CoinJar

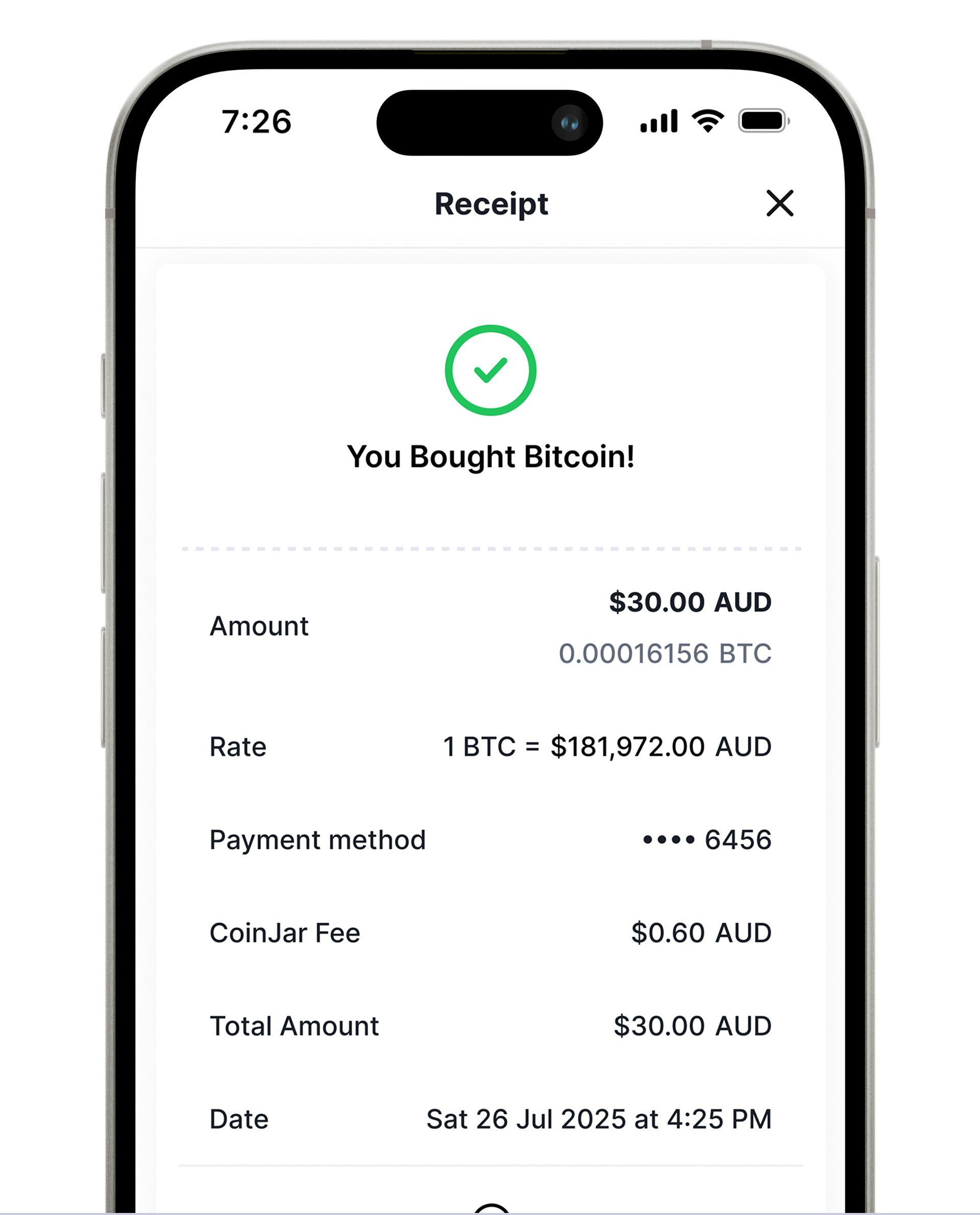

Buy Bitcoin and Crypto on Australia's #1 Crypto Exchange*

Sign up in minutes to Australia's longest-running crypto exchange and buy more than 60 cryptocurrencies. Start with as little as $10.

How CoinJar works

Pick your crypto on the crypto exchange

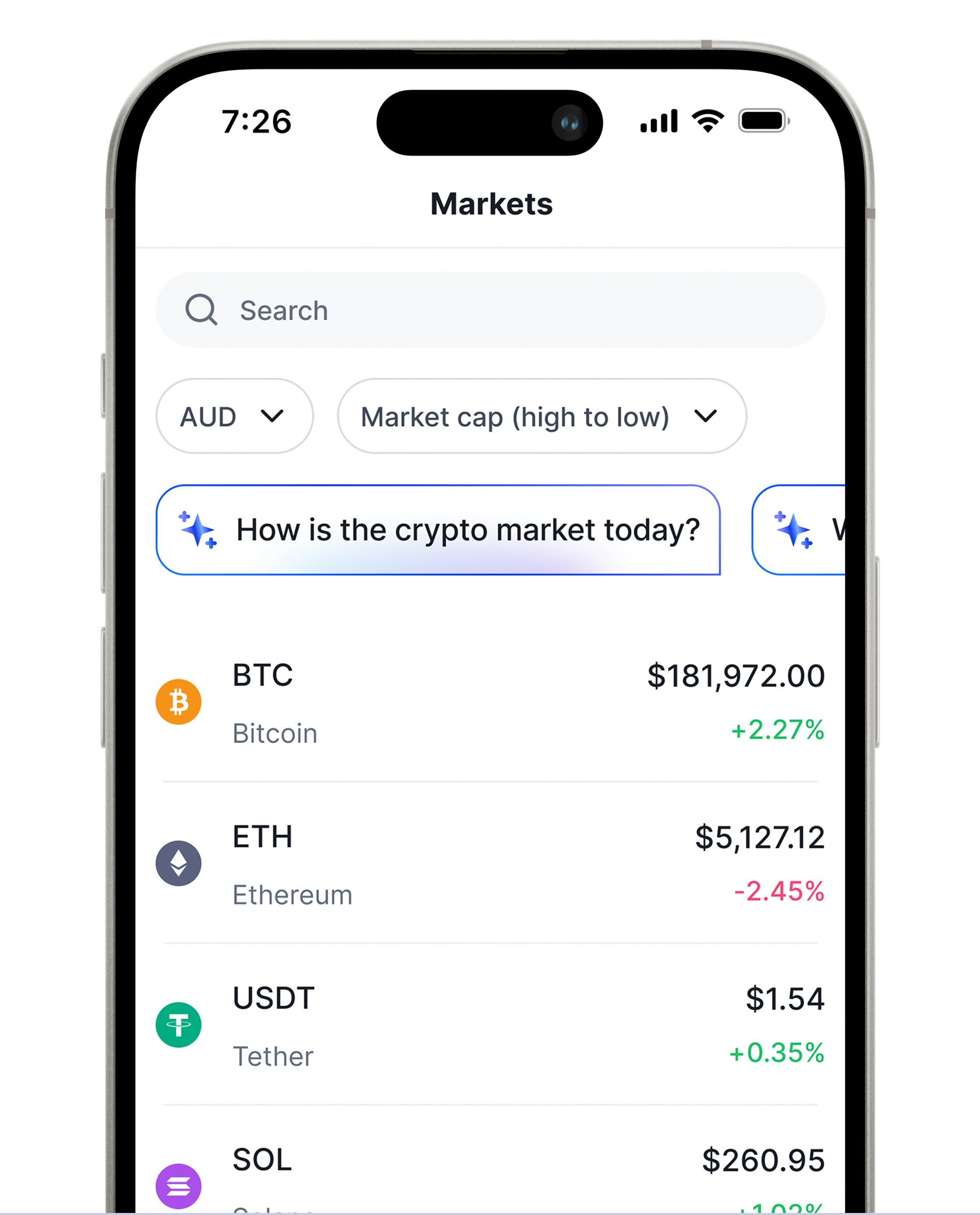

Choose between 60+ leading cryptocurrencies.Pay your way

Lightning fast AUD & GBP bank deposits or instant card payments.Grow your portfolio

Store your crypto in our ultra-secure wallet. Diversify in a flash with CoinJar Bundles.

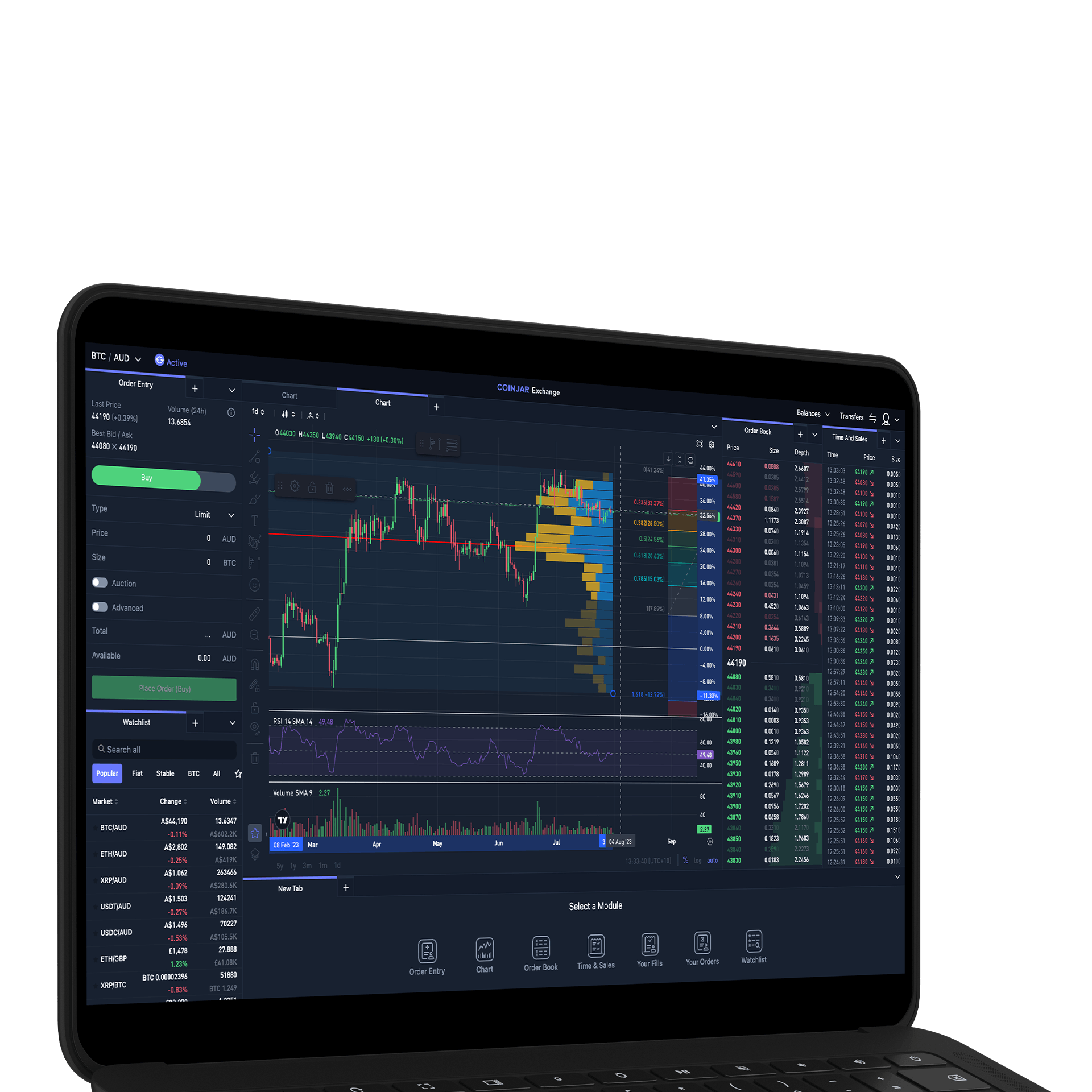

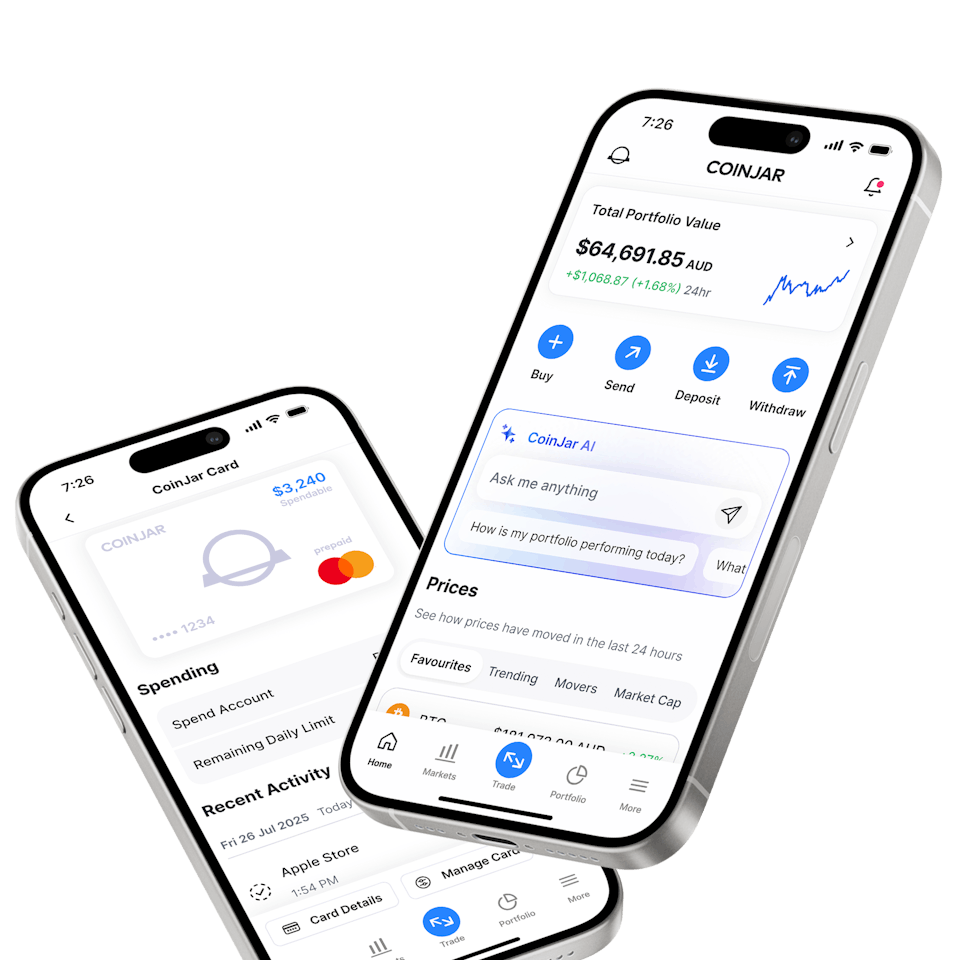

CoinJar Card

Crypto spending powered by Mastercard®

CoinJar Card

Crypto spending powered by Mastercard®

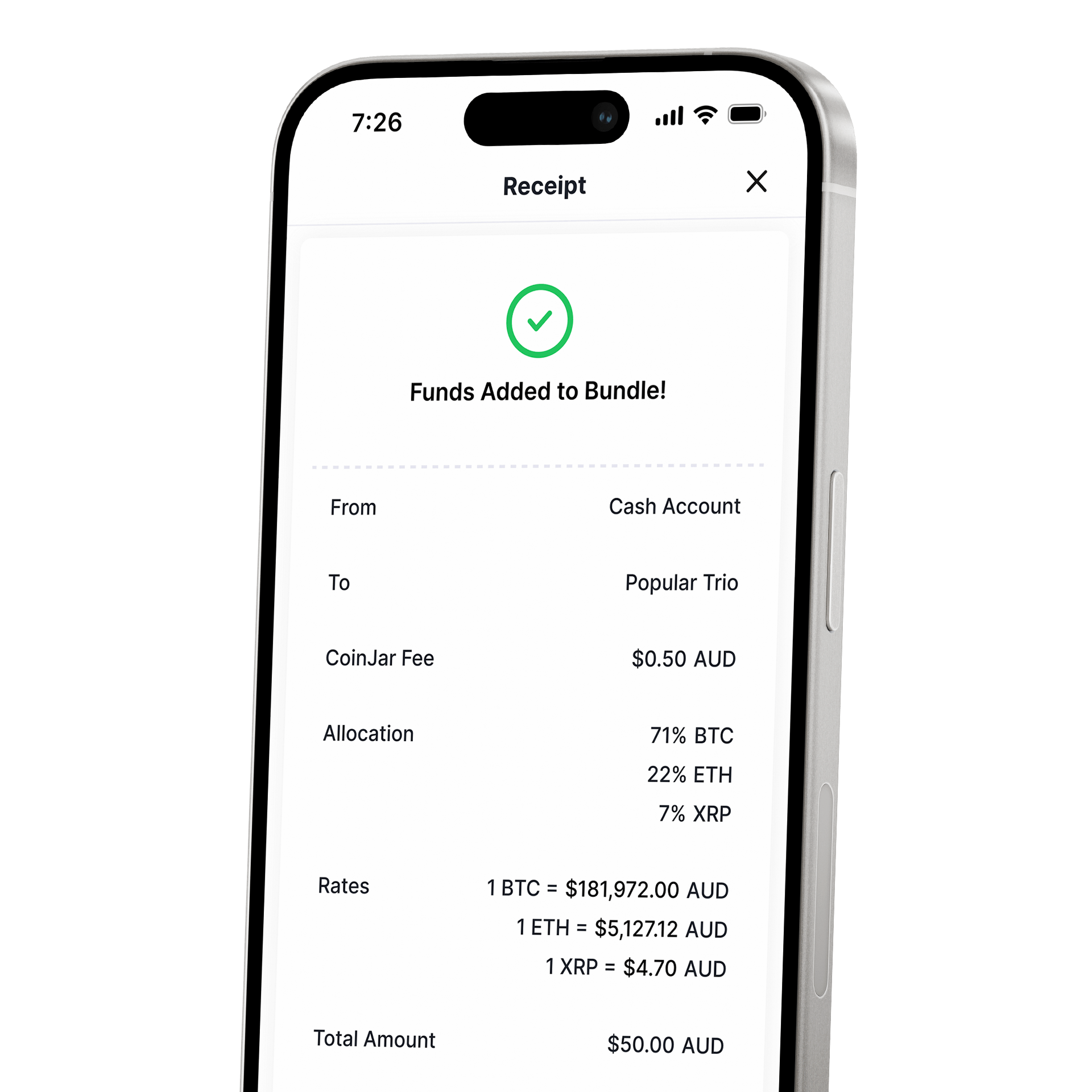

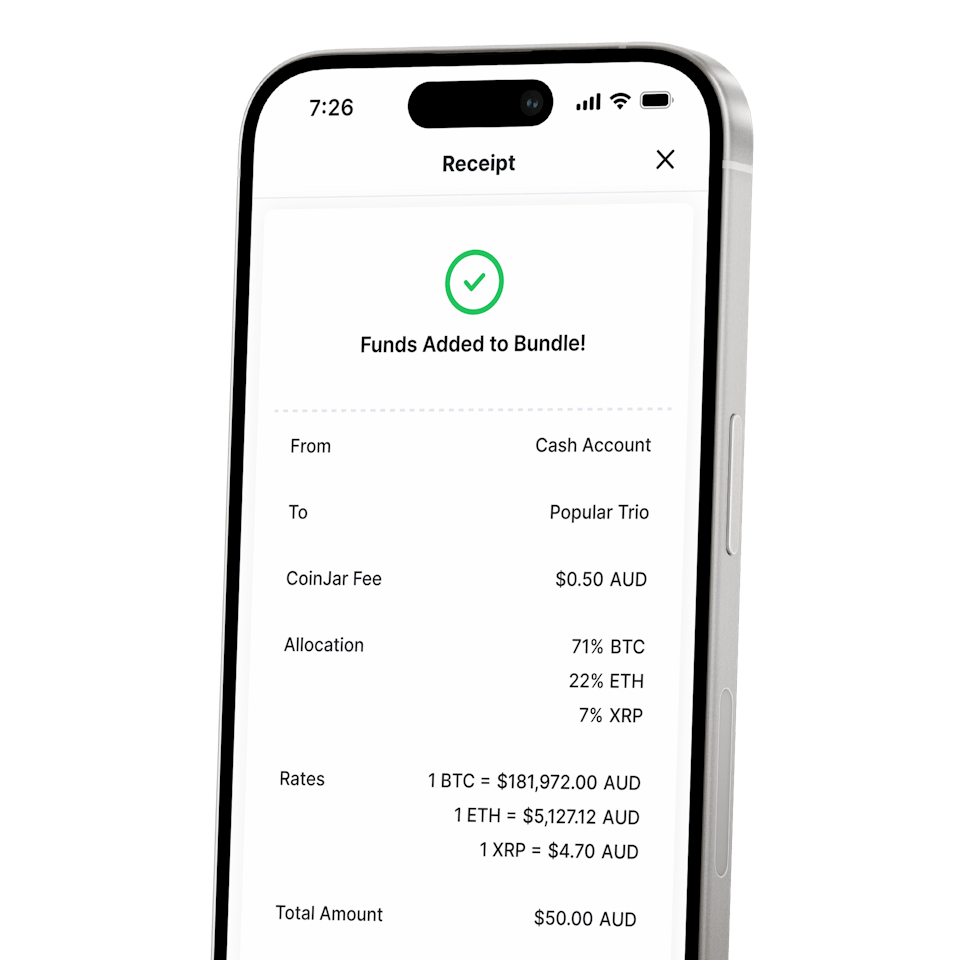

CoinJar DCA & Bundles

Automate & diversify your portfolioCoinJar DCA & Bundles

Automate & diversify your portfolio

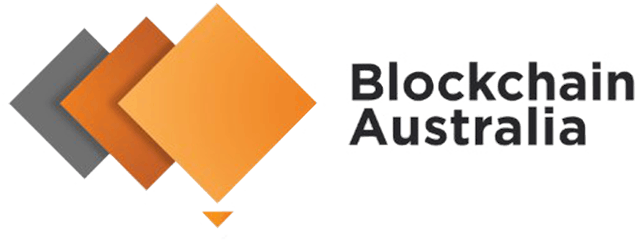

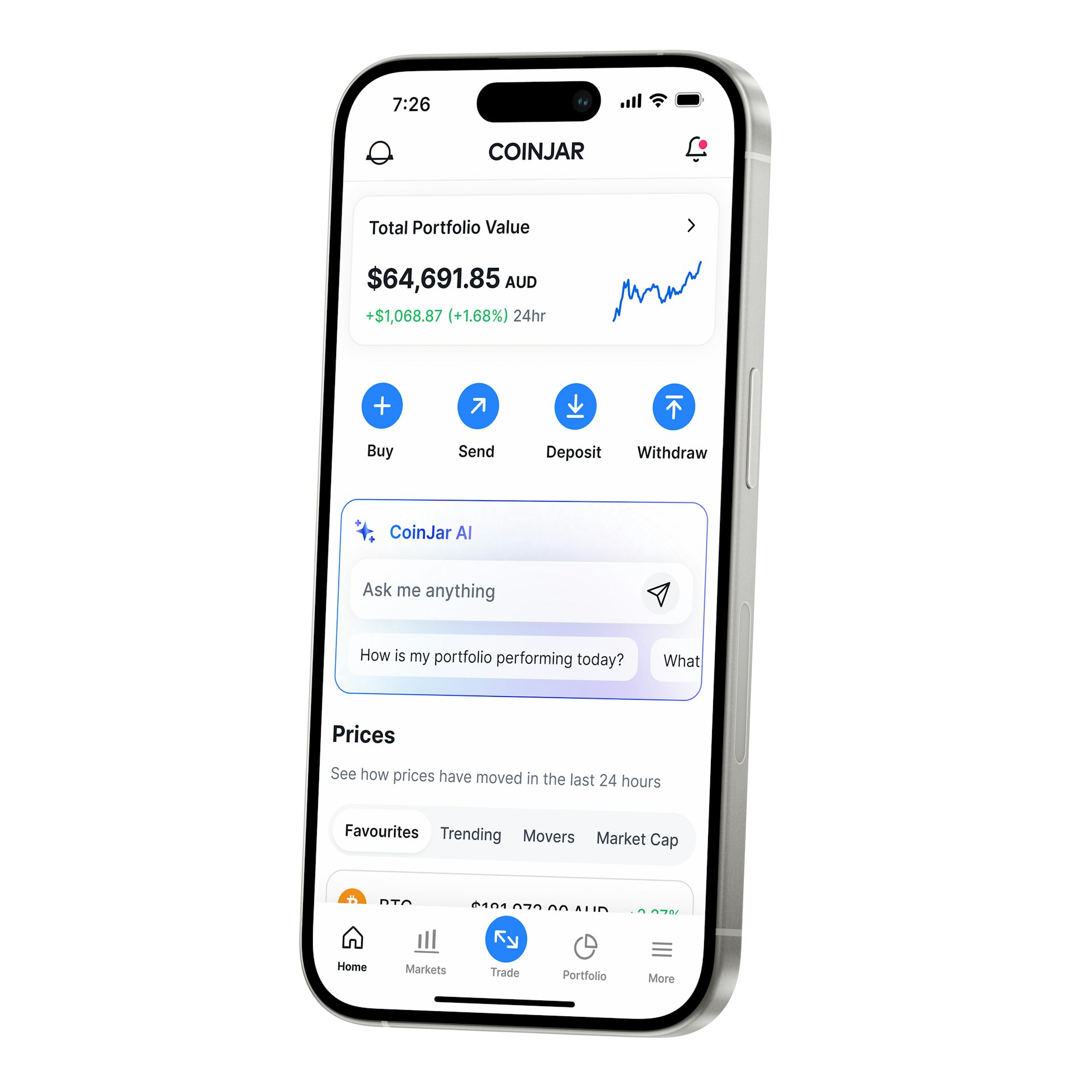

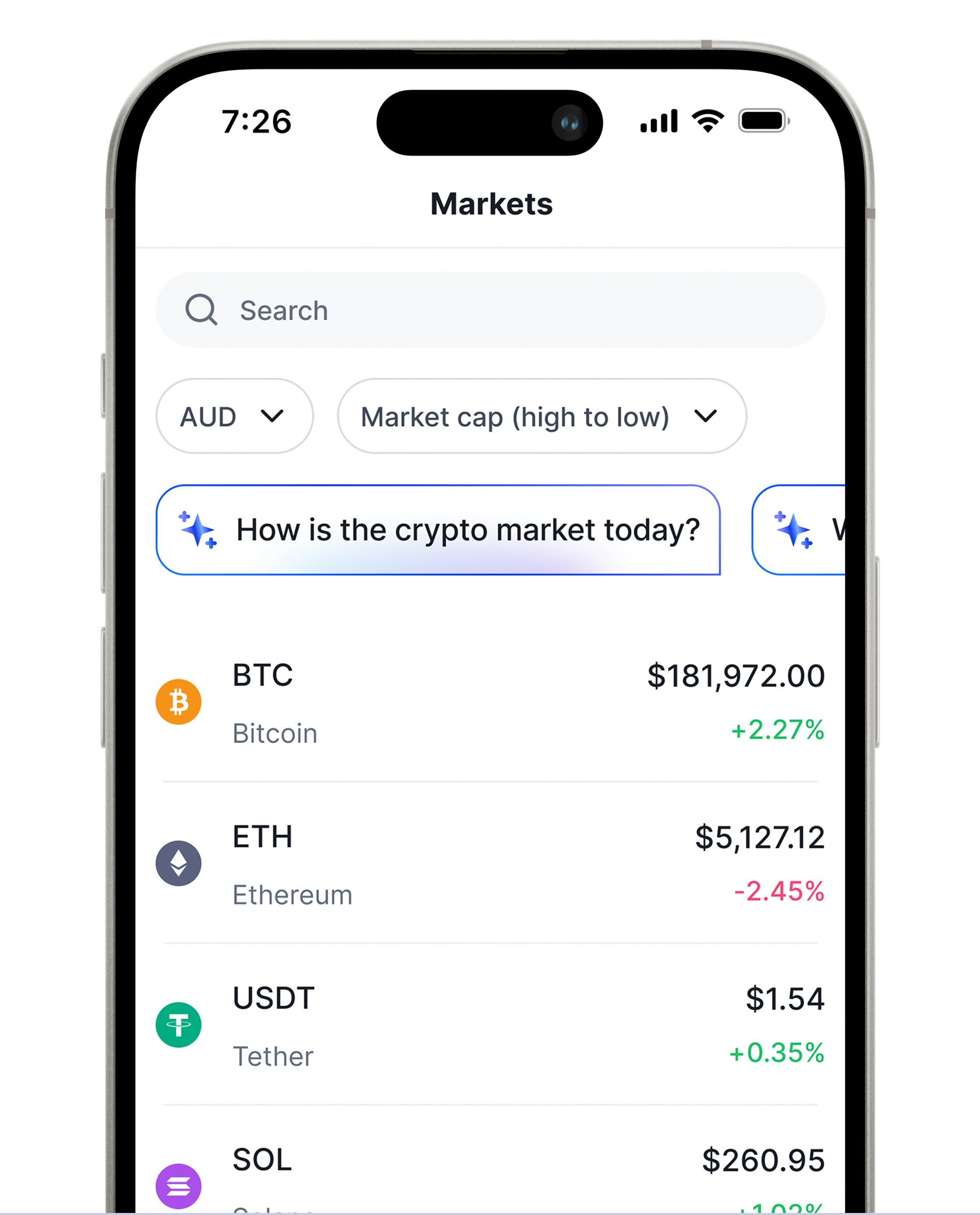

CoinJar AI

A portfolio and market assistant built into CoinJar

CoinJar AI

A portfolio and market assistant built into CoinJarInstitutional-grade crypto solutions

Powerful products and services designed for institutions, market makers and finance professionals from Australia’s longest-running cryptocurrency exchange.

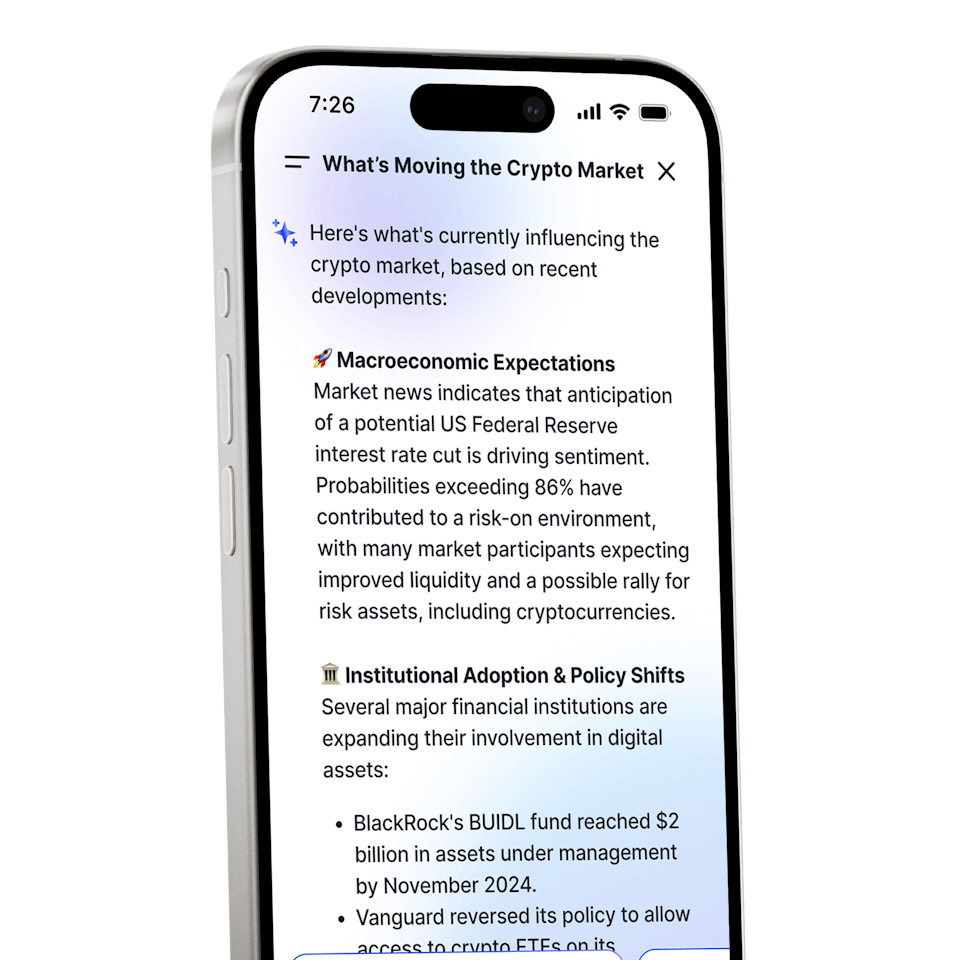

CoinJar Exchange

Trade with the best

CoinJar Exchange

Trade with the bestSecure, private and encrypted

Fraud protection

We employ multi-level data encryption, security audits and best practice organisation security to protect customer accounts on the crypto exchange. Our Support team uses advanced machine learning to recognise suspicious logins, account takeovers and financial fraud.

Asset security

Our assets are secured by BitGo and Fireblocks, two of the most respected custody providers in the cryptocurrency space. We maintain full currency reserves at all times, with sufficient assets to cover more than 100% of our customer balances.

Trusted exchange

CoinJar is one of the longest-running exchanges on the planet, operating with no downtime since 2013. We’re backed by some of the world’s top investors and are fully registered and compliant with AUSTRAC and the Financial Conduct Authority UK (for AML purposes).How to buy crypto with CoinJar

Frequently asked questions

What is a crypto exchange?

A crypto exchange is a platform where you can buy, sell, and trade cryptocurrencies. CoinJar is a trusted Australian crypto exchange offering low fees, high security, and easy access to over 60 digital assets.

Is CoinJar a safe crypto exchange?

Yes, CoinJar follows best industry practices, with industry-leading security features like two-factor authentication (2FA), cold storage, and real-time monitoring.

Can I trade altcoins on the CoinJar app like any crypto exchange?

Yes, the CoinJar app can be used like a normal crypto exchange, users can buy and sell dozens of altcoins for trading and investment.

Your information is handled in accordance with CoinJar’s Collection Statement.

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.