Onchain: Q4 is coming to an end

December 17, 2025

Share this:

But the drama on crypto twitter is forever.

Story One

EoY reflections kicking in

At least if you are to believe the one X article that has been all over my feed in the last few days. ‘Tis not just the season to be merry and get unholy drunk (what else was mulled wine invented for, right?) but for crypto bros, the season to ask themselves: have I wasted my life working in this industry?

Such is the title of Ken’s article, a guy who built a protocol called Aevo and spent 8 years in crypto. He looks back at the enthusiastic, naive optimism that carried him into crypto, the libertarian wet dreams of bringing one billion dollars across borders without a worry in the world, and, with horror, concludes that his cypherpunk ideals evaporated into contributing to a massive casino.

Of course, there were plenty of reactions to this article pointing out how, first, the poster was a bit of a hypocrite, starting to develop a moral conscience now that his token price was down bad.

Second, crypto is not alone in hypergamblification, it’s just following a bigger trend of attaching a price to everything.

Takeaway: It’s nice when crypto bros suddenly have moral concerns about how valuing everything by price might be bad. It’s sad this tends to only happen when the price no longer moves in their desired direction. Let's not forget, modern finance too is a casino.

Story Two

Aave drama

Aave, one of the longest-standing DeFi lending protocols, has become another playground for DAO drama. As with many protocols that aspire to decentralization, governance power over the underlying software is held by a DAO. Yet, this isn’t the only stakeholder, as the original entity that built the protocol continues to exist and build: Aave Labs.

When Aave Labs integrated CoWswap into its interface, it triggered an argument when DAO members noticed that the revenues generated were going to a wallet address controlled by the Labs. The DAO wasn’t even asked, which sparked a debate over who should receive the fees (estimated at $10 million per year).

Aave Labs argues that since it’s a front-end component, it is up to them. The DAO counters that the Aave brand is only as powerful because the governance delivers great work. In short, it’s a conflict about monetization, about how protocol DAOs can capture value when a lot of it is already captured on the app layer.

Takeaway: The conflict between protocol DAO and labs entity that’s building products on top isn’t new. Similar happened with Uniswap, and it is likely to happen whenever there’s larger money flows to an app built by a Labs entity on top of a protocol governed by a DAO. The more money is involved, the more arguments arise.

Story Three

Solana gets a new client (finally)

Remember when Jump Crypto first announced its new client software for Solana? Me neither. That’s because it was at least 2 years ago, and the scheduled launch date was sometime in 2024. Reassuring that it’s not just big German construction projects that are delivered horribly late.

During Breakpoint, a Solana conference, Firedancer finally went live.

It’s an execution client, the software that validators run to interact with the chain, aimed at increasing performance and helping Solana reach its 1 million transactions per second goal.

With its launch, Solana is catching up in the realm of client diversity, which sounds woke, but isn’t (the SOL people are very anti-woke). Instead, it’s a useful academic measure, where more is more. After all, imagine everyone ran the same software. It’d take just one major bug to take them all down.

Already ahead of the launch, Frankendancer, a hybrid in beta, was live for testing, quickly reaching 26% adoption, hinting at potential interest for Firedancer.

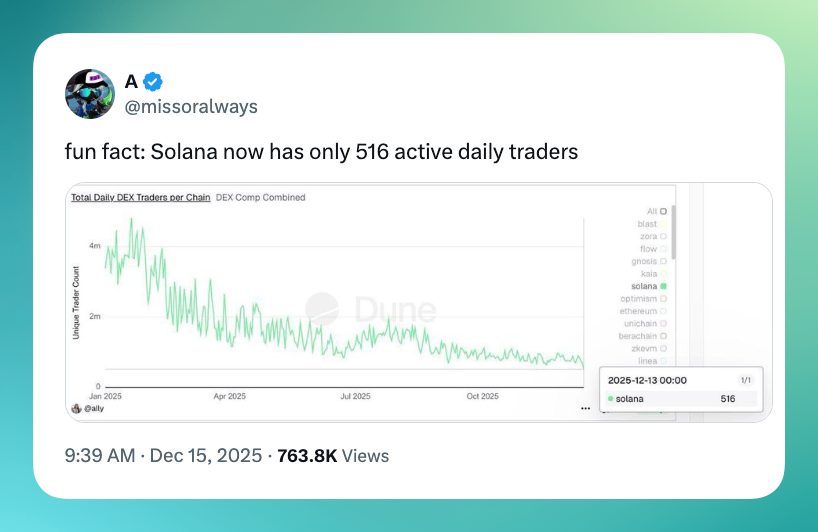

Takeaway: This all sounds great, and what's not to love about 1 million TPS except that..what's the point if there's no real demand for it?

Fact of the Week: In case you don't believe me that we Germans are bad with big construction projects... the new Berlin airport opened 14 years later than scheduled. Meanwhile, Stuttgart 21, a project to put the Stuttgart train station underground, was kicked off in 1994! And as of today, we're already 6 years behind its scheduled opening date (and not even the biggest optimist believes that 2026 is the year it will finally happen).

Naomi for CoinJar

The above article is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. This article is provided for general information and educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar, Inc. makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. Past performance is not a reliable indicator of future results.

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: Lots of things on sale

January 28, 2026Story One Crypto Social for Sale Been an interesting time to observe what happens to the still-standing crypto social networks. Aave, a leading DeFi protocol and creator of...Read more

CoinJar Unlocks European Expansion with MiCA Authorization

January 21, 2026CoinJar has just become a crypto asset gateway for Europe, having received full authorization from the Central Bank of Ireland as a Crypto-Asset Service Provider under...Read more

Onchain: New Year, Same old industry

January 15, 20262026 has been off to a strong start, with constant drama from the White House. But it’s not on Trump alone to keep our cholesterol levels high. Crypto is contributing its...Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.