The Coin 1000 AI Scam: Deceptive Advertising and Fake Promises

New scams appear every day. Here is yet another crypto scam that aims to steal your funds.

In this article...

- There are new scams every day, so be aware

- The scam starts with a sponsored ad on Facebook

- After clicking on the ad, users are redirected to a fake news article.

A new fraud called the Coin 1000 AI Scam is unfortunately becoming more prevalent. Our Scam educator, Lukas Jackson explains what it looks like and how to avoid it.

In today's digital world, financial scams have become more elaborate and convincing, preying on the vulnerabilities of individuals looking to improve their financial situations.

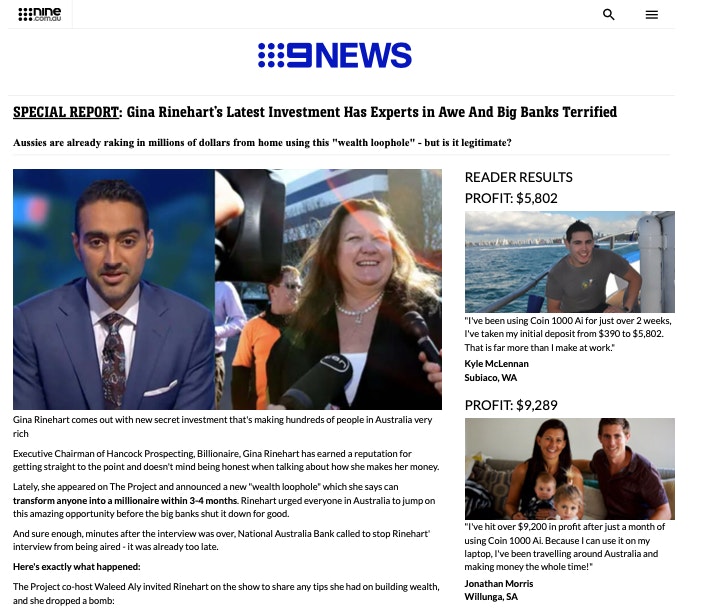

One particularly deceptive scam involves the use of a fake news article featuring a high-profile Australian figure, Gina Rinehart, to lure victims into investing in a fraudulent cryptocurrency platform, Coin 1000 AI.

Here’s a breakdown of how this scam operates, using the three images provided, and the red flags that users should be aware of to avoid falling victim.

1. The Facebook ad: Misleading and attention-grabbing

The scam starts with a sponsored ad on Facebook by "AVL Concept". The ad makes bold claims, suggesting that Gina Rinehart, one of Australia's most well-known billionaires, encourages all Australians to use a specific financial product.

The ad is designed to attract attention with its use of Gina Rinehart's image and the mention of banks and ATMs, suggesting that this is a legitimate financial solution endorsed by a credible figure.

Red flags

Unauthorised use of a public figure: Scammers often use recognisable faces to lend credibility to their claims. In this case, Gina Rinehart is mentioned to give the scam an air of authority and legitimacy.

Vague messaging: The ad does not provide clear details about the financial product, instead relying on curiosity and the lure of "encouragement" from a trusted figure to compel users to click.

2. The fake news article: Fabricated success stories

After clicking on the ad, users are redirected to a fake news article. This article features several fabricated stories of Australians making substantial profits using the Coin 1000 AI platform.

Testimonials claim individuals have turned small investments of $390 into thousands of dollars within weeks, all thanks to the "revolutionary" platform. The article also falsely claims that big banks are attempting to shut down the platform, adding a sense of urgency.

Red flags

Too-good-to-be-true claims: Statements like “I’ve turned $390 into $5,802 in two weeks” and “I’m making $3,000 a week” are designed to entice readers into thinking they can achieve similarly unrealistic returns with minimal effort.

Fabricated testimonials: The article is filled with fake success stories from non-existent people in various Australian locations, none of which can be verified. Scammers use these fabricated stories to create a false sense of security and trust. Urgency tactics: The article repeatedly emphasises that users should act quickly before the banks “shut it down,” a classic tactic used to pressure victims into making quick, unthought-out decisions.

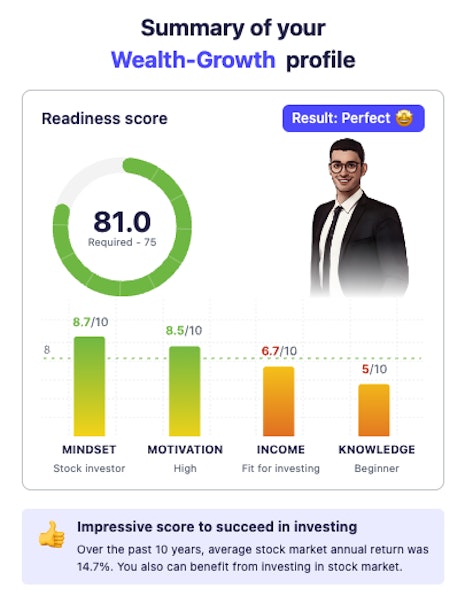

3. The Scam Platform: Coin 1000 AI and the “Wealth Growth Profile”

Once users are convinced by the fake article, they are led to the actual scam platform, Coin 1000 AI . The platform presents users with a “Wealth Growth Profile”, which falsely claims to assess their financial readiness and motivation, scoring them based on meaningless metrics like "Mindset" and "Motivation." This mock profile serves no real purpose other than to give the impression that the platform is professional and tailored to the user.

The platform also uses a series of questions, such as “How often do you feel stressed about your financial situation?”, which are designed to exploit the user’s emotions and make them believe the platform is offering a legitimate solution to their financial woes.

Red flags

Meaningless assessments: The readiness score is based on arbitrary values, such as "Mindset: 8.7/10," which have no real bearing on financial success. This is a tactic to make users feel special or qualified to participate.

Emotional manipulation: By asking users about their financial stress, the platform plays on their fears and anxieties, leading them to believe this system is the answer to their problems.

Pressuring for personal details: The platform pushes users to sign up and provide personal information, which can later be used for phishing or fraudulent purposes.

Conclusion: How to spot a scam

The Coin 1000 AI scam uses a combination of fake celebrity endorsements, fabricated success stories, and emotional manipulation to trick users into handing over their personal information and money. Here are some key tips to avoid falling for scams like this:

Be sceptical of bold claims: If an ad or article promises significant financial returns with little effort, it is likely a scam.

Check the source: Always verify the legitimacy of the website or company being advertised. Scammers often create fake news articles or sites that mimic real ones.

Beware of urgency tactics: Scammers often pressure users to act quickly to avoid missing out, creating a false sense of urgency that discourages careful consideration.

Research before you invest: Look up reviews and research the company on legitimate forums or news sites. Real financial platforms are transparent and will not rely on gimmicks or emotional manipulation.

By recognising these red flags and staying vigilant, you can protect yourself from falling victim to scams like Coin 1000 AI. Always take your time to research and consider your options before making any financial decisions online. Stay safe!

About the author - Lukas Jackson

Lukas Jackson is a leading expert in compliance with over 5 years of experience in crypto, AML/CTF regulations and scams prevention. Actively involved in initiatives focused on scam prevention and public education, Lukas has a passion for protecting individuals from online threats.

With a focus on raising awareness and developing strategies to combat scams, Lukas is committed to driving efforts that help people recognise and avoid scams.

Suggested Articles

Scam Uses Popular Anime Characters to Steal Your Money or Crypto

Have you seen your favourite character in an ad online? It might not be a legitimate use of the image. Here are the red flags to look for.Read more

Top Documentaries To Watch to Increase Scam Awareness

Here are some crypto scam documentaries you need to add to your to-do list. Read more

Crypto ATMs: How to Protect Yourself from a Growing Scam Risk

The number of victims of crypto ATM scams are on the rise. Here's what to look out for. Read moreBrowse by topic

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.