Buy Bitcoin

Bitcoin

BTC

How to buy Bitcoin with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.What is Bitcoin?

Bitcoin is the most famous cryptocurrency, and probably always will be. It has the highest market capitalisation, which is another way of saying that more people own Bitcoin than any other cryptocurrency. It was also the first cryptocurrency to be created, and this happened in 2009.

So who created this “digital gold” that now is becoming a mainstream store of value? Strangely, the creators of Bitcoin, even to this day, remain anonymous.

The cryptocurrency was created by one person or perhaps a group of people who called themselves “Satoshi Nakamoto”. They have not been heard of since 2010, and it may be a mystery that is never solved.

Why buy Bitcoin?

Bitcoin (also known as BTC) was the first digital asset to be built on a blockchain, which means that every transaction that takes place using BTC is recorded on that blockchain. These transactions can be viewed by the public at any time. While we can’t know who is using the BTC to make these transactions, it is still a public ledger that is viewable by anyone.

Culture

Bitcoin started its life just 13 years ago, but already there is an established culture and lore that keeps media outlets buzzing. Even in the early days, the idea of Bitcoin captivated people.

For example, the first Bitcoin purchase was for pizza. However, this has blown up into “Bitcoin Pizza Day” and is a really fun theme on the internet.

On May 22, 2010, a programmer named Laszlo Hanyecz paid 10,000 Bitcoin for two pizzas, which was worth about US$41 at the time. Today, that Bitcoin would be worth over US$500 million. Keep in mind that the performance of Bitcoin can be highly volatile, with the value dropping as quickly as it can rise. Past performance is not a guide to the future.

These days, you can buy a lot of stuff with Bitcoin. Besides pizza, you can use Bitcoin to buy things like travel, gift cards, games, art, and even space flights.

There are also many charities that accept Bitcoin donations.

Other interesting Bitcoin facts

Bitcoin is legal tender in El Salvador. On September 7, 2021, El Salvador became the first country to accept Bitcoin as legal tender, meaning that people can use it to pay taxes, debts, and goods and services. The government also gave every citizen US$30 worth of Bitcoin to encourage adoption.

In other interesting Bitcoin news, Bitcoin has a finite supply of 21 million coins, but not all of them are in circulation. Some of them are totally lost. Sometimes this is due to forgotten passwords, lost wallets, or the death of the owners. According to crypto data firm Chainalysis, around 20% of Bitcoin has been lost or is stuck in wallets that can’t be accessed.

Bitcoin is not only a currency, but also a network of computers that run the Bitcoin software and validate transactions. These computers are called nodes, and anyone can run one. There are tens of thousands of nodes distributed across the world, with the highest concentration in the United States, Germany, and France.

Blockchain

By using a blockchain, it means that transactions are checked as they happen. Because the blockchain is made up of a huge network of computers across the globe, and they all have to agree with one another when a transaction takes place, it means that it is probably impossible to cheat the system. This means that trust in the system is built in, so people using Bitcoin don’t need the bank or the government to act as an intermediary.

How many Bitcoin exist?

There will only ever be 21 million Bitcoin in circulation, but they have not all been “released” yet. At the time of writing, 19.6 million Bitcoin have been mined so far. When 21 million Bitcoin have been mined, that’s the end of the road for new Bitcoin. It’s still a long way off yet and is predicted to happen in 2140.

What is mining?

To mine a Bitcoin, miners use hugely complex computers to compete with each other to solve cryptographic problems. The winner is rewarded with a Bitcoin, but more importantly, the winner adds a new “block” of transactions onto the blockchain, keeping the network healthy. This process is called a Proof-of-Work consensus mechanism. The mining life isn’t always easy. For example, every four years, the Bitcoin network hits the “Halving” time.

The Halving is a time when the reward given to miners literally gets cut in half. This means that some miners will bow out of the race to mine Bitcoin, as the reward won’t be worth their efforts. The Halving is designed to make Bitcoin more scarce and subsequently put upward pressure on its price.

Trading pairs

Bitcoin is often used as a trading pair for other cryptocurrencies. Crypto enthusiasts use trading pairs to exchange one cryptocurrency for another, and they can do this without having to use normal money.

Bitcoin forks

A Bitcoin ‘fork’ is when a new cryptocurrency is created using new rules, while Bitcoin still follows the old rules. They split away the main blockchain and are then known as independent cryptocurrencies. Examples are Bitcoin Cash (BCH), Bitcoin Satoshi’s Vision (BSV), Bitcoin Diamond (BTCD) and Bitcoin Gold (BTCG).

When buying Bitcoin, be sure to check that you are buying coins on the original blockchain.

The thing to remember here is that you don't have to buy a whole Bitcoin. You can check the price of Bitcoin here.

Bank transfer (ACH and wire), or crypto?

Buy Bitcoin instantly with your bank account via ACH or deposit with wire transfer. Easily buy with ACH, wire cash to your account, or swap one cryptocurrency for another in a single click.Featured In

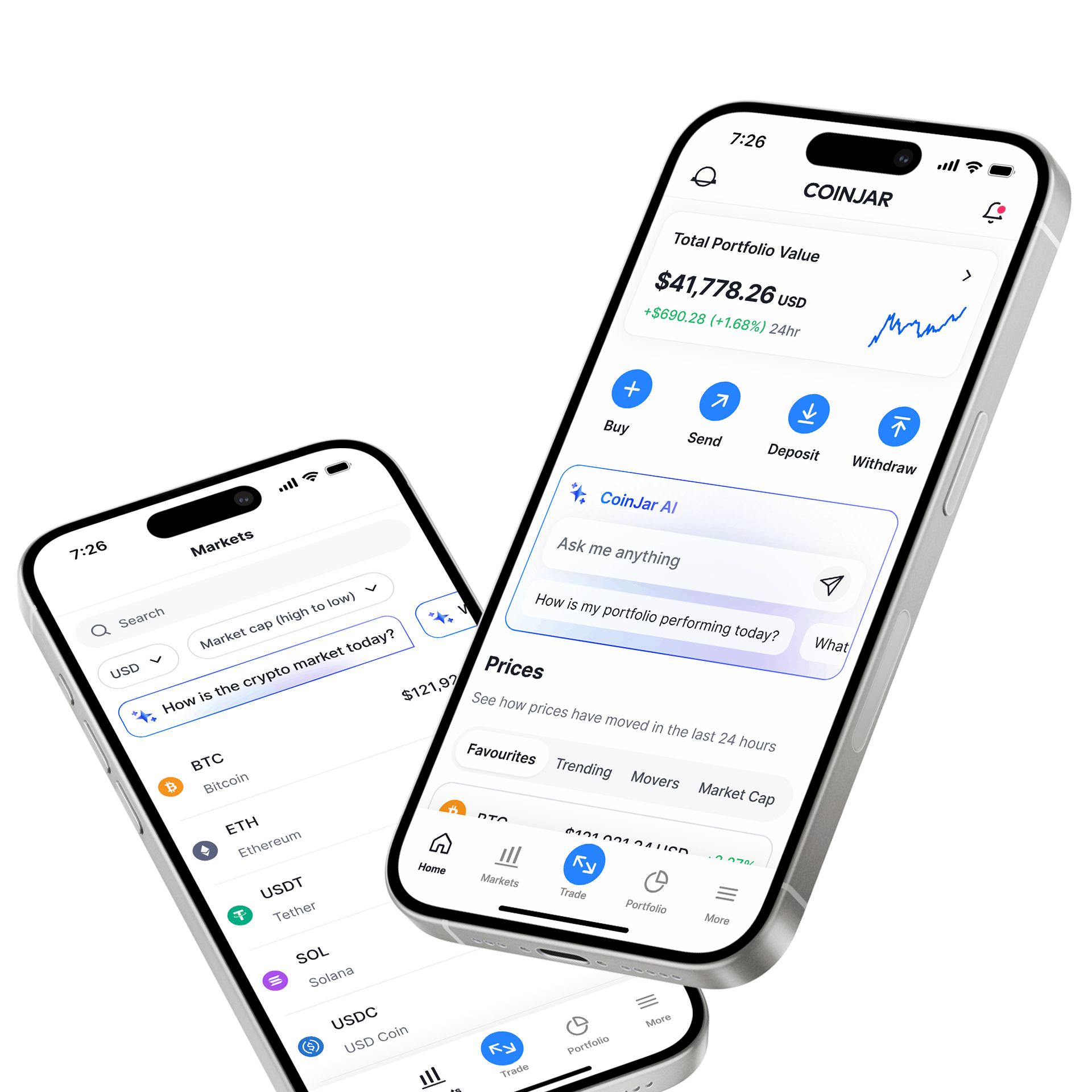

CoinJar App

All-in-one crypto walletCoinJar App

All-in-one crypto wallet

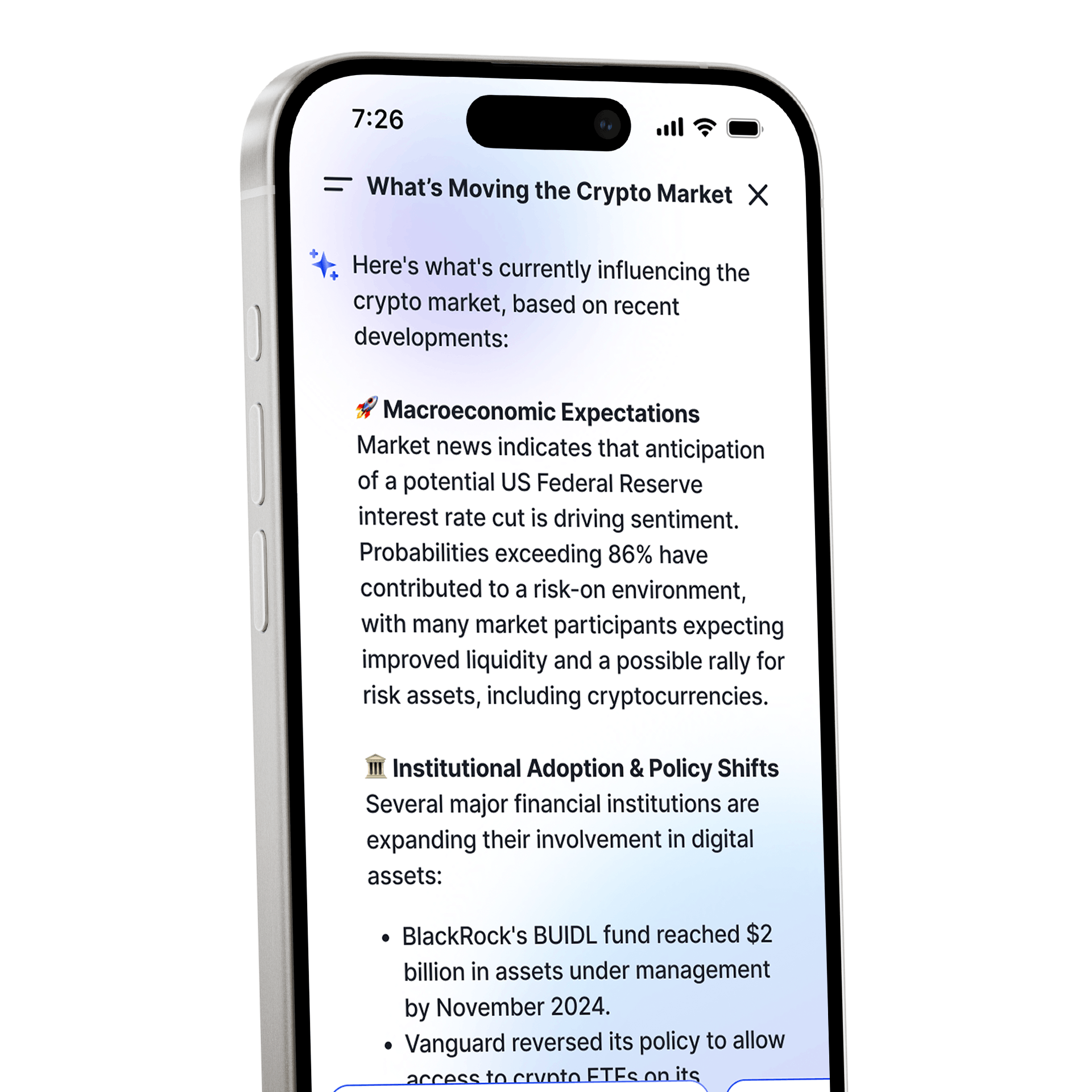

CoinJar AI

A portfolio and market assistant built into CoinJar

CoinJar AI

A portfolio and market assistant built into CoinJarBuying, selling, and holding cryptocurrencies is subject to high market risk. The volatile and unpredictable nature of the price of cryptocurrencies may result in a significant loss. CoinJar, inc. is not responsible for any loss that you may incur from price fluctuations when you buy, sell, or hold cryptocurrencies. CoinJar, Inc. does not provide any investment, tax or legal advice; before making the decision to buy, sell or hold any cryptocurrencies, you should conduct your own due diligence and consult your financial, tax and/or legal advisor.

It is your responsibility to determine whether any investment, investment strategy or related transaction is appropriate for you according to your personal investment objectives, financial circumstances, and risk tolerance. Enter into a transaction only if you fully understand its nature, the contractual relationship into which you are entering, all relevant terms and conditions, and the nature and extent of your exposure to loss. Past performance is not a reliable indicator of future results. Geographic restrictions may apply. CoinJar does not endorse the content of, and cannot guarantee or verify the safety of any third party websites. Visit these websites at your own risk.

Your information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.