Understanding Celebrity Scams: What to Look Out For

Scam protection expert Lukas Jackson explains what to look out for in new scams.

In this article...

- There are many scams out to take your crypto

- One common scam uses celebrities in its dark web

- Here's what to look out for

In recent years, the internet has witnessed an explosion of digital financial opportunities, with promises of “easy profits” and “revolutionary technologies”. It’s exciting to see the new possibilities in cryptocurrency and fintech, but with every opportunity comes risks — and scammers are getting smarter.

Let's look at an example to understand how these scams work and how to help protect yourself.

Fake celebrity endorsements

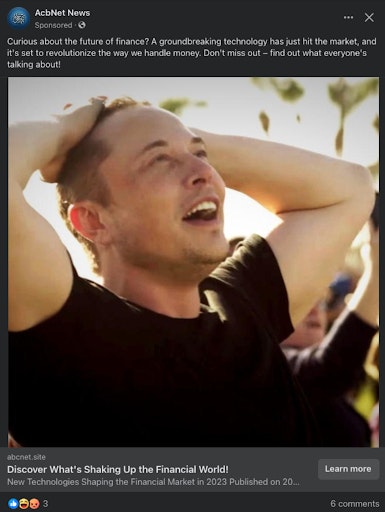

The images attached to this post showcase a concerning trend: Scammers using well-known public figures like Elon Musk to lure unsuspecting individuals into fraudulent schemes. Here’s one:

In this ad, Elon is depicted with an excited expression, paired with text like "A groundbreaking technology has just hit the market, and it's set to revolutionise the way we handle money!"

This kind of messaging is designed to create a sense of urgency and excitement. Scammers often fabricate stories claiming that celebrities have invested in or endorsed a financial product, cryptocurrency platform, or automated trading service. In this case, “Bitcoin Loophole” is promoted — a platform that falsely promises users can extract maximum profitability with ease.

What makes these scams effective?

Familiar faces and brands

Using faces like Elon Musk gives these ads a sense of legitimacy. But it’s important to remember that if it seems too good to be true, it probably is.

Urgency and Fear of Missing Out (FOMO)

Ads will often claim that this "new technology" is the next big thing and that only a limited number of people will benefit if they act fast. This FOMO tactic pressures individuals into making impulsive decisions.

Promises of quick investment returns

The idea of earning millions from the comfort of your home, with minimal effort, is highly appealing, especially in times of financial struggle. Scammers exploit this desire by making it seem like a foolproof way to make money.

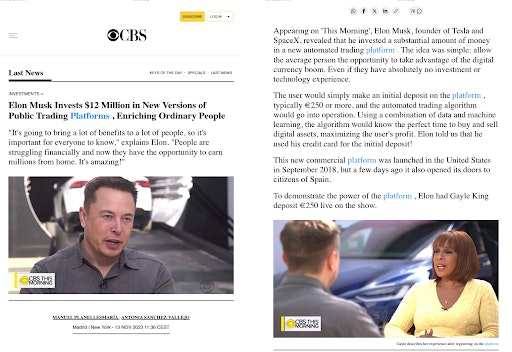

Here’s the “news article” you visit when you click the ad:

When you click any of the hyperlinks on the page, it takes you to another website, which is where (if you invest) you lose your money:

How to spot a scam

Look beyond celebrity endorsements

Always check if the celebrity or public figure has actually endorsed the product or service. Official social media channels or news sources can help you verify the legitimacy of the claims.

Question unrealistic promises

Any platform that guarantees huge returns with little effort should be treated with extreme scepticism. Real investments always carry risk, and no one can predict the market with certainty.

Check for fake news websites

The second image portrays what looks like a legitimate CBS News website article, claiming Elon Musk invested $12 million in a public trading platform. Upon closer inspection, this is not a real article from CBS but a cleverly disguised scam site. Always double-check the URL and cross-reference the information with trusted sources.

Read the fine print

Scammers often make claims that sound legitimate, but the details are where you’ll find the red flags. Look out for terms that are too vague, like "maximum profitability with ease," and promises that don’t explain how their system works. You’ll also find the fake website doesn’t have a solid Privacy Policy or Terms and Conditions.

Protect yourself

Research before you invest

Use trusted sources and financial experts to guide your investments. Avoid platforms that are promoted primarily through social media ads or spammy websites.

Be cautious with your personal information

Scammers may try to gather personal details through these fake platforms. Always ensure the sites you visit are protected and legitimate (such as regulated entities).

Report suspicious ads

If you see ads like the ones shown, report them to the platform where they appear (e.g., Facebook) and let others know about the scam.

By staying informed and vigilant, you can avoid falling victim to these elaborate schemes. Remember, if it sounds too good to be true, it probably is. Protect yourself and others by spreading the word about these scams. Together, we can reduce the impact these fraudsters have on our communities.

Suggested Articles

Top Documentaries To Watch to Increase Scam Awareness

Here are some documentaries about scams involving crypto you need to add to your to-do list. Read more

Christmas Scams: Tips to Stay Safe During the Holiday Season

New scams are on the loose. Here's one to be careful of at Christmas time. Read more

Scam Uses Popular Anime Characters to Steal Your Money or Crypto

Have you seen your favourite character in an ad online? It might not be a legitimate use of the image. Here are the red flags to look for.Read moreBrowse by topic

Standard Risk Warning: The above article is not to be read as investment, legal or tax advice and it takes no account of particular personal or market circumstances; all readers should seek independent investment advice before investing in cryptocurrencies.

The article is provided for general information and educational purposes only, no responsibility or liability is accepted for any errors of fact or omission expressed therein. Past performance is not a reliable indicator of future results. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets.

Capital Gains Tax may be payable on profits.

CoinJar's digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

In the UK, it's legal to buy, hold, and trade crypto, however cryptocurrency is not regulated in the UK. It's vital to understand that once your money is in the crypto ecosystem, there are no rules to protect it, unlike with regular investments.

You should not expect to be protected if something goes wrong. So, if you make any crypto-related investments, you're unlikely to have recourse to the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service (FOS) if something goes wrong.

The performance of most cryptocurrency can be highly volatile, with their value dropping as quickly as it can rise. Past performance is not an indication of future results.

Remember: Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

UK residents are required to complete an assessment to show they understand the risks associated with what crypto/investment they are about to buy, in accordance with local legislation. Additionally, they must wait for a 24-hour "cooling off" period, before their account is active, due to local regulations. If you use a credit card to buy cryptocurrency, you would be putting borrowed money at a risk of loss.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets.

Your information is handled in accordance with CoinJar’s Privacy Policy.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.