Onchain: Welcome to the last month of 2025

December 3, 2025

Share this:

Just when you get used to writing 2025 in communications, it's about to end. You look back and wonder, Where did the time go? Meanwhile, VCs are busy publishing their 2026 thesis, well knowing that no one will remember them later. My guess: stablecoins and privacy will feature in most.

Story One

The privacy meta continues.

If you’ve been on Crypto Twitter recently, you’ll have noticed that everyone is still speaking about privacy, making it a long-lasting trend. It likely helps that the price of our magic internet coins has been down only, forcing the industry to find different ways to advertise.

Privacy has been a core ethos of the cypherpunk, yet it remained confined to a handful of privacy cryptocurrencies (such as Monero and Zcash). Until 2025, when it became the hottest topic, and the Ethereum Foundation even launched an initiative dedicated to it. What’s more, the Godfather of ETH, Vitalik himself, just donated $765k in ETH to two different privacy messaging apps called SimpleX and Session.

As he points out, encrypted messaging is critical for digital privacy. The typical web2 messengers, even when they promote end-to-end encryption, rarely apply similar encryption to metadata, therefore leaving open when contacts talk to each other, for how long, etc. The only way to offer such protection without trusted third parties is decentralization.

Takeaway: Technology is cool, but have they ever considered that it can protect your privacy only insofar as your recipients do? We should absolutely have tools to communicate online in private, but what’s missing entirely in this discourse are the social aspects.

Story Two

Money-back guarantee

Imagine there was a money-back guarantee for VCs investing in crypto startups, allowing them to receive a refund up to one year after the launch of a token in case it does not perform. Perhaps the crypto landscape would look very different then. It doesn’t sound like a horrible thing, yet, in the last few days, X erupted over the revelation that Berachain — the L1 best-known for throwing parties and creating “vape-to-earn" — had granted its lead investor Nova Digital a refund right.

Nova invested $25 million in Berachain at $3 during its series B raise. In a side letter, they were guaranteed a refund option as long as they deposited $5 million into Bera after mainnet launch.

Whether this is legal is unclear; it’s also not obvious whether this option has been communicated to other investors. After all, much of the outrage probably stems from a lack of transparency. It doesn’t help that the Bera price is down bad.

Takeaway: Bera’s streak of getting questionable PR continues. Personally, I’d like to encourage crypto projects to democratize such refund options. Nova Digital can afford this loss, but I might not.

Story Three

Yet another stablecoin

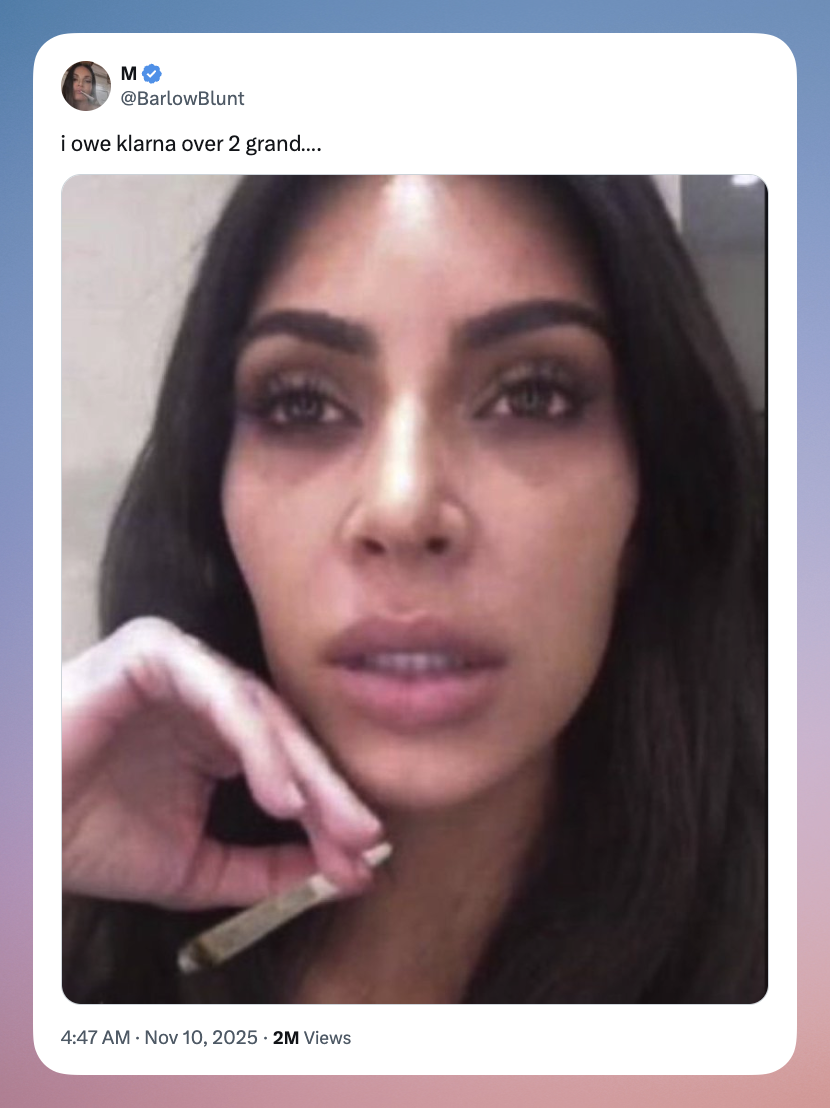

If you’re entering the holiday season a little broke and still want to buy Christmas gifts, then the Buy Now Pay Later industry will quickly creep up on you. Chief among them is the Swedish Fintech company: Klarna. They’ve kicked off a questionable trend on TikTok with young people bragging in the feed about the Klarna debt they’re incapable of paying back. This then gave rise to the idea that Klarna might go bust if more people choose to pay never.

In light of such developments, it’s not surprising that they’d want to get into the buy now, pay now business, and what better way to do that than with the launch of a stablecoin. KlarnaUSD is now live on Tempo’s testnet, the chain built by Stripe and Paradigm.

The coin itself is issued through a Stripe subsidiary and will go live on mainnet next year.

Takeaway: What’s a bit of a missed opportunity here is the lack of desire to issue non-USD stablecoins. Apparently, all crypto payment companies want to do is maintain the US dollar dominance.

Fact of the week: Since you probably know Sweden as the birthplace of IKEA and associated foods, did you know that it was a Swedish woman who invented Vodka made from potatoes? Eva Ekeblad's recipe was first published on November 5th, 1748, and the success of potato Vodka continues to this day.

Naomi for CoinJar

Warning: Past performance is not a reliable guide to future performance. If you invest in this product, you may lose some, or all, of the money you invest. The above information is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. There are no government or central bank guarantees in the event something goes wrong with your investment. This information is provided for general information and/or educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar Europe Limited makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. CoinJar Europe Limited is authorised by the Central Bank of Ireland as a crypto-asset service provider (registration number C496731).

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: In bad taste

February 25, 2026ICYMI, the tech bros have once again discovered taste, so get ready to be lectured by dudes who think it's acceptable to live with one ceiling light on what to wear and consume....Read more

Onchain: The selling continues

February 11, 2026Until morale improves, or so I hope. Story One L2s are pointless Tweets the guy who advocated for them as part of the Ethereum scaling roadmap. Perhaps to deflect from his...Read more

Onchain: Lots of things on sale

January 28, 2026Story One Crypto Social for Sale Been an interesting time to observe what happens to the still-standing crypto social networks. Aave, a leading DeFi protocol and creator of...Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Warning: Past performance is not a reliable guide to future performance. If you invest in this product, you may lose some, or all, of the money you invest. The above information is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. There are no government or central bank guarantees in the event something goes wrong with your investment. This information is provided for general information and/or educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar Europe Limited makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information.

CoinJar Europe Limited is authorised by the Central Bank of Ireland as a crypto-asset service provider (registration number C496731).

For more information on our regulatory status and the crypto-asset services we are authorised to provide, please see our official announcement and our MiCAR Legal & Regulatory Information page.

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.