Offchain: This Time is Different

May 26, 2022

Share this:

As the chill of a new crypto winter sets in, the past offers itself as a flawed guide.

Last year, during the height of the mania, people started talking about cryptocurrency launching into a new “supercycle” – basically a paradigm shift wherein the familiar boom-bust cycle would be replaced by one of perpetual, if more linear growth, a la the internet from 2005 on.

It’s a long-running joke in investment circles that everyone thinks “this time is different” and everyone is, eventually, wrong. As a general proxy for human fear and greed, free markets are intrinsically prone to speculative manias. The only thing that makes crypto different is the sheer velocity with which these cycles happen. (And you think the internet is immune? Just ask the Facebook stock price).

Well, we’ve had the boom. Now comes the hard part. Crypto has already been through some bear markets. We should know what to expect. But will this time actually be different?

Learning from the past

The issue with many of the predictions and assumptions made through the last bull run was that the sample size was insufficient. While the bubbles of 2013 and 2017 followed roughly similar patterns, the crypto-economies they represented were wildly different; 2021 was more different still.

But when prices were soaring, how easy it was to look back at the wildness of 2017 and say “we’re barely getting started”.

Now we’re on the downward arc and the temptation is to map the bleakness of 2018 onto our current situation. Already people are planning for the 2024 upcycle, as if all the possible permutations of international finance could be cleanly mapped onto the Mayan calendar.

To its adherents, that’s the whole point of Bitcoin’s mathematical certainty. But Bitcoin has never faced macroeconomic conditions like this, where interest rates are rising, energy costs are soaring and economies are tumbling towards recession.

After the dotcom collapse, it took the better part of a decade for the scions of web 2.0 to begin their inexorable takeover of the stock market. Could crypto be poised for a similar time in the wilderness?

Ctrl + Z, Ctrl + Y

To be clear, I don’t have any strong opinions as to what happens next, or how long this downturn might last. Rather it’s a reminder to keep an open mind in the face of unprecedented circumstances. Crypto’s only been here twice before; we’re still in the data-gathering phase.

What we do know is that, over a long enough timeframe, markets inevitably revert to the mean. What goes up must come down, and what descends into the depths of hell will eventually emerge spluttering into the light.

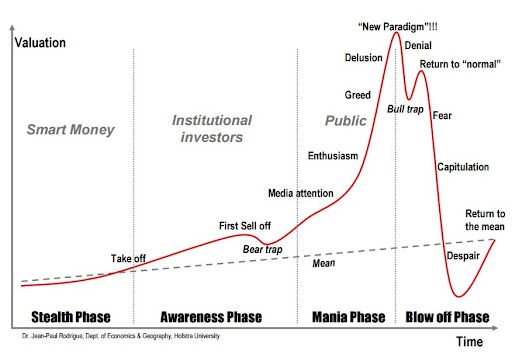

I’ve shared this speculative bubble chart before, but what’s often overlooked is the line, slowly ascending, around which all the excitement and despair occurs.

In many ways that line is the point of it all. It’s all well and good to chase shitcoins to the top of the new paradigm (*cough* supercycle *cough*) but your long-term focus should be on what the mean represents: the basic promise of blockchain technology and decentralised digital economies.

Ain’t nothing nice about it, but winter is your chance to step back and ask what that might still actually mean.

Luke from CoinJar

Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: The selling continues

February 11, 2026Until morale improves, or so I hope. Story One L2s are pointless Tweets the guy who advocated for them as part of the Ethereum scaling roadmap. Perhaps to deflect from his...Read more

Onchain: Lots of things on sale

January 28, 2026Story One Crypto Social for Sale Been an interesting time to observe what happens to the still-standing crypto social networks. Aave, a leading DeFi protocol and creator of...Read more

CoinJar Unlocks European Expansion with MiCA Authorisation

January 22, 2026CoinJar has officially become a crypto asset gateway for Europe, having received full authorisation from the Central Bank of Ireland as a Crypto-Asset Service Provider under...Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.