Want to Buy a Famous Artwork or Giant Jewel? You Can Pay in Crypto

Art and crypto seemed to have had an easy connection from the inception of the blockchain.

In this article...

- Art and crypto seem to have an easy alliance

- Auction houses are increasingly accepting crypto in payment

- Which famous artworks have price tags in crypto?

The intersection of art and cryptocurrency has evolved dramatically in recent years, with prestigious auction houses like Sotheby’s leading the charge by embracing digital currencies as a payment method for physical artworks.

Since 2021, Sotheby’s has allowed buyers to pay for select artworks using Bitcoin (BTC) and Ethereum (ETH), a trend that has broadened the appeal of high-value art to a tech-savvy, crypto-rich clientele.

Sotheby’s: Pioneering crypto payments for iconic artworks

Sotheby’s made headlines in May 2021 when it became the first major auction house to accept cryptocurrency for a physical artwork. The work in question was Banksy’s Love is in the Air..

This artwork is a stencil of a protester hurling a bouquet of flowers.

Banksy's "Love is in the Air"

When this went on sale, there was an option to pay the hammer price in BTC or ETH.

The piece, which sold for US$12.9 million, marked a turning point, proving that crypto could seamlessly integrate into the traditional art market.

As of the time of writing, March 9, 2025, Sotheby’s continues to feature auctions where cryptocurrency is an accepted payment method.

Famous artworks sold for crypto

There are other famous artworks that have been sold where the buyer could pay in crypto. Here are some examples.

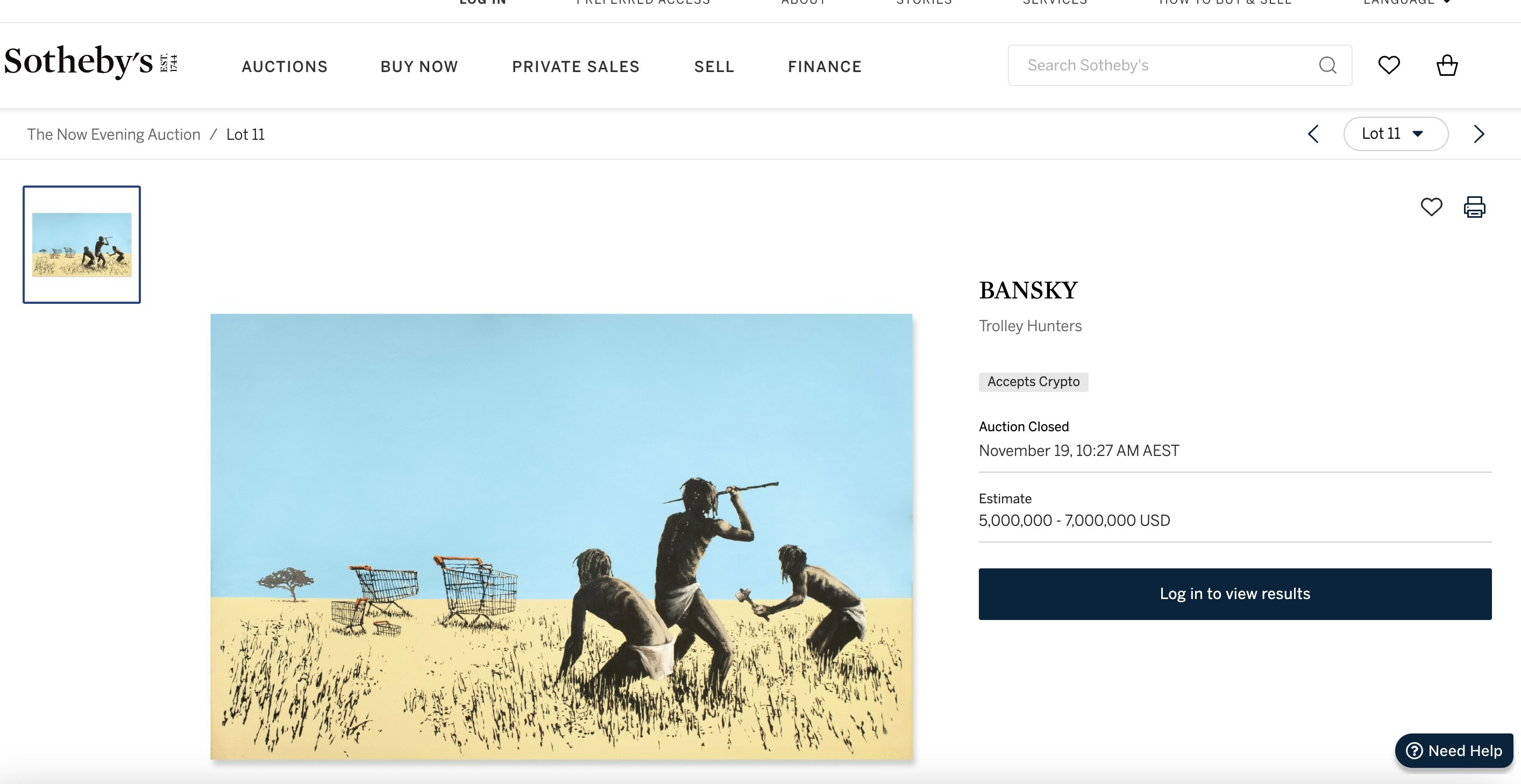

Banksy’s Trolley Hunters

In November 2021, Sotheby’s auctioned this satirical piece depicting three prehistoric hunters targeting shopping carts.

This auction accepted live bids in Ethereum alongside traditional USD bids. Estimated at $5-7 million, it showcased Banksy’s biting social commentary and fetched a strong price from a crypto-paying buyer.

Crypto for bling: Jewels

Sotheby’s doesn’t limit crypto payments to canvas. In July 2021, they sold a 101.38-carat diamond, The Key 10138, for $12.3 million in cryptocurrency, setting a record for the largest crypto transaction for a physical item at auction.

Diamonds for Crypto

Sotheby’s isn’t alone in bridging the gap between crypto wealth and high art and valuables. Several galleries, auction houses, and private dealers have followed suit, catering to collectors who prefer to spend their digital fortunes on tangible masterpieces.

Christie’s: Crypto adoption and high art

Christie’s, Sotheby’s arch-rival, has also embraced cryptocurrency for artworks. In 2021, they expanded crypto payments beyond their landmark $69 million Beeple NFT sale to include traditional artworks. A Keith Haring painting went to auction in London whereby the buyer could pay in crypto. The auction also featured masterpieces by Alberto Giacometti, Pablo Picasso, and Edgar Degas.

The untitled Keith Haring work, created in 1984, captures the dawn of the digital age with its image of a computer. It carried an estimated price tag of $5.42-$6.25 million. Christie’s announced that buyers could pay the full amount, both the final bid and the buyer’s premium, using either Ether or Bitcoin.

Phillips: Crypto-friendly auctions

Phillips, another major auction house, also accepts crypto payments for physical art. While initially focused on contemporary works, like Banksy pieces, they announced they would accept BTC and ETH for lots like a Jean-Michel Basquiat painting or a Yayoi Kusama mirrored sculpture.

Their 2025 auctions, particularly in New York and Hong Kong, are likely to feature crypto-eligible works.

The bigger picture: Why crypto for art

Allowing buyers to purchase famous artworks using crypto signals a shift in how wealth is accumulating. For example, the biggest donors of the 2024 US election cycle were from the crypto industry.

For Sotheby’s and its competitors, it’s a strategic move to tap into the new crypto-rich demographic. And there are plenty of crypto entrepreneurs and blockchain investors who are sitting on a stash of digital assets that need a good Banksy on their wall.

Freeports

Here’s a thought. What if you wanted to diversify your wealth out of crypto because you sense a bear market looming? You could park some of your crypto wealth in art. And you could send it to a freeport to be stored.

A freeport is a secure, tax-advantaged storage facility located in a designated zone where goods like art, jewellery, wine, or gold can be stored without paying customs duties or tax, as long as they remain in the facility.

These zones operate under special economic regulations, often in international transit hubs, like Geneva and Zurich, Singapore and Luxembourg.

Wealthy collectors, dealers, and investors use freeports to park wealth via valuable artworks as part of a broader wealth-preservation playbook.

For example, the Geneva Freeport reportedly holds billions in art, from Old Masters to modern works, making it a “vault” for the ultra-rich. It operates as a legal offshore account for physical assets. Instead of cash, it’s a warehouse of Warhols and Rembrandts.

While stablecoins could theoretically be a place to park wealth in a falling crypto market, some stablecoins have proven to be not so stable, so diversification away from crypto could lead to an expensive artwork in a freeport.

Challenges: Crypto and art

Challenges remain. Crypto’s volatility can complicate pricing while trying to buy a famous painting or sculpture. For example, while bidding on a Matisse, ETH could drop 10% mid-auction.

Still, if you have enough crypto to buy a Matisse in the first place, do you even care?

For collectors who genuinely love art, it’s a thrilling time. It is the chance to own a piece of history, paid for with the currency of the future. Next time you see a famous artwork being purchased for crypto, we can certainly have fun guessing who it was that bought it.

Suggested Articles

Bitcoin for Beginners: A Complete Guide to the World’s First Cryptocurrency

Unpacking the history, technology, and mechanics behind the digital asset that helped popularise crypto, along with the key risks you need to understand before you get involved.Read more

Bitcoin Dominance: Is Alt Season Near? Technical Analysis May Provide Clues

What is Bitcoin Dominance? And how can keeping an eye on it give insight into alt season? Here is the explainer.Read more

How to Buy Bitcoin (BTC) in the UK the Convenient Way

Want to Buy Bitcoin in the UK? Buy BTC the convenient way by using CoinJar. They have been in operation since 2013.Read moreBrowse by topic

Standard Risk Warning: The above article is not to be read as investment, legal or tax advice and it takes no account of particular personal or market circumstances; all readers should seek independent investment advice before investing in cryptocurrencies.

The article is provided for general information and educational purposes only, no responsibility or liability is accepted for any errors of fact or omission expressed therein. Past performance is not a reliable indicator of future results. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets.

Capital Gains Tax may be payable on profits.

CoinJar's digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

In the UK, it's legal to buy, hold, and trade crypto, however cryptocurrency is not regulated in the UK. It's vital to understand that once your money is in the crypto ecosystem, there are no rules to protect it, unlike with regular investments.

You should not expect to be protected if something goes wrong. So, if you make any crypto-related investments, you're unlikely to have recourse to the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service (FOS) if something goes wrong.

The performance of most cryptocurrency can be highly volatile, with their value dropping as quickly as it can rise. Past performance is not an indication of future results.

Remember: Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

UK residents are required to complete an assessment to show they understand the risks associated with what crypto/investment they are about to buy, in accordance with local legislation. Additionally, they must wait for a 24-hour "cooling off" period, before their account is active, due to local regulations. If you use a credit card to buy cryptocurrency, you would be putting borrowed money at a risk of loss.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets.

Your information is handled in accordance with CoinJar’s Privacy Policy.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.