Free Crypto Tax Calculator: Where Can I Find One?

Free crypto tax calculator: Do they exist and are they worth it? Here are your options.

In this article...

- Is there a free crypto tax calculator?

- If you’ve dabbled in any cryptocurrency trading this financial year, you'll need to consider the tax implications.

- We have discount codes to some really good ones that make them much cheaper.

Is there a free crypto tax calculator? There are three answers here. Yes, no, and we have discount codes to some really good ones that make them much cheaper. Free crypto tax calculator: is there such a thing? If you’ve dabbled in any cryptocurrency trading this financial year in Australia, you'll need to consider the tax implications.

Any cryptocurrency transaction, including buying, selling, trading, mining, staking, giving, or receiving, must be reported on your tax return. This requirement applies regardless of where the transaction occurred — be it Australia, the United States, or even a remote tax haven in the Pacific.

Essentially, if you’ve used crypto, the tax man wants to know about it.

However, calculating your cryptocurrency tax can be complex, with various factors to consider when preparing your tax return.

There is a really comprehensive article here if you want to speed up your knowledge before you choose a crypto tax calculator.

Does the ATO track your crypto trades?

Yes, the ATO closely monitors cryptocurrency transactions through its crypto-assets data matching program, which has been in place since the 2014-15 financial year.

It’s crucial to keep accurate records of these transactions. All Australian crypto exchanges that are registered with AUSTRAC are required by law to share data with the ATO.

Free crypto tax calculator / Free crypto tax software

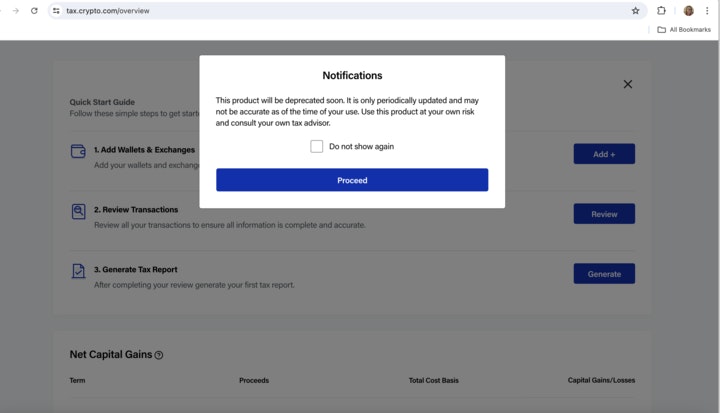

Are there free crypto tax calculators? Yes, there are. But unfortunately, the most well-known one, at crypto.com, is deprecated, may not be accurate, and it is being retired very soon.

Free trial periods

There are crypto tax software companies that have free trial periods and offer free initial calculations. But to do anything meaningful, you are going to need to get a subscription to one of the companies that offer crypto tax calculators.

So your best bet is to actually subscribe to a paid service. The good news here is that we have some discount codes for you.

Automate your tax return

Crypto accounting apps like Summ, Koinly, Syla, Koinx, and CoinLedger can help. These programs track all your transactions in real-time, regardless of where and when they occur.

At the end of the financial year, they compile your transaction history into a document that details your capital gains and losses in Australian dollars. This makes it easier to assess your tax obligations and monitor your overall portfolio performance.

CoinJar now offers full, secure transaction integration with multiple crypto tax calculators. This means any cryptocurrency transaction conducted on CoinJar will be directly transferred to your chosen crypto tax software account. This means you will be ahead of the game at tax time.

Exclusive CoinJar customer benefits

Summ

Summ (formerly Crypto Tax Calculator) is the complete crypto tax solution. With support for over 3,500 exchanges, wallets and blockchains, Summ was built to handle everything from exchange trading to complex on-chain activity, including DeFi and NFTs. Get accurate, regulator-ready tax reports. Because close enough isn't good enough.

As a CoinJar user, you’ll get 30% off all Summ plans. Use the code COINJ30 at check out or sign up via this link, and your discount will be automatically applied. Discount on first year only. Only available to new customers.

Offer: 30% off Eligibility: Discount on first year only. Only available to new customers.

Syla

Syla delivers Australia-specific crypto tax solutions from qualified tax professionals. Generate tax-optimised ATO reports designed for Australian investors.

CoinJar customer code: COINJARSAVE provides 30% off first-year subscriptions. No expiration, available year-round.

CoinTracker

New customers save 10% on all subscriptions. Valid until April 5, 2026. Activate offer here.

Notice: Customer feedback indicates Blockpit / Accointing and Crypto.com Tax currently generate inaccurate reports for CoinJar accounts.

Terms and conditions of offers

Links to third-party websites will open new browser windows. Except where noted, CoinJar accepts no responsibility for the content on third-party websites.

Important: CoinJar Australia Pty Ltd does not warrant the adequacy, accuracy or completeness of any tax calculation by any app, including those mentioned above and CoinJar expressly disclaims any liability for errors or omissions therein.

Users are personally responsible for evaluating the accuracy, completeness or usefulness of any information or other content available on these sites.

If you use the above services, remember they are not provided by CoinJar. You’ll be subject to the applicable terms and conditions of use for these products, including a separate privacy policy, which may differ from CoinJar’s privacy policy. You should read and understand all applicable terms before using them.

You should read and understand all applicable terms for the above crypto tax software before using them.

Links to third-party websites will open new browser windows. Except where noted, CoinJar accepts no responsibility for the content on third-party websites.

Frequently asked questions

What types of taxes do I need to pay on selling cryptocurrency, buying cryptocurrency and trading crypto, and how are they calculated?

Cryptocurrency is subject to both capital gains and income tax in Australia. Capital gains tax applies when you sell, trade, or spend cryptocurrency, and is calculated based on the difference between your cost basis (the price you paid for the crypto) and the selling price.

Income tax may apply if you earn cryptocurrency through activities like mining, staking, or receiving it as payment for goods or services. The tax rate you pay depends on whether the crypto was held for more than 12 months (long term) or less than 12 months (short term).

How can a free crypto tax calculator help me calculate my tax liability?

A free crypto tax calculator can help you determine your tax liability by aggregating your crypto transactions, calculating capital gains and losses, and categorizing transactions as either ordinary income or capital gains.

This information can be used to estimate your total tax due, which you can then report on your tax return.

Do I have to pay capital gains tax on crypto-to-crypto transactions?

Yes, crypto-to-crypto transactions are considered taxable events in Australia. Each time you trade one cryptocurrency for another, you are essentially disposing of the original crypto, which triggers a capital gain or loss calculation. You can calculate tax on crypto using a crypto tax calculator.

Are there any situations where I don't have to pay tax on cryptocurrency?

You generally don't have to pay tax on cryptocurrency if you are simply buying and holding it. However, if you sell, trade, or use it to purchase goods or services, you will likely trigger a taxable event.

Additionally, donating cryptocurrency to a registered charity is generally exempt from capital gains tax.

Suggested Articles

Why is Crypto Crashing? Explaining the Crypto Bloodbath

Why is crypto crashing today? Here is the explanation of some of the blow-up.Read more

You Can Use Wise to Withdraw Fiat From Select Crypto Exchanges

Having a Wise account now means that you can deposit and withdraw fiat from registered crypto exchanges like CoinJar.Read more

What is OTC in Crypto? What is Over-The-Counter Used For?

What is an OTC desk? We explain why someone might want to use an over-the-counter desk for their crypto trades.Read moreBrowse by topic

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrencies, including Bitcoin, are highly volatile and speculative assets, and there is always a risk that they could become worthless.

Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.

CoinJar does not endorse the content of, and cannot guarantee or verify the safety of any third party websites. Visit these websites at your own risk.

Your information is handled in accordance with CoinJar’s Collection Statement.

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.