Our UK submission to the HM Treasury

December 23, 2014Share this:

On 3 December, we made a submission in response to the UK government’s economic and finance ministry’s call for information on digital currencies.

In an effort to make Britain the global centre of financial innovation, the HM Treasury’s consultation focussed the function of digital currencies as a payment method, rather than as a speculative investment. As published on their website, the call for information is led by their desire to promote innovation and competition in the banking sector, learn more about digital currencies and hear the public’s views on regulation.

As suggested, our submission responded to the 13 questions posed by the HM Treasury around benefits, risks and regulation of digital currencies. Here are some excerpts:

- Some of the benefits of digital currencies are felt at a functional, use-case level: the speed, efficiency, and flexibility of transactions. These are dependent on efficient gateways, reasonable tax treatment, and market depth. Some benefits are felt at a more systemic level, the resilience and transparency of a public secured ledger, and these are only meaningful if the currency is being used.

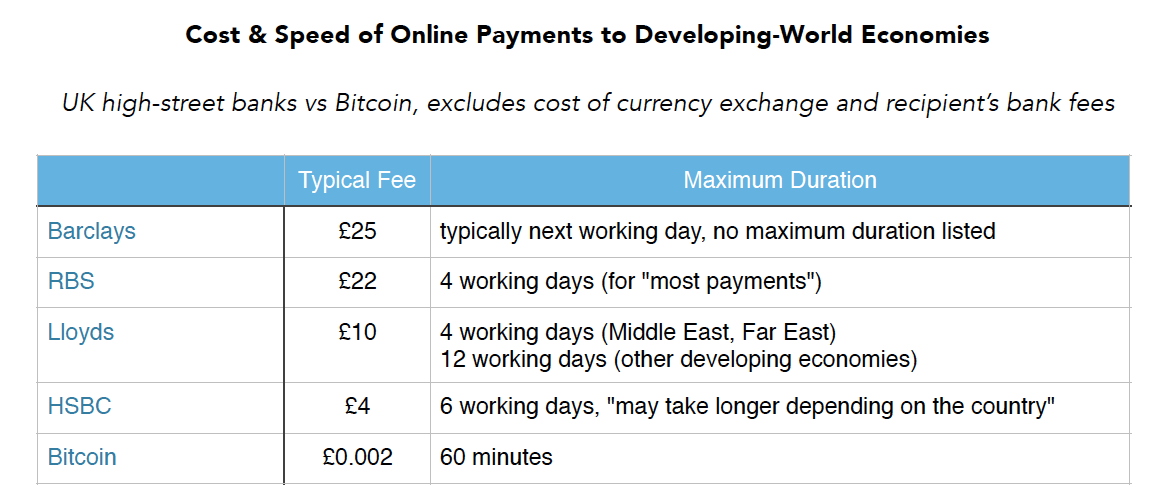

- Bitcoin poses a huge challenge to international financial products which have remained stubbornly uncompetitive, most notably remittances, as well as basic banking for underbanked populations in both developing and developed economies.

- The biggest boon policymakers could give to the industry would be to find a way to give the industry access to banking services. The largest barrier to business in the UK is the blanket refusal of British banks to provide banking services to companies like ours.

- Most user risks of digital currencies are comparable to the risks inherent in storing national currencies in an online bank account. Digital currencies do not offer an effective channel for money laundering or terrorist financing, given the permanent digital trail transactions leave in the public ledger.

“In communities such as Bitcoin these risks are actively tackled by researchers, developers, bounty hunters and ‘white hat’ hackers who endeavour to educate users, fix code vulnerabilities and document incidents of fraud and theft. In this sense the community, like any open source community, is already self-policing.”

- For most digital currencies, it is effectively impossible to regulate the protocol that underlies the technology. The possible unintended consequence of this is that it could saddle early-stage technology companies with legal and regulatory costs that render them uncompetitive. Regulators should instead work with community players to ensure that the currency’s infrastructure is being responsibly managed and used.

If you have a moment, read the submission in full here. In November, we also made a submission to the Australian Senate, which can be found here.

Thank you for your support as we expand internationally to offer you a better global service.

The above article is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. This article is provided for general information and educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar, Inc. makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. Past performance is not a reliable indicator of future results.

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: In bad taste

February 25, 2026ICYMI, the tech bros have once again discovered taste, so get ready to be lectured by dudes who think it's acceptable to live with one ceiling light on what to wear and consume....Read more

Onchain: The selling continues

February 11, 2026Until morale improves, or so I hope. Story One L2s are pointless Tweets the guy who advocated for them as part of the Ethereum scaling roadmap. Perhaps to deflect from his...Read more

Onchain: Lots of things on sale

January 28, 2026Story One Crypto Social for Sale Been an interesting time to observe what happens to the still-standing crypto social networks. Aave, a leading DeFi protocol and creator of...Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.