Buy Maker Dai

Maker Dai

DAI

Overview

How to buy Maker Dai with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.What is Maker Dai?

What is Maker DAI? Want to buy DAI on CoinJar? Here’s what you need to know.

Understanding MakerDAO and the DAI Stablecoin

MakerDAO is a decentralized autonomous organisation (DAO) built on the Ethereum blockchain. Its mission is to create a stable and decentralized digital currency. Let’s dive into the details of what Maker DAI is and how you can acquire it.

What is DAI: The simple explanation

Here’s a simple way to describe how it works. Imagine you have a coin called “DAI.” It’s like a regular coin, but it always tries to stay worth the same as one U.S. dollar.

So how does it stay stable? It is created using something called a “smart contract” on the Ethereum blockchain. Think of this smart contract as a set of rules that govern how the crypto works.

Say you have some Ethereum (ETH). You can use it as a kind of security deposit to create Dai. This is done through a platform called the Maker Protocol.

Think of it like this: You put your ETH in a digital vault called a “Collateralized Debt Position (CDP)”. It's like putting your ETH in a safe. Then, the Maker Protocol gives you Dai in return, based on how much ETH you put in.

Now, here's the catch: Because the value of cryptocurrencies can change a lot, you have to put in more ETH than the value of the Dai you want to get. This is called over-collateralization.

For example, if you want $100 worth of Dai, you might need to put in $200 worth of ETH. This is to make sure that even if the value of ETH goes down, there's still enough value to cover the Dai.

When you want to get your ETH back, you have to return the Dai you borrowed, plus a small fee for using the Maker Protocol. It's like paying rent for using the vault.

So, in simple terms, Dai is digital money you can get by trading it for Ethereum, or by using Ethereum as a deposit in a special digital vault called a CDP.

What stability means for users

DAI ideally offers stability (but nothing is guaranteed in stablecoin world!). This is good for things like online shopping (mostly with merchants accepting funds via payment companies that enable crypto payments). You can theoretically use it to buy things online, just like using dollars.

Regular cryptocurrencies (like Bitcoin) can swing up and down a lot in price. DAI aims to stay steady in price.

When you send DAI to someone in another country, they should get the same value without worrying about exchange rates.

Say your cousin in America needs some cash. Instead of dealing with exchange rates and bank fees, you send them DAI instead. This is without all the bank fees and then the banks converting currency in their favour.

Because the price theoretically stays stable, people use it in decentralised finance (DeFi) apps. These apps let you lend, borrow, and earn interest.

Other uses

It has other uses. Imagine you’re a crypto trader. When other coins swing wildly, you can switch your existing crypto into DAI to keep stability.

You can lend your DAI on platforms like Compound or Aave. Your DAI earns interest, and you don’t lose sleep over price fluctuations.

What is DAI? A more technical explanation

It is a stablecoin pegged to the US dollar. Unlike other cryptocurrencies, its value remains relatively stable, making it suitable for everyday transactions.

It is created through a system of collateralised debt positions (CDPs). Users lock up crypto assets (such as Ethereum) as collateral to generate DAI.

The collateralization ratio determines how much of it can be minted against the locked assets.

If the value of the collateral drops, users may need to add more assets or repay part of their debt.

Outstanding debt refers to the total amount of DAI in circulation.

MakerDAO components

Smart contracts

MakerDAO relies on smart contracts to manage the creation and redemption of DAI. These contracts ensure transparency and security.

MKR tokens

MKR is the governance token of MakerDAO. MKR holders participate in decision-making processes, including voting on stability fees and other protocol changes.

Stability fee

When users create DAI, they pay a stability fee. This fee compensates MKR holders and helps maintain the stability of the system.

DAI Savings Rate (DSR)

The DSR allows users to earn interest by holding the crypto in a savings account within the MakerDAO ecosystem.

What risks should I be aware of?

DAI is backed by collateral who can themselves be volatile, such as Ethereum (ETH). If the value of the collateral drops significantly, it could trigger automatic liquidation of the collateral and cause the value of DAI to fluctuate.

It uses algorithmic smart contracts to maintain price stability and to ensure that the tokens are always kept fully collateralized. Users should be aware that other tokens which have used algorithmic smart contracts to maintain their value, such as Terra (LUNA) have failed, leading to total loss of value.

Bank transfer (ACH and wire), or crypto?

Buy Maker Dai instantly with your bank account via ACH or deposit with wire transfer. Easily buy with ACH, wire cash to your account, or swap one cryptocurrency for another in a single click.Featured In

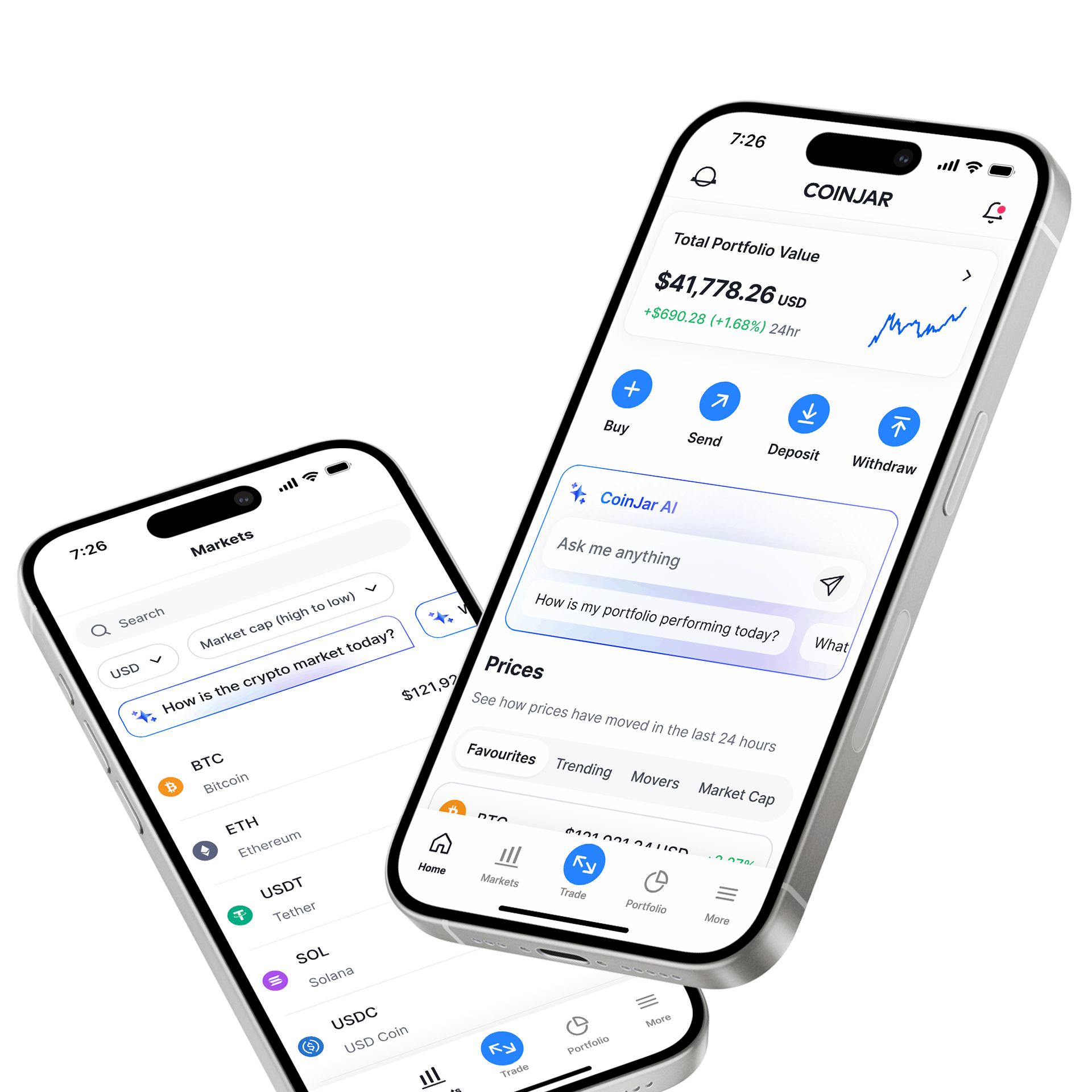

CoinJar App

All-in-one crypto walletCoinJar App

All-in-one crypto wallet

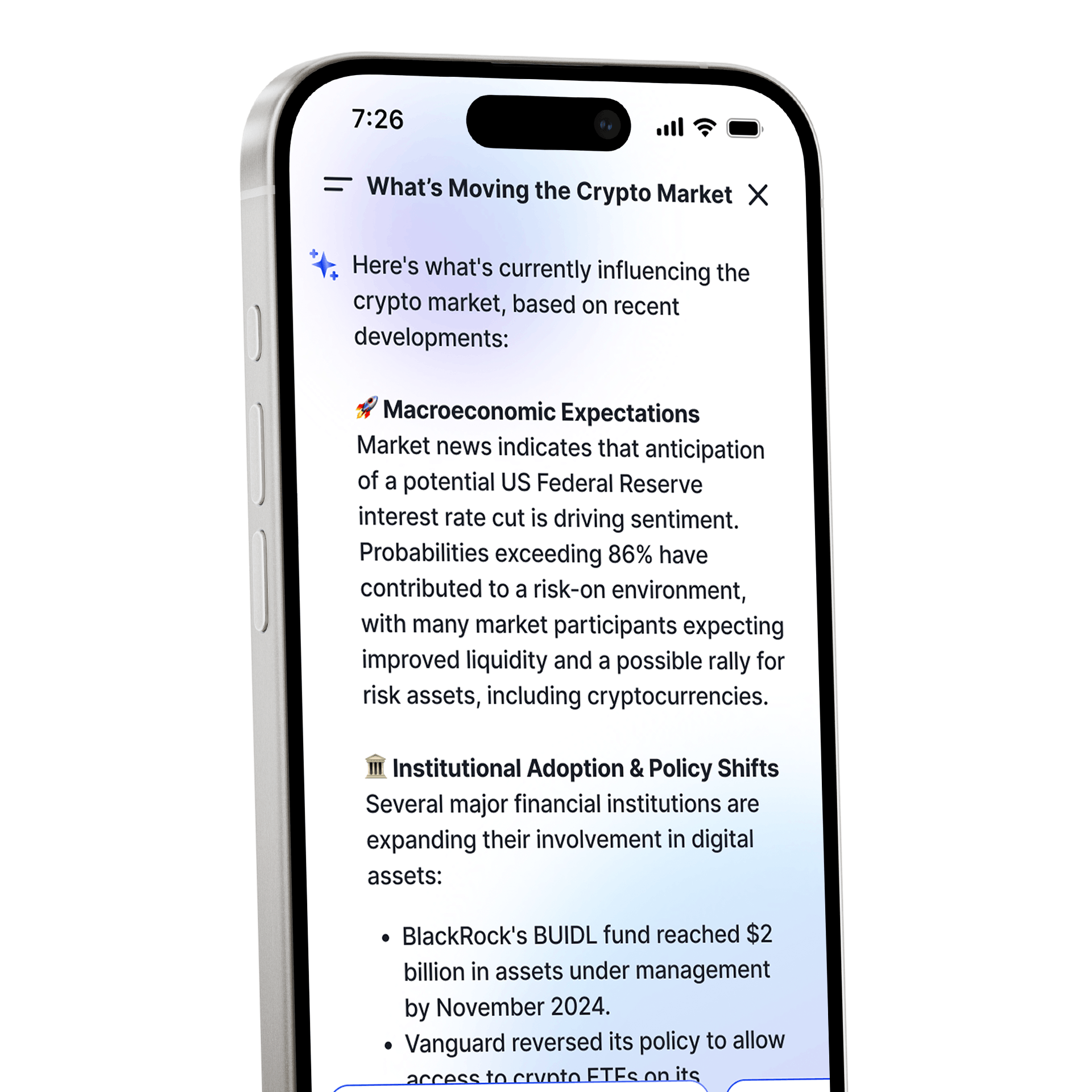

CoinJar AI

A portfolio and market assistant built into CoinJar

CoinJar AI

A portfolio and market assistant built into CoinJarBuying, selling, and holding cryptocurrencies is subject to high market risk. The volatile and unpredictable nature of the price of cryptocurrencies may result in a significant loss. CoinJar, inc. is not responsible for any loss that you may incur from price fluctuations when you buy, sell, or hold cryptocurrencies. CoinJar, Inc. does not provide any investment, tax or legal advice; before making the decision to buy, sell or hold any cryptocurrencies, you should conduct your own due diligence and consult your financial, tax and/or legal advisor.

It is your responsibility to determine whether any investment, investment strategy or related transaction is appropriate for you according to your personal investment objectives, financial circumstances, and risk tolerance. Enter into a transaction only if you fully understand its nature, the contractual relationship into which you are entering, all relevant terms and conditions, and the nature and extent of your exposure to loss. Past performance is not a reliable indicator of future results. Geographic restrictions may apply. CoinJar does not endorse the content of, and cannot guarantee or verify the safety of any third party websites. Visit these websites at your own risk.

Your information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.