DeFi-ing Gravity

August 3, 2020

Share this:

It’s the summer of DeFi! (AKA decentralised finance). But is something revolutionary happening or is it just another crypto bubble?

People have been proclaiming alt season from the rooftops recently, but it’s probably more accurate to call it DeFi season instead. From a relatively fringe pursuit whose products were considered years away from primetime, crypto’s decentralised finance ecosystem has, over the last couple of months, experienced the sort of explosive growth most commonly associated with major cosmological events.

If you’re anything like me, this begs a few questions. What the hell is DeFi? How are people actually making money from it? And why did nobody tell me to invest in DeFi pioneer Aave (LEND) before it pulled an actual 100x?

What am DeFi?

In a broad sense, the whole premise of decentralised finance is pretty simple: how can we leverage the power of blockchain technology to offer financial services that don’t require mediators such as banks?

The most obvious example is a loan. In traditional finance, you require a trusted intermediary (i.e. a bank) to both offer the money for the loan and then provide the platform for repaying it. In DeFi the bank is replaced by a decentralised marketplace where anyone can provide loans to anyone else, using smart contracts to ensure that the terms of the loan are met.

The unusual suspects

When we talk about DeFi, we’re talking about a complex ecosystem of intersecting blockchain projects, each carving out their own niche in the making-money-from-money space. There’s the aforementioned Aave, which allows people to build their own money markets. There’s Compound, which algorithmically invests cryptocurrency in different interest-bearing markets to maximise yield; it currently holds more than US$1.5 billion in digital assets. Ampleforth looks to mitigate crypto’s famed volatility (an impediment to loans denominated in bitcoin) by continuously changing its circulating supply. 0x (available on CoinJar) facilitates the peer-to-peer exchange of digital assets.

The list is extensive and the financial concepts often mind-bending, yet right now DeFi projects are the hottest thing in crypto, with valuations that have increased 5-, 10- or even 100-fold over the last six months. So what’s driving the frenzy?

Promise and execution

In theory, DeFi is the next step in crypto’s utopian promise to disintermediate money and bank the unbanked. In practice, at least so far, it’s an excuse for high functioning crypto nerds to engage in high-risk, multi-stage lending practices known as “yield farming”.

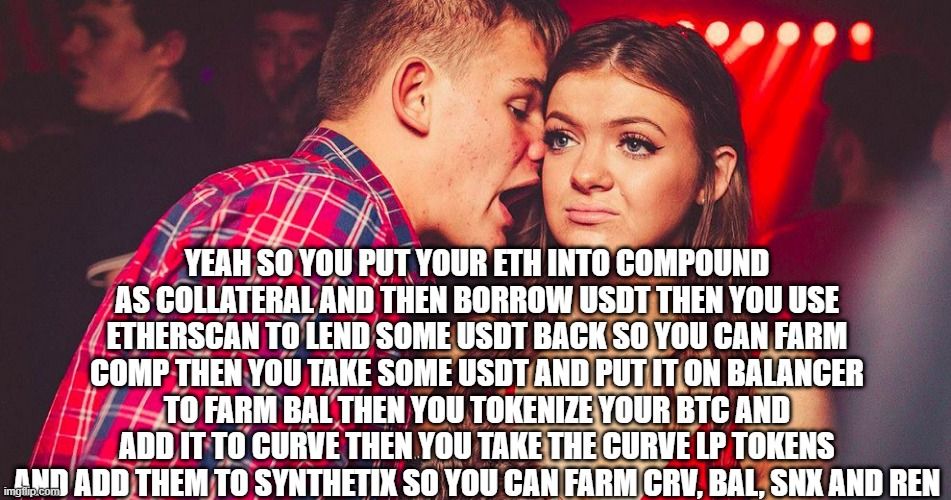

Yield farming is basically a way of leveraging different decentralised money markets to compound the interest you receive for lending out your cryptocurrency. It goes something like this:

I’ll be honest. I’ve spent the last few hours trying to understand exactly how yield farming works and I still feel like someone’s trying to explain quantum computing to me in Yiddish.

And therein lies the problem with DeFi right now. It’s not surging because it’s solved a clear and present real world need for decentralised finance products. It’s surging because it’s created a circular network that rewards people for joining by shifting capital from one person to the next. (I’ll take “Ponzi scheme” for $400, thanks Alex!) But when the pool of available investors is exhausted and there’s no more yield to farm? Hoo boy.

Don’t get me wrong. The DeFi mission is laudable and at some point it could well fulfil its promise of eliminating some of the injustices and inefficiencies of centralised finance. But the skyrocketing valuations, frantic shifts of capital from project to project and general sense of disbelief in the air is very reminiscent of the ICO frenzy in 2017.

And, sure, that frenzy was immensely profitable to those who played it right. But just keep its primary lesson front and centre in your mind: it’s all fun and games while the bubble is inflating, but when it eventually explodes you do not want to be the one holding (or should that be HODLing?) on.

We are not affiliated, associated, endorsed by, or in any way officially connected with any business or person mentioned in articles published by CoinJar. All writers’ opinions are their own and do not constitute financial or legal advice in any way whatsoever. Nothing published by CoinJar constitutes an investment or legal recommendation, nor should any data or content published by CoinJar be relied upon for any investment activities. CoinJar strongly recommends that you perform your own independent research and/or seek professional advice before making any financial decisions.

Warning: Past performance is not a reliable guide to future performance. If you invest in this product, you may lose some, or all, of the money you invest. The above information is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. There are no government or central bank guarantees in the event something goes wrong with your investment. This information is provided for general information and/or educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar Europe Limited makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. CoinJar Europe Limited is authorised by the Central Bank of Ireland as a crypto-asset service provider (registration number C496731).

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: Lots of things on sale

January 28, 2026Story One Crypto Social for Sale Been an interesting time to observe what happens to the still-standing crypto social networks. Aave, a leading DeFi protocol and creator of...Read more

CoinJar Is Cleared to Expand in Europe: What This Means for Irish Customers

January 20, 2026We're excited to share some important news about CoinJar and upcoming changes to our services for customers in Ireland. CoinJar Europe Limited (C496731) has been authorised by...Read more

Onchain: New Year, Same old industry

January 15, 20262026 has been off to a strong start, with constant drama from the White House. But it’s not on Trump alone to keep our cholesterol levels high. Crypto is contributing its...Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Warning: Past performance is not a reliable guide to future performance. If you invest in this product, you may lose some, or all, of the money you invest. The above information is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. There are no government or central bank guarantees in the event something goes wrong with your investment. This information is provided for general information and/or educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar Europe Limited makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information.

CoinJar Europe Limited is authorised by the Central Bank of Ireland as a crypto-asset service provider (registration number C496731).

For more information on our regulatory status and the crypto-asset services we are authorised to provide, please see our official announcement and our MiCAR Legal & Regulatory Information page.

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.