The case for selective indexing in digital assets

February 13, 2019Share this:

‘It’s the thing that makes the most sense practically over time’. Warren Buffett, the prince of value investing, has said of low-cost index funds. As the research will show, he’s largely right it’s incredibly hard to ‘beat the market’.

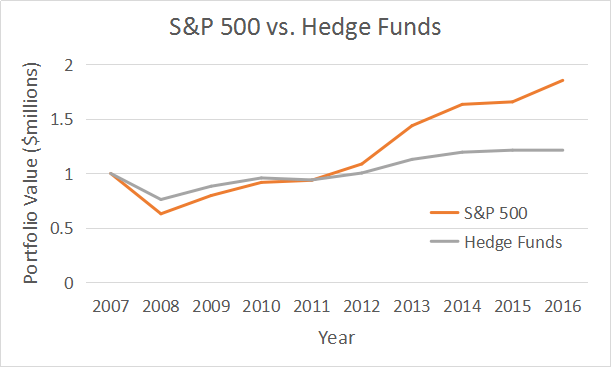

In the cryptocurrency markets, your options to gain access are either through direct investment yourself or through a fund manager. Fund managers globally are typically either active fund managers or passive index-style funds like CoinJar Asset Management. The reality is that active management rarely outperforms the market, as evidenced by the below chart.

So, what’s the best way for you to invest in crypto?

Selective Indexing a basket of currencies.

Anyone will tell you that selecting all and every crypto for an index fund is an incredibly poor idea because the industry is so nascent – see CryptoCurrencyChart’s Top 10 Cryptocurrencies by Market Capitalization. The key then is to selectively choose your basket on a few underlying factors.

What do I mean by that? Cryptocurrencies are based on the network effects we see in social networks. As the community around the currency grows, clarity in monetary policy (controlled supply), and community direction has shown to give confidence to higher numbers of people adopting the currency. In the long run, a certain group of currencies will prevail at specific use-cases (i.e. BTC as a store of value, ETH as a global computing resource).

Most cryptocurrencies will go into the theoretical elephant graveyard, and it’s up to the fund manager to ensure they don’t choose any of them. Active fund managers will try to ‘pick’ who, whereas passive index merely identifies the ‘market’. We do this at CoinJar Asset Management by choosing currencies that are: reputable, widely used, safe and secure and not likely to be scams.

Choosing a Basket

At this stage in the evolution of cryptocurrencies, price movements in most of the larger cap coins are closely tied to moves in Bitcoin. In the same way, market cap weighted stock indexes are often influenced by the largest players.

For example, the FAANG stocks on the NASDAQ – Facebook, Apple, Amazon, Netflix and Alphabet’s Google. More often than not, the index moves in-line with the sentiment of these few major players. The sentiment then influences the rest of the tech sector as a whole.

Given that the universe of reputable coins that possess solid real-world utility is quite small at this point in time, it is a smarter strategy to look to buy a basket of the top crypto names such as bitcoin, ethereum (ETH), ripple (XRP), and litecoin (LTC), rather than a broad index of all available digital currencies.

Liquidity and Volatility

One of the major advantages of passive investments is the ability to get in and out and to do so quickly. What we would call liquidity.

In the stock market, passive funds are simply trying to match the index they track and are therefore only interested in investing in the particular stocks that make up that index. They can do that by purchasing them outright or with exchange traded funds. Their biggest concern is often around the costs of transactions and any slippage that might result with the execution of their orders. The largest cryptocurrencies are highly liquid and provide easy access for investors.

Active funds, on the other hand, are trying to outperform an index or the broader market. However, they have the mandate to search far and wide for investment opportunities. In many cases, hedge funds will look to invest in illiquid assets or financial products in a bid to find alpha that might not be available elsewhere. Similar to trying to invest in ICO’s and early stage coins, where liquidity is extremely limited.

That also means that active funds can at times have lock-up periods where investors can’t access their money for the simple reason that the funds are tied up. Whereas that’s not the case for most index funds who invest in only the most liquid assets.

Benefits of Diversification

In some instances, an active strategy gives an investment manager the ability to reduce volatility. Despite the fact that stocks generally rise each year, as we’ve seen during the GFC, the major indices are not immune to large swings. This volatility, however, can be reduced by diversifying our broader portfolio of holdings.

The advantage of using an index fund is that you can quickly and easily diversify away some of the potential volatility. Harry Markowitz once said diversification is ‘the only free lunch in finance’. This is certainly true in regards to cryptocurrencies.

Investors can use an index fund to get exposure to the sector, which should make up only a small part of their overall portfolio. In the same way, gold might be a percentage of an investment strategy, to hedge against inflation or a risk-off event.

Having volatile returns is fine if those returns are a part of a broader portfolio. It is even more advantageous if those returns aren’t correlated to the broader stock markets. Which has historically been the case with cryptocurrencies.

Opening the door to wholesale investors

The world of cryptocurrencies has traditionally been the realm of the retail investor. In fact, institutions have been slow to adopt this sector as a whole. As a result, many cryptocurrency funds to date have been in the form of an ICO, which traditional institutions are perhaps unfamiliar with and not comfortable investing in. Whereas an investment structure like a unit trust might be a better option for many institutional investors, which an index fund would be a good fit.

Given the relative age of cryptocurrencies, no one can truly say just what impact they will have on the world going forward. And certainly not which individual coins will, in fact, fail or be adopted by the mainstream.

For the time being, the best approach is to simply invest in a basket of the major cryptocurrencies that have utility at this point in time. Then allocate a percentage of your overall portfolio to that basket, to gain exposure to what is generally considered an asset class with a low correlation to the broader markets.

Warning: Past performance is not a reliable guide to future performance. If you invest in this product, you may lose some, or all, of the money you invest. The above information is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. There are no government or central bank guarantees in the event something goes wrong with your investment. This information is provided for general information and/or educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar Europe Limited makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. CoinJar Europe Limited is authorised by the Central Bank of Ireland as a crypto-asset service provider (registration number C496731).

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: Lots of things on sale

January 28, 2026Story One Crypto Social for Sale Been an interesting time to observe what happens to the still-standing crypto social networks. Aave, a leading DeFi protocol and creator of...Read more

CoinJar Is Cleared to Expand in Europe: What This Means for Irish Customers

January 20, 2026We're excited to share some important news about CoinJar and upcoming changes to our services for customers in Ireland. CoinJar Europe Limited (C496731) has been authorised by...Read more

Onchain: New Year, Same old industry

January 15, 20262026 has been off to a strong start, with constant drama from the White House. But it’s not on Trump alone to keep our cholesterol levels high. Crypto is contributing its...Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Warning: Past performance is not a reliable guide to future performance. If you invest in this product, you may lose some, or all, of the money you invest. The above information is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. There are no government or central bank guarantees in the event something goes wrong with your investment. This information is provided for general information and/or educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar Europe Limited makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information.

CoinJar Europe Limited is authorised by the Central Bank of Ireland as a crypto-asset service provider (registration number C496731).

For more information on our regulatory status and the crypto-asset services we are authorised to provide, please see our official announcement and our MiCAR Legal & Regulatory Information page.

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.