Buy Sky

Sky

SKY

Overview

What is Sky?

SKY token is the governance token of the Sky Protocol, formerly known as MakerDAO. SKY represents a significant upgrade designed to enhance accessibility, scalability, and user rewards.

What Is the SKY Token / Sky Crypto?

The SKY token is the native governance and utility token of the Sky Protocol, a Decentralised Finance (DeFi) platform that builds on the legacy of MakerDAO.

SKY lets holders participate in governance and stake for rewards. USDS can be saved via the Sky Savings Rate (SSR) or used across DeFi apps (e.g., borrowing/lending on Spark).

SKY aims to make it convenient for everyday users to earn rewards through staking and savings.

Note: You must leave the CoinJar platform to access staking or rewards via the Sky Protocol.

The History of SKY Token

The story of SKY begins with MakerDAO, founded in 2015 by Rune Christensen as one of the earliest DeFi projects.

MakerDAO revolutionised crypto with the creation of DAI, a decentralised stablecoin backed by collateral. Over the years, it grew into a cornerstone of DeFi, managing billions in total value locked (TVL).

By 2021, scaling challenges and governance complexities drove the project towards a major evolution. In 2024, MakerDAO rebranded to the Sky Protocol, introducing SKY as the new governance token and USDS as the upgraded stablecoin.

This shift was designed to improve the user experience, decentralisation, and scalability.

Sky Protocol has also expanded to include "Sky Stars". These are independent subprojects like Spark. Spark enables users to access DeFi tools where they can earn rewards.

Why MKR Migrated to SKY

Governance migrated from MKR to SKY. Holders can upgrade MKR→SKY at 1:24,000 on-chain. Many exchanges supported the swap and delisted MKR trading pairs in 2025, but self-custody upgrades are not automatic.

The move is driven by the need for a more accessible and feature-rich token.

USDS holders can access the Sky Savings Rate to earn yield in USDS and can allocate USDS to Sky Token Rewards to support ecosystem initiatives.

SKY Token Features

SKY has some interesting uses in DeFi.

Governance Power

Vote on protocol changes or delegate rights through decentralised on-chain voting. This is guided by the Sky Atlas, a living set of rules evolved by the community.

Staking and Rewards

Use the Staking Engine to earn variable rewards (paid in USDS). CoinJar Customers can’t stake on the CoinJar platform, however can leave and go to the SKY protocol to access staking there.

Sky + USDS

USDS holders can deposit into the Sky Savings Rate (SSR) to earn yield in USDS or allocate USDS to Sky Token Rewards (STRs) to support Sky Stars ecosystem initiatives.

What is the price of SKY?

The price of SKY can change daily, even hourly. Please scroll to the top of this page for the live price of SKY.

Why Buy Sky Crypto on CoinJar Today?

If you're searching for "buy SKY token" or "buy Sky crypto," you've come to the right place. CoinJar provides a platform to buy the SKY token. This allows customers to be part of the SKY ecosystem.

Cash, credit or crypto?

Buy Sky using Visa or Mastercard. Get cash in your account with Faster Payments Service (FPS). Convert crypto-to-crypto with a single click.How to buy Sky with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.

Finder Awards Winner 2024

CRYPTO TRADING - VALUEFinder Awards Winner 2024

CRYPTO TRADING - VALUE

Featured In

CoinJar App

All-in-one crypto walletCoinJar App

All-in-one crypto wallet

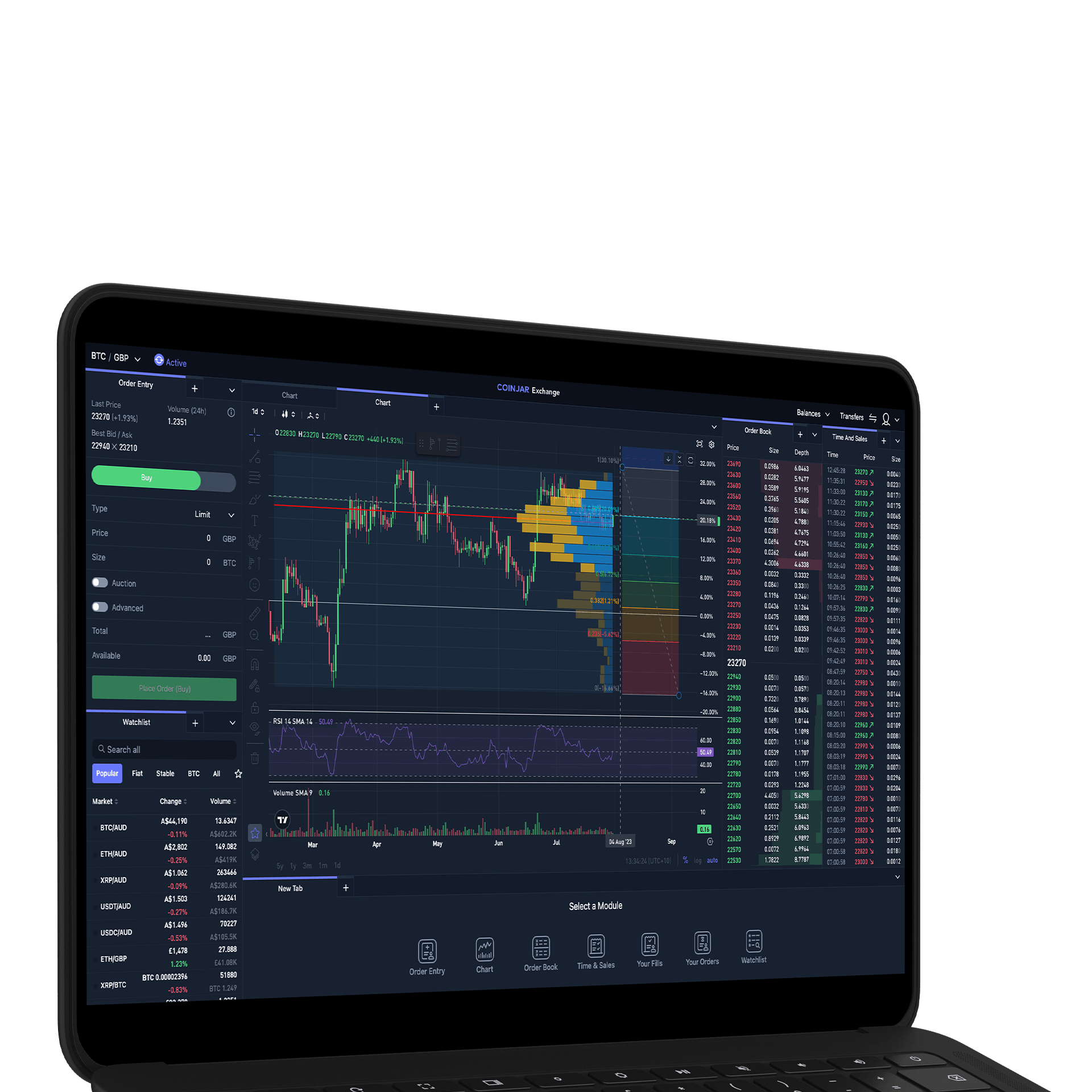

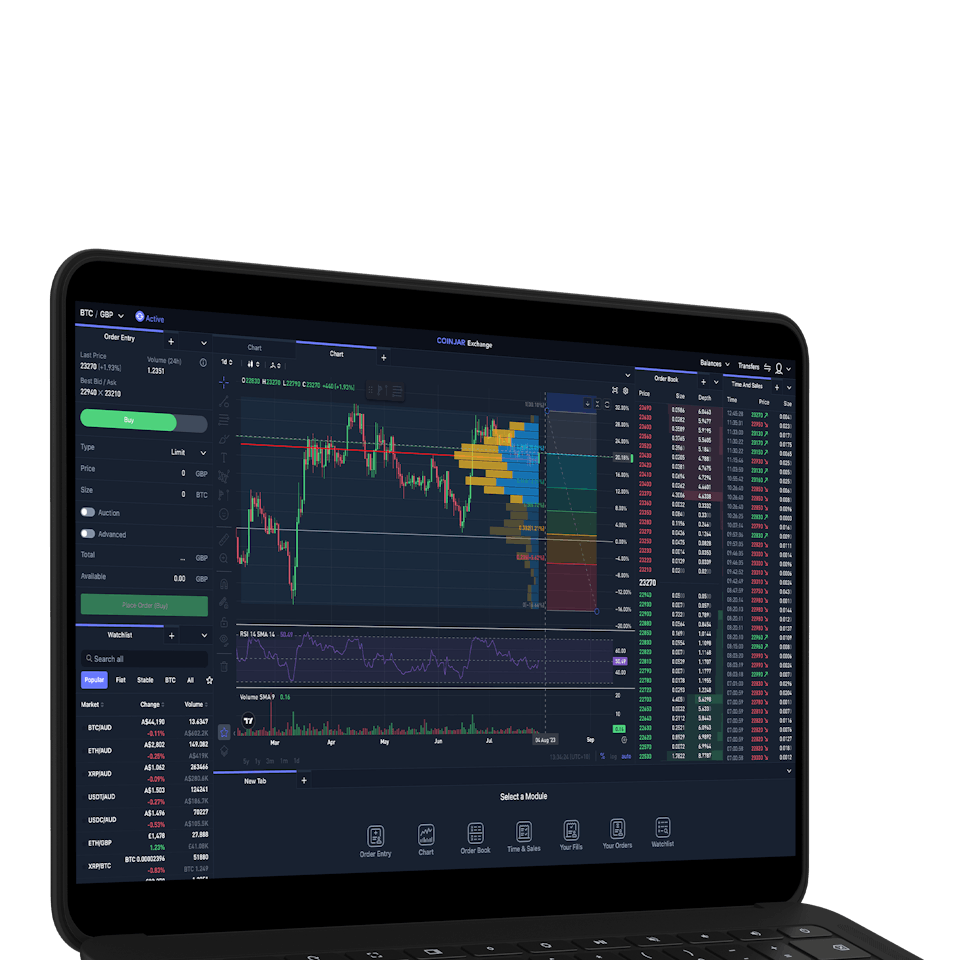

CoinJar Exchange

FOR PROFESSIONAL CRYPTO TRADERS

CoinJar Exchange

FOR PROFESSIONAL CRYPTO TRADERS

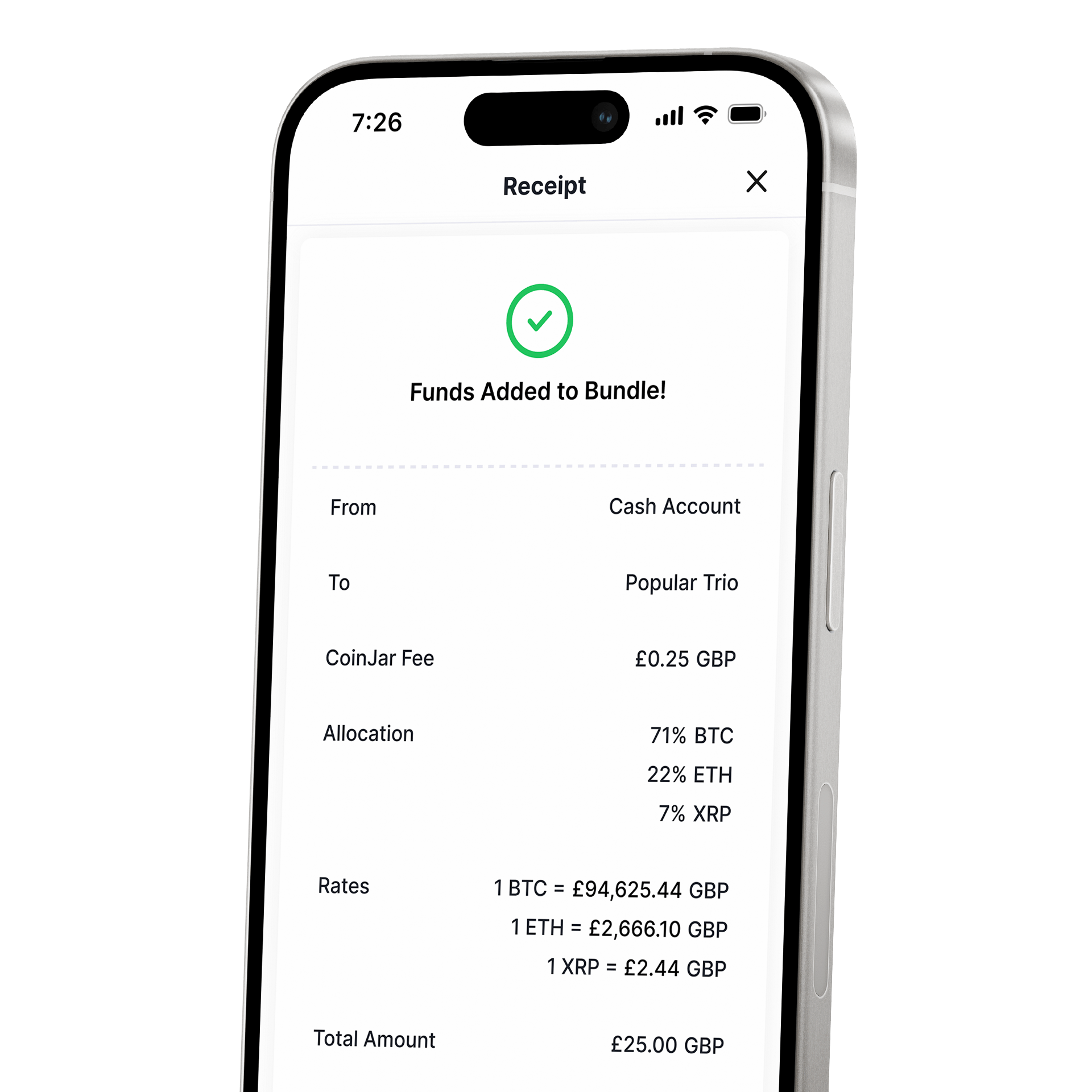

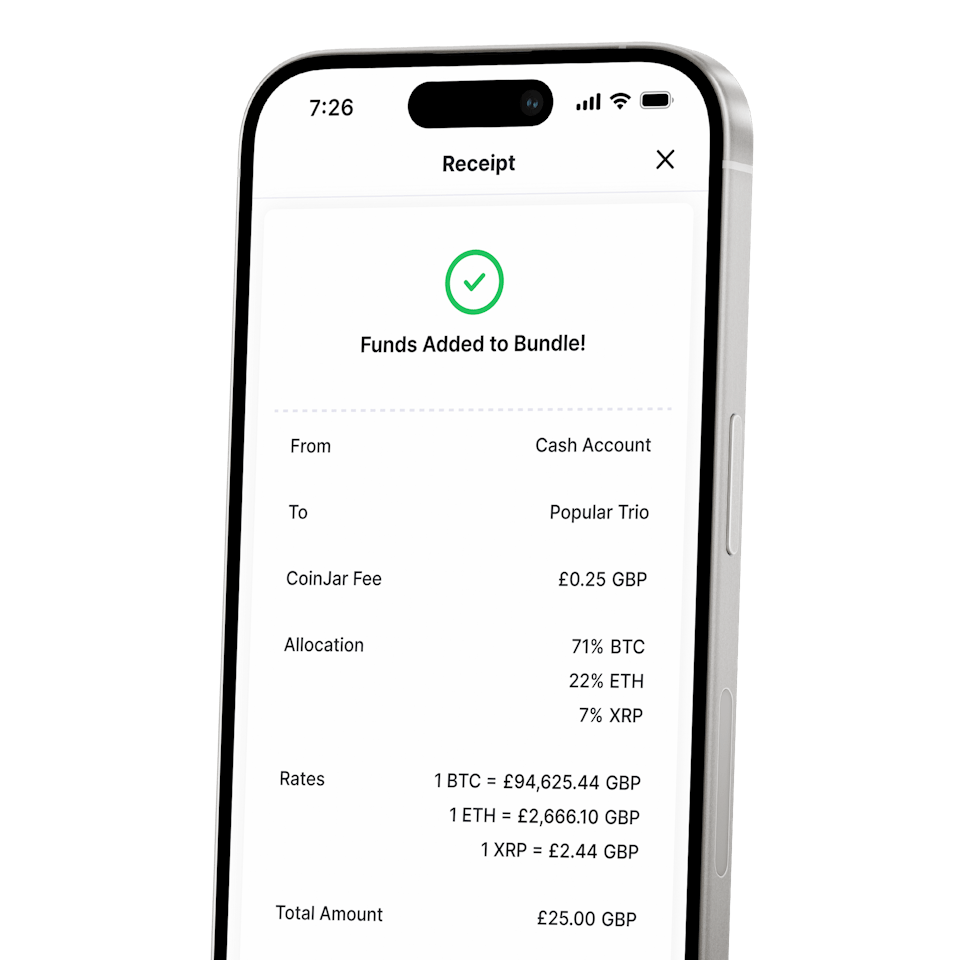

CoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIOCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Standard Risk Warning: The above article is not to be read as investment, legal or tax advice and it takes no account of particular personal or market circumstances; all readers should seek independent investment advice before investing in cryptocurrencies.

The article is provided for general information and educational purposes only, no responsibility or liability is accepted for any errors of fact or omission expressed therein. Past performance is not a reliable indicator of future results.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar's digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767). In the UK, it's legal to buy, hold, and trade crypto, however cryptocurrency is not regulated in the UK.

It's vital to understand that once your money is in the crypto ecosystem, there are no rules to protect it, unlike with regular investments. You should not expect to be protected if something goes wrong. So, if you make any crypto-related investments, you're unlikely to have recourse to the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service (FOS) if something goes wrong.

The performance of most cryptocurrency can be highly volatile, with their value dropping as quickly as it can rise. Past performance is not an indication of future results. Remember: Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at: https://www.coinjar.com/uk/risk-summary.

UK residents are required to complete an assessment to show they understand the risks associated with what crypto/investment they are about to buy, in accordance with local legislation. Additionally, they must wait for a 24-hour "cooling off" period, before their account is active, due to local regulations. If you use a credit card to buy cryptocurrency, you would be putting borrowed money at a risk of loss.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets.

Specific risks associated with DeFi tokens Decentralised Finance (or 'DeFi') tokens (e.g. UNI, AAVE) are crypto-assets linked to financial applications and protocols built on decentralised blockchain technology. DeFi tokens carry the following risks:

Smart contract risk: DeFi relies heavily on smart contracts. Even a minor coding error or oversight can lead to a contract being exploited, potentially resulting in significant losses for DeFi tokens.

Regulatory risk: DeFi operates in a decentralised manner, often without intermediaries or financial crime controls. Regulatory bodies across jurisdictions might introduce new regulations impacting the use, value, or legality of certain DeFi protocols or assets.

Rug-pulls / Exit scams: Some DeFi projects might be launched by anonymous or pseudonymous teams, increasing the risk of "rug pulls" where developers abandon the project and withdraw funds, leaving investors with worthless tokens.

Data/oracle risk: DeFi protocols often rely on external data sources or 'oracles. Manipulation or inaccuracies in these data sources can lead to unintended financial outcomes within the protocols. Protocol complexity: The complexity of some DeFi protocols can make it difficult for average users to fully understand the mechanisms and associated risks.

Specific risks associated with meme coins:

'Meme coins' (e.g. DOGE, SHIB, PEPE) are crypto-assets whose value is driven primarily by community interest and online trends.

Meme coins carry the following risks:

Volatility risk: Meme coins can have extreme price volatility, often experiencing rapid and unpredictable price fluctuations within short periods. The value of meme coins can be influenced by social media trends, celebrity endorsements, and other factors unrelated to traditional investment fundamentals. Lack of utility: Meme coins often lack intrinsic value or utility, being primarily driven by community interest, online trends, and speculative trading.

Market manipulation: Meme coins may be susceptible to increased risk of market manipulation including 'pump-and-dump' schemes, where the price is artificially inflated followed by a sudden crash.

Lack of transparency: Meme coins may have limited available information about their development teams, goals, and financials. This lack of transparency can make it challenging to assess the credibility and potential of a meme coin accurately.

Emotional investing: Meme coins often garner strong emotional reactions from investors, leading to impulsive decisions. Emotional trading activity can amplify losses.

Specific risks associated with stablecoins:

There is a risk that any particular stablecoin may not hold their value as against any fiat currency; or may not hold their value as against any other asset. Stablecoins carry the following risks:

Depegging events: Depegging events may occur with stablecoins that fail to maintain adequate controls and risk mitigants. A depegging event is when the value of the stablecoin no longer matches the value of the underlying asset. This could result in a loss of some or all of your investment.

Counterparty risk: Counterparty risk arises when an asset is backed by collateral, involving a third party maintaining the collateral, which introduces risk if the party becomes insolvent or fails to maintain it.

Redemption risk: Redemption risk refers to the possibility that an asset's ability to be redeemed for underlying collateral may not be as anticipated during market fluctuations or operational issues.

Collateral risk: Collateral risk refers to the possibility of the collateral's value declining or becoming volatile, potentially impacting the asset's stability, particularly when it is another crypto-asset.

Exchange rate fluctuations: Stablecoins, often denominated in US Dollars, expose investors to fluctuations in the USD:GBP exchange rate. Algorithmic risk: Algorithm risk refers to the possibility of an asset's stability being compromised due to unexpected failure or behaviour of the underlying algorithm, potentially leading to loss of value.

CoinJar does not endorse the content of, and cannot guarantee or verify the safety of any third-party websites. Visit these websites at your own risk.

Your information is handled in accordance with CoinJar’s Privacy Policy.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.