Offchain: This Time is Different

May 26, 2022

Share this:

As the chill of a new crypto winter sets in, the past offers itself as a flawed guide.

Last year, during the height of the mania, people started talking about cryptocurrency launching into a new “supercycle” – basically a paradigm shift wherein the familiar boom-bust cycle would be replaced by one of perpetual, if more linear growth, a la the internet from 2005 on.

It’s a long-running joke in investment circles that everyone thinks “this time is different” and everyone is, eventually, wrong. As a general proxy for human fear and greed, free markets are intrinsically prone to speculative manias. The only thing that makes crypto different is the sheer velocity with which these cycles happen. (And you think the internet is immune? Just ask the Facebook stock price).

Well, we’ve had the boom. Now comes the hard part. Crypto has already been through some bear markets. We should know what to expect. But will this time actually be different?

Learning from the past

The issue with many of the predictions and assumptions made through the last bull run was that the sample size was insufficient. While the bubbles of 2013 and 2017 followed roughly similar patterns, the crypto-economies they represented were wildly different; 2021 was more different still.

But when prices were soaring, how easy it was to look back at the wildness of 2017 and say “we’re barely getting started”.

Now we’re on the downward arc and the temptation is to map the bleakness of 2018 onto our current situation. Already people are planning for the 2024 upcycle, as if all the possible permutations of international finance could be cleanly mapped onto the Mayan calendar.

To its adherents, that’s the whole point of Bitcoin’s mathematical certainty. But Bitcoin has never faced macroeconomic conditions like this, where interest rates are rising, energy costs are soaring and economies are tumbling towards recession.

After the dotcom collapse, it took the better part of a decade for the scions of web 2.0 to begin their inexorable takeover of the stock market. Could crypto be poised for a similar time in the wilderness?

Ctrl + Z, Ctrl + Y

To be clear, I don’t have any strong opinions as to what happens next, or how long this downturn might last. Rather it’s a reminder to keep an open mind in the face of unprecedented circumstances. Crypto’s only been here twice before; we’re still in the data-gathering phase.

What we do know is that, over a long enough timeframe, markets inevitably revert to the mean. What goes up must come down, and what descends into the depths of hell will eventually emerge spluttering into the light.

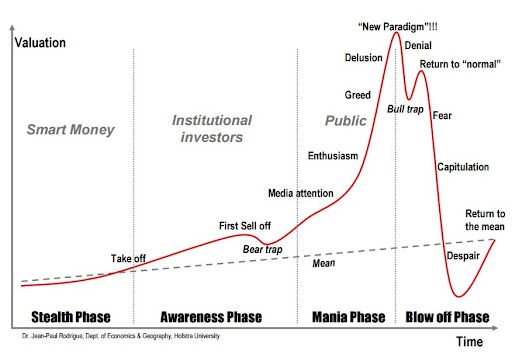

I’ve shared this speculative bubble chart before, but what’s often overlooked is the line, slowly ascending, around which all the excitement and despair occurs.

In many ways that line is the point of it all. It’s all well and good to chase shitcoins to the top of the new paradigm (*cough* supercycle *cough*) but your long-term focus should be on what the mean represents: the basic promise of blockchain technology and decentralised digital economies.

Ain’t nothing nice about it, but winter is your chance to step back and ask what that might still actually mean.

Luke from CoinJar

The above article is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. This article is provided for general information and educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar, Inc. makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. Past performance is not a reliable indicator of future results.

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: The selling continues

February 11, 2026Until morale improves, or so I hope. Story One L2s are pointless Tweets the guy who advocated for them as part of the Ethereum scaling roadmap. Perhaps to deflect from his...Read more

Onchain: Lots of things on sale

January 28, 2026Story One Crypto Social for Sale Been an interesting time to observe what happens to the still-standing crypto social networks. Aave, a leading DeFi protocol and creator of...Read more

CoinJar Unlocks European Expansion with MiCA Authorization

January 21, 2026CoinJar has just become a crypto asset gateway for Europe, having received full authorization from the Central Bank of Ireland as a Crypto-Asset Service Provider under...Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.