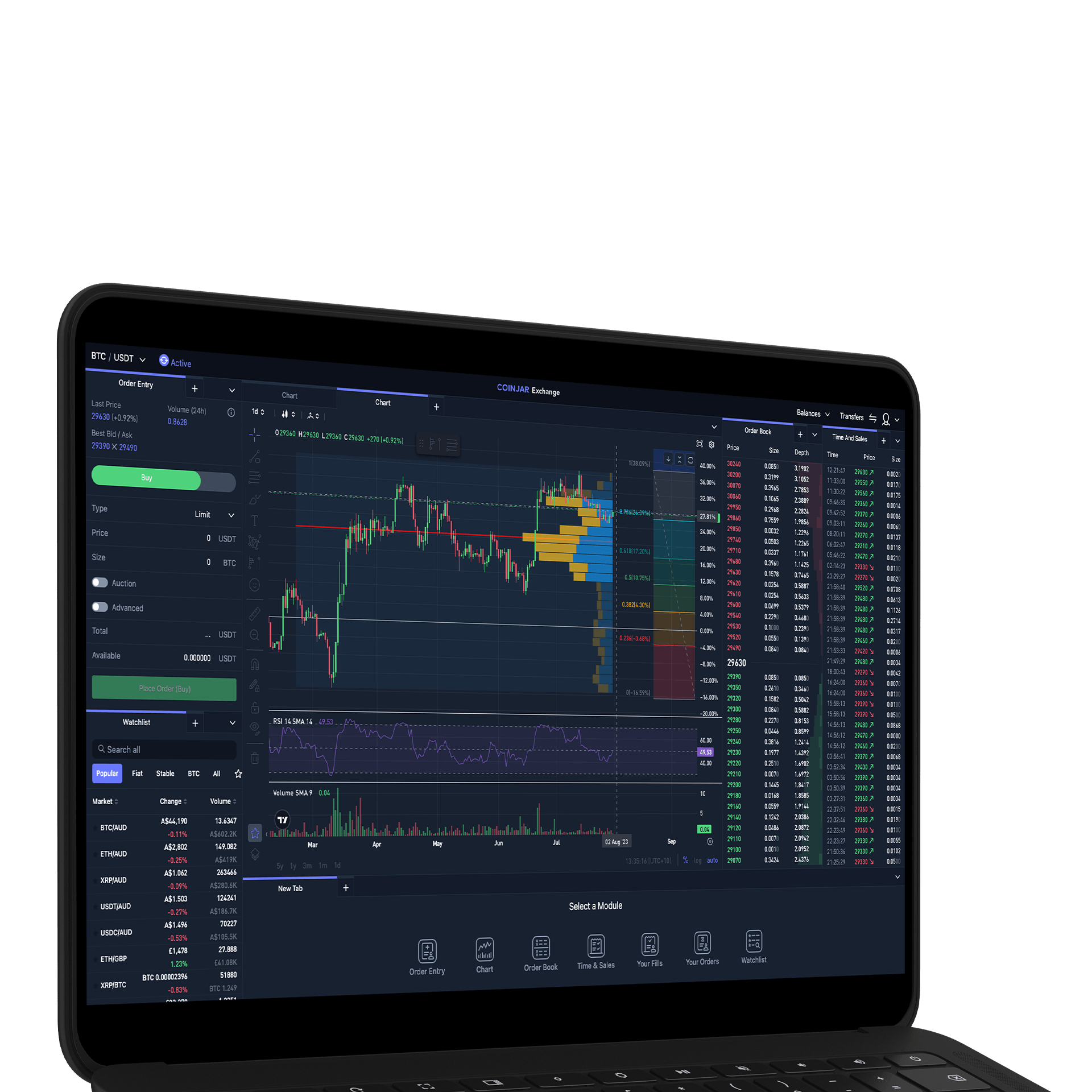

CoinJar Exchange

TRADE FOR AS LOW AS 0%

CoinJar Exchange

TRADE FOR AS LOW AS 0%CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.