CoinJar Bundles

Figures shown refer to the past. Past performance is not a reliable indicator of future results. Pricing data is provided by CoinJar.

A Bundle for every occasion

Bundles come in all shapes and sizes, whether you want to increase your exposure to Bitcoin and Ethereum, start building your DeFi portfolio or put your money into low-carbon coins.

Feature-rich and flexible

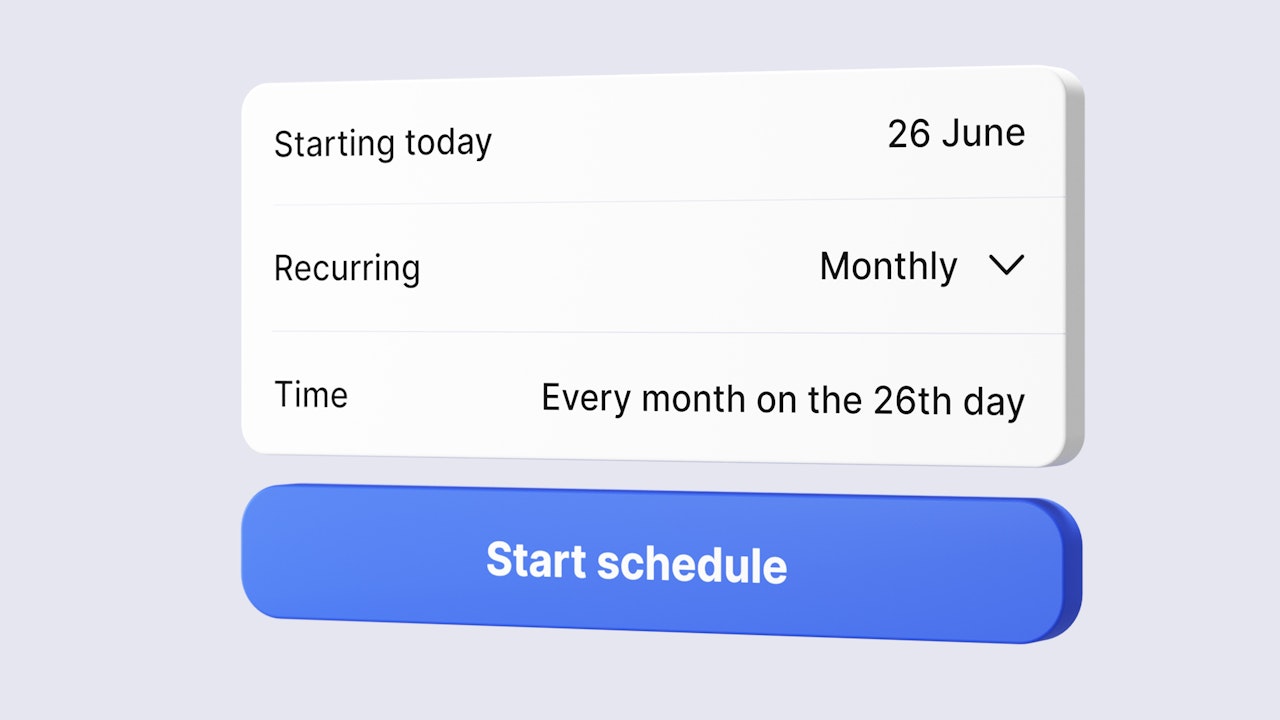

Dollar cost averaging

How CoinJar Bundles work

Grow and monitor your cryptocurrency portfolio.

Sign up and verify

Download the CoinJar app and follow the prompts.Pick a Bundle

Tap the ‘Bundles’ icon to browse the full range.Make a purchase

Enter the amount, click confirm and your crypto is in your wallet.

Finder Awards Winner 2024

CRYPTO TRADING - VALUEFinder Awards Winner 2024

CRYPTO TRADING - VALUE

Frequently asked questions

Are CoinJar Bundles the same as Exchange Traded Funds (ETFs) or index funds?

In the stock market, ETFs and index funds allow investors to buy units in a fund that owns a range of different assets, providing instant diversification.

Index funds typically track a specific market index, like the S&P 500, while ETFs can be more flexible and track various sectors, commodities, or even investment strategies.

While they are not equivalent, CoinJar Bundles also allow customers to diversify their investments by buying bundles that represent a pre-selected group of cryptocurrencies based on a theme or market segment.

This makes it convenient for investors to gain exposure to a diversified crypto portfolio without buying individual assets.

How do I buy a Bundle on CoinJar?

CoinJar allows users to buy a crypto basket using various payment methods, including credit cards and debit cards. To initiate a purchase, navigate to this page and select. (Look out for newly created bundles here too.)

You will then need to enter the amount of cryptocurrency you wish to purchase. Once you have reviewed your order details, including the order type, confirm your purchase to complete the transaction.

You can also buy and sell cryptocurrencies not in a crypto basket on the CoinJar cryptocurrency exchange.

What are the risks associated with buying this product?

The value of crypto assets, including those in CoinJar Bundles, can fluctuate significantly due to market cap changes and other factors.

Additionally, the crypto exchange itself and the protection of your crypto wallets and private keys are crucial considerations. It's essential to conduct thorough research and understand the potential risks before investing in any digital asset.

Your information is handled in accordance with CoinJar’s Privacy Policy.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.