Buy Algorand

Algorand

ALGO

What is Algorand?

Why investors buy Algorand (ALGO): ALGO is a cryptocurrency which is a part of a larger ecosystem of digital currencies, and is the native token of the decentralised blockchain network of Algorand. It was created to address some of the limitations of other cryptocurrencies, such as inefficient transaction speeds and high energy consumption.

What is Algorand? How does Algorand work?

Algorand uses a technology called blockchain. It is like a database that records all transactions. Each transaction is a “block,” and these blocks are linked together in a chain.

Algorand’s blockchain is designed to be operationally efficient. It can process thousands of transactions per second, which is optimal for everyday use.

Algorand aims to be a platform for creating new financial products and services. Algorand’s architecture allows it to handle a large number of transactions in an efficient manner. This scalability is crucial for widespread adoption.

What is ALGO?

ALGO (the native token of Algorand) can be used to make payments, just like using Dollars or Pounds.

As an investment, ALGO has been on a wild ride. The all-time high price for Algorand was US$3.56, on June 20, 2019. The all-time low price for ALGO was $0.08751, in September 2023. At the time of writing (April 04, 2024) the price of ALGO is US$0.24. So ALGO has had its ups and downs.

There’s another way to look at this though, which is that when prices are low, some people think that it is a good time to buy in case the prices shoot up again. However, others don’t prefer more volatile coins.

Algorand uses

Algorand hosts various DeFi applications, such as lending, borrowing, and trading. Some of these are truly innovative, especially in the financial sector.

Algorand also allows users to create their own digital assets (tokens) on its platform. These tokens can represent anything from real estate to gold, to loyalty points.

Cool stuff on Algorand

Meld Gold

Meld Gold is a dApp that runs on Algorand. Meld offers digital certificates backed by physical precious metals, including gold and silver. These tokens, such as GOLD$, represent real-world assets and are fully redeemable for their corresponding physical counterparts.

Each Meld Token equates to one gram of the respective precious metal. These grams are protectively stored in a network of vaults and facilities.

Algorand’s technology makes sure that Meld can operate in an environment that is protected, processes transactions/movements efficiently, is private, and uses smart contracts for seamless and transparent transactions across different asset classes, making it an ideal fit for digitising gold.

Another advantage is competitive fees (around US$0.0003 per transaction at the time of writing April 04, 2024), making it cost-effective compared to other systems like Visa or Ethereum.

In collaboration with Algorand, Meld Gold modernises the gold industry, bridging the gap between the physical and virtual worlds.

###Spindle

Spindle puts experimental fiction on the blockchain using the Algorand ecosystem. Its goal is to provide a platform for fiction authors to publish their stories in innovative ways.

These methods include incorporating multimedia elements, enabling audience participation, and using new payment systems.

By using Algorand, Spindle aims to give authors more control over their narratives and possibly a positive investor return.

Nexus

Nexus is a platform for decentralised trading and marketplace activities. The platform eliminates concerns related to scams and uncertainty by requiring both parties to provide collateral before completing an exchange.

It operates on the Algorand blockchain and employs an escrow smart contract to facilitate protected transactions between buyers and sellers.

This smart contract ensures trust and transparency during transactions, whether it is for in-game currency, services, NFTs, or physical items.

Who founded Algorand?

It was founded by Silvio Micali, a Turing Award-winning cryptographer and MIT professor. He graduated in mathematics from La Sapienza University of Rome in 1978 and earned a PhD in computer science from the University of California in 1982.

How does Algorand work?

Algorand is a decentralised blockchain network designed to address the critical challenges faced by existing blockchains: scalability, protection, and decentralisation. Let’s delve into the key aspects of Algorand.

Pure Proof of Stake (PPoS)

Algorand’s consensus mechanism, known as Pure Proof of Stake (PPoS), eliminates the need for energy-intensive mining. Unlike traditional proof-of-work (PoW) systems, Algorand achieves consensus through a Byzantine agreement protocol. This ensures better performing transaction confirmation, competitive fees, and minimal environmental impact.

Scalability and finality

Algorand boasts impressive transaction speeds of up to 6,000 transactions per second (TPS) with finality achieved in under 5 seconds. Whether you’re transferring assets, executing smart contracts, or participating in DeFi, Algorand’s efficiency is known as a seamless experience.

ALGO: The native cryptocurrency

ALGO serves as Algorand’s native cryptocurrency. It plays a crucial role in protecting the network, rewarding validators, and facilitating transactions. With a fixed supply of 10 billion ALGO, scarcity and anti-inflation mechanisms are built into the ecosystem.

Why do investors buy ALGO?

Innovative technology

Algorand’s PPoS consensus mechanism and layer-1 smart contract support means that it is an interesting choice for developers and businesses, and it is a viable alternative to Ethereum.

Network participation

ALGO holders receive participation rewards, ensuring active engagement and alignment of interests. The finite supply adds scarcity, which may appeal to long-term investors.

Energy efficiency

Algorand’s minimal energy consumption per transaction sets it apart from energy-intensive PoW blockchains like Bitcoin.

Cash, credit or crypto?

Buy Algorand using Visa or Mastercard. Get cash in your account with Faster Payments Service (FPS). Convert crypto-to-crypto with a single click.How to buy Algorand with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.

Finder Awards Winner 2024

CRYPTO TRADING - VALUEFinder Awards Winner 2024

CRYPTO TRADING - VALUE

Featured In

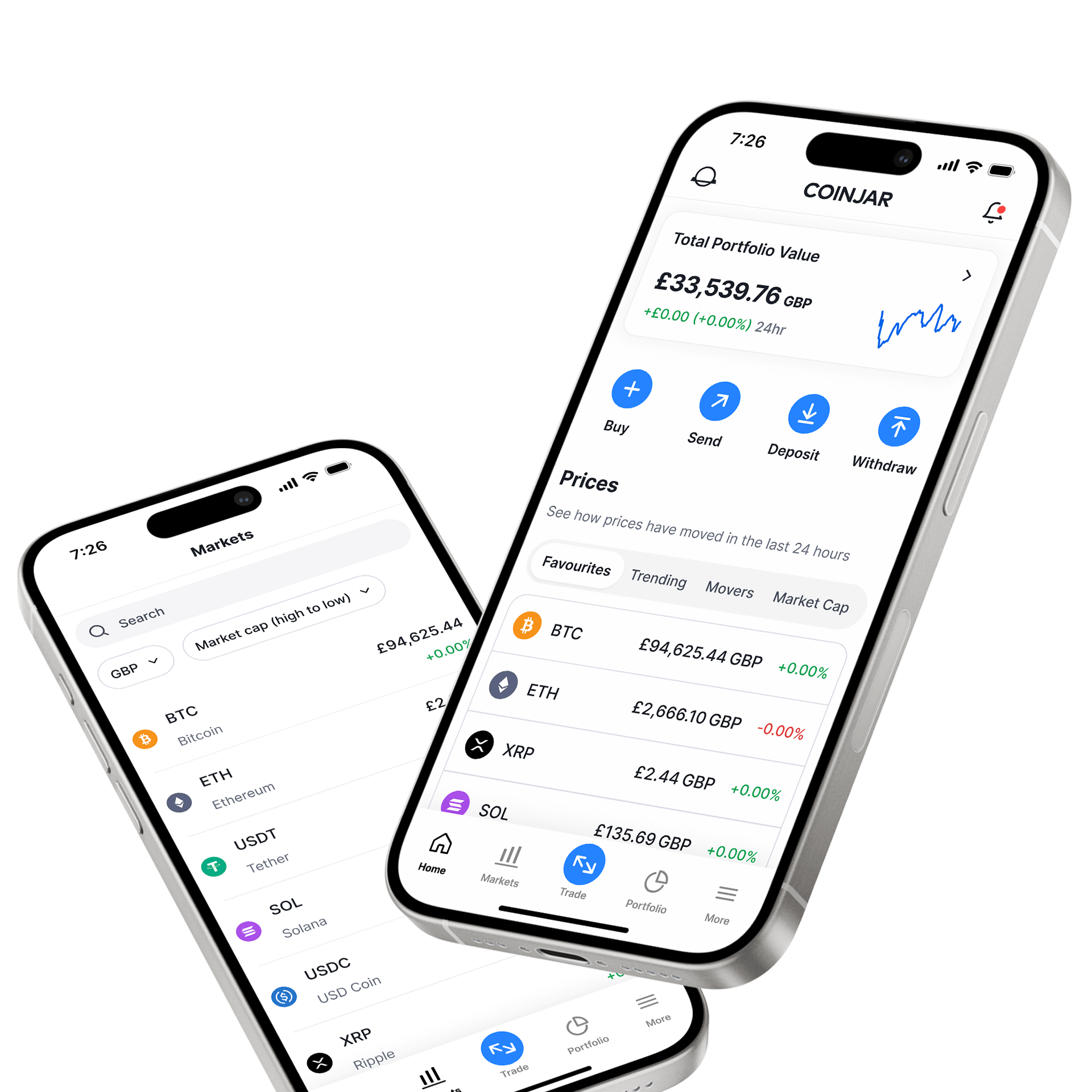

CoinJar App

All-in-one crypto walletCoinJar App

All-in-one crypto wallet

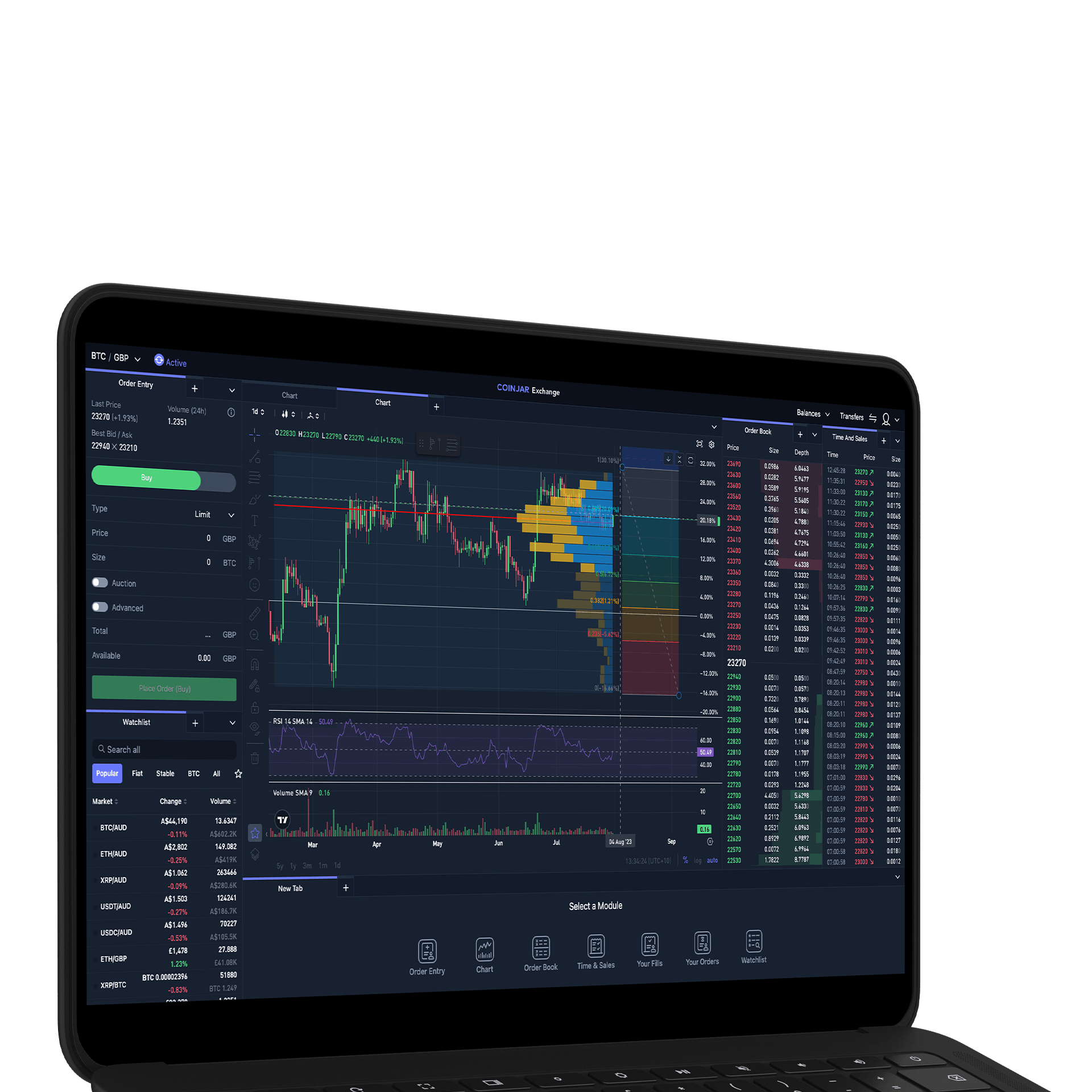

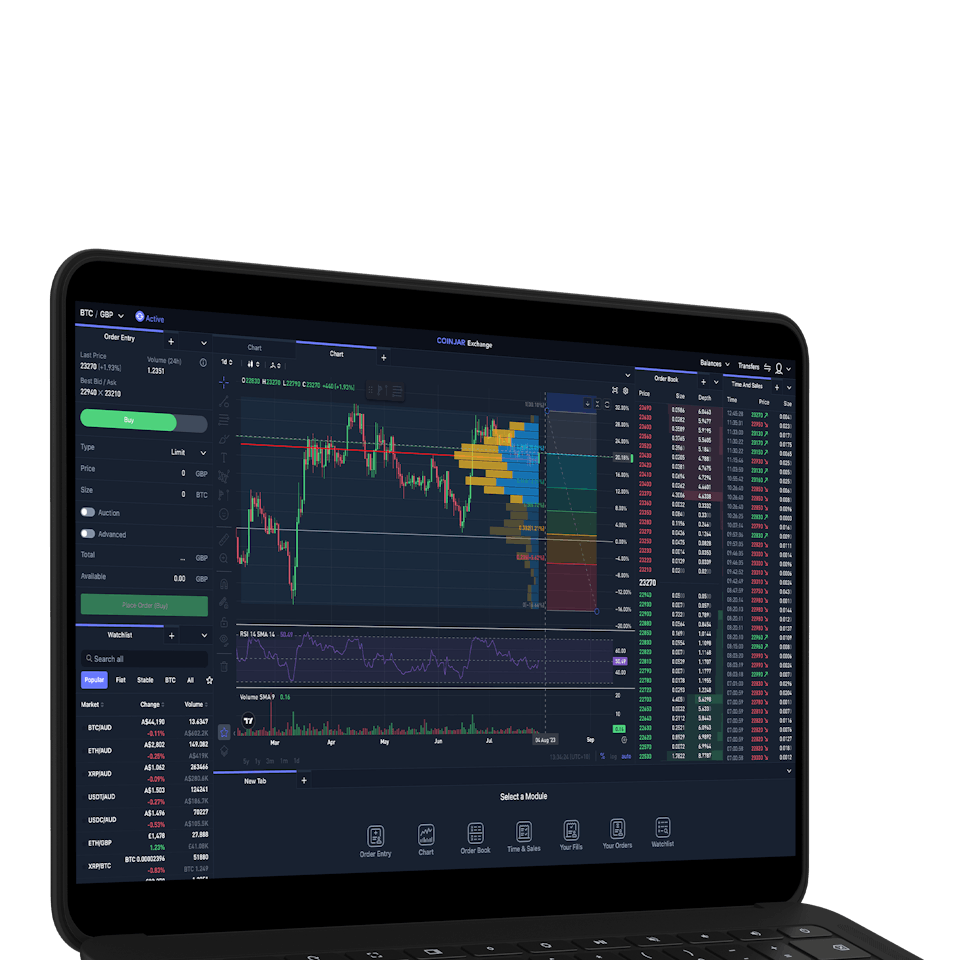

CoinJar Exchange

FOR PROFESSIONAL CRYPTO TRADERS

CoinJar Exchange

FOR PROFESSIONAL CRYPTO TRADERS

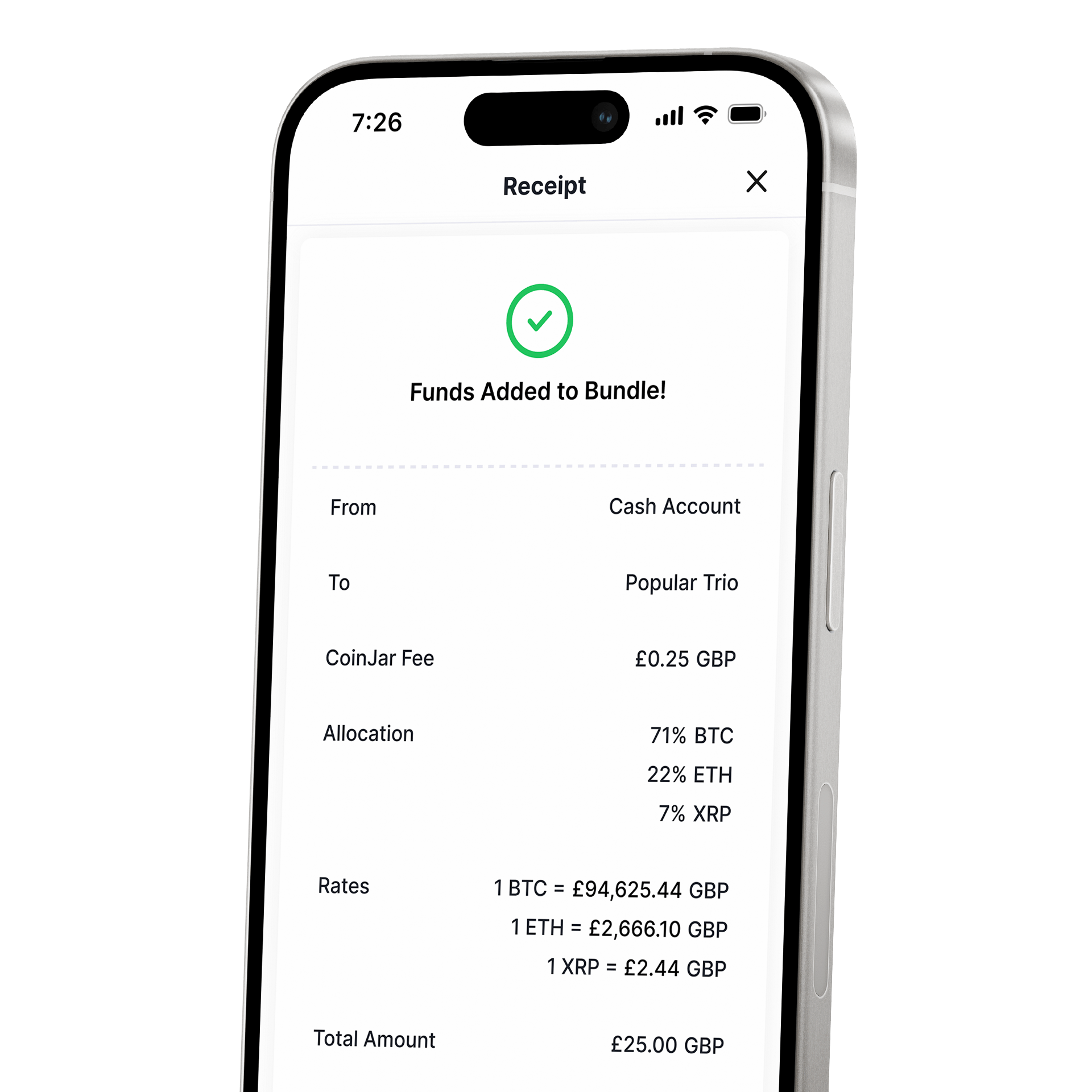

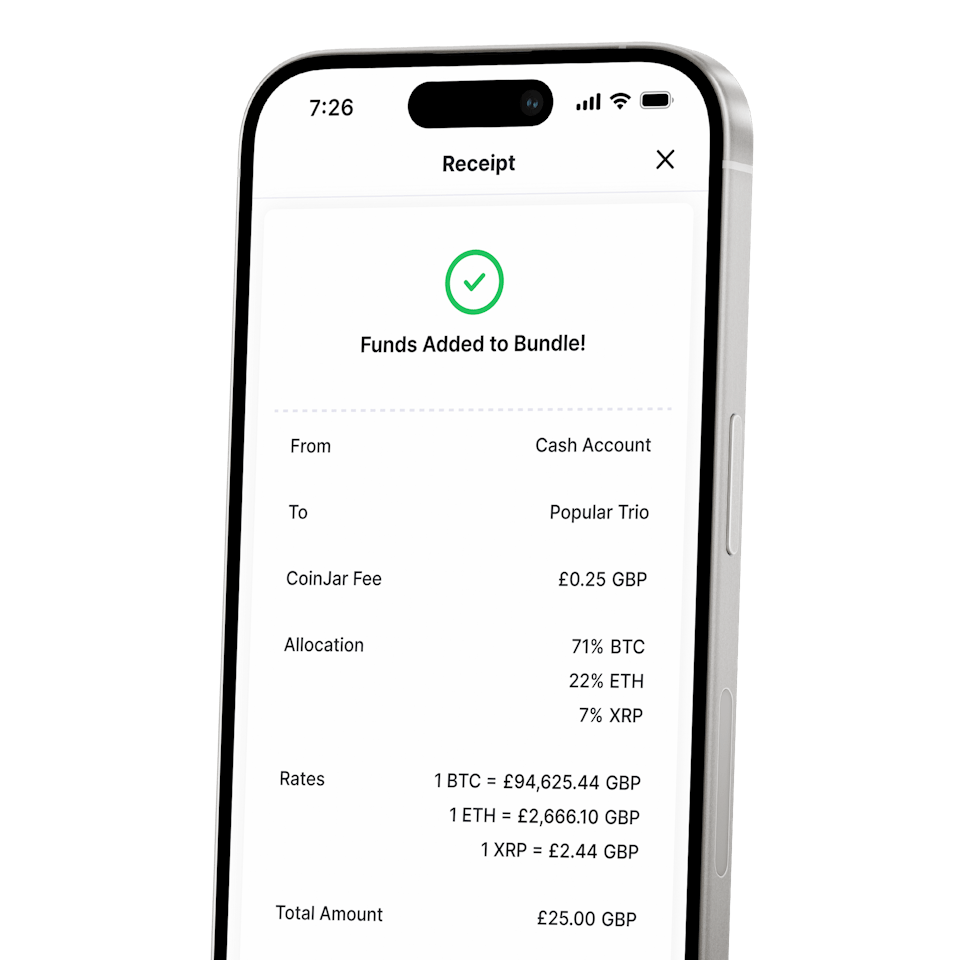

CoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIOCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Standard Risk Warning: The above article is not to be read as investment, legal or tax advice and it takes no account of particular personal or market circumstances; all readers should seek independent investment advice before investing in cryptocurrencies.

The article is provided for general information and educational purposes only, no responsibility or liability is accepted for any errors of fact or omission expressed therein. Past performance is not a reliable indicator of future results.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar's digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767). In the UK, it's legal to buy, hold, and trade crypto, however cryptocurrency is not regulated in the UK.

It's vital to understand that once your money is in the crypto ecosystem, there are no rules to protect it, unlike with regular investments. You should not expect to be protected if something goes wrong. So, if you make any crypto-related investments, you're unlikely to have recourse to the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service (FOS) if something goes wrong.

The performance of most cryptocurrency can be highly volatile, with their value dropping as quickly as it can rise. Past performance is not an indication of future results. Remember: Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://www.coinjar.com/uk/risk-summary.

UK residents are required to complete an assessment to show they understand the risks associated with what crypto/investment they are about to buy, in accordance with local legislation. Additionally, they must wait for a 24-hour "cooling off" period, before their account is active, due to local regulations. If you use a credit card to buy cryptocurrency, you would be putting borrowed money at a risk of loss.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets.

Specific risks associated with DeFi tokens Decentralised Finance (or 'DeFi') tokens (e.g. UNI, AAVE) are crypto-assets linked to financial applications and protocols built on decentralised blockchain technology. DeFi tokens carry the following risks:

Smart contract risk: DeFi relies heavily on smart contracts. Even a minor coding error or oversight can lead to a contract being exploited, potentially resulting in significant losses for DeFi tokens.

Regulatory risk: DeFi operates in a decentralised manner, often without intermediaries or financial crime controls. Regulatory bodies across jurisdictions might introduce new regulations impacting the use, value, or legality of certain DeFi protocols or assets.

Rug-pulls / Exit scams: Some DeFi projects might be launched by anonymous or pseudonymous teams, increasing the risk of "rug pulls" where developers abandon the project and withdraw funds, leaving investors with worthless tokens.

Data/oracle risk: DeFi protocols often rely on external data sources or 'oracles. Manipulation or inaccuracies in these data sources can lead to unintended financial outcomes within the protocols. Protocol complexity: The complexity of some DeFi protocols can make it difficult for average users to fully understand the mechanisms and associated risks.

Specific risks associated with meme coins:

'Meme coins' (e.g. DOGE, SHIB, PEPE) are crypto-assets whose value is driven primarily by community interest and online trends.

Meme coins carry the following risks:

Volatility risk: Meme coins can have extreme price volatility, often experiencing rapid and unpredictable price fluctuations within short periods. The value of meme coins can be influenced by social media trends, celebrity endorsements, and other factors unrelated to traditional investment fundamentals. Lack of utility: Meme coins often lack intrinsic value or utility, being primarily driven by community interest, online trends, and speculative trading.

Market manipulation: Meme coins may be susceptible to increased risk of market manipulation including 'pump-and-dump' schemes, where the price is artificially inflated followed by a sudden crash.

Lack of transparency: Meme coins may have limited available information about their development teams, goals, and financials. This lack of transparency can make it challenging to assess the credibility and potential of a meme coin accurately.

Emotional investing: Meme coins often garner strong emotional reactions from investors, leading to impulsive decisions. Emotional trading activity can amplify losses.

Specific risks associated with stablecoins:

There is a risk that any particular stablecoin may not hold their value as against any fiat currency; or may not hold their value as against any other asset. Stablecoins carry the following risks:

Depegging events: Depegging events may occur with stablecoins that fail to maintain adequate controls and risk mitigants. A depegging event is when the value of the stablecoin no longer matches the value of the underlying asset. This could result in a loss of some or all of your investment.

Counterparty risk: Counterparty risk arises when an asset is backed by collateral, involving a third party maintaining the collateral, which introduces risk if the party becomes insolvent or fails to maintain it.

Redemption risk: Redemption risk refers to the possibility that an asset's ability to be redeemed for underlying collateral may not be as anticipated during market fluctuations or operational issues.

Collateral risk: Collateral risk refers to the possibility of the collateral's value declining or becoming volatile, potentially impacting the asset's stability, particularly when it is another crypto-asset.

Exchange rate fluctuations: Stablecoins, often denominated in US Dollars, expose investors to fluctuations in the USD:GBP exchange rate. Algorithmic risk: Algorithm risk refers to the possibility of an asset's stability being compromised due to unexpected failure or behaviour of the underlying algorithm, potentially leading to loss of value.

CoinJar does not endorse the content of, and cannot guarantee or verify the safety of any third-party websites. Visit these websites at your own risk.

Your information is handled in accordance with CoinJar’s Privacy Policy.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.