Onchain: Fall is upon us*

September 24, 2025

Share this:

*at least in my hemisphere.

Whether it'll also be the fall of civilization remains to be seen. But if we learned anything from history books, decline tends to be a process, not a flashy moment. Speaking of not being flashy...

Story One

Low risk, low fun

In his latest blog post, Vitalik drops new copium for the Ethereum community, explaining why we're still not widely adopted. His answer is that we've not had enough low-risk DeFi.

You might wonder, wait, isn't that an Oxymoron? And you'd be right. Nevertheless, Vitalik believes that this area could become the Google Search, the one thing that'll allow Ethereum to monetize its blockspace better than memecoins could ever.

Low-risk DeFi covers exciting use cases such as payments, savings, and fully collateralized lending. Until now, most low-risk DeFi has focused on providing people with access to the US dollar through stablecoins, but Vitalik hopes this will change.

Takeaway: This framing overlooks the economic conditions of the normies they are trying to onboard. Most of whom don't think crypto is low-risk at all, and if they touch it, it better be worth it (4% yield when my butter price has increased by more than that, doesn't entice me).

Story Two

Hyperliquid gets its own stablecoin

Staying with the theme of stablecoins: on Hyperliquid in the last few weeks, a fight has broken out over who gets to hold the prestigious USDH ticker. ICYMI, Hyperliquid is the hottest decentralized perpetual exchange (you can trade options contracts there), complete with a native Layer-1.

While it has received a fair share of criticism for not being open-source, users didn't care, and within 18 months, the chain now makes $120 monthly revenue.

The one thing that was missing: a native stablecoin. Circle, the issuer of USDC, parked $5 billion on Hyperledger, and others, like Paxos and Ethena, threw their hat in the ring to be awarded the USDH ticker.

In the end, a community vote decided that Native Markets would be awarded the prize, a team with ample experience on Hyperliquid, whose proposal included giving 100% of the yield generated through their reserve to the ecosystem. The yield in this case will come from holding U.S. Treasuries—a nice scheme to take from the state and give to a crypto ecosystem.

Takeaway: Hyperliquid has become too big to ignore, and now everyone wants a piece of the cake.

Story Three

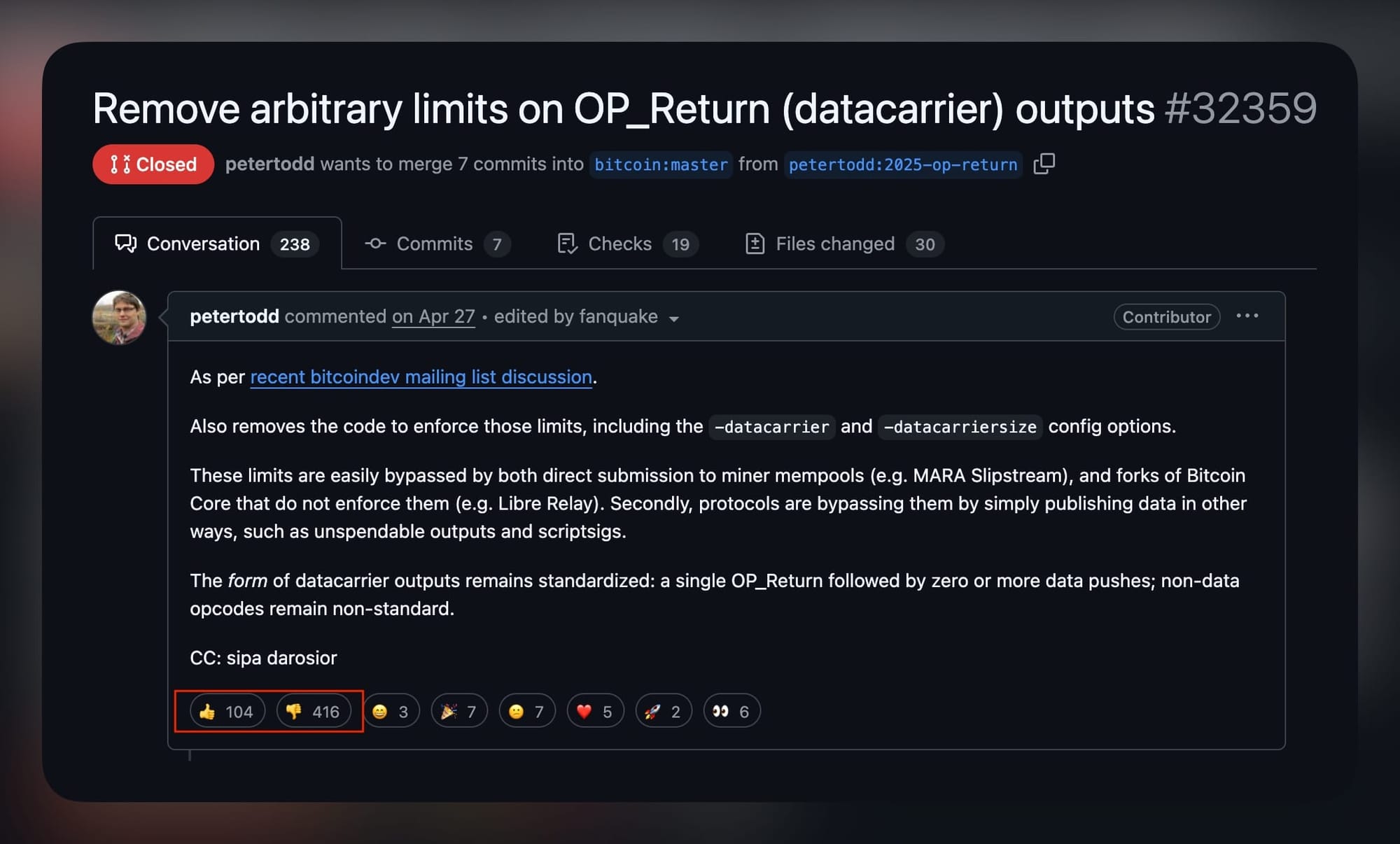

Bitcoiners not amused

For anyone into drama, the Bitcoin forums are a great source of entertainment. The most recent in-fighting concerns the Bitcoin Core developers' decision to remove the OP_Return limit for non-monetary data embedded in the Bitcoin blockchain.

Currently, this op code limits attachments to blocks to a size of 80 bytes. This'll soon change despite the proposal being hugely unpopular with the community. Anyone who has ever spent time with Bitcoin maxis will know why: they love Bitcoin and want to protect its purity as a digital gold.

Yet in this case, it's about more than that. It's also about safeguarding Bitcoin's status as a decentralized ledger, where the entry point for running a node is relatively low compared to other Layer 1s.

Takeaway: Emoji governance has failed the Bitcoiners. That can't be good. I've also found that the biggest insult Bitcoiners have is labelling someone or something "fiat". Try at your own discretion.

Fact of the week: Since I brought up butter as the RWA I care about... Did you know that butter was even used as currency in the 11th century? In Norway, King Svein Knutsson, a butter lover, demanded that people pay taxes in the form of butter. A clever tactic I might have to adopt for my client work.

Naomi for CoinJar

Warning: Past performance is not a reliable guide to future performance. If you invest in this product, you may lose some, or all, of the money you invest. The above information is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. There are no government or central bank guarantees in the event something goes wrong with your investment. This information is provided for general information and/or educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar Europe Limited makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. CoinJar Europe Limited is authorised by the Central Bank of Ireland as a crypto-asset service provider (registration number C496731).

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: Lots of things on sale

January 28, 2026Story One Crypto Social for Sale Been an interesting time to observe what happens to the still-standing crypto social networks. Aave, a leading DeFi protocol and creator of...Read more

CoinJar Is Cleared to Expand in Europe: What This Means for Irish Customers

January 20, 2026We're excited to share some important news about CoinJar and upcoming changes to our services for customers in Ireland. CoinJar Europe Limited (C496731) has been authorised by...Read more

Onchain: New Year, Same old industry

January 15, 20262026 has been off to a strong start, with constant drama from the White House. But it’s not on Trump alone to keep our cholesterol levels high. Crypto is contributing its...Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Warning: Past performance is not a reliable guide to future performance. If you invest in this product, you may lose some, or all, of the money you invest. The above information is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. There are no government or central bank guarantees in the event something goes wrong with your investment. This information is provided for general information and/or educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar Europe Limited makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information.

CoinJar Europe Limited is authorised by the Central Bank of Ireland as a crypto-asset service provider (registration number C496731).

For more information on our regulatory status and the crypto-asset services we are authorised to provide, please see our official announcement and our MiCAR Legal & Regulatory Information page.

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.