Buy yearn.finance

yearn.finance

YFI

What is yearn.finance?

Why do investors buy Yearn.finance (YFI)? Yearn.finance, also known as Yearn, is a ‘toolbox’ for people who use cryptocurrencies. It helps them earn interest from their digital assets.

What Is Yearn.finance? How does it work?

Yearn operates on the Ethereum blockchain. It also works with other decentralised exchanges like Balancer and Curve. Its main job is to help people make more money from their crypto assets by using DeFi (which stands for Decentralised Finance).

Vaults: Maximising yield

Yearn.finance offers a range of vaults where users can deposit their tokens to earn yield. These vaults automatically move assets between different DeFi lending protocols (such as Aave and Compound) to maximise returns.

By doing so, users benefit from higher yields without actively managing their assets.

Governance participation

Yearn.finance’s native token is YFI. Holders of YFI have the opportunity to participate in governance decisions. This means they can vote on proposals related to the protocol’s development, changes, and upgrades. YFI holders play a crucial role in shaping the future of Yearn.finance.

yCRV and yETH Strategies

yCRV: Yearn.finance provides a strategy called yCRV, which aims to achieve the best CRV (Curve) yields in DeFi. CRV is a stablecoin liquidity pool token, and Yearn optimises its returns for users.

yETH: For those holding Ethereum (ETH), Yearn.finance offers a straightforward, risk-adjusted liquid staking yield strategy. Users can stake their ETH and earn rewards without locking it up for an extended period.

yPrisma: This is a protocol designed to enhance yield opportunities for digital assets. While the details of yPrisma are continually evolving, it aims to provide additional ways for users to earn yield within the Yearn ecosystem.

Why Is Yearn.finance worth looking at?

Automated optimisation

Yearn.finance’s vaults automatically manage assets, ensuring users get the best returns without active intervention.

Community governance

YFI holders actively participate in shaping the protocol, fostering a decentralised decision-making process.

Diverse strategies

Yearn offers various strategies (like yCRV and yETH) to cater to different risk appetites and asset types.

Innovation

The introduction of yPrisma demonstrates Yearn’s commitment to continuous improvement and innovation.

How to Use Yearn.finance

Connect Wallet: Visit the Yearn.finance website and connect your wallet.

Explore Vaults: Browse the available vaults, choose one that suits your preferences, and deposit your tokens.

Earn Yield: Let Yearn.finance’s automated strategies do the work for you. Monitor your earnings and participate in governance if you hold YFI.

Conclusion: Buy Yearn.Finance (YFI)

Yearn.finance is a DeFi protocol that optimises yield, is run by its community, and offers innovative strategies for crypto enthusiasts. Whether you’re a yield seeker or a governance enthusiast, Yearn is worth looking into.

How to Buy Yearn.finance (YFI) on CoinJar

If you’re interested in acquiring Yearn.finance (YFI), CoinJar provides a straightforward process to get started.

Follow these simple steps:

Sign Up to CoinJar: Download the CoinJar app on iOS or Android.Create an account and complete the ID verification process.

Deposit Funds: Transfer funds from your bank account using bank transfer, PayID, or Osko.

Purchase YFI:Once your account is funded, you can buy YFI directly using cash or credit card.

Cash, credit or crypto?

Buy yearn.finance instantly using Visa or Mastercard. Get cash in your account fast with bank transfer, PayID or Osko. Convert crypto-to-crypto with a single click.How to buy yearn.finance with CoinJar

Start your portfolio with Australia's longest running crypto exchange with these simple steps.Featured In

CoinJar Card

CRYPTO SPENDING POWERED BY MASTERCARD®

CoinJar Card

CRYPTO SPENDING POWERED BY MASTERCARD®

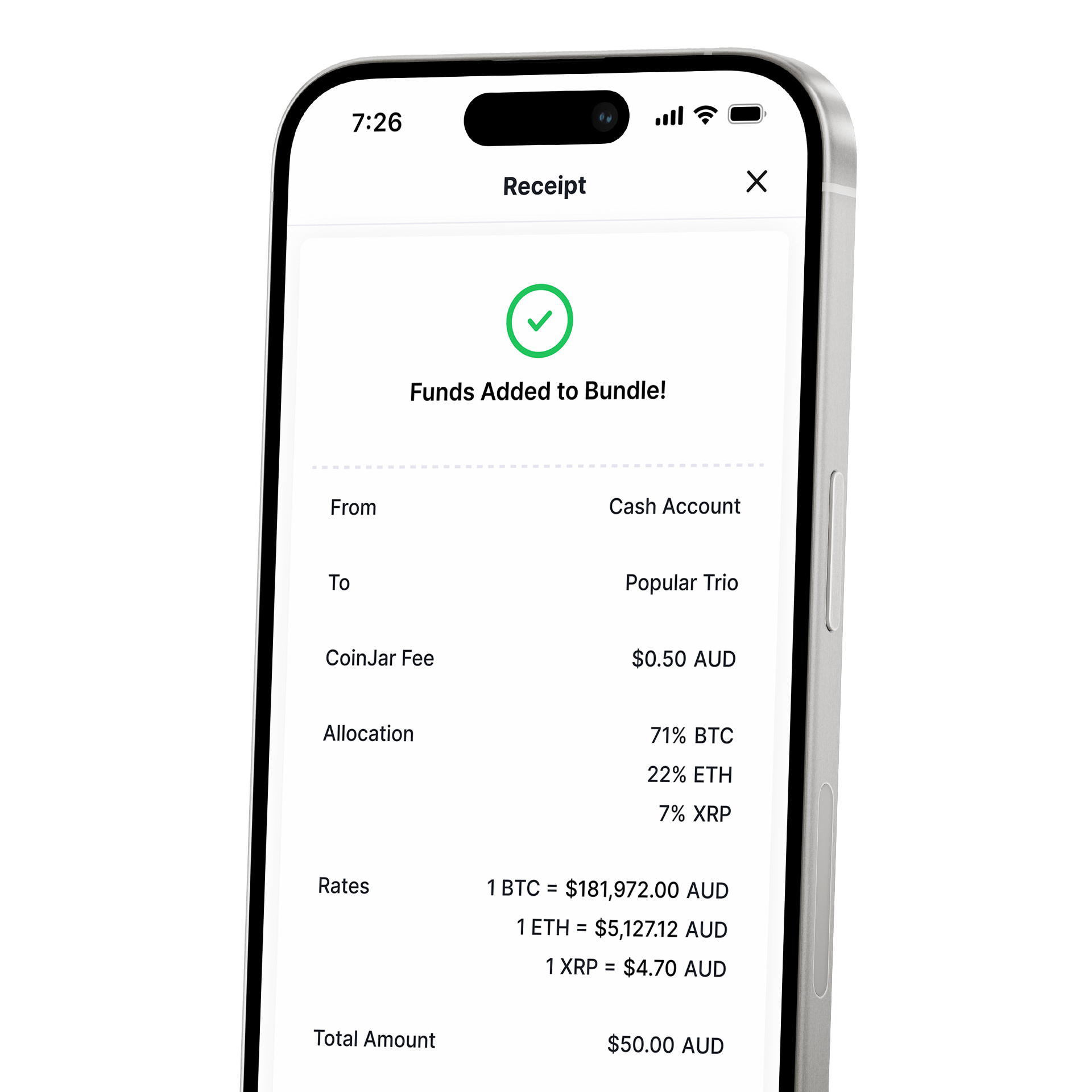

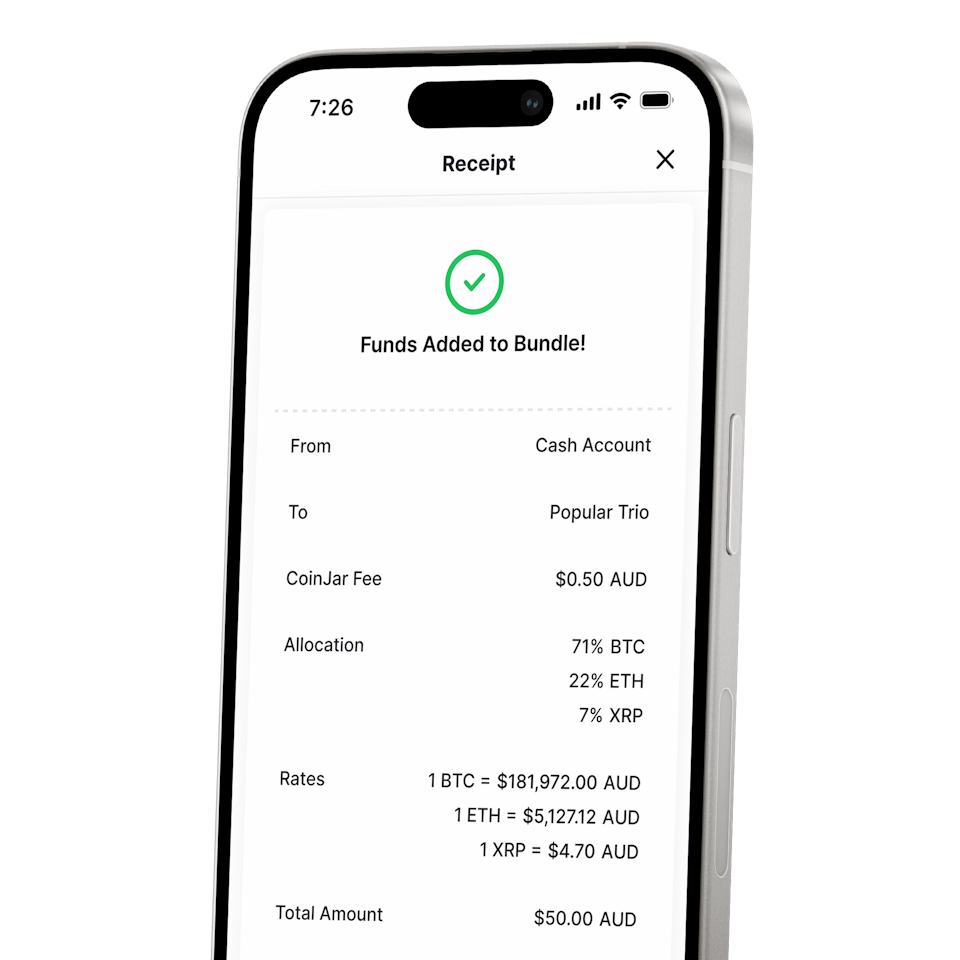

CoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIOCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

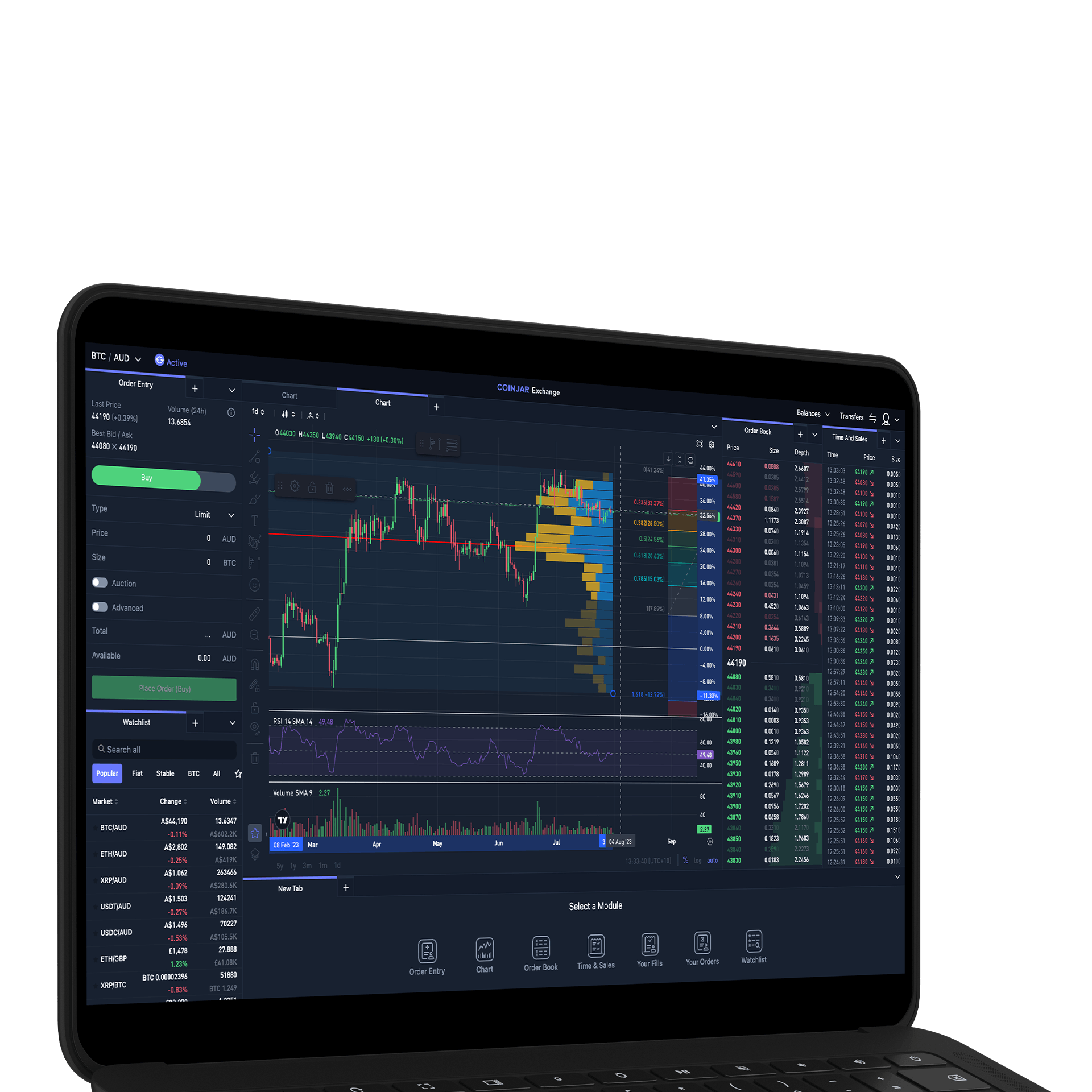

CoinJar Exchange

TRADE FOR AS LOW AS 0%

CoinJar Exchange

TRADE FOR AS LOW AS 0%

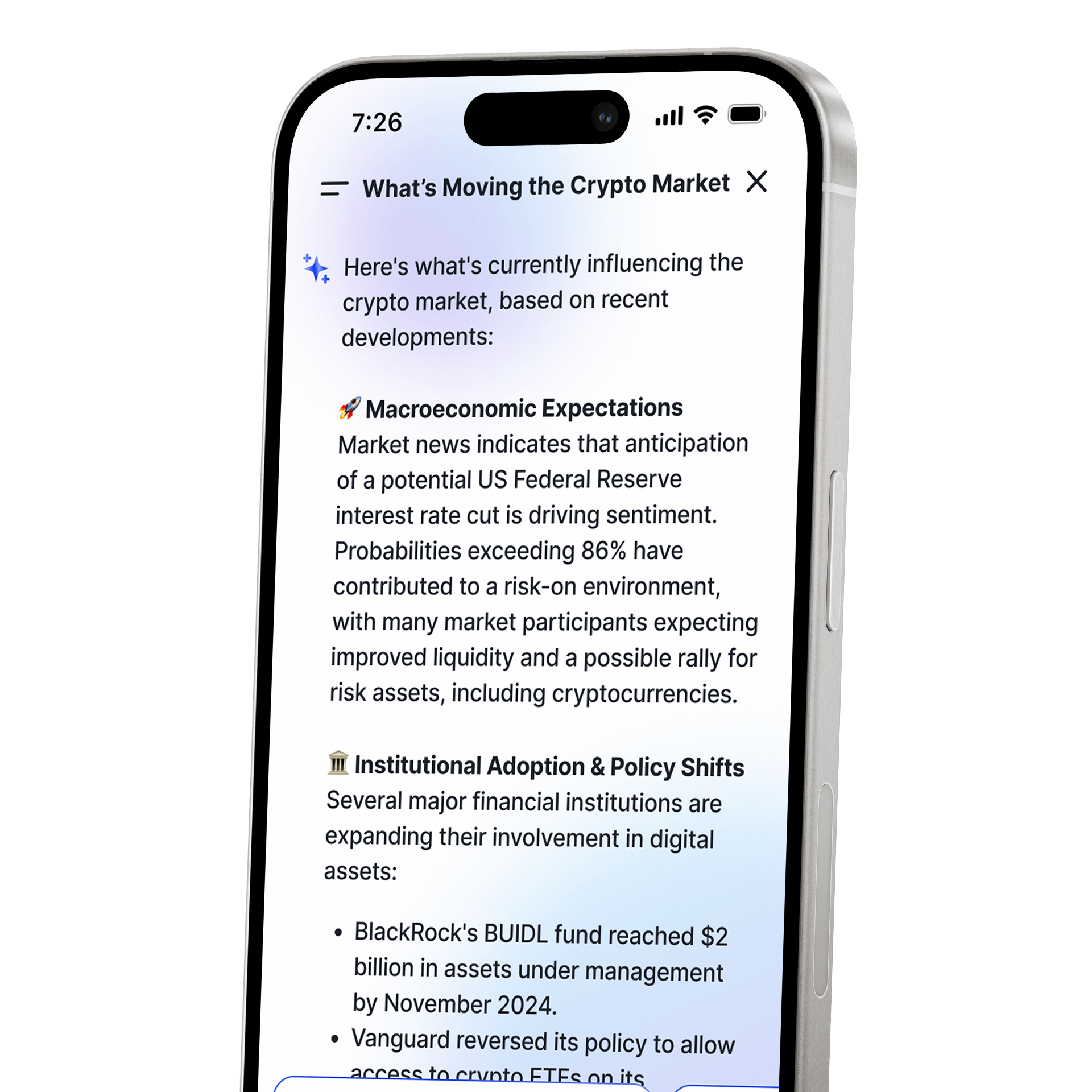

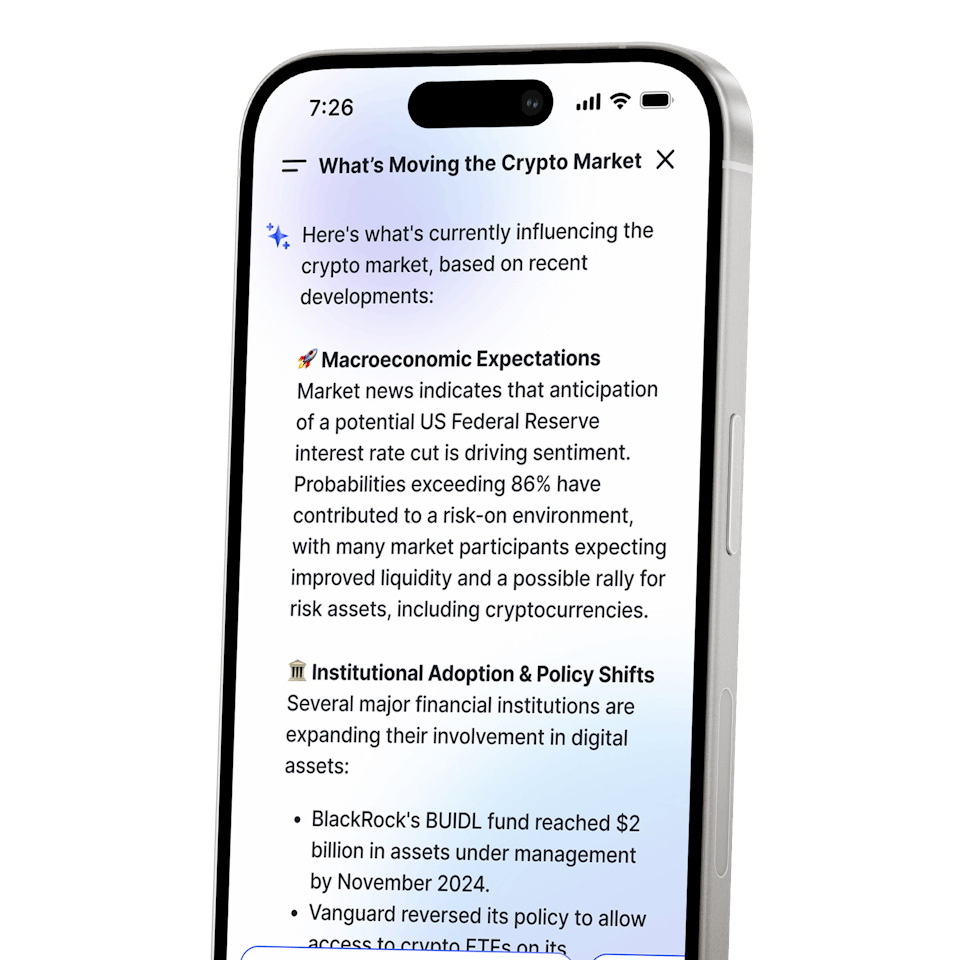

CoinJar AI

A portfolio and market assistant built into CoinJarCoinJar AI

A portfolio and market assistant built into CoinJar

Your information is handled in accordance with CoinJar’s Collection Statement.

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.