Onchain: New Year, new me

January 16, 2025

Share this:

Who am I kidding? I just saved myself the ritual of making resolutions. If you’re still sticking with the gym, I applaud you. I, for one, am busy enough trying to maintain moral integrity in crypto and report truthfully from the front lines of that battle. 🫡

Story One

Grift/Acc

Everything Ai is selling like warm bread and butter these days - a good combination, unlike AI and grifters. The latest outrage happened over the weekend when AI Accelerate DAO, short AICC launched its token.

AICC was a DAO supposedly helping builders launch agents and accelerate us further toward AGI. The pitch went something like it being A16z but onchain and not controlled by Humpty Dumpty.

Their launch happened on daos.fun (it’s what pump.fun is for memes but for daos) and didn’t go down well. Most of the allocation went to insiders, who couldn't dump their 13000x fast enough on their loyal followers.

Very prominently, David Hoffmann, known for being the host of the Bankless Podcast. When called out, his excuse was that it was an impulsive mistake. He did buy some tokens back to show good faith.

Shaw, another prominent insider of AICC, developer of the Eliza Ai agent framework, also fell from grace - his pathetic excuses have since been deleted from X.

Takeaway: It appears we’re entering the phase of the cycle when the grifts accelerate. Careful where you put your money.

Story Two

What’s a blockchain anyway?

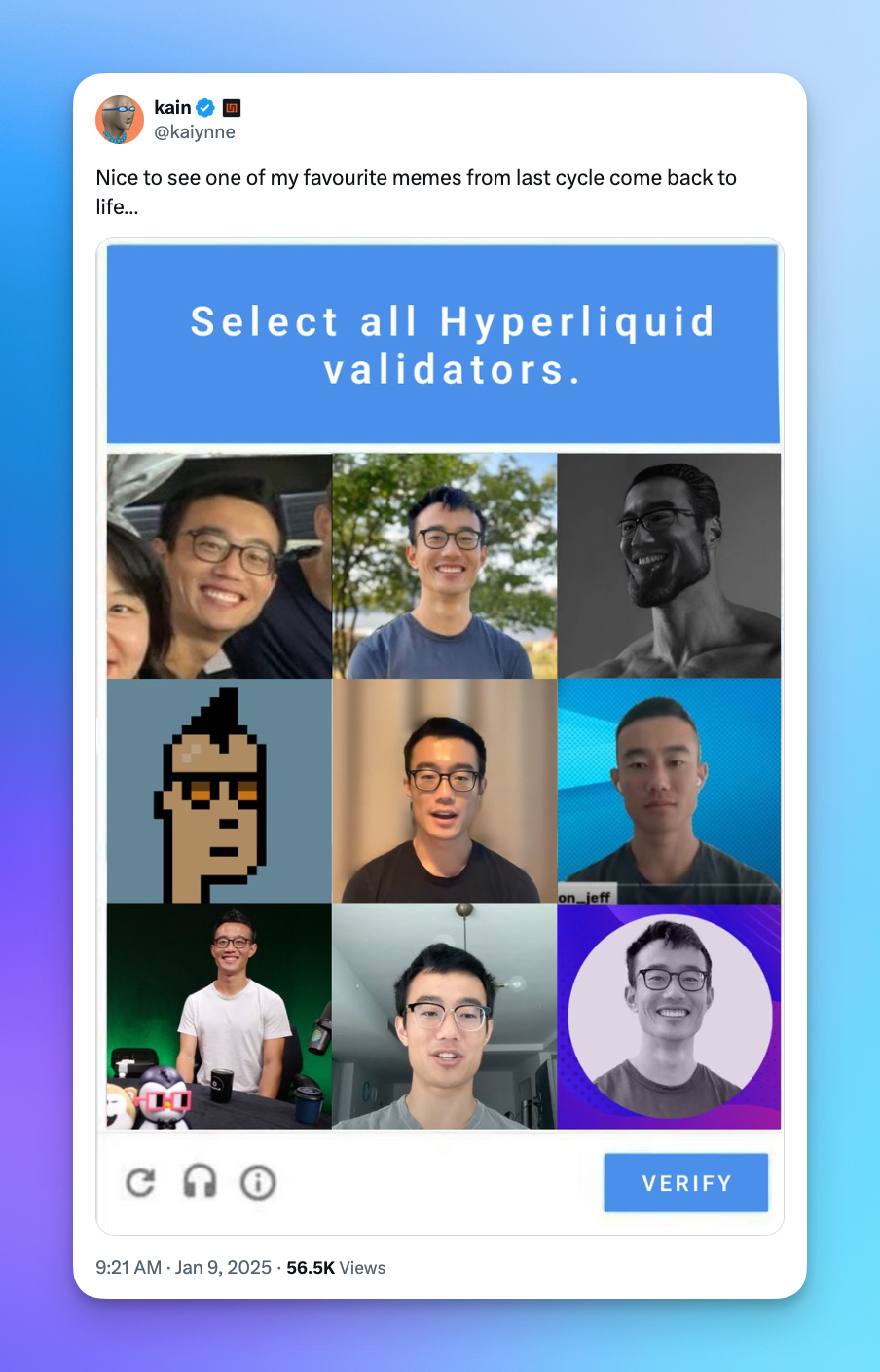

Hyperliquid has been one of the trader’s favorite Layer-1s offering low fees, low slippage, and an experience as if trading on a CEX, except it’s not a CEX.

Over 20 assets are already available on Hyperliquid for spot and perpetual trading. Their airdrop was hugely successful, enraging all the VCs while enriching people actually using their chain.

Can it really be called a chain though? That’s the question one dared to ask. In a public letter to the team, a validator called Hyperliquid out for closed-source code, and a lack of decentralization (81% of staked supply is owned by the foundation).

After some experimentation, they found out that allocating their validators in Tokyo helped, probably because that’s where the Hyperliquid Foundation runs their validators. 🤷🏻♀️

Decentralization concerns aren’t just FUD though. In December 2024, North Korean Hackers supposedly did a test run on the Hyperliquid infra.

Takeaway: Hyperliquid, the Binance Smart Chain of the new cycle.

Story Three

DeFAI

AI agents were yesterday, the new meta is now DeFAI.

DeFAI (I do not know how to pronounce this) - the combination of DeFi and AI is getting hot. What I mean by that is that hungry for a new sector to disrupt, AI agent builders, VCs and those tired of prompting AIXBT have come together to fix DeFi.

And let’s be real, ain’t no human got time to compare the yields on 50 different protocols, and make sense of their risk profiles. Considering I’ve lost money in both centralized and decentralized farms, I don’t think I have much to lose if I leave the decision-making to an agent.

The idea behind DeFAI is that agents can fix the notoriously bad UX - removing the need for us to spend too much time on gradient background websites.

Instead of figuring out how to bridge from Gnosis to Solana, you just tell the agent to do it. In the meantime, try toomanybridges.wtf.

Eventually, we’ll go from glorified algorithmic trading bots (aka trading agents) to Ai powered dApps, and who knows, humans might be freed forever from using DeFi themselves in the long run.

Takeaway: Leaving the money making to the trading bot seems like a win to me. Once that’s sorted, I suggest we start pushing for DeScAI, we already have the first app for that: an artificial worm.🪱

Fact of the week: Speaking of worms, can you believe they’ve been around longer than the dinosaurs and have a total of 5 hearts? That’s five more than an AI agent. Just sayin’

Naomi for CoinJar

The above article is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. This article is provided for general information and educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar, Inc. makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. Past performance is not a reliable indicator of future results.

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: The selling continues

February 11, 2026Until morale improves, or so I hope. Story One L2s are pointless Tweets the guy who advocated for them as part of the Ethereum scaling roadmap. Perhaps to deflect from his...Read more

Onchain: Lots of things on sale

January 28, 2026Story One Crypto Social for Sale Been an interesting time to observe what happens to the still-standing crypto social networks. Aave, a leading DeFi protocol and creator of...Read more

CoinJar Unlocks European Expansion with MiCA Authorization

January 21, 2026CoinJar has just become a crypto asset gateway for Europe, having received full authorization from the Central Bank of Ireland as a Crypto-Asset Service Provider under...Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.