Defence against the dark arts: how to spot fake volume on cryptocurrency exchanges

October 29, 2019Share this:

In early 2019, a report by Bitwise to the U.S. Securities and Exchange Commission put forward a bold statement which at the same time failed to surprise anyone, “95% of all reported bitcoin trading volume is fake”. Since then Bitwise have followed up their much-publicised report with an update mentioning, “the presence of widespread fake volume in reported bitcoin buy and sell data is now widely understood.”

Let’s take a look at the initial report’s findings in the Australian cryptocurrency exchange context.

What is fake volume?

When you trade, you’re usually meeting other parties who have slightly different expectations of how much and at what price you want to trade. This leads to normal market activity of buyers and sellers filling some of those expectations on an exchange. Fake volume happens when buy and sells happen at the same price, at the same time, for the same amount. Hence an exchange between parties isn’t really happening, just the appearance of it as both parties are colluding.

Sometimes referred to wash trading, it is illegal in traditional exchange markets as it sends false signals that there are more willing market participants than there actually are.

Why fake volume?

A busy market gives confidence to people who want to buy and sell on an exchange that they’ll find a counterparty that can fill their order.

If you want to make a token or ICO project look popular, you could attempt to fake volume to make it look like the most popular asset on the block.

Exchanges also can point to high trading volumes to entice projects to list on their exchange, often times in return for listing fees. They also do this to climb the ranks in CoinMarketCap and other exchange rankings – it’s a way of (false) advertising.

How to tell?

It’s not always apparent if trades are fake. Automated trading or ‘bots’ are common and in some cases, an identical fill might be a result of different trading strategies implemented by the same party. Volume can also be routed through different providers or multiple market-making accounts. Liquidity can be shared through orderbooks as well.

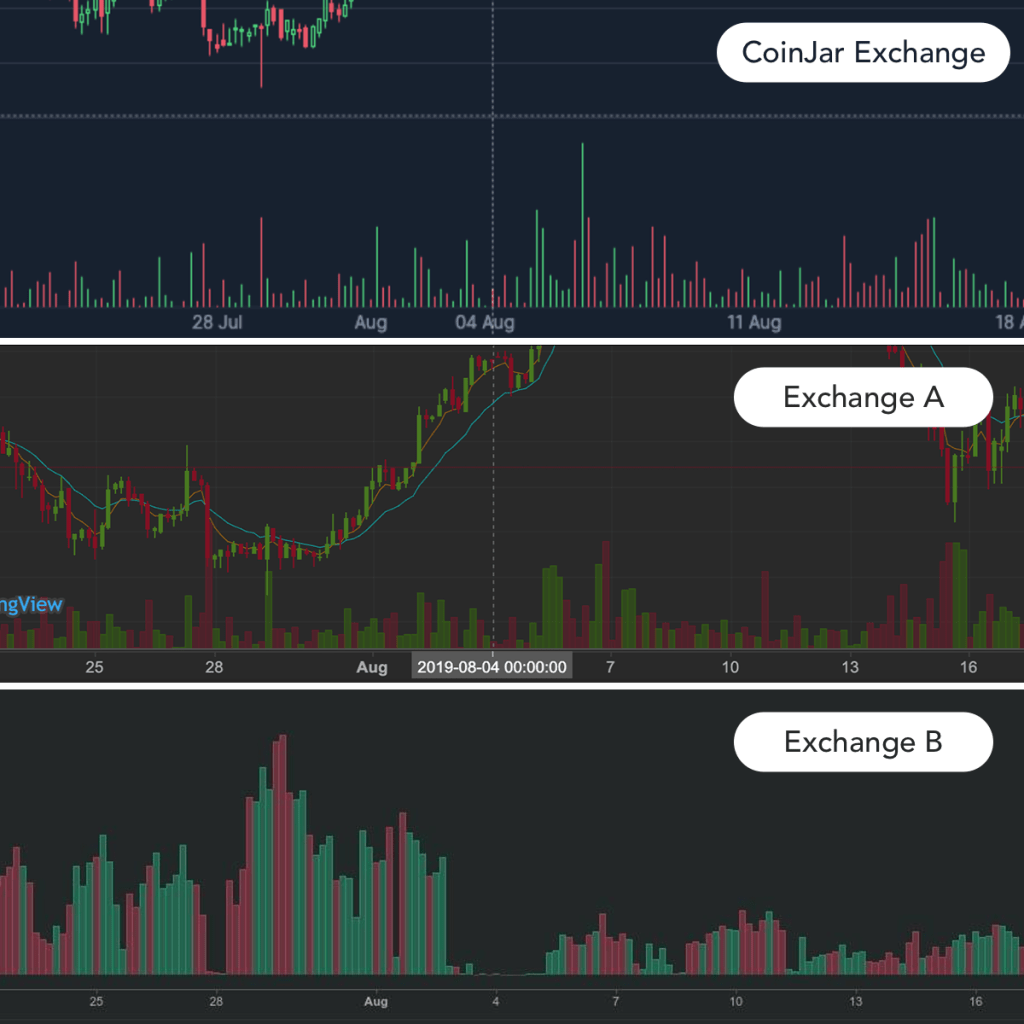

The Bitwise report highlighted ‘multiple hours (and days) with zero volume’ as a potential signal of fake volume. In the examples below, 4-hour volume charts on CoinJar Exchange are compared to two other Australian exchanges.

While CoinJar Exchange and Exchange A see consistent organic patterns of activity over the the period of 3-4 August, Exchange B sees a sharp drop-off. If you look closely there still are some trades occurring at Exchange B, indicating that this was not a total outage of the platform but perhaps revealing their true level of market activity. This is not the only instance of this behaviour evident on this platform, a similar instance occurring 4-5 September.

While inconclusive in itself of fake volume, websites like CoinGecko and even CoinMarketCap itself have attempted to better portray accuracy of exchange volume with additional factors such as website traffic and price spreads taken into consideration.

Lofty promises of high trading activity should also be reflected in the size and influence of a company running the exchange.

Does it matter?

The presence of inflated volumes is not particularly newsworthy in itself. However, questionable practises such as this should form the basis of which exchange and services you wish to trade on. If they are faking their volume, what else are they being less than honest about?

Start trading on CoinJar Exchange today, use the Crypto OTC Trading Desk and download the new CoinJar for iOS and Android apps to keep track of your crypto portfolio.

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

More from CoinJar Blog

Onchain: In bad taste

February 25, 2026ICYMI, the tech bros have once again discovered taste, so get ready to be lectured by dudes who think it's acceptable to live with one ceiling light on what to wear and consume....Read more

CoinJar Wins Gold and Silver at 2026 Asia-Pacific Stevie Awards for AI Innovation

February 12, 2026Australia's longest-running cryptocurrency exchange recognised for excellence in artificial intelligence and fintech innovation. We're thrilled to announce that CoinJar has...Read more

Onchain: The selling continues

February 11, 2026Until morale improves, or so I hope. Story One L2s are pointless Tweets the guy who advocated for them as part of the Ethereum scaling roadmap. Perhaps to deflect from his...Read moreCoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.