When to Buy Bitcoin? Let's Check The Rainbow Chart

Is it time to buy Bitcoin? Nobody has a crystal ball to see the future but check out the Bitcoin Rainbow Chart.

In this article...

- Is there a "right time" to buy Bitcoin?

- The Bitcoin Rainbow Chart is a visual tool tracking historical price movements

- While not a crystal ball, it can be a valuable tool for understanding market sentiment and historical trends.

When is the right time to buy Bitcoin? It's the million-dollar question. You can follow famous traders, you can go on your gut feeling, you can study the price charts. But what if there was a convenient tool that claims to give you a really basic idea of the opportune time to buy? And would you believe it?

Should investors buy Bitcoin?

The Bitcoin Rainbow Chart is a visual tool tracking Bitcoin's (BTC) historical price movements. For beginners it is user-friendly and logical. And interestingly, it has recently signaled "accumulate." Indicating that crypto enthusiasts who follow it should consider buying Bitcoin (that’s if you trust it!).

With the Bitcoin Rainbow Chart suggesting a potential buying opportunity, let’s dig into how it works and its origins.

What is the Bitcoin Rainbow Chart?

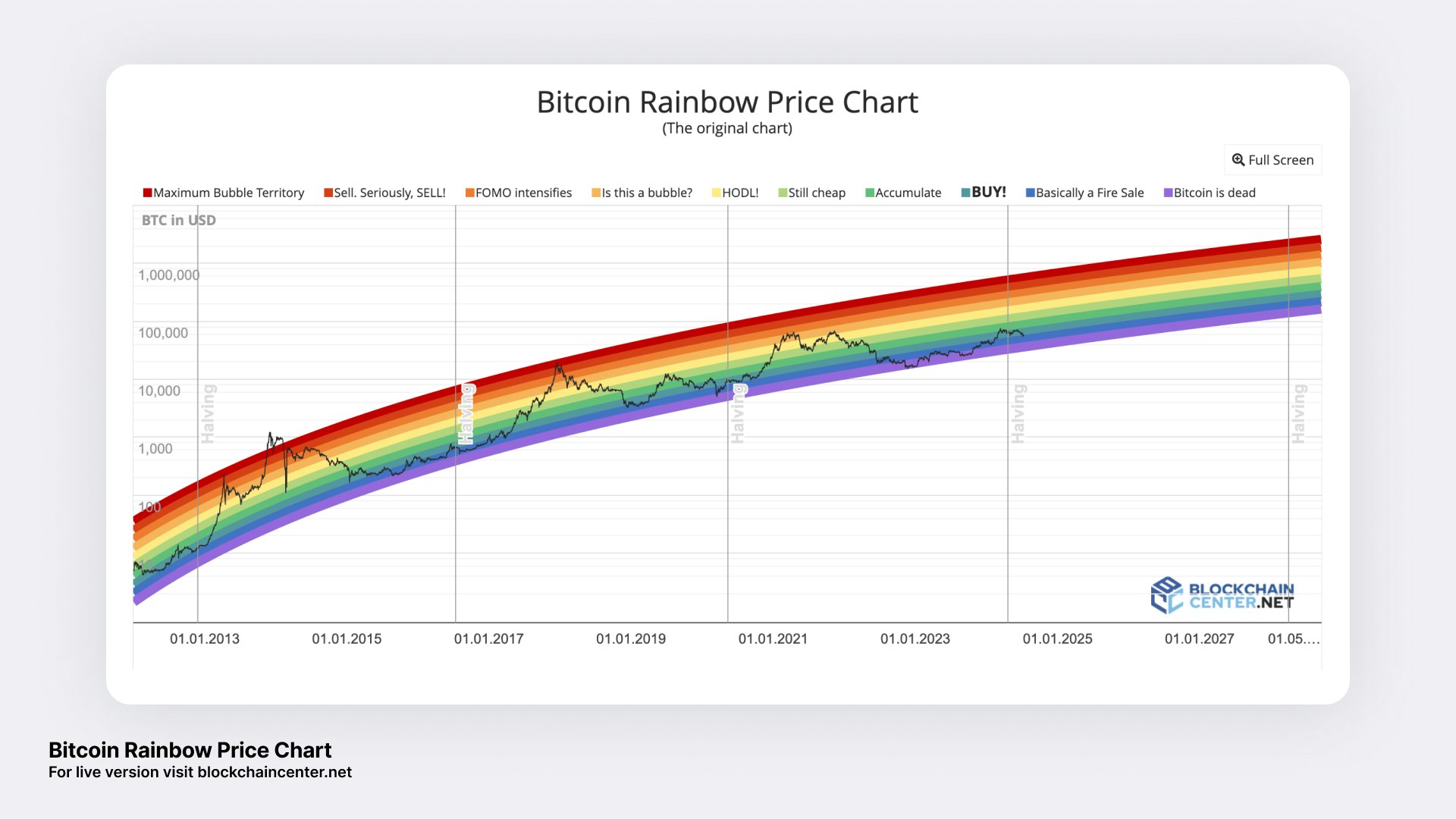

The Bitcoin Rainbow Chart is a colorful representation of Bitcoin's past performance, plotting its price fluctuations using coloured bands.

Each band corresponds to a different stage in Bitcoin's market cycle, ranging from bear market lows (hibernation) to bull market highs (charging forth). The chart serves as a general guide to where Bitcoin's price might be headed.

Here’s what the colours mean, according to the chart itself (Note: This is the chart’s specific wording):

Purple: Bitcoin is Dead. RIP.

Dark Blue: "Basically a Fire Sale" — Historically, can be a good time to buy.

Teal: BUY!

Green: "Accumulate" — Buying recommended.

Light green — Still cheap! Potential for accumulation.

Yellow: "HODL" — Hold your Bitcoin.

Light Orange: "Is this a bubble?" — Proceed with caution.

Dark Orange: "FOMO intensifies" — Fear of missing out drives prices higher.

Red: "Sell. Seriously, SELL!" — Potential market peak.

Maroon: Maximum bubble territory — sell everything and hide in a bunker.

The Rainbow Chart's track record

Introduced around 2014, the Rainbow Chart has demonstrated a reasonable degree of accuracy in its predictions over time. As Bitcoin adoption and market capitalisation increase, the chart's curve gradually flattens, reflecting the asset's maturation.

What is the current phase of the Bitcoin Rainbow Chart?

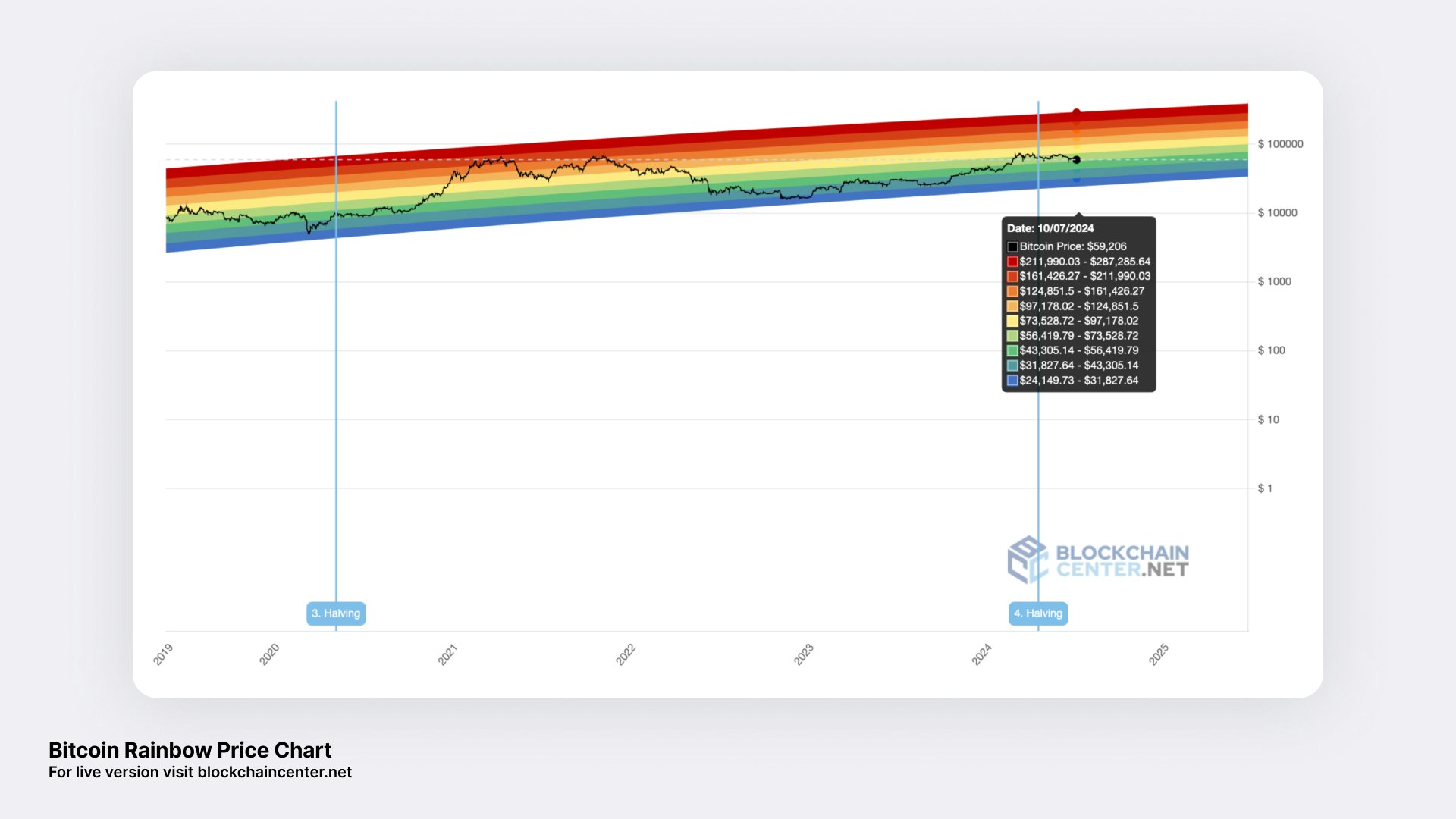

As of 30th May 2024, we are in teal territory. If you believe in the chart, then it is signalling “buy”.

With Bitcoin currently trading around US$68,000, the chart indicates we're in the accumulation zone. If historical patterns repeat, the price could reach the "Maximum Bubble Territory" (red zone) by year's end, like it did in 2017.

2025 Predictions

Based on the Rainbow Chart, Bitcoin's price could potentially reach between $152,000 and $210,000 in 2025, entering the "Maximum Bubble Territory." This blazing red signal, according to the chart, is a selling opportunity.

However, before you get all excited and start buying luxury cars and exotic holidays, you will need to calm the farm. Past performance doesn't guarantee future results.

The Rainbow Chart is not a foolproof predictor of Bitcoin's price trajectory. Various factors, such as geopolitical events, regulatory changes, and economic downturns, can significantly impact the price. Elections also have an effect.

For example, the looming US election in November of 2024 means that a lot of markets are jumpy, not just the crypto markets.

Why the teal signal might be a good time to buy Bitcoin

Historical patterns

The Rainbow Chart has a track record of aligning with Bitcoin's past price cycles. While past performance is not indicative of the future, it does provide a point of reference.

Growing adoption

Bitcoin is increasingly recognised as a legitimate asset class by institutional investors, corporations, and even governments. This wider acceptance could fuel further price growth.

Limited supply

Bitcoin's maximum supply is capped at 21 million coins. With increasing demand and a finite supply, basic economics suggest that prices could continue to rise.

Technological advancements

Ongoing developments like the Lightning Network are making Bitcoin more efficient, more competitive, and more scalable, expanding its utility and appeal.

Conclusion: The Bitcoin Rainbow Chart

The chart offers a fascinating perspective on Bitcoin's potential price movements. While not infallible, it serves as a fun tool for understanding historical trends and gauging potential market sentiment.

While not a crystal ball, it can be a valuable tool for understanding market sentiment and historical trends.

Or you could just go outside and touch grass and get some fresh air. Both are probably good for your future.

Frequently asked questions

What is the current price of Bitcoin (BTC)?

The price of Bitcoin fluctuates constantly. You can view the live Bitcoin price on the CoinJar app or website before investors buy or sell Bitcoin.

Is Bitcoin a digital asset?

Yes, Bitcoin is a digital asset, also known as a digital currency or cryptocurrency. It exists solely in digital form and operates on blockchain technology.

How do investors buy and sell Bitcoin on CoinJar?

CoinJar allows you to easily buy and sell Bitcoin through their user-friendly platform.

You can buy Bitcoin using various payment methods, including credit/debit card or bank transfer.

Selling Bitcoin is just as convenient and funds can be transferred back to your bank account.

What payment methods does CoinJar accept for buying Bitcoin?

CoinJar accepts several payment methods for buying Bitcoin, including credit/debit cards, and bank transfers.

Can investors sell Bitcoin on CoinJar and withdraw the funds?

Absolutely! You can easily sell Bitcoin on CoinJar and withdraw the proceeds to your linked bank account.

Can investors transfer my Bitcoin to a cold storage wallet for added protection?

Yes, CoinJar allows you to withdraw your Bitcoin to an external wallet, including cold storage wallets for enhanced protection. If you want to hold on to your Bitcoin for a while, you can transfer your Bitcoin to an external wallet.

Hardware wallets are also known as “cold wallets” (like Ledger or Trezor) and these are effective for long-term storage as they are offline and seriously difficult to hack.

CoinJar has been operating since 2013. CoinJar keeps the vast majority of customer assets in cold storage or private multi-sig wallets and maintains full currency reserves at all times.

Is it possible to buy Bitcoin with AUD?

Definitely! As an Australian crypto exchange, CoinJar enables you to buy Bitcoin (BTC) directly with AUD.

What are the trading fees on CoinJar when buying or selling Bitcoin?

CoinJar has competitive trading fees, which vary depending on the transaction size and payment method. You can view the fee schedule on the CoinJar website for full transparency.

Is Bitcoin considered a legal digital currency in Australia?

Yes, Bitcoin and other cryptocurrencies are legal in Australia. However, their use is subject to Australian laws and regulations, including Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations.

Can investors purchase Bitcoin using a credit card on CoinJar?

Yes, you can purchase Bitcoin using a Visa or Mastercard credit or debit card through CoinJar's Instant Buy feature.

What is the Bitcoin network, and how does it relate to my transactions?

The Bitcoin network is a decentralised peer-to-peer network of computers that collectively maintain the blockchain, which is a public ledger of all Bitcoin transactions.

When you buy or sell Bitcoin, your transaction is broadcast to the network and verified by miners to be added to the blockchain.

Does CoinJar offer Bitcoin ETFs (Exchange-Traded Funds)?

CoinJar does not directly offer Bitcoin ETFs. However, they are a crypto exchange where you can buy and sell actual Bitcoin.

What is the minimum amount of Bitcoin investors can buy on CoinJar?

You can start buying Bitcoin on CoinJar with as little as $10 AUD.

Are there any restrictions on buying or selling Bitcoin on CoinJar based on my location or banking institution?

CoinJar is available to users in Australia and several other countries. However, they may have restrictions based on your location and specific Australian bank. Please check CoinJar's terms and conditions for any applicable restrictions.

How does blockchain technology ensure the security of my Bitcoin?

Blockchain technology ensures the security and integrity of your Bitcoin by recording every transaction on a decentralised and immutable ledger, making it extremely difficult to tamper with or hack.

Do I need a Bitcoin wallet to use CoinJar?

CoinJar provides you with a Bitcoin wallet within their platform for storing your Bitcoin. You can also choose to use external wallets, including hardware wallets (cold storage) for added security.

Suggested Articles

Bitcoin Dominance: Is Alt Season Near? Technical Analysis May Provide Clues

What is Bitcoin Dominance? And how can keeping an eye on it give insight into alt season? Here is the explainer.Read more

The Bitcoin Halving - What is it and When Will it Happen?

The Bitcoin Halving is a big deal in the cryptocurrency world. But what does it mean and when does it happen? We explain the highlight of the crypto calendar.Read more

Why Should You Buy Bitcoin? Top 10 Reasons To Consider

Why should you buy Bitcoin? Here are some compelling reasons why the crypto bros and the crypto sisters think BTC is a great investment.Read moreBrowse by topic

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.